Preface: Investment carries risks, and operations should be conducted with caution.

Article review takes time, and there may be delays in publication. The article is for reference only, and you are welcome to read!

Article writing time: March 11, 11:09 AM Beijing Time

Market Information

HashKey Exchange Group Co-CEO Ru Haiyang: The number of users in the crypto market will reach 3 billion in the future, and cryptocurrencies will move towards the mainstream;

BlackRock CEO Larry Fink stated that U.S. inflation will further intensify in the next 6 to 9 months.

The European Union claims that President Trump's support for cryptocurrencies could undermine Europe's "monetary sovereignty and financial stability."

The stock market is about to correct, and Bitcoin's safe-haven role is under scrutiny;

Trump's Bitcoin reserve plan has caused volatility and skepticism, leading to a decline in the cryptocurrency market;

Market Review

Yesterday, we predicted a market decline, and last night the market did drop, with the lowest point currently at 76,600. The high point before the drop was at 84,084. After we entered the market, it started to decline, with at least a profit of 5,000 points. Even if you haven't exited yet, there is still a profit of 4,800 points. Those who followed the short position can exit on their own; Ethereum's high point before the drop was at 2,152, which was just the right entry point, followed by a low of 1,753, reaching the target range, with at least a profit of 300 points. Congratulations to friends who followed this short position for a small profit, recovering previous losses and still having profit;

Market Analysis

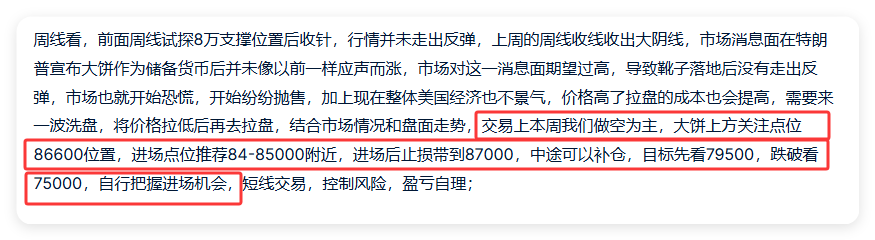

BTC:

On the daily chart, Bitcoin has formed a bullish candle after a decline. A rebound signal has appeared here, with the current price around 79,500. The daily line has not yet closed, and there is news of reserve currency as underlying support. Even if the market declines, it is likely to approach around 75,000. The market has already tested this level, and the daily line shows a bullish trend. In trading, you can consider short-term long positions, with recommended entry points around 79,000, adding to positions at 78,000, stop loss at 77,000, and targets at 84,000, 86,000. If it breaks and stabilizes at 86,600, look for 95,500. Seize your entry opportunities; for short-term trading, control risks and manage your own profits and losses;

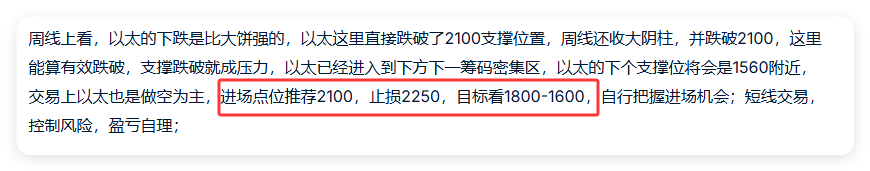

ETH:

Ethereum's decline is stronger, dropping directly to 1,752. At the weekly level, there is support at 1,820. After this drop reached the support area, it formed a pin bar. Although the daily line has not yet closed, it is possible to attempt to set up short-term long positions near the support. A long signal has appeared near the short-term support. If not going long today, consider doing so tomorrow. Recommended entry point is around 1,850, with a stop loss at 1,750 and an initial target of 2,100. If it stabilizes, look for 2,450. Seize your entry opportunities; for short-term trading, control risks and manage your own profits and losses;

In summary:

With the short-term decline touching support, you can start going long;

The article is time-sensitive, be aware of risks, and the above is only personal advice for reference!

Follow the WeChat public account "Crypto Lao Zhao" to discuss the market together;

If you don't like it, you must have your own standards for what you like. All negativity is the opposite of positive perception. The matter itself is not important; what matters is what changes you can achieve through it and what impact it can have! Some people like one-sided trends, some like fluctuations, some excel in upward movements, while others are obsessed with declines. No one is absolutely right, and no one is absolutely wrong. If you don't like it, it doesn't meet your standards; what you can't do may be what others excel at.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。