Rocket Pool, the ether liquid staking protocol, long lingered in the shadow of Lido, the dominant liquid staking derivative network. Today, the narrative pivots: Binance’s derivative offering, wrapped binance beacon ether (wBETH), has eclipsed rivals to secure its rank as the second-largest protocol trailing only Lido.

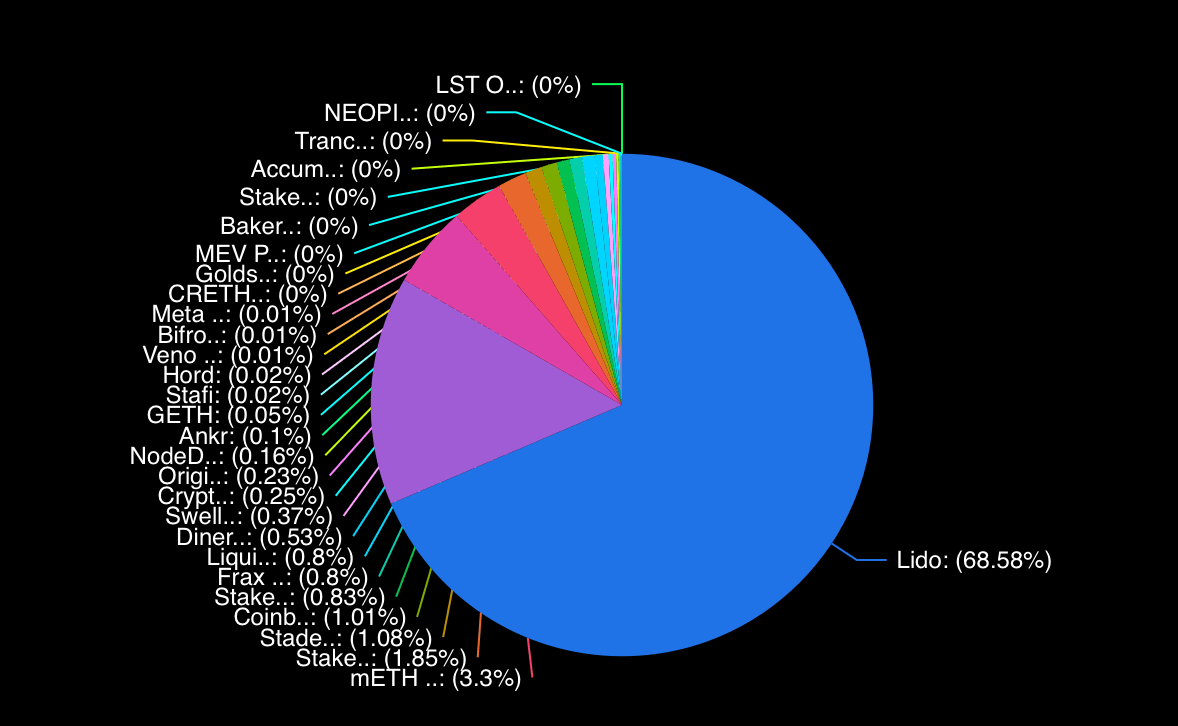

A pie chart of the total value locked ETH (13.68 million) percentages via defillama.com stats.

This shift highlights a quiet yet potent realignment in the sector, defying prior expectations of market inertia. Archived Etherscan records from Nov. 19, 2024, detail the minting of 1.43 million wBETH tokens at inception, distributed across 3,304 addresses managing Binance’s liquid staking derivative.

Three months and sixteen days later, wBETH’s Ethereum-based supply has climbed 27.27% to 1.82 million tokens, while 189,689.74 wBETH circulates on BNB Chain—yielding a combined total of 2,013,541.54. Ownership now spans 4,461 Ethereum addresses and 6,681 BNB Chain wallets, reflecting broadening adoption.

Rocket Pool, once the unchallenged second-place protocol with over one million ETH staked, now circulates 443,596.87 rETH. Despite diminished supply, its holder base has ballooned to 19,391 wallets. Yet its position grows precarious as competition intensifies.

Mantle Network’s mETH looms with 426,121.19 tokens—a hair’s breadth from rivaling rETH—while attracting 9,864 holders. Lido’s stETH maintains ironclad dominance, constituting 68% of the 13.68 million liquid staking derivatives. Ethereum’s blockchain currently hosts 9.39 million stETH, per onchain metrics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。