Preface: Investment carries risks, and operations should be cautious.

Article review takes time, and there may be delays in publication. The article is for reference only, welcome to read!

Article writing time: March 4, 11:45 AM Beijing Time

Market Information

- The sentiment in the crypto market has changed again, shifting from "fear" to "extreme fear";

- The Prime Minister of Vietnam has requested the submission of a cryptocurrency policy draft this month;

- Bernstein: It is unclear whether the cryptocurrency reserve concept can be implemented solely based on Trump's executive order;

- The CEO of Goldman Sachs stated that the likelihood of the U.S. economy falling into recession is "very small." (Watcher.Guru);

- Standard Chartered Bank stated that Trump's cryptocurrency reserve plan has brought the $500,000 Bitcoin target back into focus;

- Bernstein: If Trump's crypto reserve plan is approved by Congress, funding could come from the redistribution of gold reserves or newly issued government bonds.

Market Review

Yesterday, due to Trump's mention of setting Bitcoin and Ethereum as reserve currencies, the market responded with a rise, but then quickly fell back in the evening session. The market remains somewhat skeptical about Trump's policy of designating cryptocurrencies as reserve currencies, as the Federal Reserve is unlikely to allow such a thing to happen, leading to a subsequent decline in the market, which failed to continue rising. A long position was established yesterday based on news, but it has already hit the stop-loss. The upcoming crypto summit on March 7 will also be crucial. In trading, it is still recommended to take low long positions. Although there will be Federal Reserve intervention, it should ultimately achieve a corresponding status, which will be somewhat beneficial for the crypto space.

Market Analysis

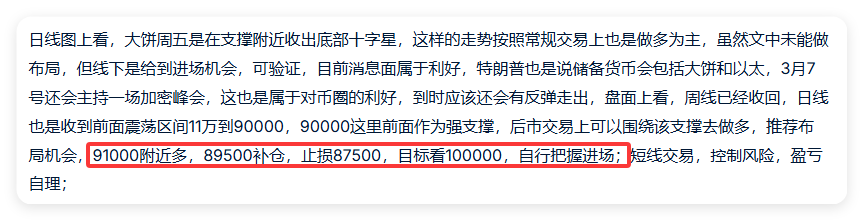

BTC:

From the daily chart, there is certain pressure above Bitcoin that has not been broken through. Currently, Bitcoin has not fallen below the 200-day moving average. With Trump's announcement of Bitcoin as a reserve currency providing support, the chance of breaking the previous low of 78,200 is not very high. In trading, one can look to go long around the support level of 82,000, with attention on stabilizing above 99,000. Recommended entry points are to set long positions at 82,000, add positions at 80,500, with a stop-loss at 79,300, and targets at 89,950 and 92,200. Please manage your entry opportunities; for short-term trading, control risks and manage profits and losses independently.

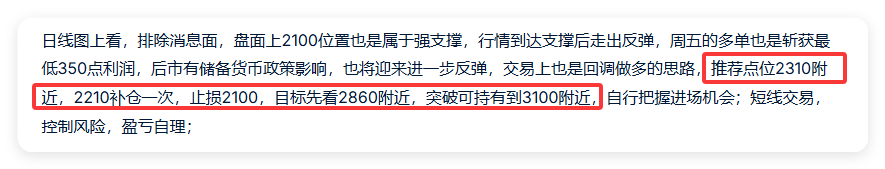

ETH:

From the daily chart, it can be seen that Ethereum has broken below the support level of 2,100. Currently, the daily line has not closed yet. If the daily line can return above the 2,100 support level by tomorrow morning, long positions can be established. The overall trend of Ethereum is still somewhat weak, with a stronger downward momentum compared to Bitcoin. In daytime trading, it is advisable to observe first, and once it closes back at support, it is not too late to go long, with the target still looking at around 2,450. Please manage your entry opportunities; for short-term trading, control risks and manage profits and losses independently.

In summary:

The news in the Bitcoin and Ethereum markets will not lead to a deep decline; pullbacks present opportunities to go long.

The article is time-sensitive, be aware of risks, and the above is only personal advice for reference!

Follow the WeChat public account "Crypto Lao Zhao" to discuss the market together;

The root of all suffering is the pursuit of certainty. Impermanence is the norm and the way life should be. Always wanting to grasp the market, not acting on a 50% certainty, not acting on a 70% certainty, must wait for a 100% certainty—where is there a 100% certainty in the market? Trading is about trading risks, trying to make the odds stand on your side. Those who give love receive love in return; those who bring blessings receive blessings. Sometimes, learn to take a little loss, be a bit foolish, a bit clumsy. For example, if the market is bullish, once this is confirmed, don’t get too rigid with your position, lower your position size a bit, and then get in first; at worst, it will reverse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。