Original|Odaily Planet Daily (@OdailyChina)

On February 27, the latest investigation results of the Bybit $1.5 billion theft incident have once again put Ethereum in the spotlight. According to preliminary investigations, the problem mainly lies in the Safe multi-signature wallet, which has been repeatedly endorsed by Vitalik and the Ethereum Foundation (hereinafter referred to as EF). Countless people exclaimed, "It turns out that the security infrastructure of the crypto industry is so fragile and makeshift."

On the other hand, on February 26, Ethereum co-founder Vitalik posted to announce that former EF executive director Aya Miyaguchi has been promoted to EF chair, praising her significant achievements over the past seven years, including the stable execution of Ethereum hard forks, client interoperability workshops, Devcon, Ethereum's culture, and her firm commitment to its mission and values.

When looking at these two events together, market opinions vary. Regarding the former, the market is largely filled with disbelief, disappointment, and fear, as the assets related to the Safe multi-signature wallet exceed $100 billion, and the Bybit hackers simply chose the Bybit cold wallet with the largest ETH holdings. Regarding the latter, some believe this move reflects Ethereum's steadfast practice of decentralization, while others think the Ethereum Foundation shows no improvement and remains inefficient.

Odaily Planet Daily has previously published multiple articles discussing the reform of the EF organization (see “Vitalik fires the first shot of ‘reform,’ where is the Ethereum Foundation headed?”, “Ethereum is ‘sick,’ do these three remedies work?”, etc.). In this article, we will explore the latest news in conjunction with these discussions, not as investment advice.

The Beginning of EF Reform: Still a Centralized Decision-Making Process

The First Shot of EF Reform: “The organization decided to appoint you as chair”

As we mentioned in the article “Ethereum is ‘sick,’ do these three remedies work?”:

The chaos in management leads to chaos in the organization, and the chaos in the organization is why the Ethereum Foundation cannot play a true leadership role, providing a coherent development roadmap and a clearer direction for the ecosystem, rather than relying on numerous “personal centralized nodes,” including Vitalik, to brainstorm for Ethereum. This is neither in line with the long-term development needs of the Ethereum ecosystem nor can it support the innovative growth of the Ethereum ecosystem.

The current key issue for EF is that decision-making at the organizational management level is made by centralized nodes. In the article “Vitalik fires the first shot of ‘reform,’ where is the Ethereum Foundation headed?”, Vitalik's proposed reform ideas for EF, while “excluding some wrong answers,” still resulted in Aya Miyaguchi's position change being driven by centralized decision-making, with the decision-maker even being her—according to Vitalik's post: “A year ago, Aya first shared the idea of transitioning from executive director of @ethereumfndn to chair.”

In this process, we did not find any publicly announced position change process from Vitalik or the EF organization. What the Ethereum community received was merely Aya's “acceptance speech-like” tweet after assuming the EF chair and a long blog post titled “A New Chapter in the Infinite Garden”. However, this seemingly organically growing crypto garden has its nutrient supply roots firmly controlled by some members of EF.

Previously, in response to the public criticism of Aya by Ethereum community member and crypto KOL @coinmamba, Vitalik revealed: “The person deciding the new EF (Ethereum Foundation) leadership team is me. One of the goals of the ongoing reform is to provide EF with a ‘suitable board.’ But before that, the decision-making power is in my hands.”

On one hand, this indeed shifted the focus of public criticism away from Aya; on the other hand, it also exposed the rigidity, inflexibility, and “dictatorship” of the EF leadership changes, which are contrary to the “decentralized ideology” that Vitalik has always believed in.

This is also the aspect that has been most criticized by the Ethereum community and crypto industry insiders: Vitalik, who is more adept at academic research and technical development, has always actively or passively taken on the role of spiritual leader and decision-maker of the ETH ecosystem, but he is not actually good at community communication, marketing, or even product application.

This is also one of the important reasons why Vitalik's number of posts on X platform in recent months has far exceeded the number of external communications in the previous 1-2 years: because he cannot effectively communicate based on market conditions with the ETH community and the crypto circle, he can only unilaterally express his views, emotions, and values, and even had to release related meme images at the community's request.

If Vitalik were the CEO of a publicly traded company worth hundreds of billions of dollars, from a personal perspective, he has indeed done enough and made enough “sacrifices.” But the reality is, he is not a CEO of a publicly traded company; he is a co-founder of a crypto ecosystem, a token project, and a core figure of the EF organization.

Therefore, a better approach would be—“Render unto Caesar what is Caesar's,” applied to Ethereum and EF means, “Technology and research belong to Vitalik and EF researchers, education and public welfare belong to Aya and some EF organizational members, and market, marketing, and community belong to suitable ETH community members.”

Vitalik: Ethereum is great (don't FUD)

Vitalik even played around with the meme “Let's learn to meow together, meow meow meow meow meow”

Slightly Outdated Organizational Philosophy: A Zen-like Management Style Combining Idealism and Romantic Spirit

After discussing the “human” aspects, let's talk about the “management philosophy” at the organizational level of EF.

Stewart Brand's Layered Rhythm Theory

In the same article “A New Chapter in the Infinite Garden”, Aya revealed her and EF's organizational philosophy:

Ethereum's “ownership”: It does not belong to any individual, so Ethereum belongs to everyone. Because of this, our permissionless culture not only tolerates differences but also becomes stronger.

EF's primary goal: To maintain Ethereum's cultural values, hoping to integrate Ethereum into the world framework rather than as a short-term corporate product, ensuring its resilience as an ecosystem;

Philosophical guidance for Ethereum: The original intention of Ethereum remains to be a world computer, and EF must help Ethereum maintain its potential infinity, ensuring it remains independent and free amidst various captures;

The value of EF: To open up a dialogue platform for core developers, ensure the diversity of node clients; support research and development interoperability workshops; promote community development account abstraction or cross-L2 coordination; adhere to the principle of “leading without controlling, coordinating without centralizing” to complete the transition from POW to POS mechanism; make Devcon and DevConnet independent yet relevant community networks;

At the same time, she reiterated what Vitalik had previously emphasized—the goal of EF is not to make EF “win” (Odaily Planet Daily note: that is, to achieve victory in terms of commercial value) — but to achieve long-term victory for Ethereum while adhering to its core values. Finally, she summarized the philosophical guiding principles of EF:

Subtraction, not minimalism

Long-term sustainability, not short-term gains

Thoughtful complexity, not oversimplification

Management, not control

Adaptive growth, not rigid structure

Purposeful evolution, not corporate-style expansion

Community leadership, not domination

In addition, she mentioned: “The uniqueness of Ethereum lies in its resilience rooted in values, which provides the possibility for technological and social innovation, making it a thriving infinite garden in an infinite game due to its biodiversity, rather than a machine; EF is committed to maintaining a democratic system and values that allow Ethereum's technological and social innovations to continue serving humanity's decentralized ideals.”

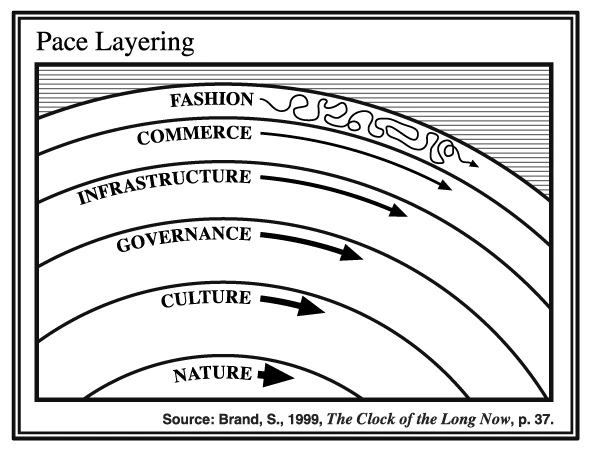

Finally, she expressed her expectations for becoming the EF chair—“My goal is to continue nurturing Ethereum's unique culture and to serve as a voice bridging the gap between Ethereum and the broader global community. Just as in Pace Layering, cultural development is the slowest, but it provides a solid foundation for everything that follows (‘If the slow parts are not occasionally frustrating, then they are not working - Stewart Brand’). Culture far exceeds market cycles, supporting us through winters and propelling us through springs.”

All of these statements are filled with the “naivety” of idealism and romantic spirit, and they also carry the Zen-style management approach that Aya has emphasized multiple times. However, this represents another form of “cultural hegemony”—defining Ethereum's culture unilaterally according to her own principles and ideals.

In the early development of the Ethereum ecosystem, a more flexible, free, and decentralized organizational philosophy undoubtedly maximized the enthusiasm and innovative genes of the ecosystem network. As a result, Ethereum experienced waves of industry booms from 2018 to 2022, transforming the concept of a “world computer” into reality, with its ICO price rising from $0.4 to a historical peak of nearly $4,800.

However, starting in 2022, after the collapses of UST, LUNA (Terra), 3AC, FTX, and other incidents plunged the crypto industry into a winter, and with BTC taking over as the focus of the crypto narrative, and the Bitcoin spot ETF landing on the US stock market, the times have changed.

An uncomfortable yet undeniable reality is that the crypto industry has moved past the early chaotic phase where scammers and idealists danced together, and people from the old world flocked to the new continent. It has now entered a stage where the crypto economy is becoming part of the world economy (even just a small part), BTC is becoming a slightly different investment target in the US financial industry, and the industry narrative has reached a dead end.

The long-desired Mass Adoption and the so-called positive externalities are merely the wishful thinking of crypto industry insiders under a veil of arrogance and prejudice, much like Vitalik's previous disdain and disregard for the only unrefuted DeFi track in the crypto industry.

Decentralization cannot be achieved merely by words, nor can it take root and blossom in reality solely through passionate solitary courage; if a person or an organization is merely superstitious about technological decentralization without achieving decentralization on multiple levels, then how can they win over the public? What about values? What about the unity of knowledge and action?

At the same time, the recent theft of over 500,000 ETH from Bybit has also revealed another hidden concern within the Ethereum ecosystem: the crisis of decentralization.

The Decentralization Concerns of ETH: The Bybit Theft Incident and the Insecurity Crisis of Safe

All along, what BTC Maxis and ETH Maxis take the most pride in and often boast about is the decentralization of their ecosystems. The former has created the world's largest digital gold, originally intended as a “peer-to-peer payment system”; the latter has been racing towards the vision of a “world computer” competing with Windows and MacOS.

However, closely related to decentralization is the security risk brought about by the anonymity that is inseparable from it.

On the evening of February 27, Bybit co-founder and CEO Ben Zhou posted: The hacker forensic report provided by Sygnia and Verichains revealed that the theft of funds was caused by a vulnerability in the Safe infrastructure, and malicious code was deployed at 15:29:25 UTC on February 19, specifically targeting Bybit's Ethereum multi-signature cold wallet.

Previously, the multi-signature wallet platform Safe officially stated that the developer's machine was attacked, but there were no vulnerabilities in the smart contracts or front-end source code; however, the investigation results from security companies clearly showed that the truth was not so: the truth is supply chain poisoning, and malicious code was implanted in the front-end related js of Safe. In other words, there was a problem with the security of Safe's infrastructure, which led to Bybit being targeted by the Lazarus Group hackers due to the large amount of ETH in the multi-signature cold wallet (Odaily Planet Daily note: According to industry insiders revealed, up to 400,000 ETH, far exceeding Bitfinex's cold wallet of 310,000 ETH, Vitalik's cold wallet of 240,000 ETH, and Bandit hacker's 51,000 ETH), resulting in the theft of over 510,000 ETH and derivative assets.

As an established crypto project, Safe, with related assets amounting to $100 billion, is mired in a trust crisis of “security projects being insecure.” It is worth noting that this is a multi-signature wallet platform that Vitalik himself also uses and has endorsed multiple times. The incident with Safe has also triggered another layer of trust crisis: Are the developers in the cryptocurrency industry carefully arranged insiders of hacker organizations like the Lazarus Group?

If previous security incidents were more about technical vulnerabilities and gaps in risk management, the Bybit theft incident and the security risks of the Safe multi-signature wallet involve a “mutual non-attack dilemma” akin to a dark forest—within the decentralized world of on-chain anonymity, we cannot determine whether there is a long-hidden member of the Lazarus Group among those involved in the development, maintenance, and growth of a crypto project (even a crypto security-related project).

This morning around 9 AM, on-chain analyst Yu Jin monitored that the Bybit hacker has laundered 206,000 of the stolen 499,000 ETH, averaging 45,000 ETH per day, leaving 292,000 ETH (worth $685 million) in the hacker's address at that time.

Bybit hacker's ETH holdings (as of around 9 AM on the 27th)

On one side, the hacker who stole over $1.5 billion in assets is using various mixers and decentralized protocols to launder the stolen funds; on the other side, there is the EF, which supports the ideals of decentralization and privacy protocols.

On February 26 at 7 PM, the EF officially posted, announcing a donation of $1.25 million for the legal defense of Tornado Cash developer Alexey Pertsev, stating that “privacy is normal, and writing code is not a crime.”

It is worth mentioning that previously, BitMEX co-founder Arthur Hayes and DWF Labs partner Andrei Grachev had called out to Vitalik regarding whether Ethereum would roll back like it did after The DAO hack in the Bybit theft incident. As of the time of writing, neither Vitalik nor the EF has made any statements on this matter, appearing to take a stance of watching from the sidelines. (Odaily Planet Daily note: Previously, Ethereum core developer Tim Beiko had personally posted a response to “Why can't Ethereum roll back after the Bybit incident?”, I personally believe this also reveals the disconnect between the EF foundation and the community)

Between decentralization and industry security management, Ethereum and EF may need to find a balance.

Conclusion: Confidence is More Important than Gold, Where is Ethereum's Confidence?

After ten years of Ethereum, in addition to the ancient whales and ICO profit-taking, it should also find new “confidence growth points.” After all, many times, confidence is more important than gold, or even “digital gold.”

The current reality is that the crypto community cannot find the confidence to support ETH's subsequent development, only seeing the EF occasionally dumping and selling coins, its delayed response to external changes, its one-sided pursuit of metaphysical ideals and values, and its evasion and indifference to the community's genuine voices and real concerns.

What will be the next event that brings new life to Ethereum? Who will be the individual? Which project will it be?

Like the readers, I do not know. All we can do, besides waiting, is to quietly build in our own way.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。