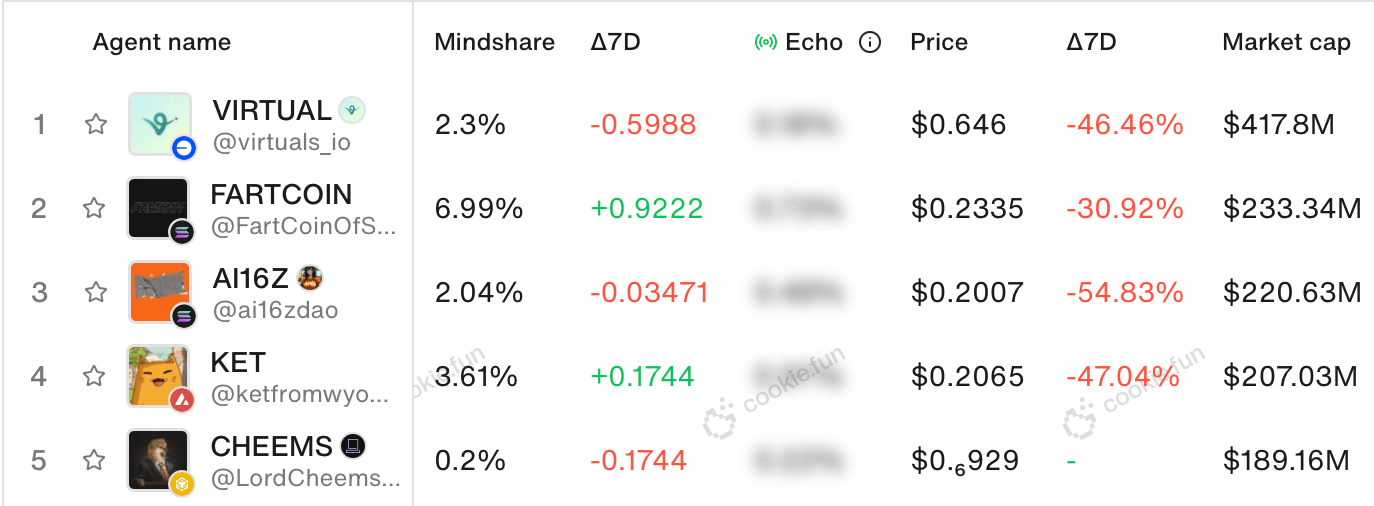

Of the 1,459 agents monitored by cookie.fun, the AI agent token market holds a valuation of $4.19 billion, yet has experienced a 10.4% loss in value within the last 24 hours. The leading virtuals token (VIRTUALS) has plummeted 46.46% over the past week, currently holding a $417.8 million market capitalization.

Top five AI agent tokens by market cap on March 9, 2025.

Trailing closely, fartcoin (FARTCOIN) has deflated by 30.92% during the seven-day span. As of press time at 4:30 p.m. Eastern Time on Sunday, Mar. 9, 2025, FARTCOIN’s total market valuation rests at $233.34 million.

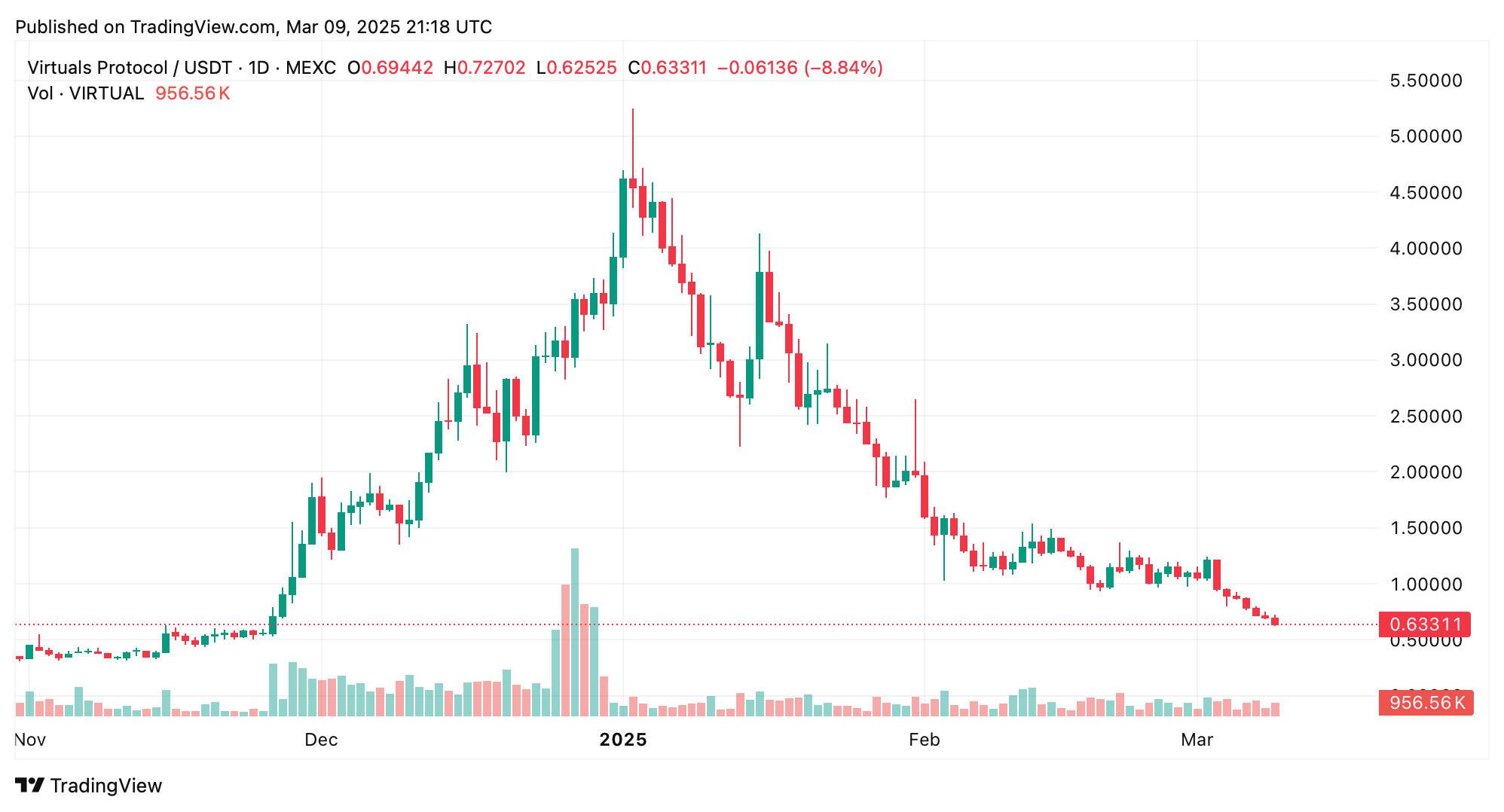

VIRTUALS/USDT 1D chart on March 9, 2025.

Meanwhile, AI16Z—valued at $220.63 million in market capitalization—has experienced a steep 54.83% decline this week. Separately, the AI agent token KET has dropped 47.04% against the U.S. dollar during the same period, concluding Sunday with a $207.03 million market cap. The crypto token CHEEMS defied the downturn, securing a 5.6% uptick amid broader declines.

AI16Z/USDT 1D chart on March 9, 2025.

CHEEMS commands a total market capitalization of $189.16 million. Meanwhile, ACT maintained a $183.26 million valuation this weekend but faced a 12.71% decline over the past week. TOSHI plummeted 30.6% during the same period, concluding with a $150.82 million market cap. TURBO tumbled 43.38%, and the tenth-ranked AI agent token FAI retreated 38.86%.

As of Sunday, TURBO holds a $144.47 million market cap, whereas FAI’s valuation settled at approximately $112.59 million. Within the $4.19 billion sector, $1.78 billion in tokens are allocated to Solana, while Base accounts for $1.41 billion. Cookie.fun data reveals $1.42 billion in tokens circulating on alternative blockchains.

The synchronized decline across AI agent tokens this week reflects heightened volatility in niche and speculative digital asset markets, with sector-wide corrections. While CHEEMS’ resilience highlights selective investor optimism, the pronounced erosion in AI agent token valuations across the board—particularly among Solana- and Base-issued tokens—signals shifting risk appetites.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。