The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smoke screens!

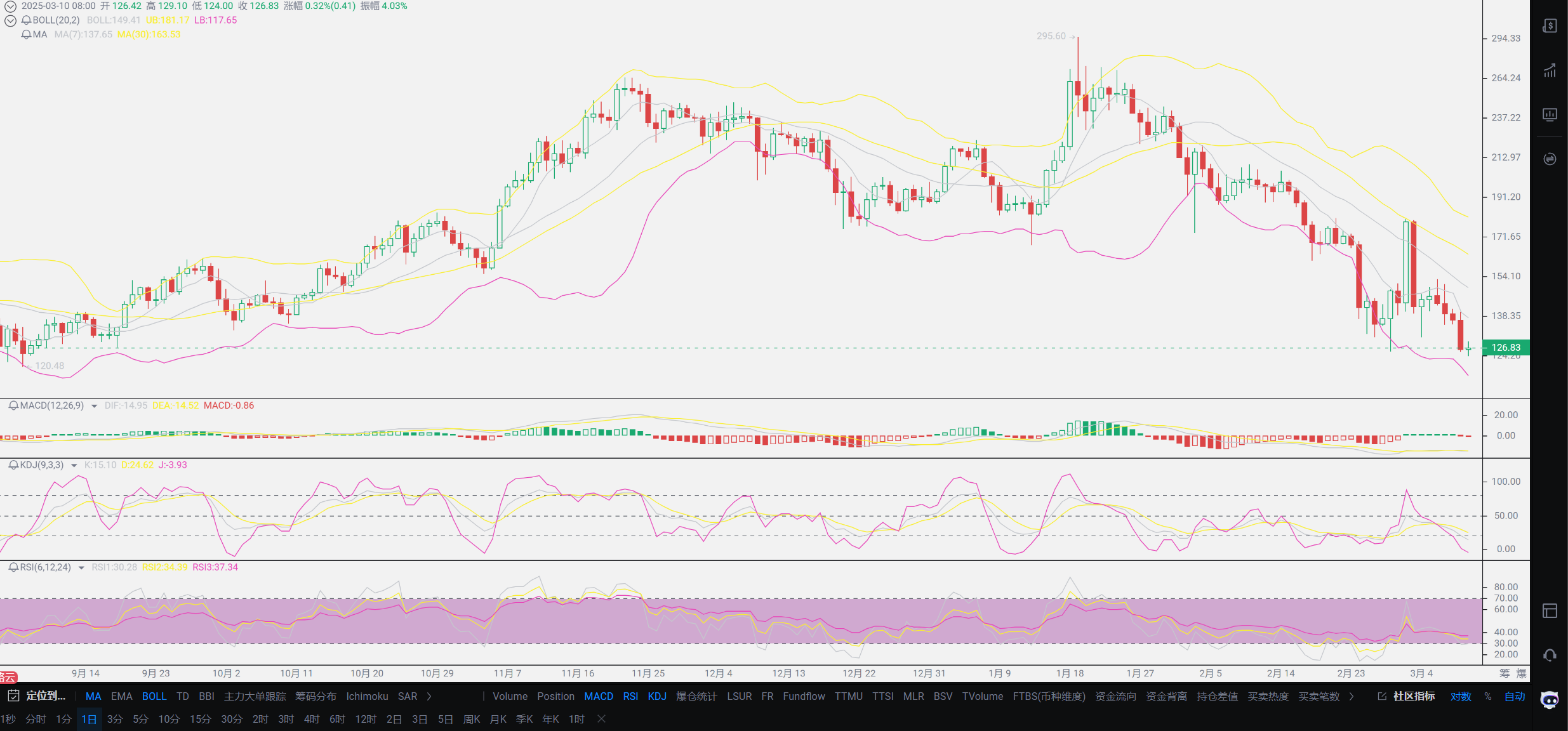

The market has once again moved down as expected, and everyone sees the side of Lao Cui that is pleased with himself. I won't stimulate everyone's beautiful vision for the market; congratulations to those who have followed Lao Cui's advice and successfully sold their chips, and congratulations to those who have entered short positions. With limited energy, I will take this time to talk about the future trends. Similar to this trend, the future will likely still be dominated by the following behaviors. There will still be rebounds, but they will only provide opportunities for long positions to exit. This prediction of a bearish trend indeed tests human nature, as everyone has just experienced a historic rise, and suddenly being asked to short is very perplexing. Today, I will conduct a comprehensive review of Lao Cui's judgment logic. Although it is presented in the form of a review, it still has its merits. I hope this review can help everyone with their trend judgments, and you can also use this thinking to view the financial market in the future. To judge the trend, the first factor is how the current financial environment is. Many friends see the growth in the cryptocurrency circle and blindly charge forward, ignoring the environment we are currently in; the current financial environment is not good, especially in the world stage, where wars are still breaking out, and war is extremely depleting of original capital. Therefore, the movements of large capital must be centered around war, which is why you see BlackRock bottoming out in Ukraine and taking over shares in major ports.

With the influence of war in the front and the impact of trade wars in the back, we see the competition between the first and second largest economies. This is undoubtedly adding insult to injury for the financial market, one causing inflation and the other causing deflation, both presenting historical levels of financial risk. The question is not who can hold on, but whether the current environment is suitable for bottom-fishing in the cryptocurrency circle? A hindsight statement that was often discussed last year is that 2024 is a year suitable for bottom-fishing, while 2025 is not the best time for it. Everyone should understand this issue objectively; the factors that crazily called for bottom-fishing in 2024 have been discussed before, and I won't elaborate on them today; the best timing does not mean there are no opportunities for bottom-fishing this year, just that the return rate may not be as high as in 2024. At this point, many friends will ask Lao Cui what price levels are suitable for bottom-fishing? Generally, I find such questions very sharp; there is never an absolutely suitable position in this market. Entering at the same price level also depends on the risk of holding positions. If you always think about absolutely low points for bottom-fishing, you will miss all market trends, and when a bull market arrives, you will not be able to grasp it. There is never the most suitable position for everyone to choose; the essence of investment is still as Buffett said, value investing is the first priority, and the most controversial topic in the cryptocurrency circle is where the embodiment of value truly lies. Whether it is Lao Cui's gray industry value theory or the harvesting value theory from outsiders, they may not be the correct explanations; the real interpretation always stands on the side of time.

Returning to the main topic, since we are convinced that the financial environment is poor, we must judge the market from a factual perspective. Without the inflow of large funds, there will be no high points of growth, and the public opinion market has already done its best; the rest can only be dominated by shorts. Since the bearish trend is the main theme, why not short now? The second factor is how the cryptocurrency market environment is. This is actually very difficult for everyone to make a correct judgment because many friends are unclear about what the anchor of their cryptocurrency market is. Therefore, it is impossible to start judging the good or bad of the cryptocurrency market. Most friends blindly charge forward after listening to the speeches of coin issuers, and after suffering losses, they can only curse the lack of moral conscience, never considering the practical application of value. The actual value in the cryptocurrency circle, whether you admit it or not, has already been proven by examples. The EU and Russia's underground transactions have utilized Bitcoin, and VIVO has brought back funds from India using blockchain; even the Americans have already made strategic reserves. Do we still need to discuss the embodiment of actual value? These issues are somewhat difficult to understand. You can question the gray industry theory, as it is merely at the stage of speculation at the current price. However, one must have a certain sensitivity to major events in the world. The actual value does not need us to discuss; the pricing issue is also in the early stages of the cryptocurrency circle, and the question of who holds the pricing power is now also in doubt, which is the fundamental reason for the large fluctuations in the cryptocurrency circle. Wanting to move towards the gray industry theory but fearing the uncontrollability of the cryptocurrency circle, these issues are what the upper echelons need to think about; we only need to grasp their temporary thoughts to make a fortune.

In the embodiment of actual value, Bitcoin currently indeed has too much bubble, especially influenced by last year's events, which can be said to have exhausted the startup funds for Bitcoin's four-year cycle. The funds that should have entered the market have basically all been involved last year, and if we want to have large funds pulling the market in the future, there must be a greater embodiment of actual value. Therefore, in the short term, it will mainly digest the growth bubble of 2024. In other words, Bitcoin should return to its rightful position. The growth in 2024 has allowed too much capital that does not belong to the cryptocurrency circle to enter the market, and now is the beginning of their exit. The legitimate process of Bitcoin must come at the cost of eliminating speculators; this is true for any market, and the legalization process of securities is almost consistent with that of the cryptocurrency circle. There are many bubbles in actual value, so in the short term, the bearish trend will definitely continue. The third factor is the issue you are considering, the short-term positive news. At the beginning of the digital currency conference, Lao Cui mentioned that Trump has made too many promises, but there are too few actual implementations. If he does not inject chips into the cryptocurrency circle this time and does not take actual action, the cryptocurrency circle will fall; the current stage is influenced by news. The first two factors define the form of Bitcoin this year, while the third factor determines the short-term trend. Looking at the combination of the three, Bitcoin has only one path to fall.

Lao Cui summarizes: Through the judgment of these three factors, we can draw the probable behavior of the market in the future. We can boldly speculate that if the current financial market performs well, the cryptocurrency market will be the same, and with the arrival of short-term positive news, then the high point of 2024 cannot stop at the 110,000 high point; it is possible that 2024 can achieve the goals of 2025 or even 2026. Applying this formula to the current market situation, we can clearly judge the upcoming trends. The first factor is that the global financial market's prospects this year must be greater than the environment in which it was in 2024. After all, with Trump in office, the improvement of the Russia-Ukraine conflict and the gradual dissipating of the war's corrosiveness can also be indirectly confirmed from the gold trend. Moreover, global data will further improve with this year's interest rate cut strategy, and in the future, more funds will be released; it is just a matter of the upper limit. Once there are two interest rate cuts or more, the cryptocurrency circle will return to the right track. The judgment of the second factor is even more obvious; the environment of the cryptocurrency circle depends on Trump's attitude. In other words, as long as the upper echelons do not strike, it is the biggest positive news for the cryptocurrency circle.

The worst point in the cryptocurrency circle's environment was the year we struck against it, which directly led to the escape of funds from the cryptocurrency circle. Now we are gradually accepting the existence of the cryptocurrency circle, especially looking at the technological innovation effects of coins like SOL, there is still potential. The market for blockchain technology is continuously expanding, and the number of consensus holders is also increasing; at least it is much more observable than when Lao Cui entered the cryptocurrency market. At this stage, no one in the cryptocurrency circle claims it is a scam; the market situation in the cryptocurrency circle is still quite observable. The third factor is the short-term positive news, the most recent being the listing of SOL, followed by the establishment of cryptocurrency organizations and the process of compliance, as well as the upcoming interest rate cuts. These things cannot be accomplished in the short term, so the bearish trend is the main theme at this stage. We must wait for these news to continuously emerge and be implemented before the cryptocurrency circle can return to the right track. This is also Lao Cui's core theory; the short-term bearish trend does not mean the end of the bull market. Spot users must seize the opportunity to enter the market; do not care about short-term gains and losses. If you really cannot accept short-term losses, you can use contracts to recover some losses. As for contract users, you must primarily focus on shorting; the change in the direction of shorts will also end with the positive news landing. This year's Bitcoin should not be seen as having too high an upper limit; reaching around 120,000 would already be passing. To avoid going too far, just remember that all rebounds in the short term are traps for the greedy; it is best to short as much as possible.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's Message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes the big trend, does not focus on one piece or one territory, and aims to win the game, while the novice fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。