Is it a bull market or a bear market right now? Where is the bottom for Bitcoin? When can we buy at the bottom? The conclusion may be surprising.

To begin with, the situation has indeed not been good in the past week. We are in a phase of competing with friends, and the more we try to prove ourselves right, the more energy we exhaust. This is actually a very wrong thing. I realized this yesterday, and I also thank @TJ_Research01 for his guidance.

Today's post is based on a discussion I had early this morning with my neighbor, where I explained the expansion during the transition between bull and bear markets. My neighbor is a very good friend, and in our mutual exploration, we discussed how to configure our current positions.

He is a major holder of Fil and has a strong belief in it. Therefore, he is unwilling to sell at a loss. His mining costs are still significantly higher than the current price, and he is very eager to know whether we are in a bull or bear market in order to adopt different investment strategies:

If it is a bull market correction, he will not care and will continue to hold.

If we have already entered a bear market, he may consider reallocating or liquidating part of his assets.

So, let's state the conclusion:

Currently, it is neither a standard bull market nor a complete bear market, but it is indeed closer to a bear market in the short term. However, in the long term, we will inevitably enter a bull market within the next 2 to 3 years.

The actual price support for Bitcoin is currently around $70,000, assuming no recession.

Now, let's get into the main content. Most friends can skip this part as it does not provide much help regarding price levels.

First, why is there a struggle between whether it is a bear or bull market?

Because the buying and selling strategies differ in different cycles. In a bull market, every drop is an opportunity to buy at the bottom, while in a bear market, the judgment of positions is more important. Although both involve buying at the bottom, the methods and intensity of buying will inevitably differ.

Secondly, what are the conditions for a bull market to start? What are the conditions for a bear market to begin?

Many friends are accustomed to using price fluctuations to judge bull and bear markets. This is not entirely wrong, but purely judging by price makes it difficult to provide accurate guidance during price fluctuations. So let's first discuss the conditions needed for a bull market.

- A monetary easing environment.

- Near-zero low interest rates.

- Quantitative easing and/or balance sheet expansion.

- The economy is in positive development.

- A decline in the US dollar index (DXY).

- Government policy stimulation.

Except for the first-ranked monetary easing, the others do not have a specific order, and generally, under the condition of satisfying monetary easing, 3, 4, and 5 are very easy to achieve. Therefore, monetary easing can be seen as a primary but not necessary condition for entering a bull market.

Why is monetary easing considered a non-necessary condition?

Because monetary easing is a continuous action, not a final result. During the process of monetary easing, there is often a long transition period, during which anything can happen, especially since monetary easing does not equate to zero interest rates or low interest rates.

The core of monetary easing is to lower the cost of capital and increase market liquidity.

So how can we lower the cost of capital? There are usually three common methods:

- Lowering interest rates

Lowering the benchmark interest rate (such as the Federal Reserve's federal funds rate) reduces the cost of bank loans, promoting consumption and investment.

- Quantitative easing

The central bank purchases long-term assets (such as government bonds, mortgage-backed securities), directly injecting funds into the market and increasing the money supply.

- Balance sheet expansion

The central bank increases the size of its balance sheet (i.e., holding more bonds, MBS, etc.) to release liquidity into the market.

Thus, we can conclude that lowering the cost of capital and increasing market liquidity is the essence of monetary easing. Now, at what stage are we? Many friends are very clear that we are currently in a rate-cutting phase, but we are only in the early stages of rate cuts. The Federal Reserve has cut rates three times since entering this phase, totaling 100 basis points, and the current federal funds rate remains as high as 4.5%, which is historically high.

Moreover, as for points 2 and 3, not only have they not occurred, but balance sheet reduction has not even stopped, and balance sheet reduction is one of the signs of a bear market. Although balance sheet reduction does not completely equate to a bear market, it restricts liquidity, which contradicts the liquidity easing of a bull market. So essentially:

We are still in a situation of high interest rates + liquidity restrictions, which does not fully meet the standards of a bull market.

I know many friends want to say something. If it is not a bull market, how can the US stock market continuously break new highs? If it is not a bull market, how can Bitcoin continuously break new highs?

Yes, if we look purely at the price, it does seem like we are in a bull market. However, if we broaden our perspective a bit, the US stock market is not just about the "Magnificent Seven," and the cryptocurrency industry is not just about Bitcoin and a few other assets breaking new highs. Currently, it does not meet the expectations of a comprehensive rise in a bull market. Take Nike ($NKE), which I often use as an example; it ranks right in the middle of the global Fortune 500, but despite the new highs in the US stock market, Nike has not only not risen but has continued to stay at the bottom. Even McDonald's and Best Buy have not had smooth sailing, and even the stock price of UnitedHealth Group, which ranks among the top of the Fortune 500, has not risen as well.

As for the cryptocurrency industry, everyone is even clearer. Apart from Bitcoin ($BTC), there are even fewer cryptocurrencies that have broken previous highs in this cycle, with only a limited few like $BNB, $XRP, and $SOL. More importantly, there has been no new breakthrough in the narrative this time. Many people believe that the on-chain bull market's meme has not resulted in actual profitable investors compared to past bull markets.

But if we deny that we are in a bull market, why can prices continue to break new highs? Isn't that contradictory?

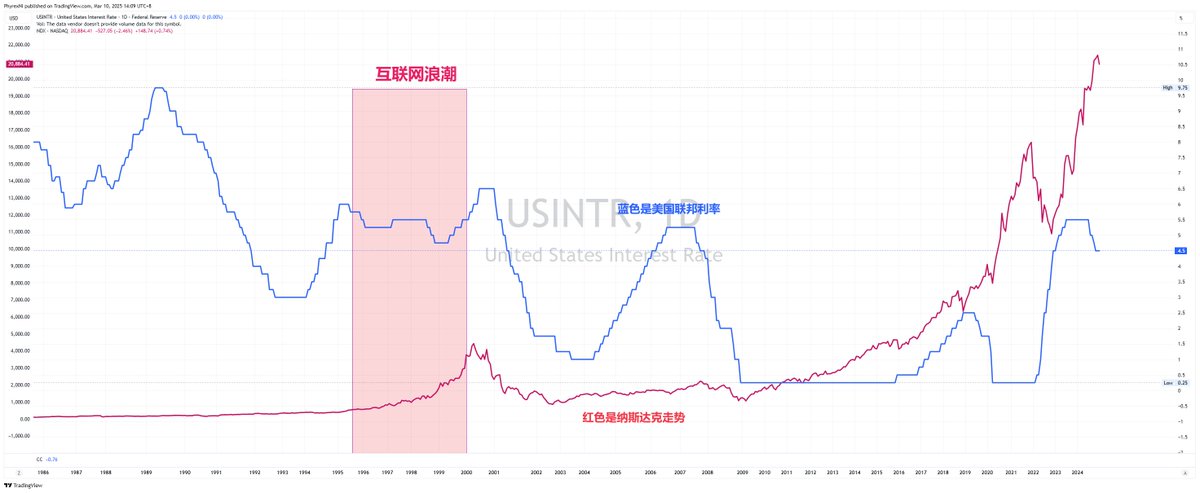

Actually, it is not contradictory. There have been historical precedents for this, and that precedent is the internet boom.

From the chart, doesn't it look quite similar to now? Both started rising when interest rates were increasing, and continued to rise even when rate hikes paused and interest rates were held steady. Ultimately, they reached their peak when interest rates rose again, and the bubble burst when interest rates fell significantly.

In fact, during the internet boom, there was no quantitative easing or balance sheet expansion; there were only intermittent rate cuts and repeated inflation. Moreover, the internet craze at that time was similar to the current AI industry, seen as a market revolution. Of course, it was indeed a revolution, but the bubble ended with the Federal Reserve's rate hikes and continued liquidity tightening in 2000, which also led to an economic recession, with the Nasdaq index dropping 78% within two years.

The reason the Federal Reserve continued to raise rates was due to high inflation.

Previously, I wrote a post discussing how rate cuts are often accompanied by economic recessions. I wonder if friends still remember that high interest rates lead to economic recession, and the emergence of recession forces the Federal Reserve to increase the intensity of rate cuts. Therefore, recession is a double-edged sword.

Is recession an opportunity or a challenge?

In conclusion, without a recession, it may be difficult to have quantitative easing (QE). The essence of QE is to help the US economy quickly recover from recession, which is what we often refer to as "flooding the market." Although it is not to say that only flooding the market leads to a bull market, flooding will inevitably accompany the arrival of a bull market, and the conditions for initiating QE are generally in a zero or low interest rate (0.25%) environment.

This time, Powell has clearly stated that QE will not be initiated unless rates are lowered to zero. However, reaching zero is not a necessary condition for initiating QE; recession and recovery are the reasons the Federal Reserve chooses QE, and even the main reasons.

However, recession brings significant declines. The average drop in the S&P 500 during recessions is around 50%, while currently, it has only dropped 10%. So if we are in a recession, then the S&P 500 has only just begun to decline. To put it more clearly, if a recession occurs, the probability of the US stock market entering a bear market is infinitely high. In fact, in the last 12 economic recessions in the US, apart from one or two exceptional cases, the rest have all been deep bear markets.

Why is recession an opportunity? Because recession is the best solution for reducing inflation, almost without exception. The Federal Reserve often initiates rapid rate cuts to respond to recession, and to stimulate the economy, it will terminate balance sheet reduction early and initiate balance sheet expansion in the later stages of rate cuts. This is when risk markets tend to rise significantly.

Returning to the main point, are we in a bull market now?

- A monetary easing environment.

We are currently transitioning from monetary tightening to monetary easing, and we are still in a relatively tight phase. Therefore, essentially, we have not entered the monetary easing phase, especially since rate cuts have been paused.

- Near-zero low interest rates.

The current interest rate is 4.5%, which is still at a high level historically. While high interest rates do not prevent a bull market, they can accelerate its end and increase the probability of economic recession.

- Quantitative easing and/or balance sheet expansion.

Currently, there is none; not only is there no easing, but balance sheet reduction is still ongoing, and it has not even paused.

- The economy is in positive development.

Currently, the Federal Reserve predicts GDP is on the rise, but the conclusion from GDPNow is completely opposite. The GDP data from April can reveal the situation of the first quarter's GDP.

- A decline in the US dollar index (DXY).

Indeed, the dollar index has started to decline recently, but the decline is more due to concerns about signs of recession in the US economy, especially with the increase in tariffs.

- Government policy stimulation.

Although the Trump administration has provided favorable stimuli for the AI and cryptocurrency industries, these benefits are unlikely to become the main reason for stimulating industry growth in the short term. Instead, the government's competition has initiated a trade war, leading to a situation where inflation may fluctuate, which is very detrimental to economic development.

Therefore, from a historical and economic perspective, we are not fully in a bull market now. It is highly likely that we are very similar to the internet boom before 2000, where emerging industries stimulated market development, and a large amount of capital flowed into the internet industry, significantly pushing up valuations and leading to a bubble. Once the economy enters a recession, what we face is valuation cuts and bubble clearing.

Is Bitcoin and cryptocurrency the same?

If the rise of the US stock market is the risk market's pursuit of emerging industries, where hot money has no better outlet, then Bitcoin follows a similar logic. Since the beginning of 2023, or as policies have entered a pause phase, the price of Bitcoin ($BTC) has been hovering around $25,000. The main reason for the price surge to over $73,000, achieving nearly a threefold increase, is due to ETFs.

Emotionally driven ETFs can push Bitcoin's price to around $50,000, while the entry of a large amount of traditional capital buying nearly 2 million BTC is the main reason for pushing the price above $70,000. As ETF purchases become routine and investor sentiment recovers, Bitcoin's price has stabilized around $65,000.

The push from $65,000 to nearly $110,000 is driven by Trump's campaign. As the first "crypto president," Trump's expectations provide more emotional support rather than actual changes in liquidity.

In simple terms, while the macro liquidity has not increased from $25,000 to $65,000, the additional liquidity brought by ETFs has pushed up Bitcoin's price. However, the election has not brought new liquidity, and if new liquidity does not come from macro sources, then it will be:

- Corporate purchases of BTC as a strategic reserve.

- State governments buying BTC as a strategic reserve.

- Sovereign nations buying BTC as a strategic reserve.

These three points indicate that the first one is currently in progress, while the second and third are still in very early stages. Therefore, at this stage (assuming no recession), the actual bottom support for $BTC should be around $70,000.

The reason is as mentioned earlier: there has not been an actual increase in liquidity. Even if we disregard the positive impact of Trump's campaign on Bitcoin, the price drop of BTC should be anchored to the price point established after liquidity was introduced through the spot ETF in the previous phase.

The average price of the last price anchor is around $65,000. However, from October 2024 to February 2025, the spot ETF will continue to buy, and the amount purchased is not insignificant. Even today, there has been a net inflow of over 200,000 BTC, accounting for about 20% of the entire ETF, and this buying has pushed the price of BTC to around $70,000 without any issues.

As for the possibility of falling below $70,000, it is not entirely out of the question, but it would require a significant amount of selling. This selling can actually be judged from the exchange's positions and the ETF's holdings. At least, there are currently no signs of such a situation. Although there is a portion of holdings from another group of miners, their impact on the price is still limited.

Therefore, without a large-scale sell-off from ETF users (with holdings below 1 million), the likelihood of Bitcoin's price falling below $70,000 is not very high. Even if it does drop, we need to consider the attitude of ETF investors. If ETF investors panic, it could indeed lead to further selling and a price drop, or if the BTC inventory on exchanges rises significantly, there may be expectations of selling. Otherwise, the buying power support around $70,000 still has a good chance of holding.

In addition, the concentration of chips in the URPD is also a very good reference data, which can help gauge investor sentiment support.

However, if a recession occurs, the panic sentiment may drive more investors to exit, making the $70,000 bottom less applicable. It will still depend on the selling situation of investors, which is difficult to judge at this moment.

So, is it a bear market now?

Earlier, we spent a lot of time discussing whether we are in a bull market. The conclusion is that it is not a complete bull market, but we have not fully entered a bear market phase either.

Bear markets are often accompanied by significant and rapid declines, typically around 50%. We have not reached that point yet; at most, we might be in the early stages of a bear market, provided a recession occurs. If there is no recession, we might just be in a phase of significant pullback and consolidation.

The economy is showing signs of slowing down. According to the Federal Reserve, the current economy is still in a phase of slight growth. However, if the GDP data released in April shows a significant decline, it cannot be ruled out that we have entered the early stages of a bear market.

Liquidity is receding, and user funds are withdrawing. In the US stock market, we can indeed see a large amount of selling data, and the current liquidity is indeed poor. However, in the cryptocurrency industry, due to its greater transparency, mainstream stablecoins like USDT and USDC have not yet shown obvious signs of withdrawal.

The unemployment rate has risen significantly. Although Trump has initiated layoffs of government employees, the current unemployment rate remains low at 4.1%. It may take a quarter to recalculate the unemployment rate.

The volatility index (VIX) has risen significantly. Similar to the fear index, it typically enters a bear market when it exceeds 40, but it is currently around 20, indicating that investor sentiment is not particularly bearish.

Therefore, we are not in a traditional bear market. A decline of 10% to 20% can still be seen as a short-term consolidation, fluctuation, and pullback. Of course, it does not rule out the possibility of being in the early stages of a bear market, as the recent decline has been relatively short.

Considering all economic conditions and historical cycles, we are neither in a traditional bull market nor have we entered a bear market. Instead, we are in a phase of prosperity and bubble in emerging industries. In the short term, the probability of entering a bear market (recession) is higher, but from a slightly longer-term perspective, we will inevitably see a bull market driven by monetary easing in the next two to three years.

The key question is, under what circumstances is it the safest time to buy at the bottom?

- Prelude to monetary easing.

Two key times: one is the initiation of SLR, and the other is the cessation of balance sheet reduction.

But the premise is that there is no substantial recession in the economy. If SLR is used for short-term buying, it can be a bet on a rebound, while a complete cessation of balance sheet reduction should ideally be implemented in conjunction with the economic state.

- Buying Bitcoin at lower prices.

As seen in the chart, the trends of BTC and the Nasdaq are very similar. Generally speaking, if there is a pullback, fluctuation, and consolidation, it corresponds to a decline of about 20% in the Nasdaq. Currently, it has dropped 10%, which means there is still about 10% space left. For Bitcoin, this corresponds to around $75,000. However, considering that Bitcoin's decline is likely to be greater than that of the Nasdaq, and given Bitcoin's strategic reserve and spot ETF, gradually building positions between $70,000 and $75,000 may be the right approach.

In reality, the Nasdaq has already dropped 10%. If there is no recession, the probability of further decline is also low, which corresponds to a Bitcoin price of around $80,000. So, if you are bold and have enough funds, you can build positions around $80,000. A drop below $80,000 could also present an opportunity.

However, it is still important to be prepared for the possibility of a recession. A recession brings both panic and opportunity, and it is often the final drop.

- Macroeconomic data points.

The dot plot remains a standard for assessing investor sentiment. Whether there are two or three rate cuts will significantly impact sentiment, at least in the short term. Of course, we also need to see what Powell says in the press conference following the dot plot release. There will certainly be questions from reporters regarding expectations for the GDP data provided by GDPNow, but Powell is unlikely to answer directly.

If the impact of the dot plot is positive, the GDP data in April will be quite important. If it truly shows a negative 2.4%, then a trading recession will inevitably arrive. Starting from Q2, the data will have an increasing impact on the macroeconomic situation, and whether we are in a recession or not will become a key point of market speculation.

- Be cautious about shorting at lower prices.

Although this is unrelated to buying at the bottom, many friends prefer to use contracts rather than spot trading. Therefore, the timing and direction of contract positions are also quite important. Previously, I shared that the open interest in contracts is now at a one-year low, indicating that many investors are not very confident in the current bullish or bearish sentiment. If there is no recession, the returns from shorting now may not be very good.

Of course, this does not encourage everyone to go long, as going long also carries risks, such as prolonged fluctuations around $80,000, the possibility of a recession, or significant volatility due to macro data like the dot plot. All of these could ultimately lead to the right direction but with depleted positions.

In such cases, appropriately reducing leverage may not be a bad idea. While it may result in lower profits, it increases safety. After all, surviving is the first step to thriving.

- Position management is crucial.

No one has publicly known the future, so no one knows what it holds. I previously fell into the trap of predicting the future. Even if history has repeated itself many times, it does not mean that blindly following it will happen 100% of the time. While going all-in may present a greater opportunity for profit, it also carries a significant risk of loss. Managing positions to ensure you always have funds available to buy at the bottom is the best way to respond to extreme situations.

In conclusion,

These are the main points I can think of. I firmly believe that as monetary easing progresses, by 2028 at the latest, we will escape the current liquidity predicament. The most likely asset to retain value right now is Bitcoin, followed by quality platform tokens, and then public chains or projects with real returns, especially those whose returns can cover expenses. Finally, there are those with real application scenarios but currently cannot achieve a balance between income and expenditure for various reasons.

Lastly, I want to thank all my friends for their support. I indeed should not have been fixated on the performance of Q1, nor should I have used contracts to represent my views. My perspective should always be based on facts and data, not speculation. I apologize for having taken a wrong path for a while, but now I am back on track. Thank you all for your support and for the encouragement from friends around me.

Whether I am right or wrong is not important; as long as my views are helpful to my friends, that is enough.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。