Introduction: The Rise of Tokenization Wave

In the past decade, blockchain technology has evolved from the experimental innovation of Bitcoin into a disruptive force in the financial sector. Today, an application known as "Real World Asset Tokenization" (RWA) is rapidly emerging, bringing traditional assets such as real estate, art, and bonds into the digital world. As of September 2024, the market value of on-chain RWA has surpassed $12 billion, and McKinsey predicts that by 2030, the market size of tokenized financial assets could reach $20 trillion, with an optimistic scenario even hitting $40 trillion. This trend not only changes the way asset ownership and transactions are conducted but could also reshape the global financial landscape. However, opportunities come with challenges, as issues such as regulation, security, and technological interoperability still need to be addressed. This article will explore the current status and potential of RWA from multiple perspectives, including technology, market, regulation, and future prospects.

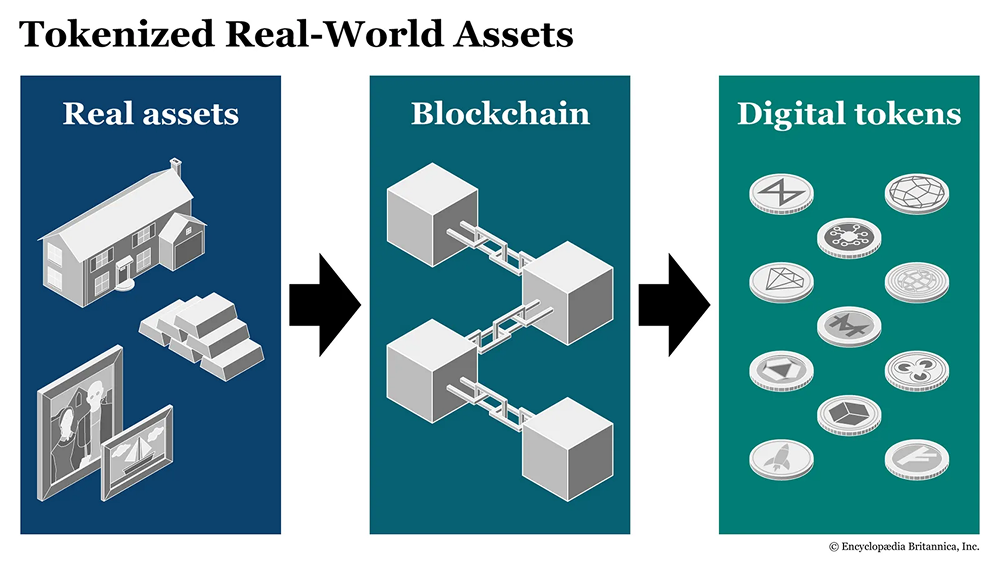

What is RWA?

Real World Asset Tokenization refers to the process of converting real-world assets (such as real estate, gold, and stocks) into digital tokens using blockchain technology. These tokens represent ownership or value of the assets and can be traded, divided, and managed on the blockchain. For example, a property valued at $1 million can be tokenized into 100,000 tokens, each worth $10, allowing investors to purchase a small number of tokens to gain partial ownership of the property.

According to Chainlink's report "Real-World Assets (RWAs) Explained," the tokenization of RWA is considered one of the most promising market opportunities in the blockchain industry, with potential scale covering almost all human economic activities, from financial assets (such as bonds and stocks) to physical assets (such as art and commodities) and intangible assets (such as intellectual property and carbon credits). The core of this technology lies in its ability to enhance the liquidity, transparency, and accessibility of traditional assets to unprecedented levels.

Multiple Advantages of Tokenization

The rise of RWA is not coincidental; it is driven by several significant advantages:

- Increased Liquidity: Traditionally, the trading cycle for assets like real estate or art is long and costly. Tokenization enables instant trading and a 24/7 market through blockchain. For example, the RealT platform allows users to purchase tokenized shares of U.S. real estate via the Ethereum blockchain, with trading volume increasing by nearly 200% in 2023.

- Partial Ownership: RWA lowers the investment threshold. Small investors can participate in high-value asset investments by purchasing tokens. For instance, Masterworks tokenizes paintings by Picasso or Basquiat, allowing ordinary people to own a portion of the artwork.

- Transparency and Efficiency: The distributed ledger technology of blockchain ensures that transaction records are immutable, eliminating reliance on intermediaries in traditional finance. McKinsey noted in "From Ripples to Waves: The Transformational Power of Tokenizing Assets" that tokenization can reduce settlement times from days to seconds, significantly lowering costs.

- Global Opportunities: RWA enables assets to be traded across geographical boundaries. For example, an Asian investor can easily purchase a tokenized version of U.S. Treasury bonds (such as OpenEden Labs' TBILL token) without navigating complex cross-border financial channels.

These advantages are attracting the attention of traditional financial institutions. In the first quarter of 2024, a pilot project by Canton Network, involving 15 asset management companies and 13 banks, successfully tested cross-institutional trading of tokenized assets, demonstrating the potential for integration between traditional finance and blockchain.

Thriving Market and Representative Projects

The RWA market is rapidly expanding. According to Binance Research, as of September 2024, the total value locked (TVL) in on-chain RWA has exceeded $12 billion, with equity, debt, and money market funds accounting for about 60% of the share. Here are some leading projects:

- Chainlink: As a leader in the oracle network, Chainlink provides real-time data support for RWA, ensuring that tokens are synchronized with the value of real-world assets. In 2024, its collaborations with several banks further promoted bond tokenization.

- RealT: Focused on real estate tokenization, RealT allows users to purchase tokenized shares of U.S. properties for less than $100 and earn income through rent. By early 2025, the platform had tokenized over 500 properties.

- Paxos: Its PAX Gold (PAXG) token is backed by physical gold stored in a vault certified by the London Bullion Market Association, with each token representing one ounce of gold, becoming the "gold standard" in the crypto market.

- Aave and Compound: These decentralized finance (DeFi) platforms have begun accepting RWA as collateral for lending, integrating traditional assets into the crypto ecosystem.

- Societe Generale: This French bank issued the first tokenized green bond on the Ethereum blockchain to fund sustainable projects, marking a step towards RWA in traditional finance.

Market data also shows that since the second quarter of 2023, the growth of RWA has been primarily driven by financial assets, particularly the tokenization of U.S. Treasury bonds and corporate bonds. This trend reflects investors' demand for stable, low-risk assets.

Challenges and Risks: Stumbling Blocks Ahead

Despite the bright prospects, the widespread adoption of RWA still faces multiple obstacles:

- Regulatory Uncertainty: There are significant differences in the legal definitions and regulatory requirements for tokenized assets across countries. In the U.S., the Securities and Exchange Commission (SEC) may classify certain RWAs as securities, requiring compliance with strict regulations; while the European Union's Markets in Crypto-Assets (MiCA) regulation has been introduced, specific details regarding RWA remain unclear. Bitbond's report "Real World Asset Tokenization: Regulatory Landscape At A Glance" highlights that tax policies and anti-money laundering (AML) compliance are major pain points.

- Security Risks: Vulnerabilities in smart contracts and hacking pose threats to the security of RWA. In 2023, a small RWA platform lost tokens worth $3 million due to a contract vulnerability, highlighting the technological risks.

- Custody and Trust: Tokenized assets require reliable custody mechanisms to ensure that tokens correspond one-to-one with the underlying assets. If custodial institutions encounter issues, investors may face significant losses.

- Interoperability Bottlenecks: Currently, there is insufficient interoperability between different blockchains. For example, tokens on Ethereum are difficult to transfer seamlessly to Polygon or Solana, limiting the widespread application of RWA.

- Valuation Challenges: The market price of illiquid assets (such as art) is difficult to determine, which may lead to token value fluctuations or insufficient investor confidence.

Forbes warned in its March 2024 report "Tokenization of Real World Assets" that if regulatory and security issues are not resolved, they could slow the growth of RWA.

The Future of Regulation and Collaboration

The long-term success of RWA depends on clear regulatory frameworks and industry collaboration. Some countries have already taken steps:

- Singapore and Switzerland: Both countries provide relatively clear regulatory guidelines for tokenized assets, becoming popular locations for RWA projects.

- United States: The SEC is exploring pilot projects for tokenized securities and may release specific rules by 2026.

- European Union: The implementation of the MiCA regulation provides a foundational framework for crypto assets, but the uniqueness of RWA still requires supplementary policies.

At the same time, traditional financial institutions are accelerating their involvement. In 2024, JPMorgan and Goldman Sachs announced plans to explore RWA tokenization, intending to apply it in private equity and real estate markets. This fusion of "traditional and emerging" could become a key catalyst for the widespread adoption of RWA.

Future Outlook: The Dawn of a Trillion-Dollar Market

The future potential of RWA is exciting. McKinsey predicts that by 2030, the market for tokenized assets could reach $20 trillion, covering areas such as cash, bonds, and mutual funds. Binance Research is even more optimistic, estimating that the market size could reach $16 trillion by 2030. Here are some trends that may drive this growth:

- Technological Integration: Artificial intelligence (AI) may be used for asset valuation and risk management. For example, AI algorithms can analyze real estate market data in real-time to provide pricing guidance for tokens.

- Cross-Chain Solutions: Projects like Polkadot and Cosmos are developing cross-chain protocols that may address current interoperability issues.

- Full Participation of Traditional Finance: As banks and asset management companies join in, RWA may transition from the fringes of the crypto market to the mainstream.

- Emerging Market Opportunities: In regions like Africa and Southeast Asia, RWA can provide investors lacking financial infrastructure with access to global markets.

A specific case is OpenEden Labs' TBILL token, which tracks a portfolio of U.S. Treasury bonds and attracted over $500 million in inflows in 2024, demonstrating the potential of RWA in the fixed-income asset space.

Conclusion: From Ripples to Waves

Real World Asset Tokenization is at a turning point, transitioning from ripples to waves. It not only offers new opportunities for investors but also creates more efficient financing channels for asset issuers. However, success in this field will not come overnight. Regulators need to establish globally coordinated standards, technology developers must address security and interoperability issues, and market participants need to build trust in this new model.

As McKinsey stated, tokenization could be "the next revolution in finance." As of 2025, RWA is no longer a science fiction concept but a real force changing the way we interact with assets. The degree of adoption of this technology in the coming years will determine whether it can truly fulfill its promise of a trillion-dollar market.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。