Today's homework has become interesting. Unfortunately, I've hit my posting limit again, and I don't know when I can post. Next time, I really should write my homework earlier instead of replying to my friends' messages first. I imagine that friends who sleep early might be shocked when they wake up and check the prices. It's still because of Trump; the previous drop was due to his tariff policy, and today's rise is because he announced the U.S. cryptocurrency strategic reserve, which mentions $BTC, $ETH, $SOL, $XRP, and $ADA. Isn't that a bit surprising? I also have some.

But in any case, the strategic reserve matter is almost a foregone conclusion. Details should emerge in the early hours of March 8, Beijing time. The pinned tweet has explained it in detail. In this situation, if the non-farm payroll data on March 7 has a negative impact, it is very likely to be offset by the crypto summit on the 8th, provided that the data isn't too bad; being around expectations would be best.

Overall, the Q1 market is still jointly determined by Trump and the Federal Reserve. Although Trump cannot decide the Federal Reserve's actions, he can directly call the shots. What we can still look forward to in March is the end of the Russia-Ukraine conflict, the completion of the strategic reserve in Utah, and most importantly, the dot plot. Friends who are interested can check the pinned tweet.

Some friends asked me if there would be a sell-off during the daytime in Asia. I said I don't know if I'm right, but we should be able to see in a few hours. I estimate that there will not only be no sell-off but also a certain buying power, as this is a clear positive news. The real implementation or further good news should come on March 8. The significance of a sell-off now may not be great, and even if the sentiment is poor during the day, what will happen when the U.S. stock market opens in the evening?

The U.S. stock market rebounded nicely on Friday, indicating that investor sentiment is stabilizing. The strategic reserve information was announced on Sunday, and I think it shouldn't be too bad. Of course, this is just my personal speculation and should not be used as a basis for trading; I may not be right, so please do not seek me for rights protection.

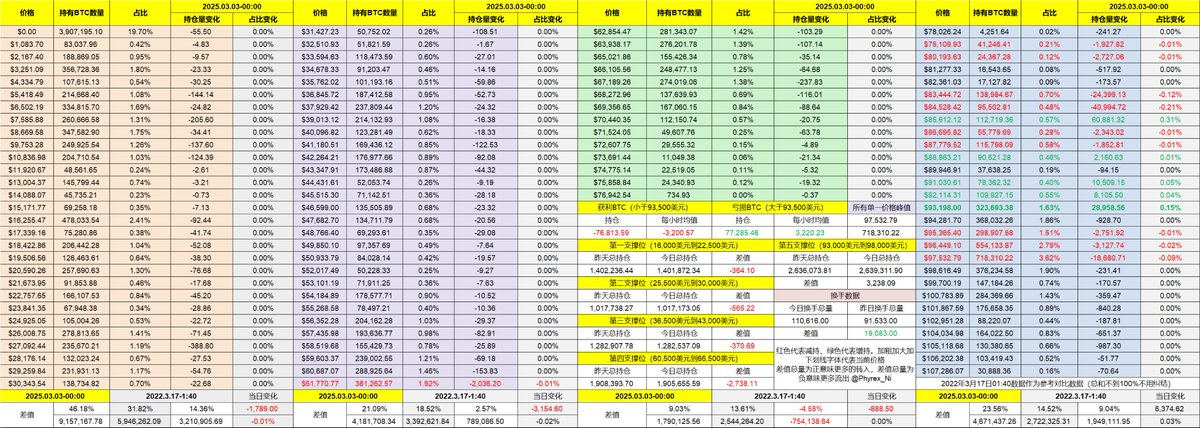

Looking at the data for Bitcoin itself, liquidity suddenly increased on Sunday, as Trump's information greatly boosted investor sentiment. Now the price of #BTC has returned to around $93,000. From the data, due to the large fluctuations, most of the friends who bought the dip started from $90,000.

In the last two days, short-term investors who bought the dip have also been selling quite aggressively. Overall, there is still some risk, mainly on a macro level, but the timing should be around the dot plot. If one wants to choose to hedge and exit, around March 17 might be a good time.

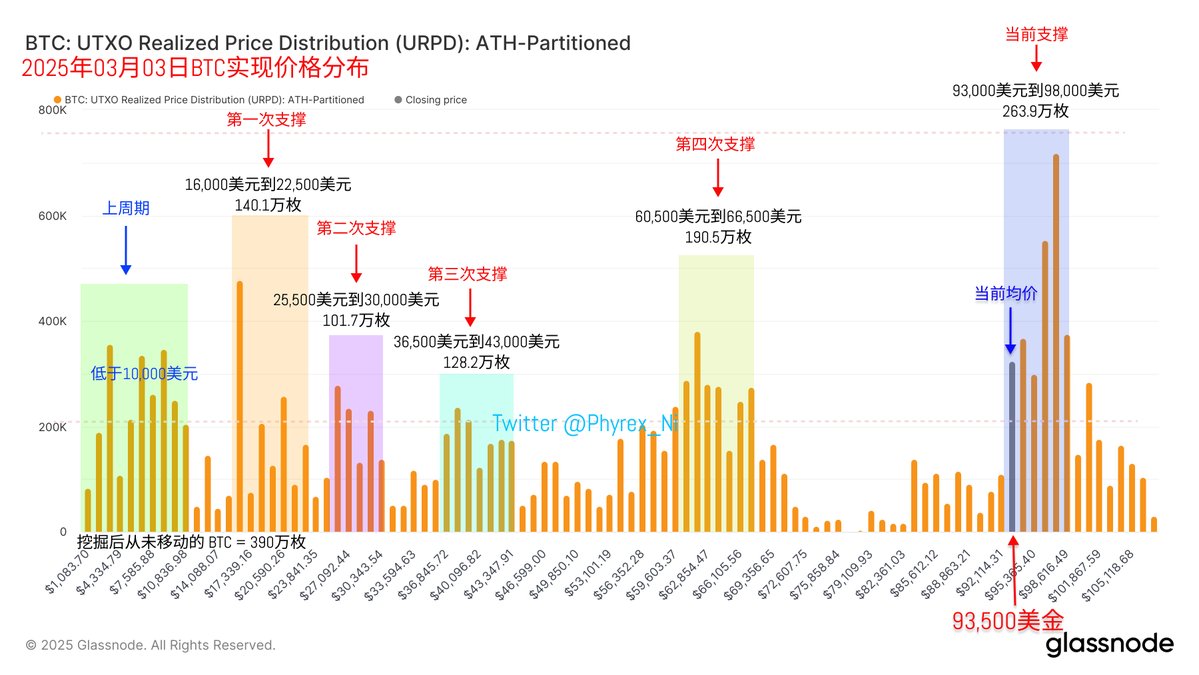

I am not surprised that the price has returned to around $93,000; it just happens to be the support level we talk about every day. @Murphychen888, Brother Murphy, likes to call it the "magnetic effect." He is one of the few who can resonate with on-chain data, which is quite rare. I no longer have the energy to explain repeatedly why this magnetic effect occurs; you can check out Brother Murphy's tweet from yesterday, which touches on this.

On-chain data support is also a form of support. This type of support is different from candlestick charts; it is not unbreakable. This support refers to a dense accumulation of chips within a certain range. For example, the range from $93,000 to $98,000 currently represents the largest dense accumulation of chips. As long as these investors do not exit and do not panic, the support for Bitcoin will be strong. Even if it breaks below, it will likely return to the support range. I have talked about 2024 for over six months, and I won't continue discussing 2025.

The data has been updated. Address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。