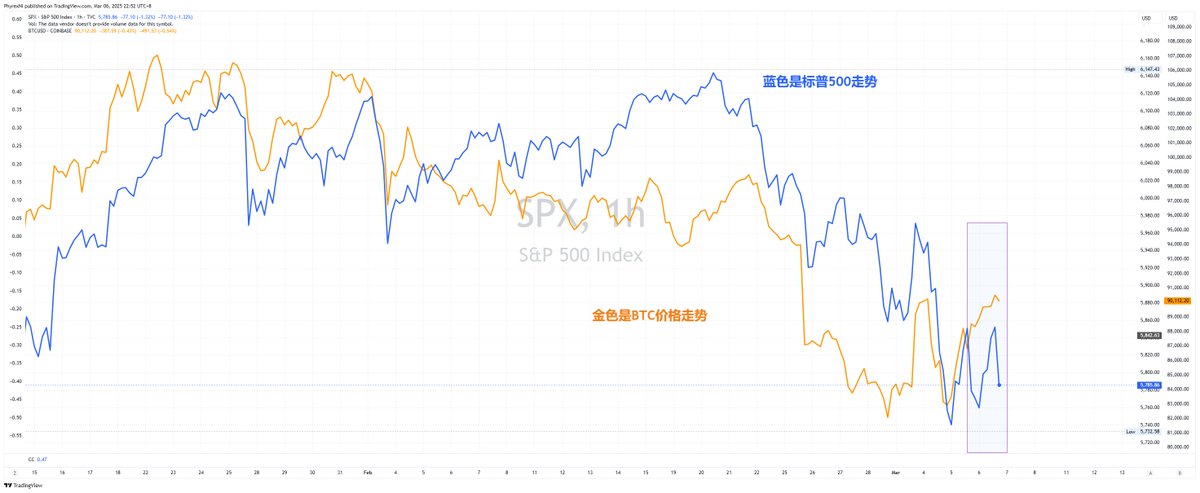

In the blue box, it can be clearly seen (on the hourly chart) that after the market closed on March 5th Beijing time, #Bitcoin's trend diverged from that of the S&P 500. The main expectations for BTC, aside from macro data, include the anticipation of Trump's crypto summit on March 8th. Meanwhile, the S&P 500, in addition to macro data, will also be influenced by external factors, such as Manus, and the market may be concerned about another DeepSeek.

However, from the data after the market opened, leading AI companies like Nvidia and Microsoft have rebounded somewhat. For the time being, BTC may be able to establish a short-term independent trend, likely until around the opening of the U.S. stock market on March 8th Beijing time.

From the 8th to the 20th, we will be waiting for the Federal Reserve's interest rate meeting and dot plot. During this period, what BTC can expect is whether other states in the U.S. will implement strategic reserves, such as Utah.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。