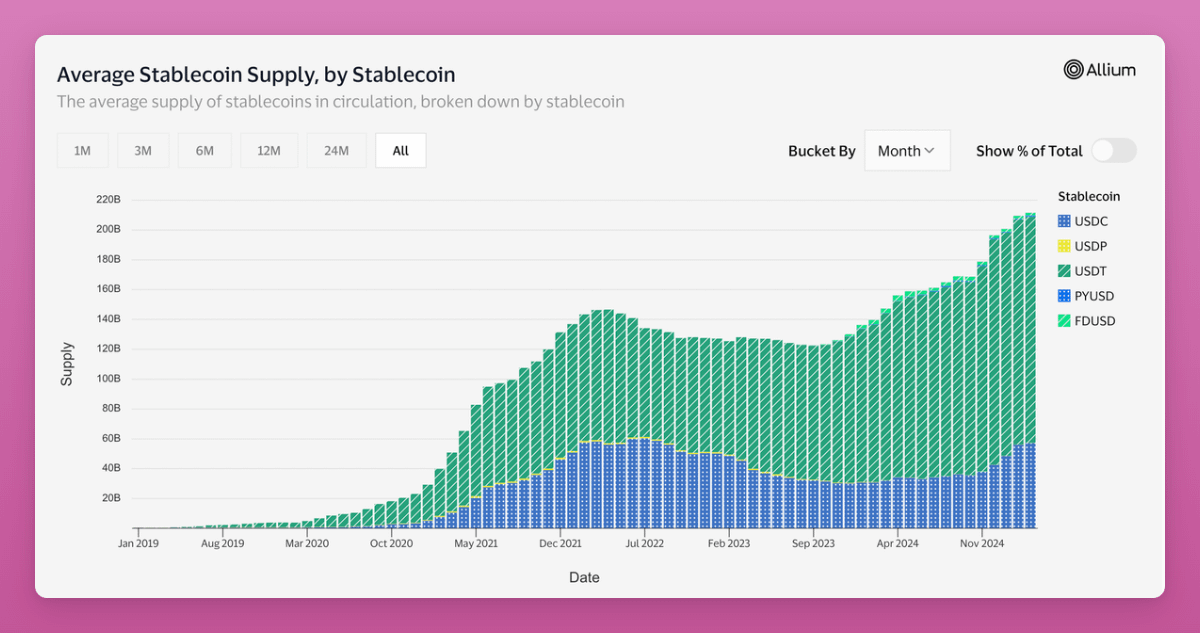

Stablecoin supply hits ATH, growing by 44% over two years.

Which trades will capitalize on their mass adoption?

For context, Trump admin gave until August to pass Stablecoin bill.

With it, major TradFi players are preparing for stablecoin growth. Just a few examples:

- Bank of America: open to its own stablecoin if regulations allow

- Standard Chartered: HK dollar stablecoin

- PayPal: expanding PYUSD rollout in 2025

- Stripe: bought Bridge stablecoin platform for $1.1bn

- Revolut: exploring stablecoin issuance

- Visa: using stablecoins for payments and global ops

Until recently, an increase in stablecoin supply led to a pump in crypto prices, as stablecoins were mostly used for short-term holding between trades.

Now, stablecoins are growing beyond speculation with SpaceX sending back funds from Starlink sales in Argentina and Nigeria, and ScaleAI pays overseas contractors with them.

The simplest trade is betting on where major players will issue new stablecoins.

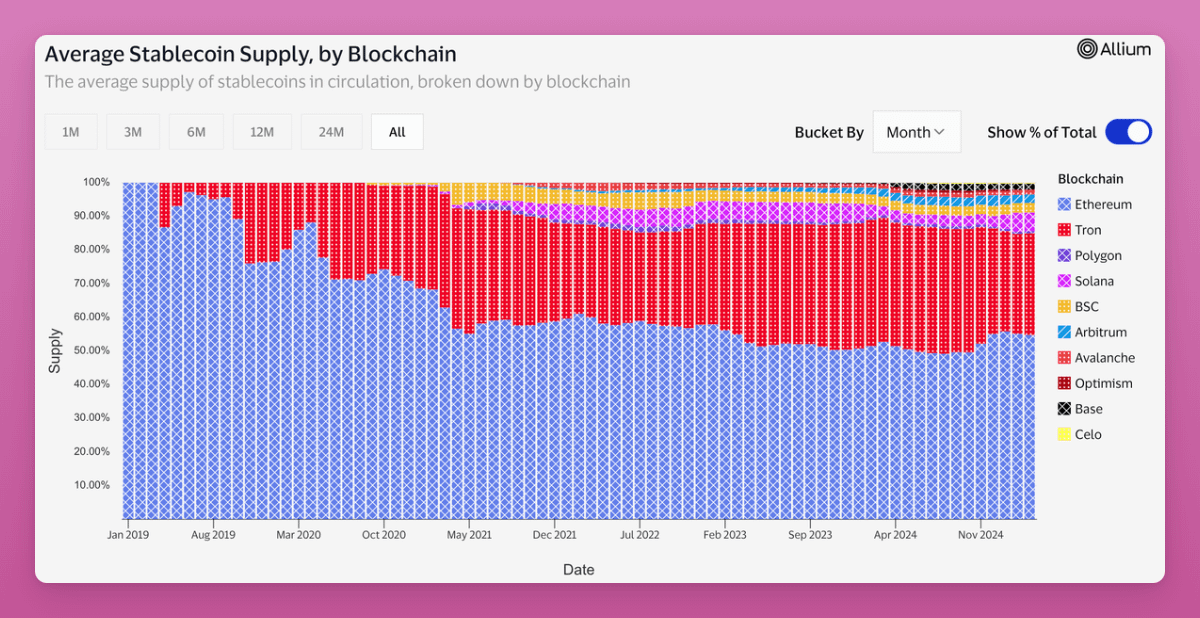

Ethereum, Base, Tron, and Solana are primary chains.

Notice how despite $SOL dominating this bull run, stablecoin growth on Solana is slow. Only Base with USDC managed to significantly sneak into stablecoin game.

As Base has no token Coinbase $COIN is a potential trade.

Alternatively, can wait for a USDC's Circle IPO. Or bet on Visa, Paypal stocks, too.

On top of trading, and payments stablecoins are used in DeFi to earn yield:

So if stablecoin supply growths, established DeFi protocols will likely benefit from it:

- Aave/Morpho/Euler/Fluid

- Uniswap/Curve

- Maker

- Ethena

Increased supply-> higher TVL-> for fees -> higher token valuation (especially with rev share)

Yield is a key factor that influences stablecoin dynamics:

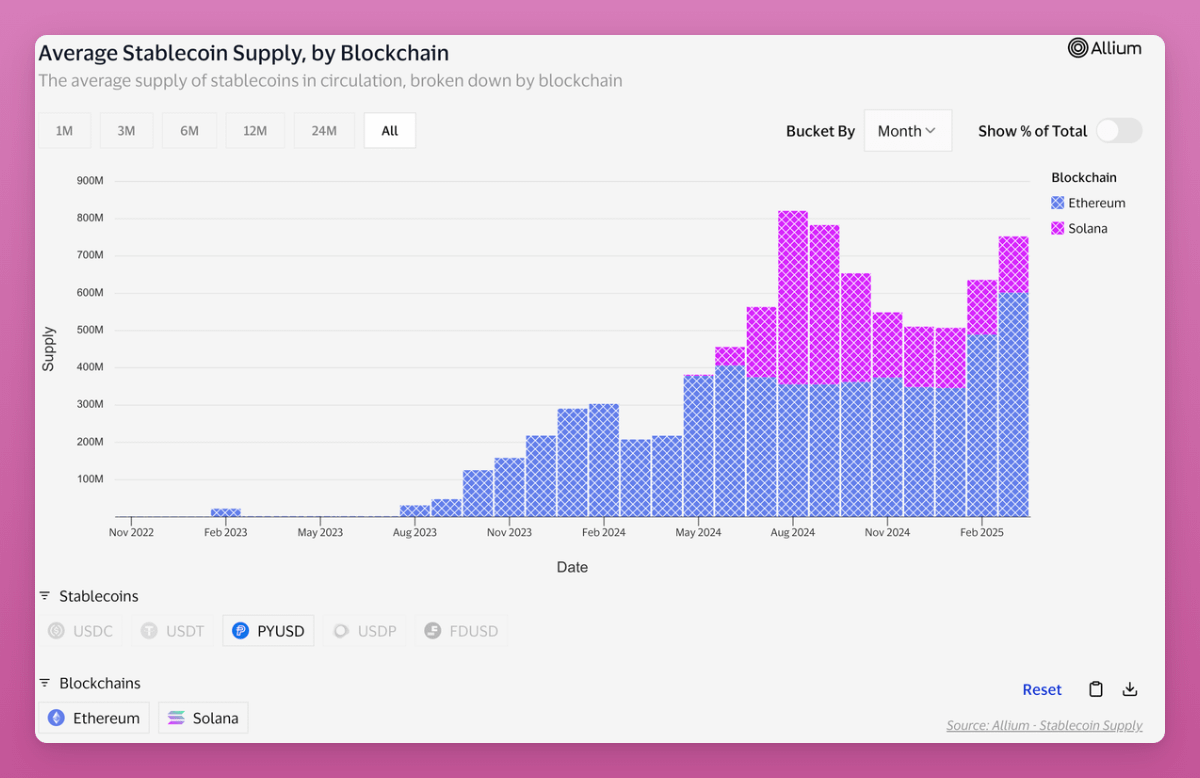

E.g. PayPal's $PYUSD is now live on Solana and Ethereum, but growth is slow.

Solana challenged Ethereum when Kamino initially offered high APYs thanks to incentives; however, supply on Solana has since stagnated, while supply on Ethereum continues to grow.

Cross-chain platforms and oracles benefit from multichain stablecoin growth through more transactions and fees.

- Chainlink

- LayerZero/Socket

- Debridge/Across etc.

Yet probably the juiciest trades will come from new infra/consumer facing/yield apps that are yet to launch. New exciting tokens usually attract more attention.

This will grow into a mega narrative when prices pick up and where I'll spend more of my degen researcher time.

In any case, stablecoin adoption is super bullish for crypto:

Blockspace on Eth, Sol, Base etc. will have more demand so betting on smart contract chains is the simplest trade of them all.

What trades do you have in mind?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。