📊 Monitoring CEX Capital Inflow Data About a Week After the Bybit Hacking Incident!

Today, the hacker who stole from Bybit took ten days to launder all 499,000 $ETH. In everyone's impression, this theft incident has come to a close;

Clearing out Ethereum is somewhat a good thing, allowing Ethereum to complete a full turnover. If there are any upward movements later, this round of washing will be very thorough;

Additionally, during the period of the theft incident, I monitored the capital flow between CEXs after the Bybit hack and found an interesting trend:

Let me summarize the entire process:

1) Background——

Bybit was hacked on February 21, 2025, resulting in a loss of approximately $1.5 billion, making it the largest cryptocurrency theft in history.

This incident raised concerns in the market about the security of exchanges, leading to capital flowing out of the affected platform and concentrating into exchanges perceived as safer.

I mainly looked at where the funds escaping from Bybit went and where they remained!

2) Short-term Capital Flow——

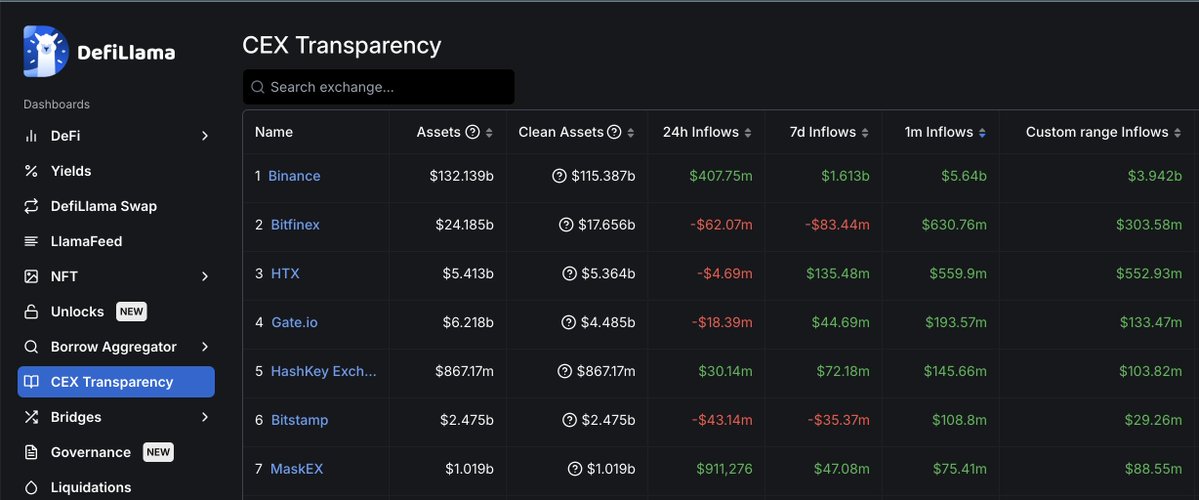

Research data shows that in the week following the Bybit hack, market funds exhibited a clear trend of concentration flowing into Binance.

Binance's weekly net inflow reached $3.971 billion, while the total net inflow of the other nine major exchanges (excluding Bybit) was $396.83 million.

Calculations indicate that Binance's capital inflow was ten times that of the total of the other nine exchanges (39.71 / 3.9683 ≈ 10).

This phenomenon reflects that during sudden events or market fluctuations, investors tend to transfer funds to platforms perceived as safer and more stable, with Binance being the primary choice at present!

3) Long-term Capital Trends——

According to February 2025 data, Binance's net inflow for the month reached $5.323 billion, while the total net inflow of the other nine exchanges (excluding Bybit) was $1.229 billion (Bitget data missing).

Binance's net inflow was 4.33 times that of the total of these nine exchanges.

Moreover, Binance's net inflow was seven times that of the second-ranked Bitfinex ($768.19 million).

According to historical data from DefiLlama, in the past 12 months, Binance had a net inflow exceeding $3 billion over six months, with November 2024 reaching $9.2946 billion, setting a record high for the past year.

Summary——

The Bybit hacking incident reveals the dynamic response of the cryptocurrency market when facing security threats.

In the short term, investors tend to withdraw funds from affected exchanges, concentrating them into platforms like Binance that are perceived as safer. This behavior reflects the market's high sensitivity to exchange security.

In the long term, Binance's continued leading position may benefit from its strong technological infrastructure, regulatory compliance, multiple large-scale withdrawal stress tests, and the trust of its global user base.

Finally, let’s leave a prompt for everyone to discuss together:

Of course, if Binance encounters problems, such as historical large-scale withdrawal incidents due to "regulatory turmoil" or the FTX incident, where would everyone move their money?

I initially withdrew to a cold wallet! What did you all do?

Data reference: https://defillama.com/cexs

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。