I have to say, I just spent another fantastical 24 hours. As of now, after Trump announced the cryptocurrency strategic reserve information, Bitcoin and ETH have already fallen below their levels before the announcement. From a god's perspective, it might be that Trump is worried that his tariff policy on Monday will cause turbulence in the cryptocurrency industry, so he released favorable information in advance to pump the market. Therefore, when facing tariffs and the Russia-Ukraine issue, the decline in cryptocurrencies may be relatively limited; otherwise, it would likely drop even more. (The above bold text is all a joke)

The main reason for the pullback in risk markets, including U.S. stocks and cryptocurrencies today, is that Zelensky believes the Russia-Ukraine conflict may not end quickly, along with Trump's insistence on tariffs. Yes, if you want to know the reason for today's decline, it's this. Many friends will ask, wasn't it already known that tariffs were going to increase? When Zelensky was ousted, wasn't it clear that negotiations had failed? Why did it all explode today?

Because the market has been anticipating that Trump's hardline stance on tariffs is a bargaining chip for negotiations. For example, during the first instance, he paused for a month to give Mexico and Canada room for negotiations, but this time he directly announced the start without any room for negotiation. The reciprocal tariffs on April 2 are the same, so the market has given up its last hopes.

If you can't win, just surrender.

As for the Ukraine and Russia issue, although everyone feels that Zelensky has been humiliated, it doesn't matter; after all, he has no cards to play. Everything before was just a performance. Ukraine will ultimately agree to the U.S. proposal. As a result, Zelensky directly stated today that the war will not end quickly. Coupled with the recent condemnation of the U.S. by the EU and its expression of support for Ukraine, there are indeed unseen risks for a short-term halt in the Russia-Ukraine conflict.

The tariffs that have already been implemented and the war resolution that cannot be achieved in the short term mean that the probability of rising inflation in the U.S. will be very high. The result of this will be a reduction in the number of interest rate cuts and an increase in the risk of economic recession under high interest rates. It should be noted that another catalyst for today's decline is the GDPNow forecast that the U.S. GDP for the first quarter will drop to negative 2.8%, nearly doubling from last Friday's negative 1.5%.

U.S. inflation may rise, and the economy may enter recession; being slightly pessimistic is normal. I know some friends will ask if I still have faith in Q1 and whether this decline will be a buying opportunity. The answer is the same: I still have faith in Q1. If the price of $BTC drops below $80,000 before the summit on the 8th, I will continue to execute my buying plan.

My optimism only represents my personal view and is not any investment advice. I also do not recommend being as optimistic about Q1 as I am. After all, for me, if Q1 does not perform well, I won't suffer much loss; at most, I will earn a little less, which will not affect my life in any way.

Additionally, the investment announcement from Trump that everyone is looking forward to today has nothing to do with cryptocurrencies; it is TSMC's investment in the U.S. Although it is seen as beneficial for the development of AI in the U.S., Nvidia fell by 10% following Trump's statements on tariffs and the Russia-Ukraine conflict.

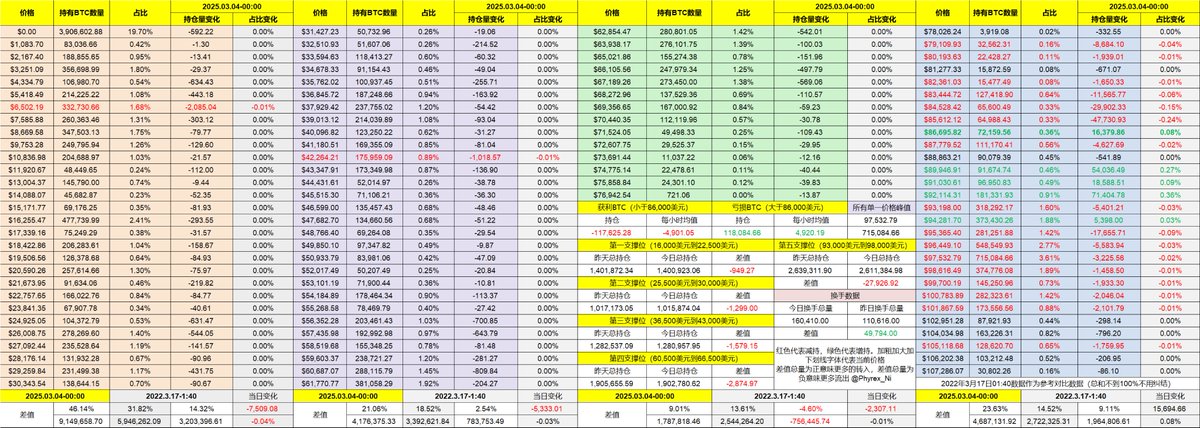

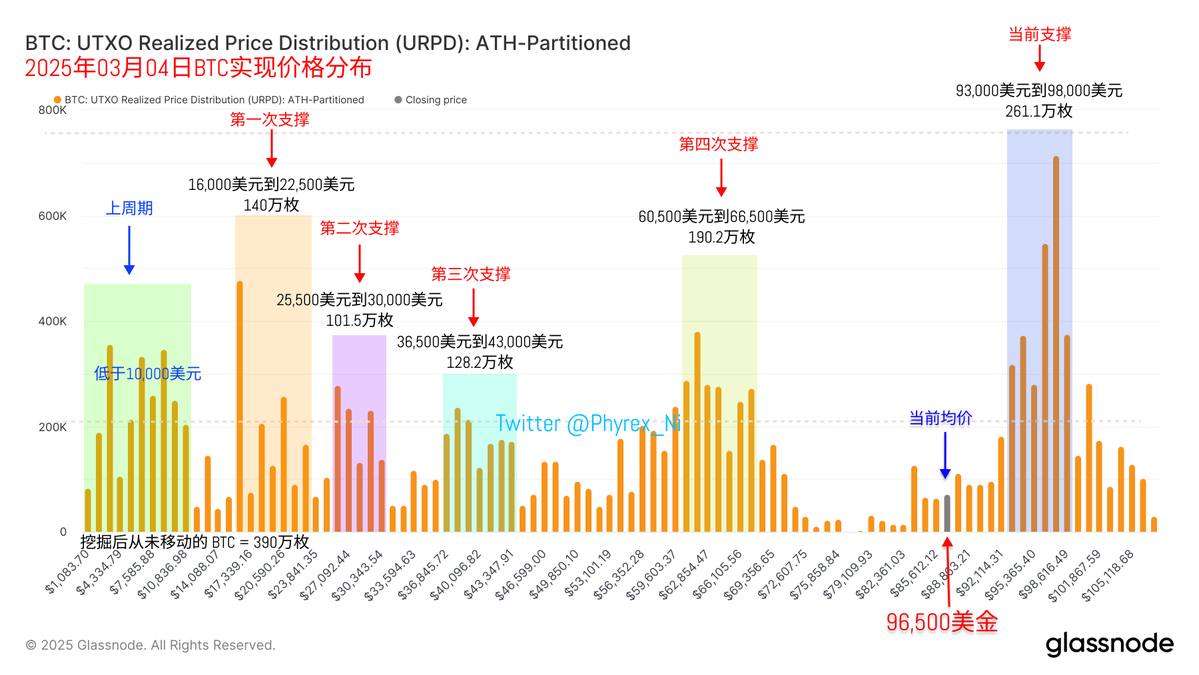

Looking back at the data for Bitcoin itself, it has almost returned to the starting point in the last 24 hours, but the turnover rate has increased quite a bit. Many friends have exited with profits and losses, but overall, there are more who have exited with profits. Indeed, quite a few investors stopped speculating before the $90,000 mark.

From the current situation, after Tuesday, the sentiment should settle down a bit. After all, what needed to happen has happened. Next, we will await the non-farm payroll data on the 7th, and after that, there will be the meeting on the 8th. So overall, the pinned tweet has been written in great detail, and the general process has not exceeded that.

In terms of support, there hasn't been much change. The support between $93,000 and $98,000 remains very solid, and investors in this range still show no signs of panic. However, it is worth noting that the gap at $77,000 in the URPD has not yet been filled. Historically, URPD has never left a gap unfilled, so this is also a risk. Similarly, there is a gap at this position in the CME; it just depends on when they will be filled together.

Although filling gaps is somewhat mystical, it really cannot be ignored, but when it will happen is very hard to say.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。