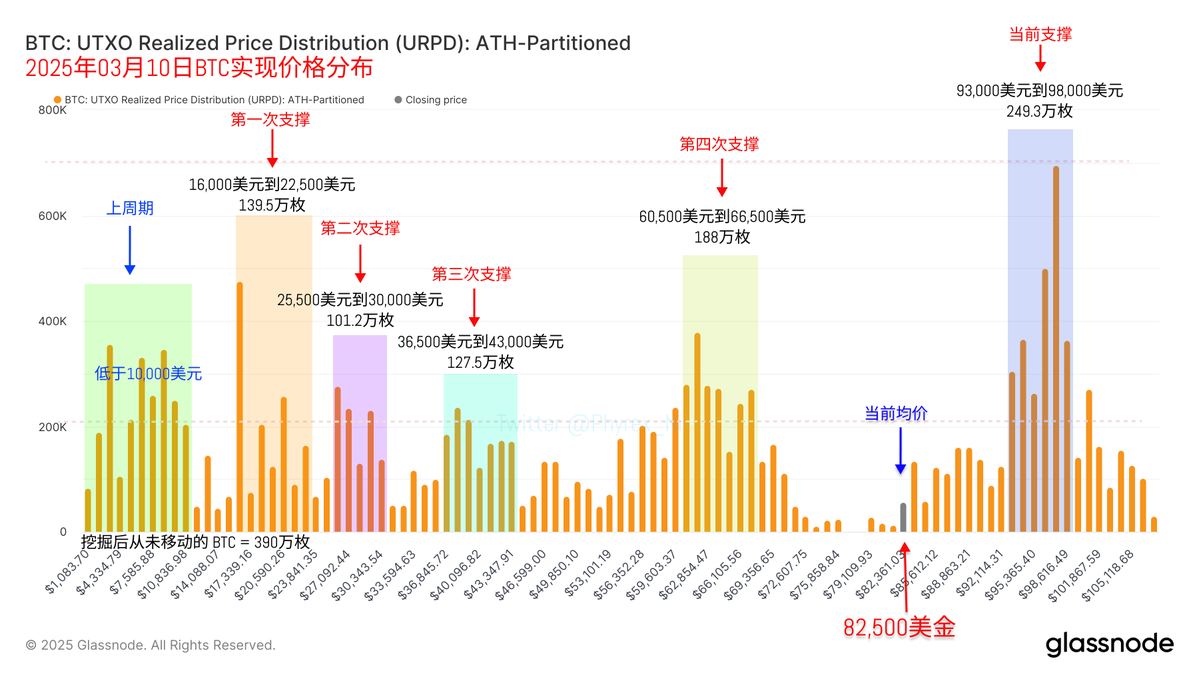

Today is also the weekend, but it's a bit difficult to submit assignments. Investor sentiment experienced a slight outburst over the weekend, panicking during a time of poor liquidity. From the current data, it is highly likely that there will be an upward gap after the CME opens on Monday, and the gap between $78,675 and $77,930 has not yet been filled, nor has the gap between $76,000 and $78,000 in the URPD.

Many friends are still asking if we are in a bear market now. If we look at the decline of the U.S. stock market, it has dropped 10% from its peak, while #Bitcoin has fallen 20% from its high. There is still some distance from the halving during the 312 period, but indeed, investor sentiment is very poor, and it’s hard to say if it will continue to drop.

Today, a lot of data was released, and through this data, we can see that most investors are in a state of doubt. The current market feels very much like the garbage time in 2024 when it dropped from $73,000 to over $50,000, with similarly poor sentiment. The difference is that at that time, there were positive expectations for the U.S. election, while now we don’t even know if the positive expectation is about interest rate cuts.

So, what to do in the current market is more important. For most friends who are not very good at short-term trading, it may not be wrong to wait and see for a while. They might miss a good opportunity to buy the dip, but the risk is lower, especially for those who still hold a large number of tokens. I believe most are at a loss; I don’t know about others, but I am really too lazy to sell some of the altcoins I have.

However, this does not mean I won't do anything. First, I will choose to swap some altcoins that have little hope for certain tokens that have a chance to rise, as it might not be impossible to bet on a rebound. After all, the altcoin market has already dropped significantly, and many altcoins have fallen to their 2022 lows. Of course, clearing out now and finding the right opportunity to buy back is also fine; the key is not to do nothing but to consider what should be done.

How to swap positions may be my main consideration in the coming period. Most of my altcoins were obtained from Launchpool and other airdrops, and a small part was bought with real money. For the airdrop portion, I will likely swap them all for $BNB, as BNB still provides some airdrops every month, and my position in BNB is still profitable. Of course, it’s not a mindless swap; I will first check the exchange rate of these tokens against BNB, and if it’s about the same, I will act. The other part that may have opportunities, I will hold onto for now, as if a rebound occurs, I can also take a chance. If it continues to drop, I will be prepared to hold on.

Additionally, regarding buying the dip, my personal view is that one should only buy the dip if it is likely to make money or if they can hold onto it. For me, BTC is the most suitable, so I will choose to buy the dip in BTC. After all, I am quite optimistic about BTC in both the long term and the medium-short term. However, buying the dip does not mean buying just because it has dropped; this is more suitable for those who are not short on cash. For most friends, right-side trading may not be wrong.

Looking back at the data for Bitcoin itself, after the strategic reserve was implemented, BTC temporarily has no positive news. The U.S. election has turned from a positive to a negative factor, and macro data and the Federal Reserve's stance remain the main narrative now. In March, there will also be CPI, PPI, and the dot plot data. The first two may not significantly impact prices, while the dot plot could be an opportunity to change sentiment in the short term.

However, although BTC's price fell more than 4% today, the actual amount of BTC involved in trading was not much, and there was no significant inflow or outflow of BTC on exchanges. Even from the trading volume, it can be seen that there was no substantial increase, so the price drop is not due to a large number of users dumping.

From the URPD data, it can also be seen that the changes in BTC over the last 24 hours have been very low, and naturally, there has been no change in the concentrated area of chips, but it is unknown when sentiment will recover.

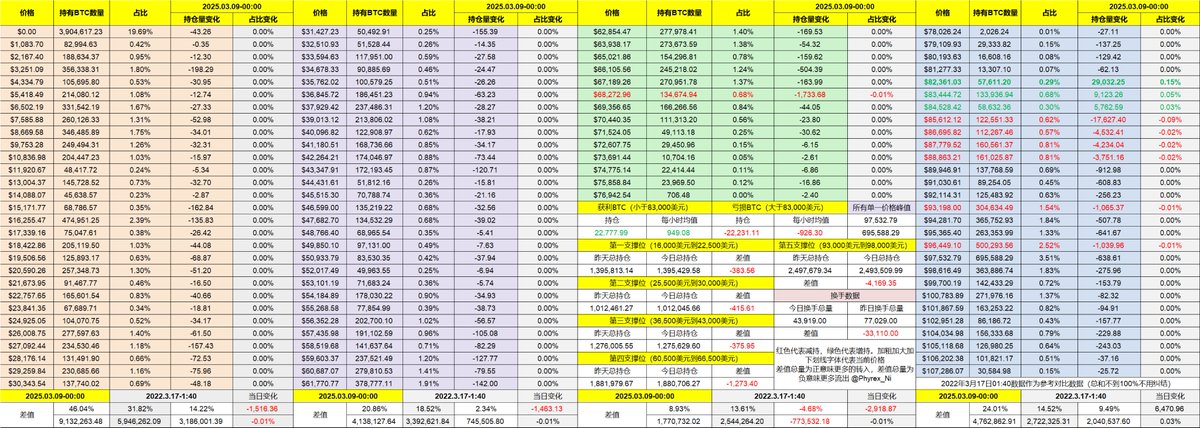

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。