The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smokescreens!

Finally, the Trump conference has ended. As we anticipated earlier, the so-called surge did not occur. The so-called strategic reserve is merely a promise that the Americans will hold 200,000 bitcoins and will not sell them, nor will they use funds to increase their holdings. This news, released at any time, would be a positive message; it may not be a major positive, but it could at least drive Bitcoin's growth by five thousand points. However, the promise made at this conference seems insincere, instead leading to a decline of five thousand points. Do you all remember what was said earlier? As long as there are no major positive news, the crypto market will fall into a mid-term downward fluctuation phase, and it is expected to break the previous new low. The downward trend will unfold for about 2-3 months, and it will not break the downward trend, but will currently move in the direction of bears. The three elements for growth this year have already been shattered, and compared to Bitcoin's new high, it will definitely have a negative impact. At this stage, the next wave of the bull market's peak may only be maintained in the range of 12-15.

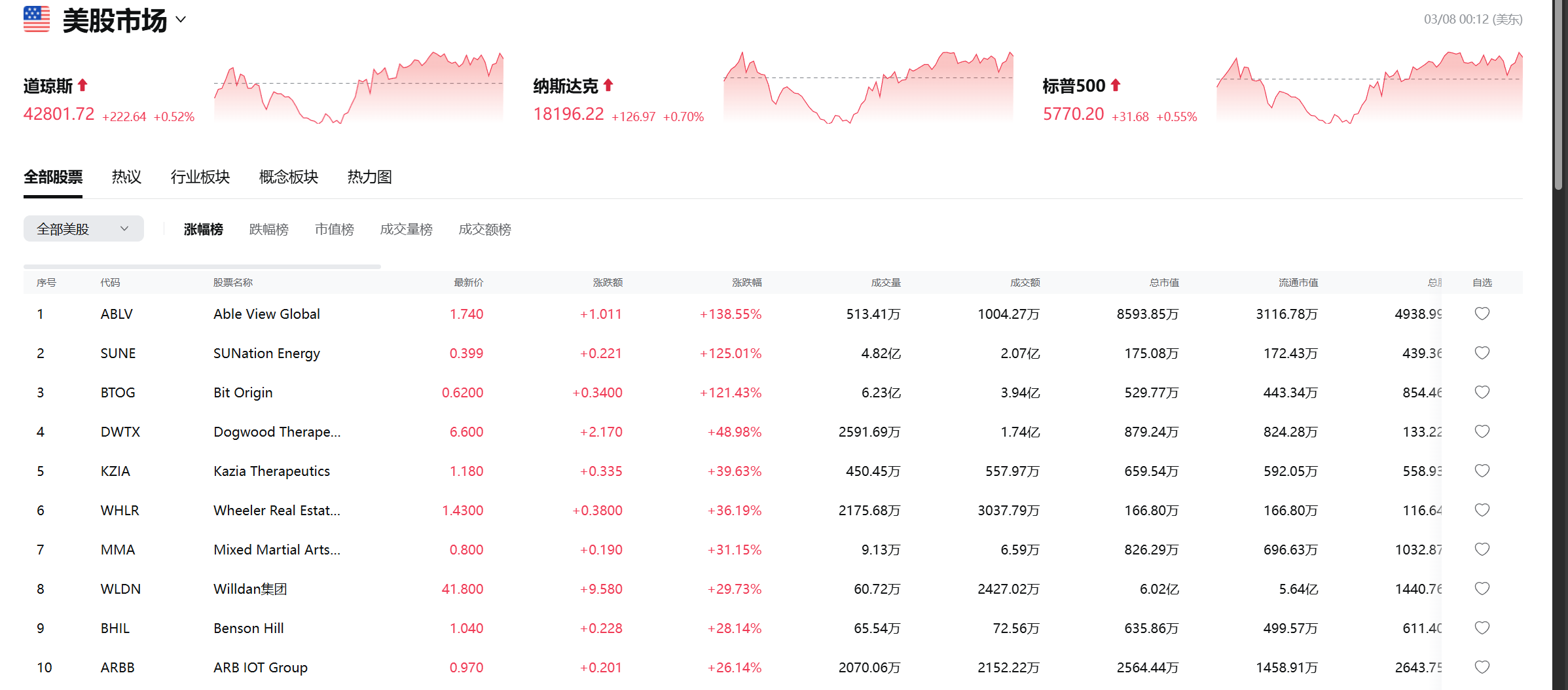

From a global financial perspective, the US stock market and the crypto market are moving in completely opposite trends. The US stock market is also affected by short-term non-farm payrolls, increasing the possibility of interest rate cuts, which allows the US stock market to rise, while the crypto market is not strongly affected. The short-term influx of funds is almost entirely directed towards the US stock market, with the crypto market being completely influenced by Trump's decisions. Trump's influence is essentially the promises made before he took office, which have almost all been fulfilled. This year's bull market has once again returned to the influence of interest rate cuts. Many analysts believe that increased tariffs are negative for the crypto market, but what Lao Cui sees is quite different from many analysts. In the short term, indeed, increased tariffs will drive more funds towards the US stock market, reducing investment in the crypto market. However, from another perspective, this is also a drawback of traditional currencies. What if the settlement method is changed to Bitcoin? The impact of tariffs may not be too high. Don't think Lao Cui's idea is fanciful; bypassing the dollar trading system, tariffs cannot track the flow of funds. It can be said that increased tariffs will only lead to more gray market settlement methods adopting the crypto system. In the long run, this is not harmful to the crypto market. This proposition is like the old saying, "A blessing in disguise."

Returning to Trump's perspective, his decision this time is negative for the crypto market. At least from the perspective of American strategy, it is clear that there will be no investment in strategic reserves. This is what Lao Cui mentioned before the conference: do not just look at promises, but also consider Trump's investment costs. Without real capital inflow, this statement is very clear; at least it will lead to the disillusionment of other states' strategic reserves and the investments of many smaller players. The financial market itself requires capital inflow. Almost all of America's choices have vetoed the investments of other countries. Without their strategic reserves, there will not be excessive capital inflow into the crypto market. This is also Lao Cui's estimate that the peak of the bull market will be reduced by at least twenty percent. In the estimates for 2024 and the beginning of the year, Lao Cui placed the highest point around 15. This decision directly leads to instability at the 15 mark, and it can almost be declared that this position will not be reached. It can only be given to everyone in the form of a range. The trend for 2024 will almost exhaust the luck of the crypto market. The rise is too fierce, and we must accept this short-term decline. After May and June, we will prepare for the start of the bull market. It can be declared that a new high will not appear in the first half of the year. Not breaking the previous bull market's new high of 73,000 is already good. (Of course, be prepared for a potential drop; the short-term downward trend is already set.)

Lao Cui has previously shared with everyone how much capital is needed for Bitcoin to reach the 150,000 mark. Under the current conditions, at least 200 billion in capital inflow is needed to potentially drive Bitcoin to this target, provided that smaller coins cannot divert the flow. The current trend has Ethereum blocking the way, SOL waiting to be listed, and the diversion of Trump coins. It is almost very difficult to reach this target. This section is meant to remind those doing smaller coins that in such a difficult situation for Bitcoin, users with contracts, especially those holding positions, must take advantage of this rebound to sell as soon as possible. Holding on this time may require waiting for a period of rebound; the next round of the bull market may not necessarily drive the growth of smaller coins. Currently, the number of coins that can grow is very few, and they are mostly coins preparing to be listed, with potential for growth or even doubling. For other coins to have significant growth, the basic conditions will become increasingly difficult. The third coin that can be listed and take the lead is almost SOL, while the remaining coins will face a very high possibility of failure in obtaining listing rights. Including the next round of the bull market, aside from Bitcoin, Ethereum's growth will also be very limited, especially after the recent Ethereum theft incident, which will greatly impact Ethereum's downside space. This capital has not been cashed out, and such a large volume will inevitably impact all coins. The current bearish range is increasing, and there is no need to bear this risk.

Lao Cui summarizes: Overall, the current trend will revolve around bears for the next two months. The capital level, including all markets in the financial sector, will open up downward space without the support of interest rate cut strategies. Especially in the crypto market, the time for a crash is not far off. Relying solely on interest rate cut strategies can only be maintained for a limited time. The end of this round of the bull market is almost within visible range. There will still be bullish growth this year, and with the support of interest rate cuts, even if two interest rate cuts occur, the growth that can be driven is extremely limited. Breaking the previous high point, based on the current capital reserves, is insufficient to support Bitcoin at the 150,000 mark. In the short term, everyone must use contracts to hedge against spot losses. The direction for contract users can be adjusted to focus on short positions, while long positions should be bottomed out in spot form as much as possible. After three consecutive days of decline, today will still see some recovery, and an exit window will be provided for everyone. The subsequent growth will also be viewed as a short-term small rebound, which does not mean that bulls will counterattack. All rebounds are opportunities for everyone to exit, and it is essential to seize them. The trend of interest rate cuts will gradually emerge, and it will only present itself phenomenally, maintaining stability for only a few days before going down again. Those with long positions trapped can talk to Lao Cui, and you can also ask about entry points; Lao Cui will reply to everyone. At the end of the article, I remind everyone that for contracts, shorting is the trend, and for spot users, it is also an opportunity. Being able to see the endpoint of the bull market does not mean that the bull market has ended. After all, this year is still in the interest rate cut cycle. Although the downward space has opened, the lows will be lower than before, but it is also an opportunity for spot bottoming. What if Trump changes his mind again midway?

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's Message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and the big trend, not focusing on one piece or one square, aiming for the ultimate victory. The novice, however, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。