Safety is the main theme of the blockchain industry's development. Bybit lost $1.4 billion due to a Safe error, Infini was hacked for $50 million due to poor private key management, while CoinW has operated for 8 years without incidents, forming its own insights on security and blockchain.

Now, CoinW has decided to transfer this experience to the on-chain world, aiming to provide the safest and fastest on-chain derivatives DEX product, DeriW. Unlike products like dYdX and Hyperliquid, DeriW adopts a parallel concept that balances security and speed from the very beginning, leading to an ultimate user experience. Let's take a closer look from a technical perspective.

Technical Foundation: CoinW Reshapes the Future of On-Chain Trading

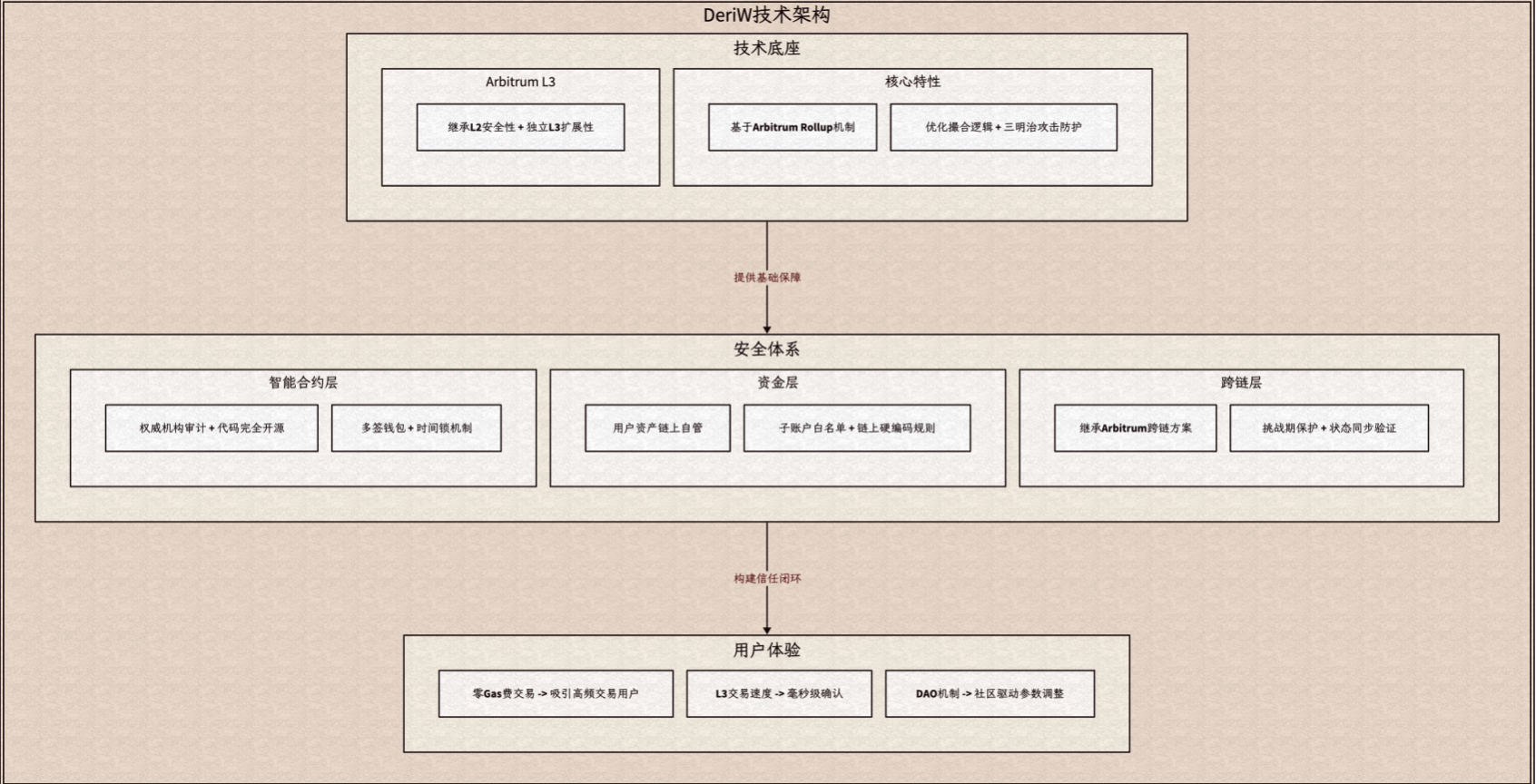

On March 4, 2025, the decentralized perpetual contract trading platform DeriW, based on Arbitrum, announced the launch of its testnet. DeriW is built on Arbitrum's L3, with its security guaranteed by L2, which in turn is secured by Ethereum. Based on this, DeriW can enjoy Ethereum's security and the ultra-high TPS of a customizable L3, reaching up to 80,000.

As an innovative protocol focused on derivatives trading, DeriW attempts to balance user experience and asset security through a multi-layer security architecture and optimized trading logic.

In terms of security, DeriW not only inherits the underlying security of L2 and L1 but also achieves cross-chain state synchronization through a Rollup mechanism. It actively combines proactive measures with passive defenses, with on-chain security tools monitoring for anomalies in real-time and offering a bug bounty program to eliminate risks at their inception.

Thanks to the high customization of L3, not only can it achieve 0 Gas Fee, but DeriW also optimizes trading aggregation logic to minimize MEV attacks, reduce user trading costs, and enhance trading fairness.

On this basis, DeriW adopts a non-custodial model, allowing users to manage their own funds, eliminating the risk of third-party interference. Additionally, the core contracts are managed through a multi-signature wallet + time-lock mechanism and have completed audits by authoritative security agencies, with all code open-sourced for community oversight.

Moreover, based on its development experience in CEX, CoinW has set multiple defenses for DeriW's fund permissions, ensuring that even DeriW cannot access user funds. All operations involving funds are limited to a whitelist and are immutable, with risk isolation implemented at the underlying architecture level.

Regarding the criticized security of cross-chain bridges, DeriW chooses to inherit Arbitrum's mature solution, adopting the same cross-chain bridge implementation as L2. It achieves cross-chain state synchronization through the Rollup mechanism, and when submitting fund states from DeriW L3 to Arbitrum L2, it employs an optimistic verification mechanism to correct abnormal transactions within a protection period, ensuring user safety.

With multiple security guarantees at the smart contract layer, fund layer, and cross-chain layer, DeriW essentially achieves the optimal solution under current technical conditions, thereby building a trust loop with users and attracting various types of users. If you missed HyperLiquid, don't miss DeriW.

Ecosystem Incentives: 6600 DER Points Rewards Await

Since the development of DeriW began, it has achieved or plans to achieve on-chain open source, multi-sign governance, and DAO mechanism establishment. In the future, DeriW will also optimize core parameters through community voting, gradually achieving complete decentralized governance.

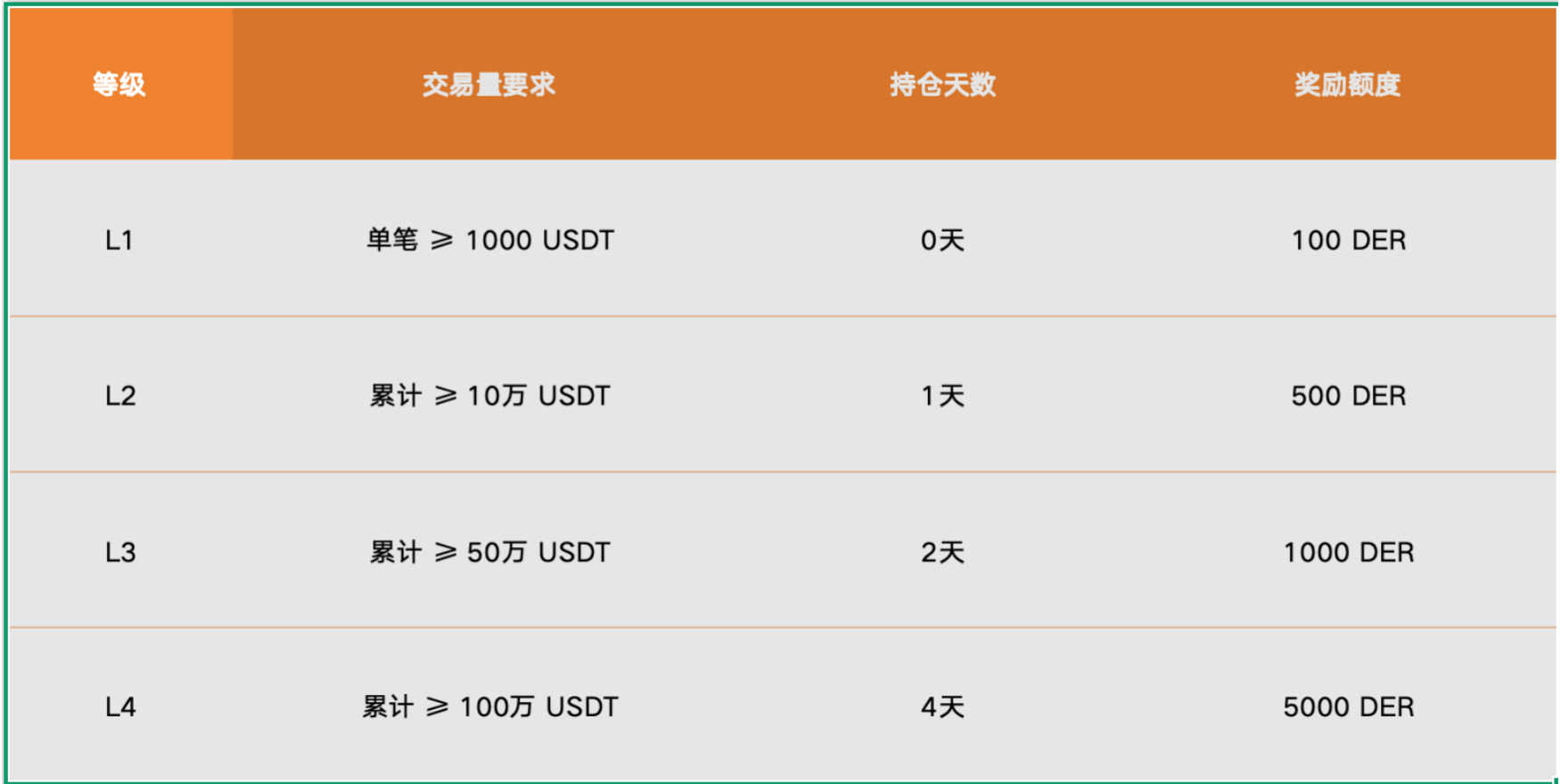

Furthermore, CoinW has prepared rich rewards for users participating in the DeriW testnet activities. DeriW has launched the "SUPERNOVA Plan", where each user can earn up to 6600 DER Points.

The activities are divided into two main modules: tiered tasks and basic airdrops. After users complete the corresponding tasks, rewards will be airdropped to their addresses after the mainnet launch:

1. Basic Task Level 1: Users only need to connect their wallet or create a DeriW wallet, receive test tokens, and complete a first transaction of ≥ 1000 USDT to earn a reward of 100 DER;

2. Tiered Tasks: Divided into three levels based on cumulative trading volume and holding days:

a. Level 2: Trading volume ≥ 100,000 USDT, holding for 1 day, reward of 500 DER tokens;

b. Level 3: Trading volume ≥ 500,000 USDT, holding for 2 days, reward of 1000 DER tokens;

c. Level 4: Trading volume ≥ 1,000,000 USDT, holding for 4 days, reward of 5000 DER tokens.

Conclusion

Decentralization is an unstoppable historical trend. CoinW chooses to engage in this space, and DeriW inherently embodies the genes of high speed, security, and low cost. With multiple guarantees such as authoritative audits, multi-signature management, MEV resistance, and a mature cross-chain bridge solution, DeriW can balance high security with an exceptional user experience.

After 8 years of CoinW's establishment, the emergence of DeriW will continue CoinW's glory, becoming the first stop for building a fast, efficient, and cost-effective on-chain contract experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。