Crypto venture capital activity rebounded in February 2025, with $951 million in disclosed funding across 98 projects, marking a 14% increase from January. Despite the month-over-month growth, investment levels are still down 35% year-over-year compared to February 2024, according to RootData.

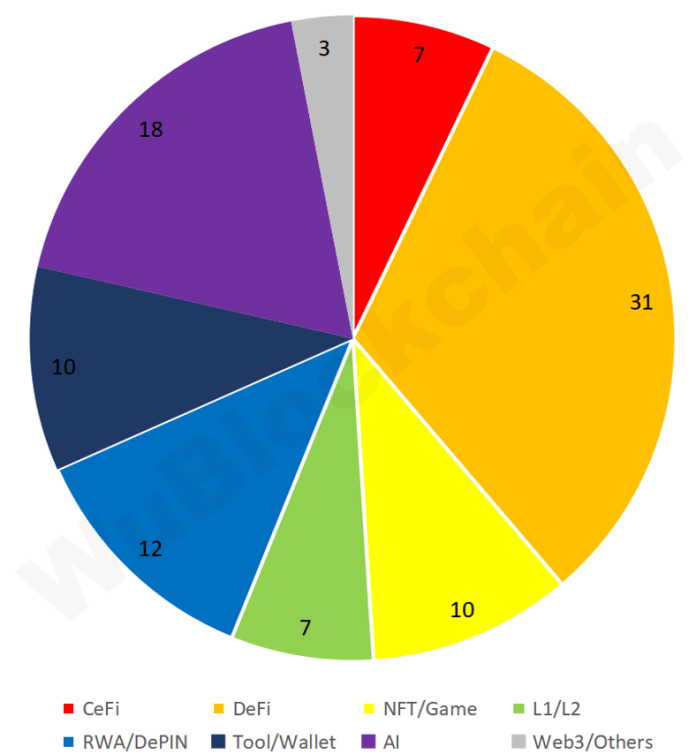

Stablecoins and payments emerged as the dominant categories, attracting significant institutional backing. Decentralized finance (DeFi) and AI sectors also saw notable funding increases. However, Layer1/Layer2 blockchain projects and centralized finance (CeFi) investments remained subdued.

The top disclosed venture capital investment in February was on Figure & Sixth Street which raised $200M joint venture to boost private credit liquidity. Ethena raised $100 million to develop institutional-friendly tokenized assets, Bitwise secured $70 million to expand crypto asset management services, and Raise saw a $63 million funding round to integrate stablecoin payments into gift card services.

Other key investments in February saw Blockaid raise a $50 million Series B for on-chain security solutions, HashKey received a $30 million investment, and Plasma got $24 million to build a dedicated stablecoin blockchain with zero-fee Tether transactions.

The continued flow of capital into stablecoins, payments, and DeFi infrastructure signals growing institutional confidence in regulated and scalable crypto applications. With regulatory clarity improving, VC-backed firms are expected to drive the next wave of crypto adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。