Original|Odaily Planet Daily (@OdailyChina)

In the recent downtrend and volatile market, the most outstanding traders are undoubtedly those who have sought excess profits through frequent contract openings on Hyperliquid. Amid the fluctuations of mainstream coins like BTC and ETH, they seem to always be one step ahead in identifying market trends, quickly opening positions, and precisely closing them, thus earning the nickname "Insider Brother" amidst jealousy and suspicion in the community.

Currently, some retail investors regard them as "opening indicators" and have achieved real-world success by following their trades. In light of this, Odaily Planet Daily will briefly summarize the operations of profit-making whales on the Hyperliquid platform and the addresses for observation in this article for readers' reference.

Hyperliquid Becomes the Latest Gold Rush: Monthly Trading Volume Grows Over 4 Times in 6 Months

After experiencing the baptism of political meme coins like TRUMP, MELANIA, and LIBRA, the meme phase of the cryptocurrency market has temporarily receded, replaced by the on-chain contract market, which has become the latest gold rush for countless traders.

At the beginning of February, a Messari report indicated that Hyperliquid's monthly trading volume has increased over 4 times since October 2024, demonstrating the platform's rapid rise in the decentralized trading market. Hyperliquid has cultivated a group of high-value, continuously active trading users, becoming the only Layer 1 alternative with a clear core user base in the market.

In late February, Hyperliquid's official announcement stated that the HyperEVM mainnet is now live, introducing general programmability into Hyperliquid's high-performance financial system. The initial release of the mainnet includes: HyperEVM blocks built as part of L1 execution, inheriting all the security of HyperBFT consensus; spot transfers between native spot HYPE and HyperEVM HYPE; and a standardized WHYPE system contract applicable to DeFi applications.

Meanwhile, on February 22, Degen News cited DeFiLlama data on the X platform, stating that in the past 24 hours, HyperliquidX protocol revenue reached $2.46 million, surpassing pump.fun to rank third, only behind the two major stablecoin issuers, Tether and Circle. It must be said that the trend may have already been evident at that time.

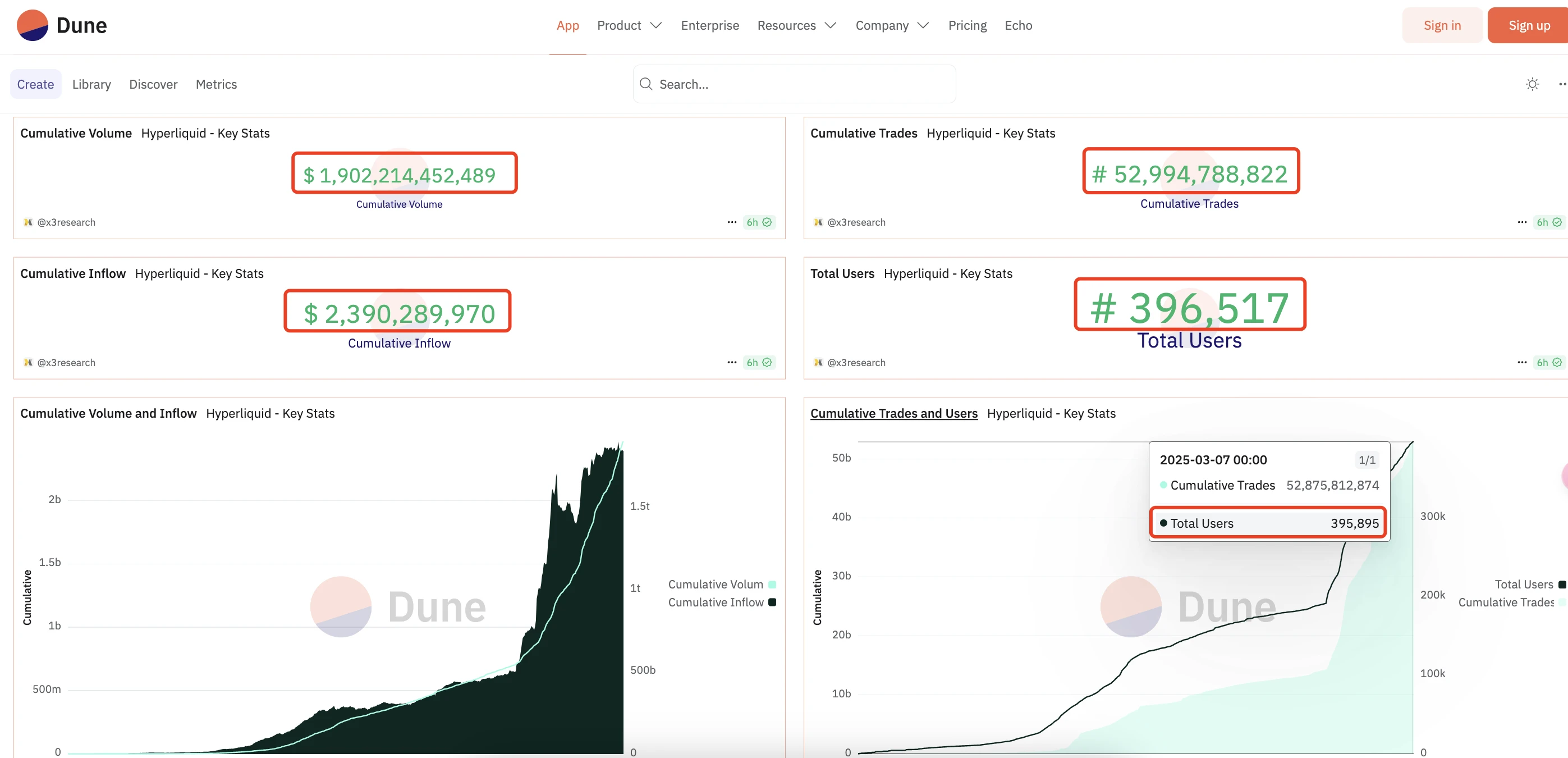

According to Dune data, as of March 7, the number of independent users on Hyperliquid has approached 400,000; the total number of trades has reached 53 billion; and the platform's cumulative trading volume has exceeded $1.9 trillion.

"On-chain Binance," terrifying indeed

Since February, many large holders have achieved impressive results on Hyperliquid—profit scales ranging from hundreds of thousands to tens of millions of dollars. Under the banner of "on-chain Binance," Hyperliquid has become a "winning ground" with substantial trading depth in the fluctuating monkey market.

Whale "Insider Trading" Operations Summary: BERA, BTC, ETH, and More Within Range

Whale Operation: Shorting BERA to Earn $589,000 in 2 Hours

At the beginning of February, according to Lookonchain monitoring, after BERA was launched, a whale earned $589,000 by shorting BERA in less than 2 hours. This whale deposited $1.6 million into Hyperliquid 16 hours prior and shorted BERA at a price point of $13, making a profit of $589,000.

Observation address: https://hypurrscan.io/address/0x0eC0A15e5763ED97A85e860fDCCd7D1e082b5AA9

It is worth mentioning that this address has now been fully liquidated.

Whale Operation: Shorting ETH with 50x Leverage, Floating Profit Exceeds $62.4 Million

At the end of February, according to Onchain Lens monitoring, a whale shorted ETH on HyperLiquid with 50x leverage, with floating profits exceeding $62.4 million at that time.

Observation address: https://hypurrscan.io/address/0x20C2d95a3Dfdca9e9AD12794D5fa6FaD99dA44f5

Currently, this address still holds $98 million in contracts.

Suspected Insider Brother: Going Long on ETH and BTC During a Major Drop, ETH Position Reaches 88,500 Coins, $6.83 Million Profit in 24 Hours

According to on-chain analyst Ai Yi's monitoring, the 88,510 ETH long position of a user on Hyperliquid with 50x leverage has been fully liquidated for profit, and they have now started to take profits on Bitcoin, with 315 BTC remaining.

This address previously opened a long position worth over $200 million with a principal of 6 million USDC. Among them—ETH: 49,384 coins, opening price $2,196, liquidation price $2,133.9; BTC: 1,260 coins, opening price $85,671, liquidation price $84,629. Subsequently, this address added 914 ETH and 41 BTC to the long position.

The subsequent story is well-known; Trump directly called out XRP, SOL, ADA, BTC, ETH, claiming to establish a cryptocurrency reserve. Affected by this news, the address once floated a profit of $646,000. Due to the extreme timing of the opening and liquidation points, many in the market speculated that this might be an insider close to Trump. Although this view was later refuted by Coinbase executive Conor Grogan refuting it, claiming the funds originated from phishing scam money. However, the truth remains unknown.

Currently, this address has been fully liquidated.

Observation address: https://hypurrscan.io/address/0xe4d31c2541A9cE596419879B1A46Ffc7cD202c62

Insider Brother Strikes Again: Opens a $13.45 Million Bitcoin Short Position

In early March, according to ai_9684xtpa monitoring, with 20 minutes left until the US stock market opened, the "Hyperliquid 50x leverage long BTC and ETH whale" who made a profit of $6.83 million opened a $13.45 million Bitcoin short position, still at the familiar 50x leverage, still at a sensitive time, but switched from long to short with a significantly smaller position; the opening price was $93,117.5, liquidation price $94,083, and at one point, it was floating a loss of $60,000. However, soon after, the address successfully exited with a profit of "nearly $300,000 again."

Institutional Operation: 50x Leverage Opens a $139 Million ETH Short Position, Floating Profit of $78.19 Million at One Point

On March 4, according to Hypurrscan data, a whale opened a $139 million ETH short position on Hyperliquid with 50x leverage, which had a floating profit of $78.19 million, with a liquidation price of 3,507 USDT. Subsequently, it was learned that this position was actually opened for the stablecoin USR maintenance protocol Resolv Labs.

Observation address: https://hypurrscan.io/address/0x20c2d95a3dfdca9e9ad12794d5fa6fad99da44f5

Currently, the contract position value of this address is approximately $97 million.

Suspected Insider Brother's Hat Trick: 50x Leverage Long ETH, $2.15 Million Profit in 40 Minutes

This afternoon, according to on-chain analyst Ai Yi monitoring, the "Hyperliquid 50x leverage long BTC and ETH whale" who made a profit of $7.13 million deposited 1.95 million USDC as margin and opened a 50x long position on ETH, holding 27,809 ETH (approximately $57.88 million), with an opening price of $2,057.49 and a liquidation price of $2,008.

Shortly after opening the position, ETH rose to a maximum of $2,149, and ultimately, he closed all positions for profit, earning $2.15 million in less than 40 minutes. So far, he has accumulated a profit of $9.28 million through three leveraged trades.

Observation address: https://hypurrscan.io/address/0xf3F496C9486BE5924a93D67e98298733Bb47057c

Whale Operation: Long BTC with 4.06 Million USDC, Floating Profit of $589,000

On March 6, according to Lookonchain monitoring, a dormant wallet sold 1,863 ETH at an average price of $2,181, obtaining 4.06 million USDC. Subsequently, this address deposited 4.06 million USDC into Hyperliquid and went long on BTC at a price of $89,930 with 20x leverage, achieving a floating profit of $589,000, with a liquidation price of $75,186.

Observation address: https://hypurrscan.io/address/0x523b21F469825D0104ac6A3c762a955EeDb75e5B

Summary: Eating Meat and Drinking Soup, All Depends on Speed

Currently, the suspected Insider Brother has an unusually high win rate in long and short operations, and his true identity could be a hacker involved in phishing scams, though it cannot be ruled out that he is an insider or a whale accomplice.

Given that Hyperliquid's infrastructure is still immature, current followers rely heavily on speed. Odaily Planet Daily reminds that in times of unclear market trends, leverage should be used cautiously, and proper risk control should be in place before choosing a "big brother."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。