Worried that Uniswap rugs itself by incentivizing LPs to migrate from Ethereum/L2s to Unichain.

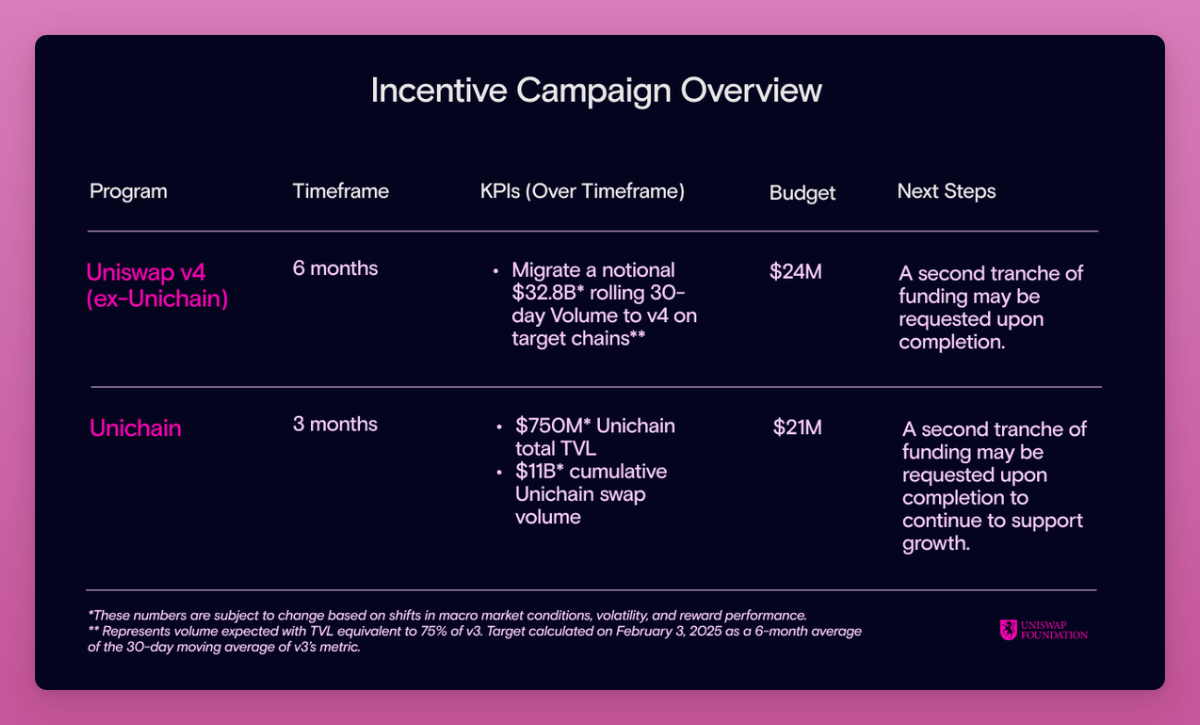

The DAO votes to allocate $21m to attract TVL to Unichain. However, most of this money will likely come from LPs already on Uniswap's DEX.

In effect, Uniswap is pressuring its users to leave Ethereum.

Incentivizing TVL on Unichain -> LPs migrating from Ethereum and L2s -> decreased market share on ETH/L2s -> Competitors on Ethereum emerge

Moreover, Unichain worsens liquidity fragmentation for all.

Was launching Unichain truly a smart decision?

Maybe Uniswap Labs should have consulted the DAO before secretly launching their own L2.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。