On February 13, 2025, Huaxia Fund (Hong Kong) announced that its "Huaxia Hong Kong Dollar Digital Currency Fund" has been approved by the Hong Kong Securities and Futures Commission (SFC), becoming the first tokenized fund for retail investors in the Asia-Pacific region, expected to officially launch on February 28. This fund is the first retail fund approved in Hong Kong since the issuance of the "Tokenized SFC Recognized Investment Products" circular in November 2023, marking a key breakthrough in the transition of tokenized assets from being exclusive to institutions to entering the mass market. Currently, the official announcement on Huaxia Fund (Hong Kong)'s website shows that the "Huaxia Hong Kong Dollar Digital Currency Fund" was issued as scheduled on February 28, 2025.

Traditional currency funds are relatively easy to understand, but what is a tokenized fund? How is it different from traditional funds? Which investors can subscribe, and how can they redeem? As the first tokenized fund aimed at the public in the Asia-Pacific region, what are its investment assets? The Crypto Law team, a professional legal team continuously tracking the latest developments in the global Web3 and cryptocurrency fields, will address these questions by combining examples from other global tokenized funds.

1. What is a Tokenized Fund? How Does It Differ from Traditional Funds?

The term tokenization refers to the process of converting the rights of real-world assets (RWAs) into digital tokens on the blockchain, while a tokenized fund is one where fund shares are "on-chain" as digital tokens, with ownership represented by these tokens, where one token (or a portion of it) represents a unit or share (or a portion) of the fund.

Therefore, the essence of fund tokenization is to issue fund shares as on-chain certificates. For example, BlackRock's BUIDL tokenized fund launched in 2024 uses a USD/USDC subscription mechanism, with tokens strictly pegged 1:1 to fund shares, achieving automated conversion through smart contracts, investing in USD cash reserves, short-term U.S. Treasury bonds, and high-quality money market instruments (such as large bank certificates of deposit, high-rated commercial paper, etc.).

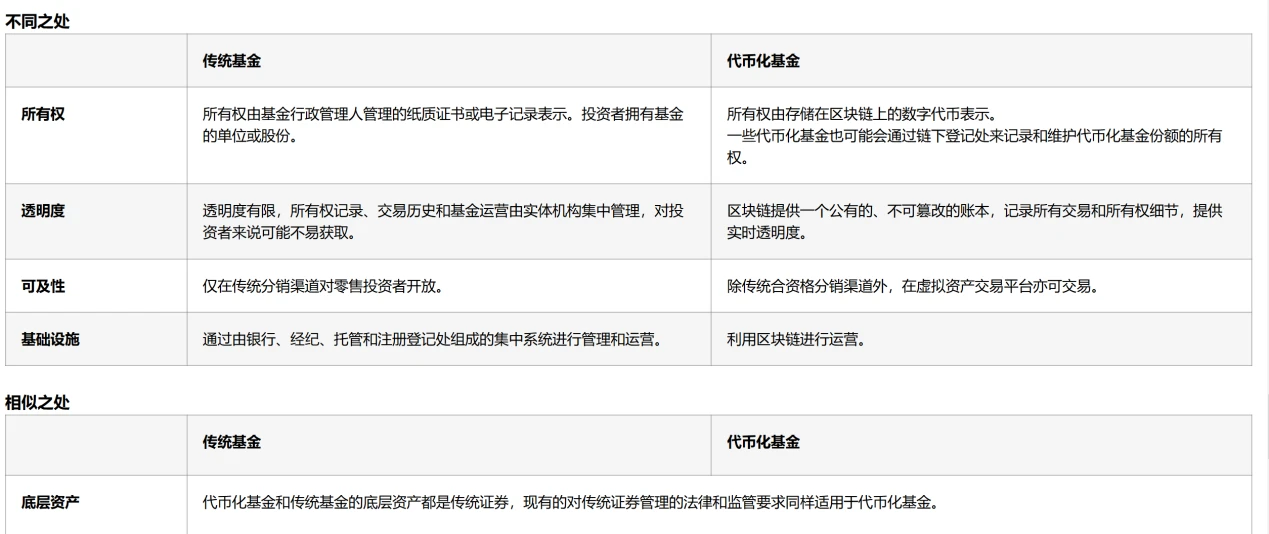

From an investment perspective, there is no significant difference between tokenized funds and traditional funds. However, since tokenized funds are built on the foundation of blockchain technology, they have many innovations in ownership attribution, information transparency, and trading models:

(Huaxia Fund's official comparison chart of the two)

2. What Makes the "Huaxia Hong Kong Dollar Digital Currency Fund" Special? How Can Investors Subscribe and Redeem?

In fact, the investment assets of the "Huaxia Hong Kong Dollar Digital Currency Fund" are not fundamentally different from traditional currency funds. According to the fund's "Product Information Summary," its main investment assets are Hong Kong dollar short-term deposits and high-quality money market instruments, with other money market instruments and money market funds as auxiliary investment assets. Additionally, the fund offers three share classes in Hong Kong dollars, U.S. dollars, and Chinese yuan for investors to choose from.

However, as the first tokenized fund for retail investors in the Asia-Pacific region, its core feature is the special issuance method of "tokenization." From the perspective of the tokenization model, the fund adopts a custodial tokenization model, with Standard Chartered Bank (Hong Kong) serving as the tokenization agent, digital platform operator, and token custodian, completing the technical implementation through its wholly-owned subsidiary Libeara's internally authorized digital platform.

Moreover, due to the differences in fund structure, the channels and methods for investors to subscribe and redeem will also differ from traditional funds. It is important to note that the "Product Information Summary" emphasizes that retail investors can only subscribe or redeem tokenized shares through qualified distributors in the form of tokens. Currently, the only "qualified distributor" disclosed by Huaxia Fund is OSL Digital Securities Limited, which is also the only publicly listed and compliant licensed cryptocurrency trading platform in Hong Kong. Specifically, investors can only subscribe to the fund tokens on-chain through the qualified distributor, OSL Exchange, and after subscribing, the fund shares will be converted into corresponding tokenized shares, which will be custodied by SCB (Standard Chartered Bank).

Next, regarding the scope of investors targeted by the fund. The articles of association of the corresponding company for this sub-fund clearly state that the fund is only issued to investors in Hong Kong and is not offered in any other countries or regions. Therefore, investors from mainland China cannot directly participate in the subscription and redemption of this fund.

3. How Does the Tokenized Fund Achieve Token Subscription and Redemption?

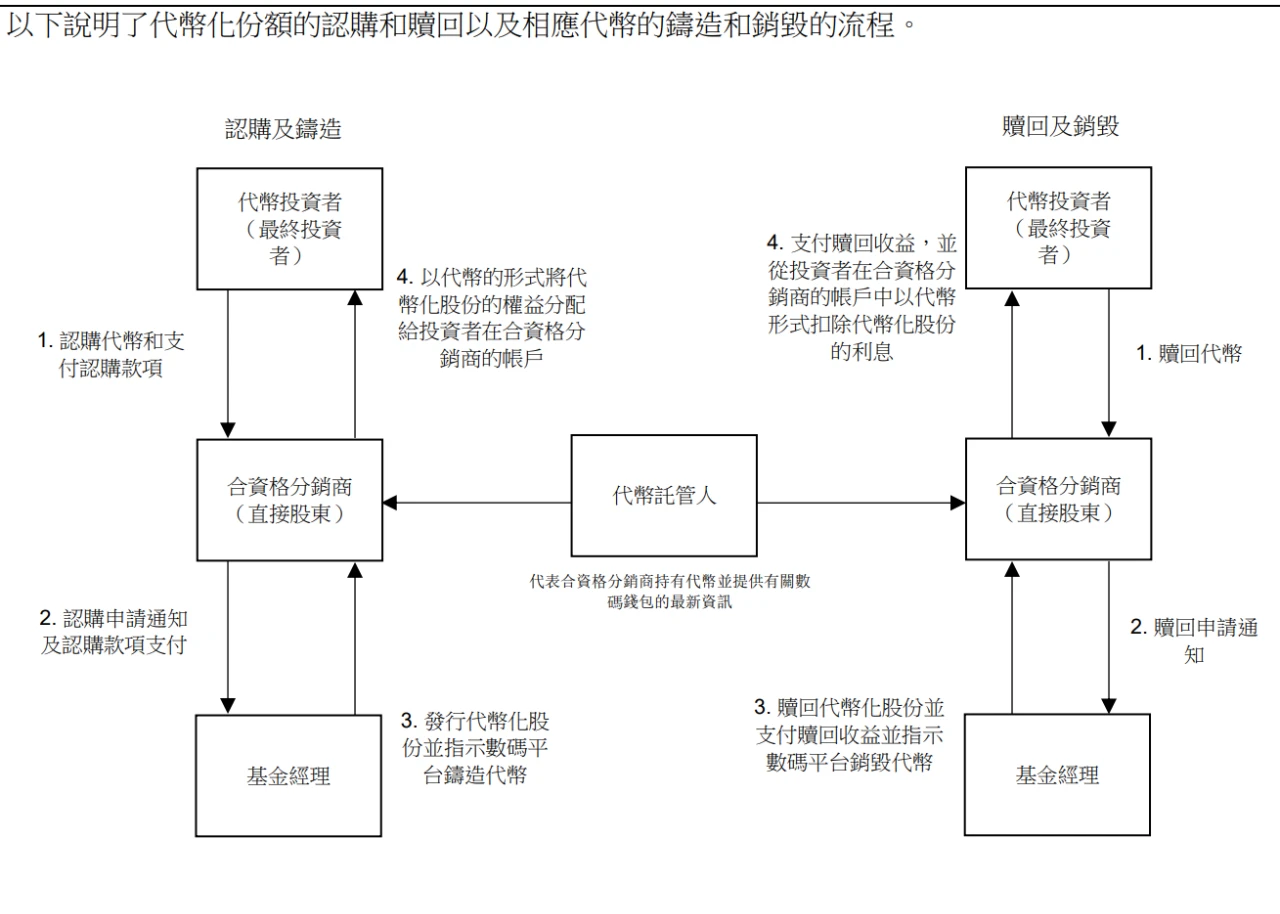

Due to the differences in product structure, the subscription and redemption mechanisms of this tokenized fund are also quite different from traditional funds.

(Huaxia Fund's official illustration of the fund's subscription and redemption mechanism)

Subscription (Fiat → Token):

Process: The final investor subscribes to the fund token through the qualified distributor's channel and confirms payment of the subscription amount using fiat currency. The qualified distributor notifies the fund manager of the subscription application and pays the final investor's subscription amount to the fund manager. After receiving the subscription application, the fund manager will issue corresponding tokenized shares and instruct the blockchain digital platform to mint the tokens. Once the tokens are minted, the token custodian will hold them in the qualified distributor's blockchain wallet on behalf of the final investor. Finally, the qualified distributor will distribute the rights of the tokenized shares to the investor in the form of tokens.

Redemption (Token → Fiat):

Process: The final investor redeems the fund token through the qualified distributor, which then issues a redemption application notification to the fund manager. After receiving the redemption notification, the fund manager will redeem the tokenized shares and instruct the blockchain digital platform to destroy the corresponding tokens, while paying the redemption proceeds to the qualified distributor. Finally, the qualified distributor will pay the redemption proceeds to the final investor, deducting the tokens held in the qualified distributor's wallet.

In addition to the "Huaxia Hong Kong Dollar Digital Currency Fund," other global tokenized funds also have their unique subscription and redemption mechanisms. For example, BUIDL achieves its 1:1 dual peg between fund shares and on-chain certificates (tokens) through the following methods:

Subscription (Fiat/Stables → Token):

Process: Investors transfer USD/USDC to a designated custody account (off-chain bank account or on-chain smart contract). After the system verifies the funds have arrived, the smart contract automatically mints an equivalent amount of BUIDL tokens and sends them to the investor's whitelisted address.

Subscription Method: Investors can subscribe directly through the blockchain after passing KYC/AML checks, using a compliant digital wallet to complete on-chain transactions; they can also subscribe in cash through a bank or broker, with the fund manager tokenizing and distributing to the on-chain wallet.

Redemption (Token → Fiat/Stables):

Process: Investors send BUIDL tokens to a designated redemption address, and after the smart contract destroys the tokens, the custodian bank will transfer an equivalent amount of USD/USDC to the investor's account as instructed. Redemption can be completed in two ways:

Off-chain settlement: Initiated through the Securitize platform, with funds arriving within T+0 business days;

On-chain atomic settlement: Real-time exchange for USDC through the Circle liquidity pool (only for the token portion; undistributed earnings need to be handled separately).

Yield Calculation: Each business day, yields are recorded based on the shares held at the address, and on the first business day of each month, yields are distributed by minting additional BUIDL tokens and airdropping them.

4. Crypto Law's Commentary

The approval of this tokenized fund by Huaxia as the first retail tokenized fund in the Asia-Pacific region represents a milestone breakthrough for the application of Web3.0 and blockchain technology. The Crypto Law team believes that this event signifies that the application technology of the Web3.0 era has entered a new stage, officially opening the door for public investors to participate.

Although the underlying assets currently invested are low-risk currency funds, official documents also indicate that this attempt at tokenization aimed at the public focuses on the innovation of RWA (real-world assets) and blockchain technology, emphasizing asset security and high liquidity rather than a high-risk, high-return investment orientation.

Therefore, for the construction of the tokenized fund market ecosystem in Hong Kong, this issuance is just the first step, and the overall attitude is relatively cautious. However, the Crypto Law team believes that if this attempt can run smoothly, it is very likely that more funds will follow the path of blockchain tokenization, and we can expect more investment strategies to emerge. For instance, beyond fiat trading methods, is there a possibility of achieving real-time trading through digital currencies? Although currently only cash-like products are available, will future tokenized funds be able to further expand their investment assets and launch higher-yield products?

With the gradual maturation of the compliant blockchain currency system, asset tokenization, leveraging on-chain trading and global liquidity advantages, may become a core driving force in reshaping the global asset management landscape.

Special Statement: This article is an original piece by the Crypto Law team, representing the personal views of the author and does not constitute legal advice or opinions on specific matters.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。