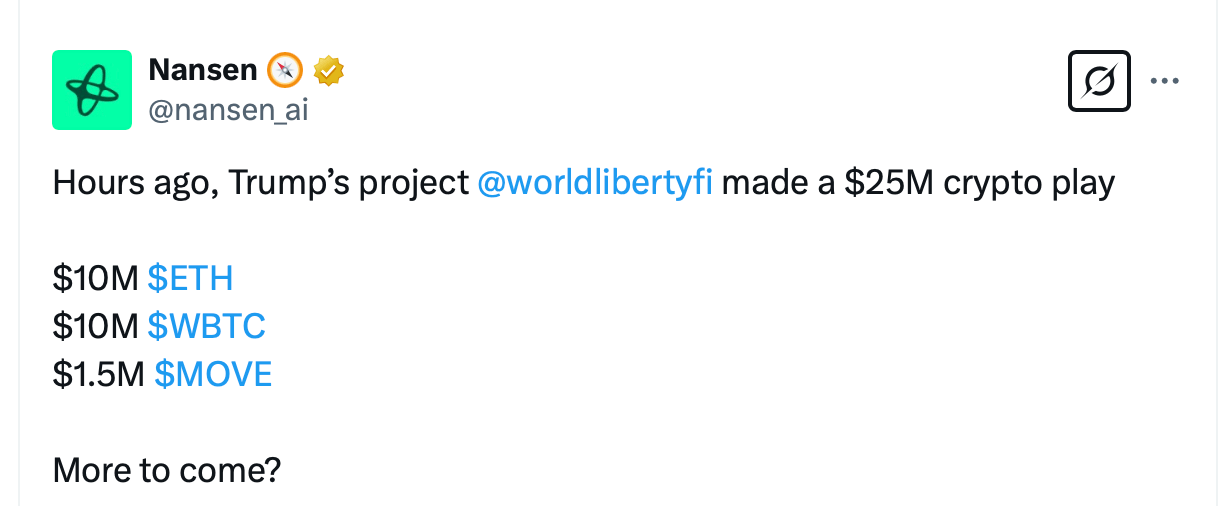

According to onchain data analyzed by blockchain firm Nansen, WLF acquired 4,468 ETH ($10 million), 110.6 WBTC ($10 million), and 3.42 million MOVE tokens ($1.5 million) using USDC from a new multi-signature wallet. This adds to WLF’s existing crypto holdings, which total over $79.77 million across a myriad of assets, including significant stakes in ETH and WBTC.

Founded in 2024, WLF positions itself as a DeFi platform for crypto-backed lending and borrowing, with Trump serving as “chief crypto advocate” and his sons Barron, Eric, and Donald Trump Jr. holding roles as “DeFi visionary” and “Web3 ambassadors.” The WLF project has raised hundreds of millions through token sales, including $220 million in one hour during a January 2025 launch.

The timing of the purchases aligns with the White House Crypto Summit on March 7, 2025, hosted by President Trump to discuss crypto regulations and innovation. The event, chaired by White House AI and Crypto Czar David Sacks, will convene industry leaders to address stablecoins, bitcoin reserve legislation, and market frameworks. Analysts suggest the buys may signal confidence in pro-crypto policies or an effort to influence summit outcomes.

Notably, the inclusion of MOVE—a token tied to the Movement Network, a blockchain interoperability platform—highlights World Liberty Financial’s interest in emerging technologies. While ETH and WBTC are established assets, MOVE’s selection suggests strategic diversification ahead of discussions on integrating newer blockchain ecosystems into regulatory frameworks.

Cryptocurrency markets reacted cautiously to the summit’s approach, with bitcoin rising 3% to a $91,380 intraday high. Analysts anticipate further volatility as investors await clarity on regulations. WLFs moves, alongside Trump’s recent pledge to bolster U.S. crypto dominance, highlights the sector’s growing intersection with political and institutional agendas.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。