Bitcoin touched 80,000 in the early session and rebounded to a high of 84,100 before a sharp drop. In the evening, U.S. stocks opened significantly lower, with the Nasdaq down 3.84%, the Dow Jones down 1%, and the S&P 500 down 2.18%. The average drop for the seven major U.S. stocks was around 20%, with Tesla seeing a maximum drop of nearly 50%.

Bitcoin followed the U.S. stock market's opening drop, directly breaking below 80,000, hitting a low of 79,155, and is currently still around 80,000. Given the situation in the U.S. stock market, which has now seen three consecutive weeks of declines, especially with a high probability of a Nasdaq circuit breaker, it is safer to wait for this storm to pass before making any moves.

The weekly BOLL lower support for Bitcoin is between 74,000 and 75,000. If it breaks below the daily support of 78,258, it cannot be ruled out that it may go down to 69,000-70,000 before rebounding, so continuous monitoring and sharing are advised.

Bitcoin

The daily chart shows a rebound of 4,000 points, but it was still brought down by the U.S. stock market in the evening. During this period, pay more attention to the trends in the U.S. stock market! Bitcoin's daily chart has broken below the MA200, and the daytime rebound has not recovered. Currently, it is directly testing the support level of 78,256 for the second time, and the rebound strength appears to be weak.

In the short term, pay attention to whether 78,256 can hold as support and the chances of breaking below and recovering.

Support: Pressure:

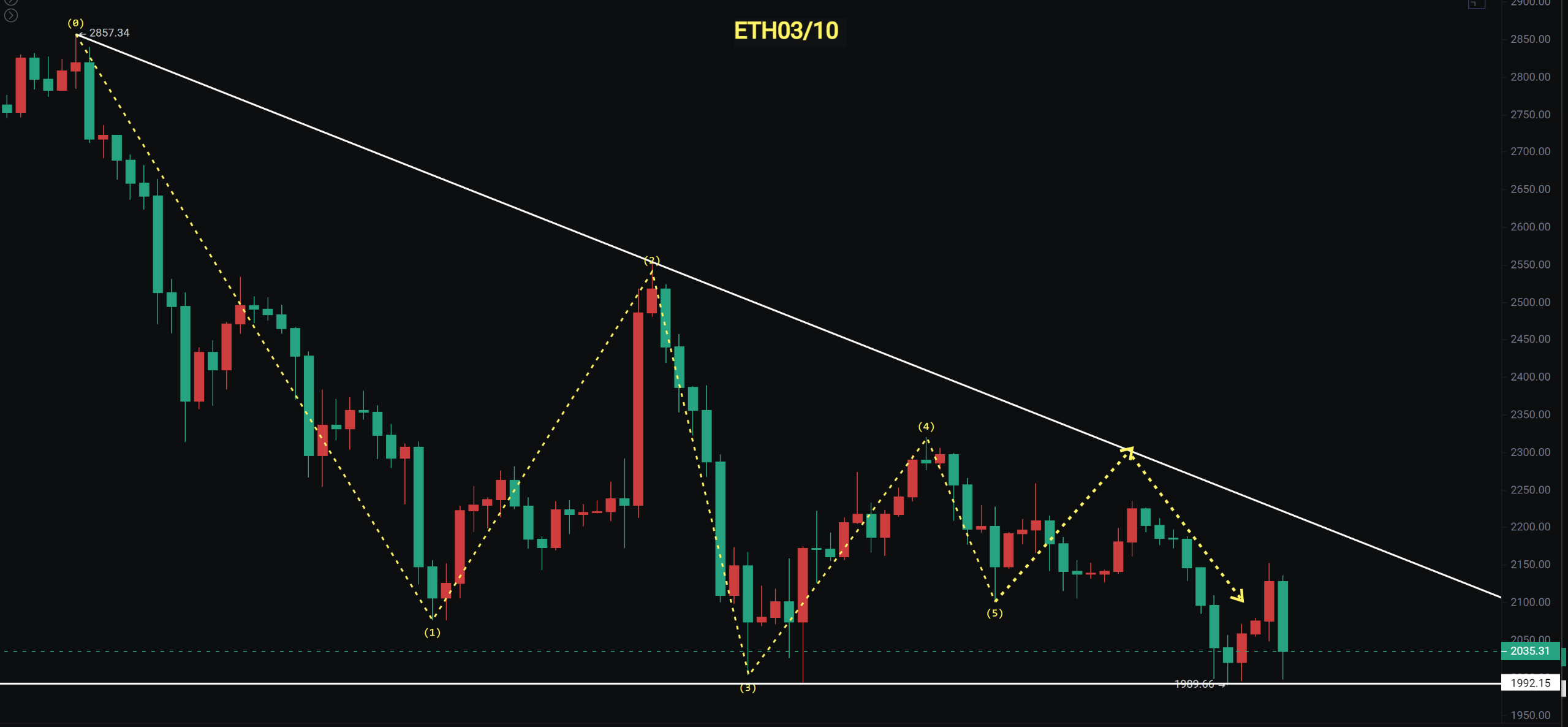

Ethereum

The market continues to decline, and the rebound strength is weak, but it has been oscillating between 1,990 and 2,100. Ethereum has also shown a high probability of breaking below multiple bottom levels, so wait for a significant drop opportunity. The stablecoin sector in altcoins is worth paying attention to. In two days, it will be 3/12; let's see the situation first.

If you like my views, please like, comment, and share. Let's navigate through the bull and bear markets together!!!

This article is time-sensitive and for reference only; it will be updated in real-time.

Focusing on K-line technical research, sharing global investment opportunities. Public account: Trading Prince Fusu

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。