How many Bitcoins do retail investors hold? Will these BTC affect the price increase?

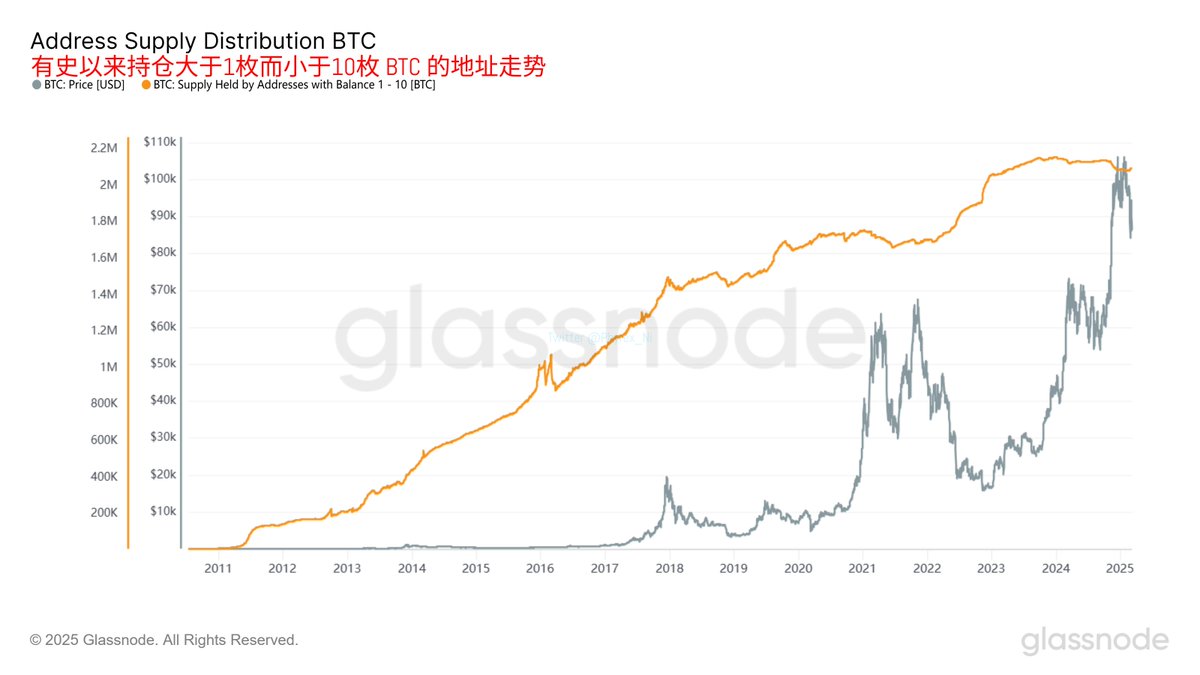

First, if we consider holding less than 10 BTC as retail investors, then as of now, a total of 3,485,848 BTC is held. This number may exceed the recognition of many friends, and of course, many may wonder if high-net-worth investors are diversifying their BTC holdings.

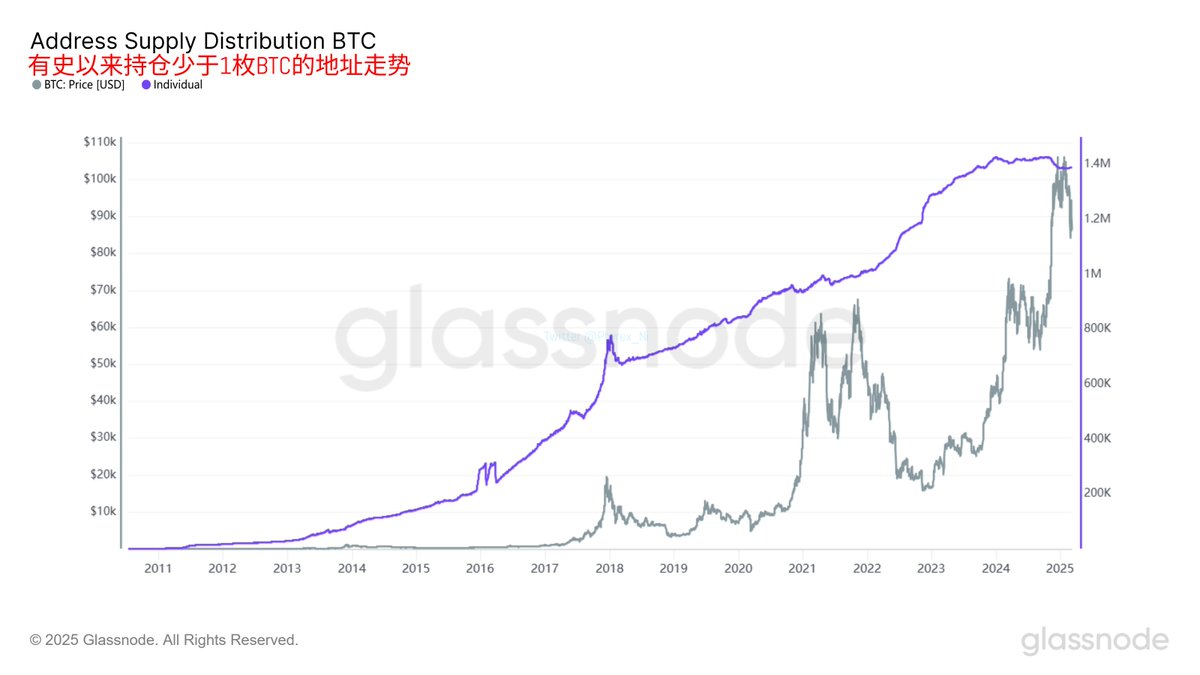

If we consider investors holding less than 1 BTC as retail investors, then as of now, a total of 1,388,842 BTC is held. This means that investors holding between 1 and 10 BTC collectively hold 2,097,005 BTC.

So even if we calculate based on holdings of less than 1 BTC, it still exceeds 1.388 million BTC. But do these investors frequently trade?

Interestingly, historical data shows that investors holding less than 1 BTC have been increasing their holdings over time. In simpler terms, more and more investors are choosing to hold even 0.001 BTC, and this group of investors shows little interest in selling their BTC. Although we can see signs of selling whenever BTC reaches historical highs, this selling is quite minimal.

What about investors holding between 1 and 10 BTC?

The answer is almost similar; investors holding between 1 and 10 BTC are still primarily holding. Compared to those holding less than 1 BTC, these investors are more concerned about "selling at the top" and "buying at the bottom." It is evident that when prices remain high for a long time, this group of investors tends to exit, and when prices are at a low point, they buy in. However, the number of investors choosing to trade is still very small.

What does this indicate? Retail investors on the blockchain show little interest in selling their BTC, while more retail investors on exchanges tend to be short-term holders.

So when we switch to holdings of less than 10 BTC, we can see that investors holding less than 10 BTC are still primarily buying, and the higher the price of BTC, the more they buy.

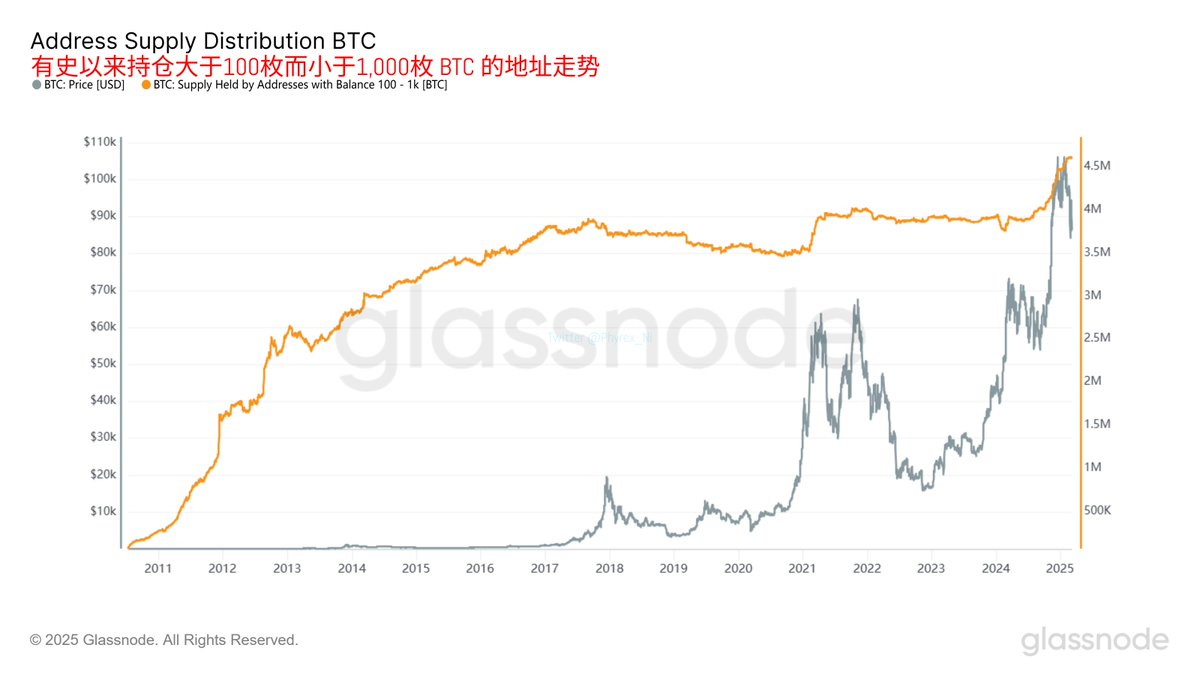

As for holdings greater than 10 BTC, it becomes slightly difficult to quantify, as this may include hot wallets from exchanges and accounts held by certain institutions.

Are these retail investors on the blockchain long-term holders or short-term holders? From the movement of retail investors, the probability of them being long-term investors is greater than that of short-term investors. More retail investors are actually long-term holders, as the overall data continues to trend upwards, indicating that most retail investors on the blockchain are not participating in trading.

If we consider investors holding for less than 6 months as short-term investors, then short-term investors currently hold 3,907,136 BTC. This data is surprisingly similar to the fluctuations of addresses holding over 100,000 BTC, which are often the holdings of top exchanges or custodial institutions.

In reality, addresses holding between 100 and 1,000 BTC have seen the most accumulation recently. Many may ask if these addresses belong to exchanges; the answer is likely no, as we have observed that the BTC held by exchanges has not increased. Therefore, at least not all of these addresses belong to exchanges.

What do these data results tell us? The majority of investors still choose to hold Bitcoin, regardless of how Bitcoin's price fluctuates. Moreover, the BTC held on-chain generally does not show significant signs of large sell-offs; instead, the overall trend is upward.

The price changes are often influenced by the BTC supply on exchanges. Therefore, the less BTC available on exchanges, the lower the pressure on prices. Conversely, the more BTC available on exchanges, the greater the pressure on prices.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。