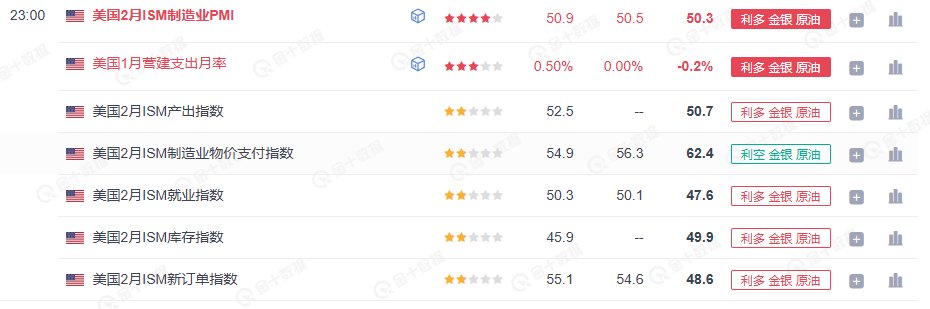

From the data, ISM's PMI is still declining, not only below the previous value but also below expectations, especially as the price payment index reached 62.4, possibly due to concerns over tariffs. However, the final value of the S&P Global Manufacturing PMI for February in the U.S. has increased. The comparison of these two data points shows that small and medium-sized enterprises are active, while large enterprises face challenges (such as rising costs and decreasing orders).

PS: The market impact of ISM PMI is stronger, but the S&P Global PMI is more indicative of future manufacturing trends.

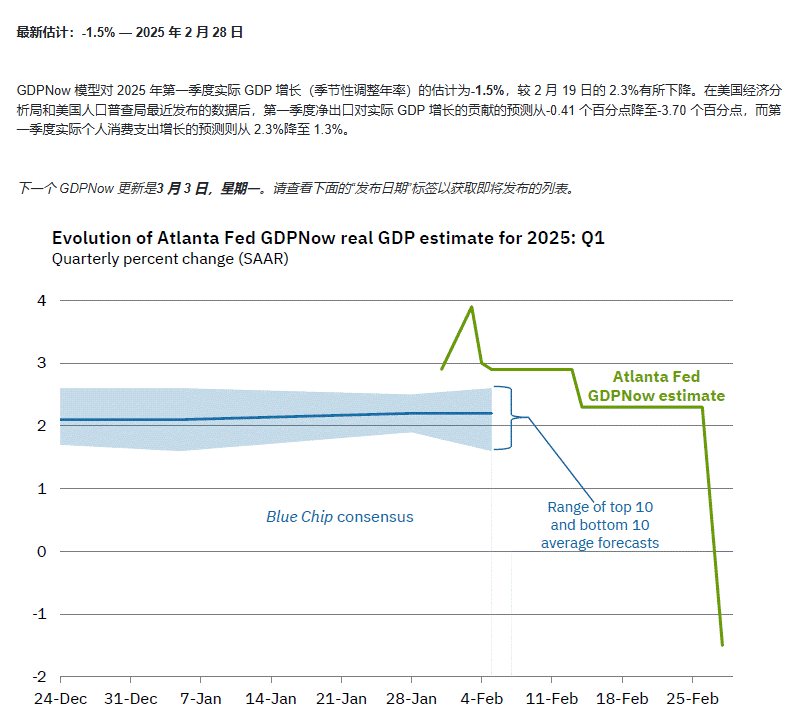

Currently, discussions about recession mainly focus on two major aspects: GDP and unemployment rate. Regarding GDP, the data provided by GDPNow is not particularly optimistic, but the specific data will not be released until April. Therefore, if there are doubts about a tendency towards recession, the short-term outlook is still relatively good.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。