Price Trends and Market Performance

Significant Decline: Bitcoin experienced multiple sharp drops early this morning, reaching a low of $79,933.3, a decline of over 7.3%, with the current price fluctuating around $82,000.

Continuous Downtrend: Over the past month, the cumulative decline has exceeded 15%, and it has fallen for five consecutive trading days, with market sentiment remaining tense.

Ripple Effect: Major cryptocurrencies such as Ethereum, Binance Coin, and Dogecoin have collectively plummeted, with declines generally in the range of 9%-13%.

Market Volatility and Risk Indicators

High Volatility: Bitcoin's annualized volatility has recently maintained between 58%-59.4%, far exceeding traditional assets, reflecting high market volatility.

Leverage Risk Exposure: In the past 24 hours, over 210,000 people globally have been liquidated, with liquidation amounts reaching $588 million, of which long positions account for 88% ($520 million), indicating significant losses for leveraged long positions.

Core Influencing Factors

Discrepancies in Trump's Policies:

Bitcoin Strategic Reserves: Trump signed an executive order requiring a review of the approximately 200,000 Bitcoins (valued at about $17 billion) held by the U.S. government and plans to establish strategic reserves, but did not commit to purchasing new assets.

Market Interpretation Discrepancies: Some believe this move is long-term beneficial for Bitcoin as a reserve asset, but it raises short-term concerns about policy uncertainty; WhaleWire founder Jacob King and others argue that "the bear market has arrived," and the policy narrative is unlikely to support prices.

Macroeconomic and Geopolitical Risks: Trump acknowledged the possibility of a recession in the U.S., compounded by tariff threats (such as tariffs on Canadian products), intensifying market risk aversion.

Market Outlook and Strategy Recommendations

Short-term Risks: The market lacks confidence in policy implementation, and in a high-volatility environment, further pullback risks should be monitored, with technical focus on the $78,000 support level.

Long-term Logic: If the U.S. government clarifies the details of strategic reserve operations (such as long-term holding and not selling), it may enhance Bitcoin's reserve properties as "digital gold." Avoid blindly chasing price increases or decreases; pay attention to policy execution progress, U.S. economic data, and global trade situations.

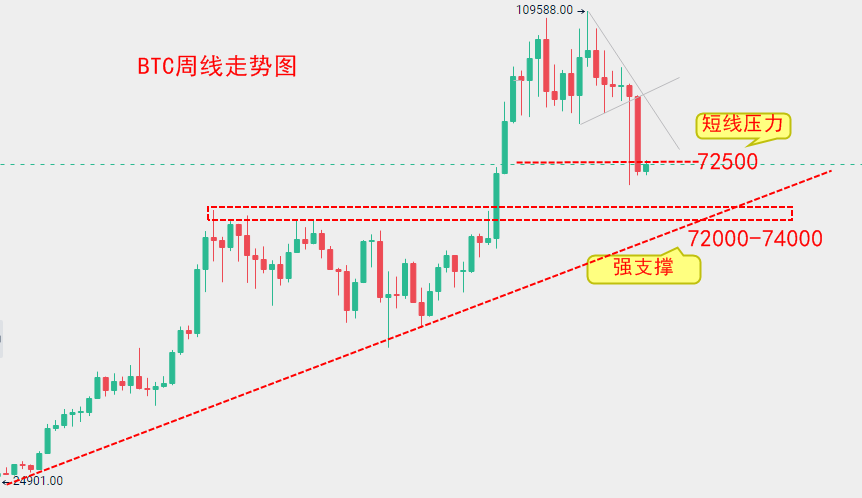

From the daily chart, BTC faced resistance near $95,000 during the rebound, dropped to around $81,500, then surged about $10,000 upwards, only to experience another significant drop near $92,800, erasing all gains and even dipping below $80,000 this morning. Overall, BTC has fluctuated over $10,000 within a week, indicating intense long-short battles in the market. Such large fluctuations have little impact on spot trading, and profits are hard to come by. However, for contracts, as long as one can grasp the rhythm, there is still significant profit potential.

The trend favors bears; we should not go against the trend in intraday contracts, just short on rebounds, with reference to the position around $82,500, stop loss at $83,500, and target $80,000—$78,000. If the price breaks below $78,000, follow the trend and enter short positions, targeting $75,000—$74,000. In summary, operate in line with the trend, as volatility is high, and ensure proper stop-loss measures.

Regarding ETH, we previously analyzed that the $2,070 level was an important support level, which, once broken, turned into a resistance level for rebounds, forming a dense trading area. Therefore, in intraday contract trading, one can consider setting up short positions near $2,070, with a stop loss at $2,110 and a take profit at $1,980. If it breaks below $1,980, follow the trend and enter short positions, targeting around $1,900.

In terms of operations, ETH and BTC are generally similar in trends, just differing in magnitude, so choose based on your trading preferences.

If the pattern determines life, then what determines the pattern? Many retail investors often find that while their strategy plans and analyses are well done, they fail to execute them. In life, we call this a lack of self-discipline; in trading, it often relates to mindset and confidence. If the reasoning behind the planned strategy is insufficient, and the long-short thinking and entry points are too random, then when a sharp drop or rise reaches your entry point, hesitation is likely to occur; additionally, being overly cautious often means a lack of flexibility and inadequate strength, using caution as an excuse. An excellent trader is cultivated on the battlefield, not from theoretical books; an improper mindset, fear of stop-losses, and an inability to view gains and losses with a calm mind can lead to overemphasizing stop-losses and becoming overly hesitant.

Market conditions change in real-time, and there may be delays in article publication; strategy points are for reference only and should not be used as entry criteria. Investment carries risks, and profits and losses are borne by the investor. Daily real-time market analysis, along with experience exchange groups and practical discussion groups, are available for real-time guidance. Evening live broadcasts will explain real-time market conditions.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。