Bitcoin’s descent below the $80,000 threshold on Thursday proved less than ideal for miners, as their earnings took a significant hit. As of now, with bitcoin (BTC) climbing back above $83,000, the hashprice—or the estimated value of 1 PH/s—has seen a slight recovery but remains at its lowest level since Jan. 28.

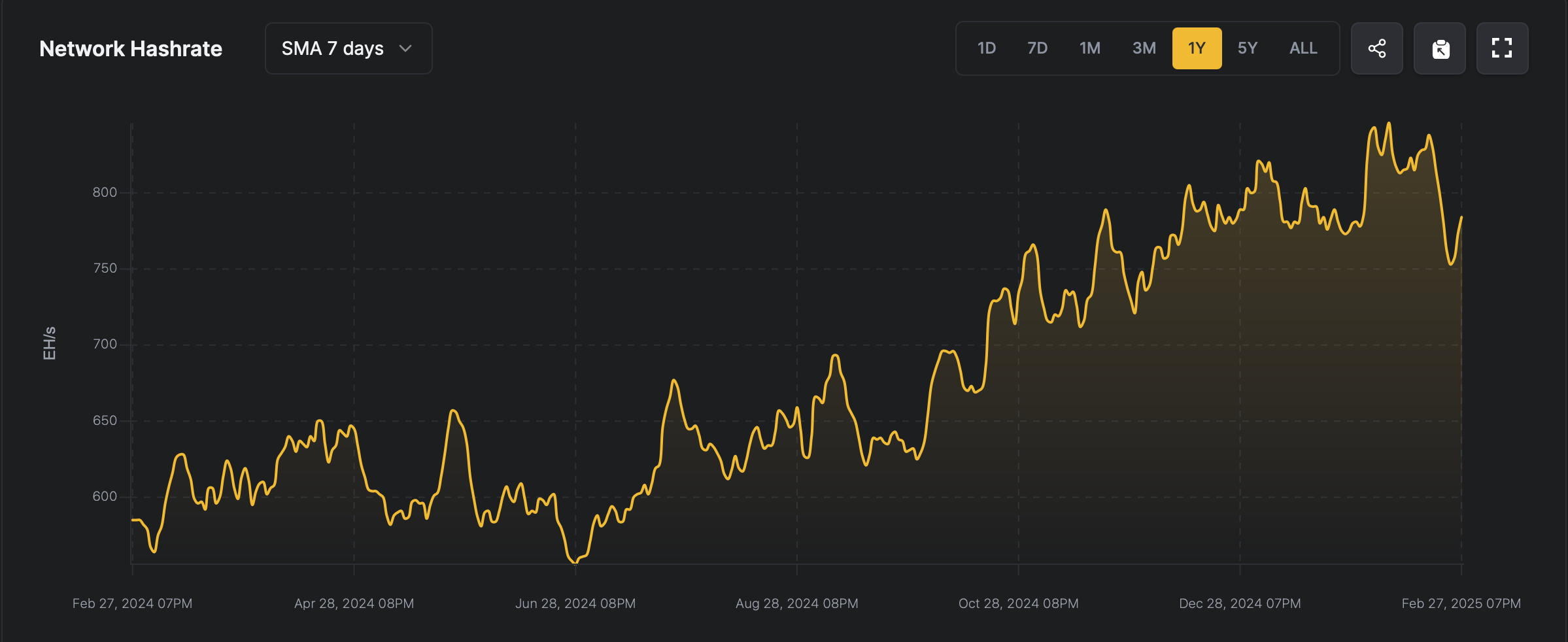

Bitcoin hashrate via hashrateindex.com

On Thursday, the hashprice dipped to $45.41 per petahash, and as of 3:30 p.m. Eastern Time on Friday, it has inched up to $48.65 per petahash. Just 30 days ago, the hashprice was a more favorable $60.19 per PH/s, highlighting the recent challenges faced by BTC miners. Bitcoin’s hashrate also experienced a significant peak in February, climbing to 852 EH/s on Feb. 7, 2025.

However, with the current rate at 799 EH/s, the network has shed over 50 EH/s of its computational strength, marking a noticeable shift in processing capacity. The reduction in hashpower coincides with a 3.15% decline in Bitcoin’s difficulty, which occurred five days ago on Feb. 23 at block height 885,024. Currently, the network difficulty rests at 110.57 trillion, with the next adjustment anticipated to take place on March 9.

While official metrics remain incomplete as Feb. 28 has not yet concluded, it appears bitcoin miners have extracted less value this month compared to January. According to data gathered from theblock.co, miners generated $1.4 billion from block subsidies and fees last month. However, this month’s tally stands at $1.21 billion, with just three hours and 20 minutes left before February draws to a close.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。