Let's talk about the topic of tariffs, which currently dominate trade.

First, let's look at the current situation:

- China 19% (original) => 19% (effective March 4, executive order)

- Products from Mexico and Canada are subject to a 25% tariff, with a 10% tariff on Canadian energy products (executive order)

- European Union: 25%, with no specific deadline yet

Specific impacts:

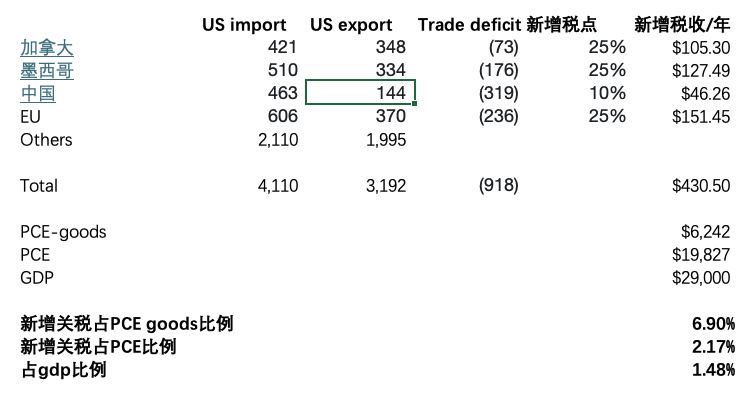

Refer to Figure 1, the overall tax revenue is about $430 billion, accounting for 7% of PCE goods, about 2% of PCE, and around 1.5% of GDP. Therefore, I believe the impact on inflation is quite significant - I do not think these effects are "one-time" as some people say, because the rise in import prices may be instantaneous (and Europe will be even later), but retail prices may reflect a delay, and this delay will spread the price increase over different months.

Additionally, the public will feel the pain clearly, as the prices of goods are expected to rise by about 5%-6%…

Of course, since imports will decrease due to tariffs, the overall impact will be somewhat smaller.

Conclusion 1: Tariffs have a real impact on inflation.

In this context, the probability of the Federal Reserve raising interest rates is not high.

Another question is whether this will trigger a trade war and further escalation of tariffs? For example, Trump initially said he would impose a 60% tariff on China, so is the current 10% just the first step?

I believe this is determined by the trading positions of both sides. Currently, the U.S. has trade deficits with these economic entities, such as East Asia, which may retaliate relatively mildly, but it may not necessarily lead to a trade war. Because if the trade war continues to escalate, the impact on exports to East Asia will be greater.

Conclusion 2: There should not be a large-scale mutual escalation of trade wars like in 1930. However, Trump may not hesitate to continue raising tariffs, as his objectives are still not very clear so far.

The third question is whether Trump will extend tariffs to other countries?

It can be seen that China, Mexico, Canada, and the EU only account for 50% of U.S. imports.

Conclusion 3: Tariffs will inevitably extend to other countries and regions.

If tariffs are charged at around 20%, the overall tax revenue would approximately double, meaning that product prices would increase by about 10%, and the impact on PCE would be around 4%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。