American ETF investors are also following macro trends and sentiment. Last Friday, the core PCE data was good, and Trump announced that he would hold a crypto summit at the White House on the 8th Beijing time. This prompted many Bitcoin spot ETF investors to start buying again, and Friday finally ended a streak of eight consecutive working days of net outflows, with a net inflow of 1,239 #BTC.

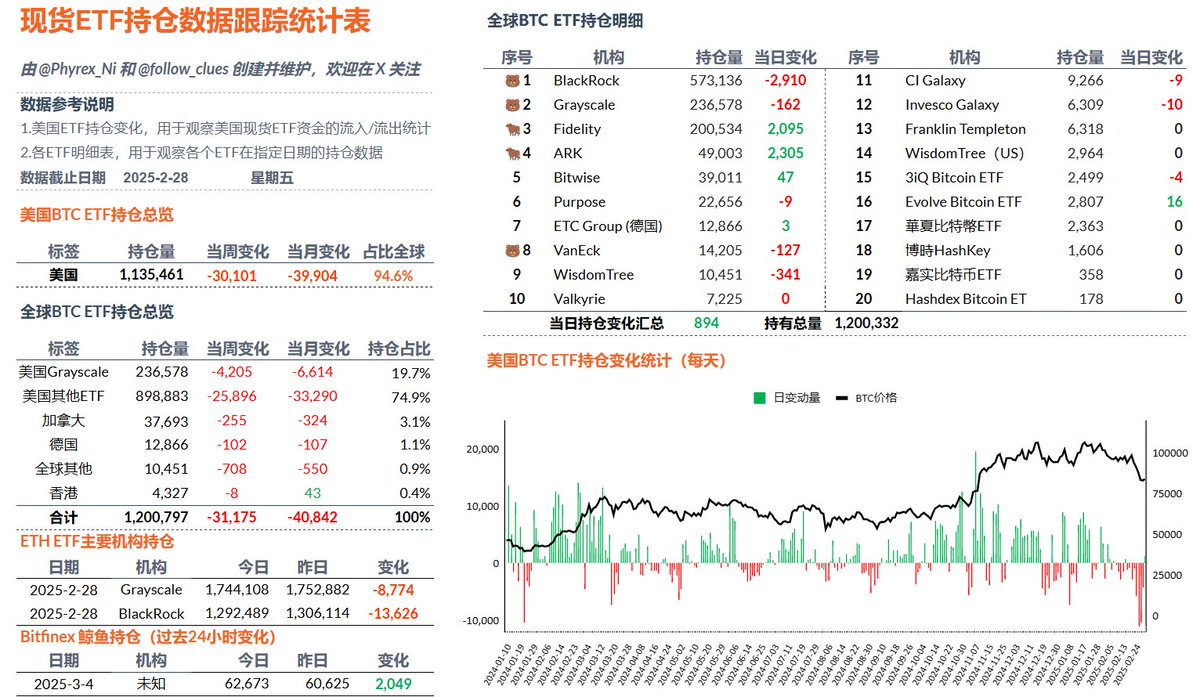

However, in Friday's data, BlackRock's investors were still the largest sellers of BTC, with other institutions lagging significantly behind BlackRock. The strongest buying power still came from Fidelity and ARK. It must be mentioned that although many people say that Fidelity has a lot of retail investors, Fidelity's investors are indeed more sensitive to price changes.

At least from the current data, investors who bottomed out with Fidelity and ARK on Friday are now in profit. However, the weekly data is not ideal. In week 59, net selling by American investors increased more than six times compared to week 58, with BlackRock selling 13,732 BTC in just one week, accounting for 2.34% of the total supply. Fidelity ranked second, selling 6,266 BTC, which is 3.03% of the total supply.

Although some ETF investors may be engaging in arbitrage, the Bitcoin being sold will still serve as active chips in the market and affect investor sentiment. Overall, however, more ETF investors are still maintaining a wait-and-see attitude.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

Weekly data, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。