On the fourth working day of this week, the outflow of BTC and ETH spot ETFs continues, but the outflow has slowed down. Some may say this is due to the decent core PCE data, but that data is from Thursday, which was when the drop was most severe, with #Bitcoin even falling below $80,000. Of course, I am not saying that investors have stopped selling; in fact, investors are still selling.

However, it can be seen that the panic sentiment is gradually dissipating. Please do not misunderstand this; it does not mean that there is no panic anymore, but rather that the most panicked moment has temporarily passed. The remaining investors have certain expectations regarding the tariff issues, so the number of investors leaving due to panic is decreasing. However, if today's core PCE data is not optimistic and inflation continues to rise, I believe Friday's data will be even worse.

Although the core PCE data is somewhat optimistic, there are still many challenges ahead, one of which is the unemployment rate and another is the dot plot. The dot plot, in particular, basically determines the sentiment for the second quarter. Many may have already seen that the GDP announced in April may not be optimistic enough, which indicates that the U.S. trading recession or expected recession is about to begin again.

Therefore, for the entire year of 2025, it may be that Q1 has a chance to be somewhat optimistic, and Q4 has a chance to rebound, while everything else remains uncertain.

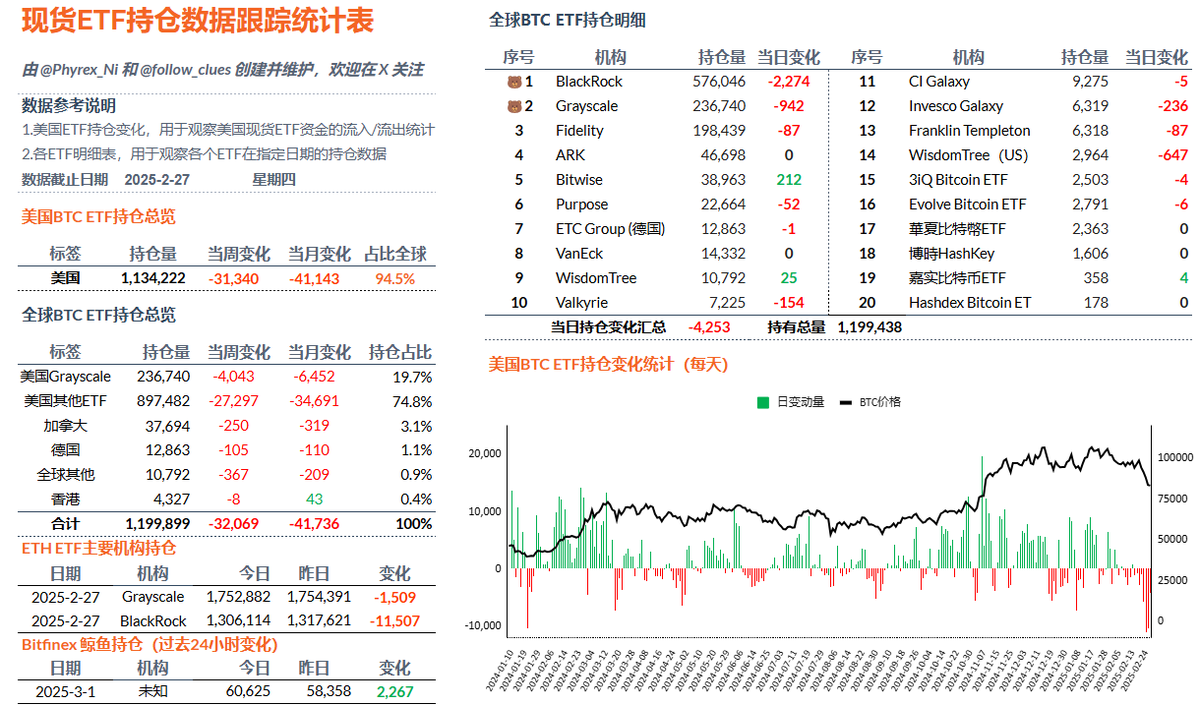

In yesterday's data, BlackRock was still the main seller, while other ETF institutions have reduced their selling.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。