Table of Contents:

This week's large token unlock data;

Overview of the crypto market, a quick read on the weekly rise and fall of popular coins/fund flows in sectors;

Inflow and outflow situation of spot ETF funds;

Altcoin index remains low;

Key macro events and economic data forecasts for this week.

1. This week's large token unlock data;

This week, several projects have announced unlock details, sorted by unlock value as follows:

Cheelee (CHEEL) will unlock approximately 20.81 million tokens at 8:00 AM Beijing time on March 13, valued at about $162 million;

Connex (CONX) will unlock approximately 4.33 million tokens at 8:00 AM Beijing time on March 15, with a circulation ratio of 376.3%, valued at about $78 million;

Aptos (APT) will unlock approximately 11.31 million tokens at 6:00 AM Beijing time on March 13, with a circulation ratio of 1.92%, valued at about $67.4 million;

Polyhedra Network (ZKJ) will unlock approximately 17.22 million tokens at 8:00 AM Beijing time on March 14, with a circulation ratio of 28.52%, valued at about $35.3 million;

Sei (SEI) will unlock approximately 55.56 million tokens at 8:00 PM Beijing time on March 15, with a circulation ratio of 1.19%, valued at about $11.8 million;

Starknet (STRK) will unlock approximately 64 million tokens at 8:00 AM Beijing time on March 15, with a circulation ratio of 2.33%, valued at about $11 million;

Staika (STIK) will unlock approximately 1.5 million tokens at 8:00 AM Beijing time on March 10, valued at about $7.8 million.

The unlocking situation of these projects may have varying degrees of impact on the related markets. The above times are in UTC+8. This week, pay attention to the negative effects brought by the unlocking of these tokens, avoid spot trading, and seek shorting opportunities in contracts. Among them, CONX, CHEEL, ZKJ, and APT have larger proportions and scales of unlocked circulation, warranting extra attention.

2. Overview of the crypto market, a quick read on the weekly rise and fall of popular coins/fund flows

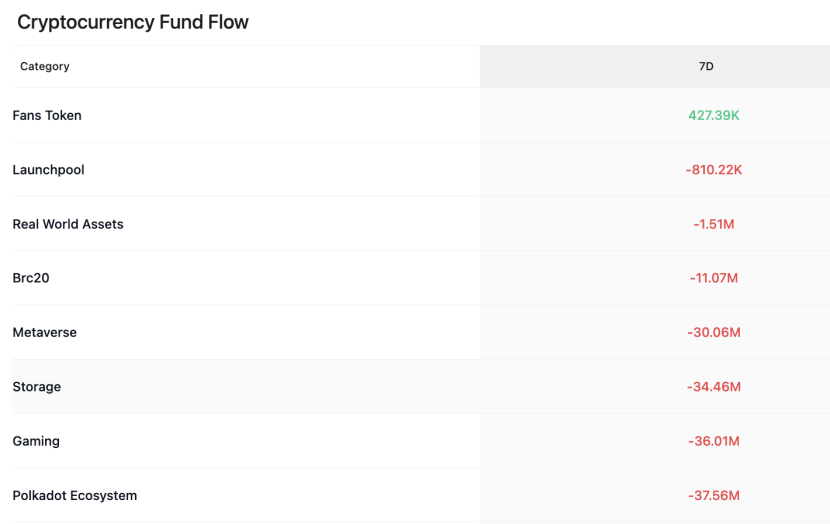

According to CoinAnk data, over the past 7 days, the crypto market has generally shown an outflow trend by sector, with only the fan token sector achieving net inflows, while other sectors such as Launchpool, RWA, brc20, Metaverse, and storage have seen smaller net outflows. In the past week, many coins have also experienced rotational increases. The top 500 by market capitalization are as follows: AUDIO, REN, SHELL, MERL, HMSTR, and ENA have relatively high increases and can continue to be prioritized for trading opportunities in strong coins.

3. Inflow and outflow situation of spot ETF funds.

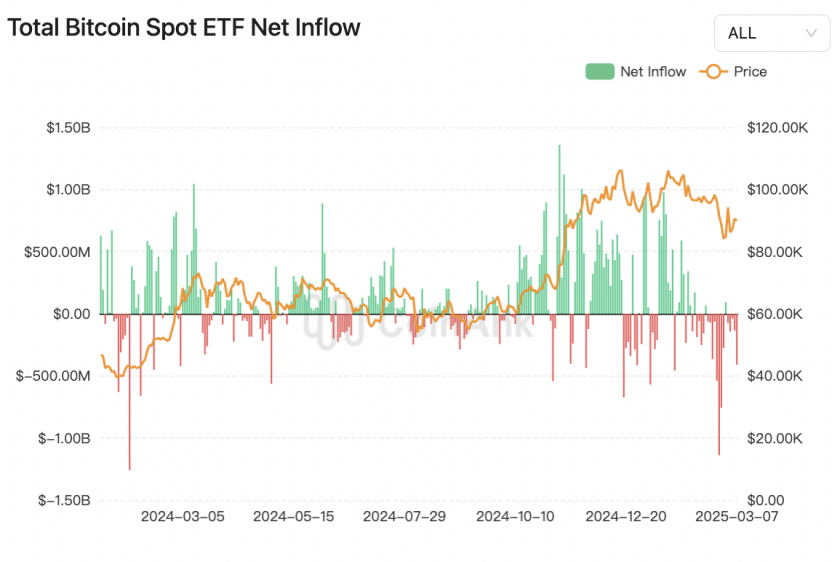

According to CoinAnk data, last week, the U.S. Bitcoin spot ETF saw a net outflow of $739.2 million, with four trading days of net outflows, only on Wednesday seeing $22.1 million, including: BlackRock IBIT with a net outflow of $129.6 million; Fidelity FBTC with a net outflow of $201 million, marking six consecutive weeks of outflows; ARKB with a net outflow of $163.5 million; Grayscale GBTC with a net outflow of $125.4 million.

The U.S. Bitcoin spot ETF market has seen outflows for four consecutive weeks. With institutional investors withdrawing, weak demand has disrupted the supply-demand balance of Bitcoin, leading to an 8.76% drop in Bitcoin over the past week.

We believe that the four consecutive weeks of net outflows from the U.S. Bitcoin spot ETF (reaching $739 million last week) reflect a deepening rebalancing strategy among institutional investors under macro uncertainty. The simultaneous outflows from leading products like BlackRock IBIT and Fidelity FBTC (of $130 million and $200 million respectively) indicate that traditional asset management institutions are responding to potential liquidity risks by reducing their Bitcoin exposure—this is closely related to the risk asset valuation reconstruction triggered by U.S. Treasury yields rising to 4.6%.

In the short-term transmission mechanism, ETF fund outflows directly impact the supply-demand balance in the spot market. According to current data, the average daily net outflow is about $185 million, equivalent to 2.3 times the daily selling volume of miners (approximately 900 BTC), creating significant selling pressure. Additionally, on-chain data shows that the proportion of short-term holders selling at a loss has risen to 68%, indicating that the market has entered a negative feedback loop of "institutional withdrawal - price decline - panic selling."

The mid-term structural contradictions are reflected in two types of differentiation: first, the internal liquidity stratification of ETFs, with Grayscale GBTC's outflows slowing (at $125 million vs. $180 million the previous week) while Fidelity accelerates its withdrawal, possibly indicating that some institutions are shifting to low-fee products; second, the concentration of Bitcoin on-chain holdings is increasing, with whale addresses (holding 1000+ BTC) increasing their holdings by 12,000, forming a characteristic of "weak hands exchanging for strong hands."

The current market is in the liquidity repricing phase of the mid-bull market, and a reversal of ETF fund flows requires waiting for two signals: first, a drop in U.S. CPI data reigniting rate cut expectations; second, Bitcoin volatility dropping to a year-low (currently 44% vs. a peak of 78%) attracting allocation funds back. Historical data shows that adjustments led by institutions often complete the chip exchange with "sharp declines and slow recoveries," and the current price level may be close to the end of short-term risk release.

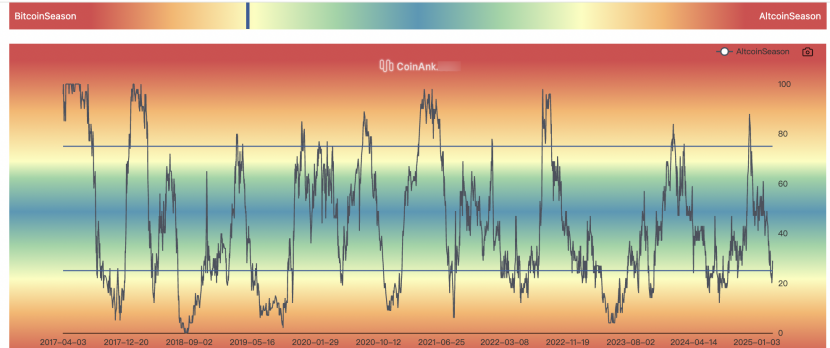

4. Altcoin index continues to decline.

The altcoin season index is currently around 22. According to CoinAnk data, since February 27, this index has remained below 25 for 13 consecutive days. This index measures the heat of altcoins by counting how many tokens among the top 100 by market capitalization have outperformed BTC. If this value is around 75, the market is more likely in an altcoin season; if below 25, it is likely in a Bitcoin season. Among the top 100 tokens by market capitalization, only 17 tokens have outperformed BTC in the past 90 days, including BERA (+499%), IP (+81%), and a certain platform token +78%. Meanwhile, BTC's performance during the same period was -15%.

We believe that the altcoin season index remaining below 25 for 13 days reveals that the current crypto market is still deeply entrenched in a Bitcoin-dominated risk-averse mode. Despite BTC's 15% decline during the same period, only 17 of the top 100 tokens outperformed, reflecting a highly selective allocation of funds under liquidity tightening—tokens like BERA (+499%) and IP (+81%) rising against the trend essentially indicate capital gathering towards strong narratives (such as DePIN, AI agents) and platform tokens for risk aversion, rather than an overall warming of market risk appetite. The structural differentiation is driven by three factors: first, the continuous net outflow from Bitcoin spot ETFs for five weeks (totaling over $2.8 billion), leading to a contraction of the overall liquidity pool in the crypto market, forcing funds to concentrate from high-beta assets to more certain targets; second, U.S. Treasury yields rising to 4.6% suppressing risk appetite, with retail leverage (loan balance/market cap) dropping to 0.8% (a new low for the year), weakening speculative momentum for altcoins; third, new public chains (like Berachain) attracting existing funds through innovative token distribution mechanisms, creating local hotspots but failing to activate overall rotation.

On the implicit signal level, the coexistence of "point explosions" of excess returns in altcoins and "area fatigue" reflects that the market is undergoing a narrative reconstruction period—valuations in previous cycles such as DeFi and GameFi still need to be cleared, while capital is preemptively positioning in directions like modularization and parallelization for infrastructure iteration. Historical data shows that the start of altcoin seasons often lags Bitcoin's bottoming by 1-2 months, and the current drop in BTC volatility to a year-low (30-day volatility at 26%) may provide a window for fund switching. However, a trend reversal requires waiting for two conditions: a reversal of Bitcoin ETF fund flows and net inflows of stablecoins breaking the monthly average threshold of $3 billion.

5. Key macro events and economic data forecasts for this week: U.S. CPI + PPI, North American Daylight Saving Time.

Monday: ① Data: Japan's trade balance, Eurozone investor confidence index, New York Fed's 1-year inflation expectations; ② North American Daylight Saving Time begins, U.S. stock trading and economic data release times will be advanced by one hour; ③ Trump meets with U.S. tech industry executives; ④ China's tariffs on certain imported goods originating from the U.S. officially take effect.

Tuesday: ① Data: U.S. JOLTs job openings and NFIB small business confidence index; ② U.S. and Ukrainian officials hold their first talks in Saudi Arabia.

Wednesday: ① Data: U.S. API crude oil inventories and EIA crude oil inventories, U.S. February CPI; ② Bank of Canada announces interest rate decision; ③ EIA releases monthly short-term energy outlook report; ④ European Central Bank President Lagarde speaks; ⑤ OPEC releases monthly oil market report; ⑥ G7 group holds a foreign ministers' meeting until March 14; ⑦ U.S. tariffs on imported steel and aluminum take effect at 25%.

Thursday: ① Data: Eurozone January industrial production month-on-month, U.S. initial jobless claims, February PPI year-on-year; ② IEA releases monthly oil market report.

Friday: ① Data: U.K. January industrial production month-on-month, Canada January wholesale sales month-on-month, U.S. March 1-year inflation expectations preliminary value and University of Michigan consumer confidence index preliminary value; ② U.S. government's existing temporary funding bill expires.

We believe that this week's U.S. CPI and PPI data will have a core impact on the crypto market. As key indicators of the Federal Reserve's monetary policy, if inflation data exceeds expectations (such as CPI year-on-year remaining high or PPI rebounding), it may strengthen market expectations for a delayed rate cut. Historical data shows that in such scenarios, expectations for tightening U.S. dollar liquidity rise, putting pressure on risk assets, and the crypto market may face short-term selling pressure. Additionally, the U.S. tariffs on steel and aluminum may push up input inflation through supply chain costs, further constraining the Federal Reserve's easing space and indirectly suppressing risk appetite in the crypto market.

On the other hand, Trump's policies may have a hedging effect. His meeting with tech executives and supportive stance towards the crypto industry (such as the Bitcoin reserve plan) may boost long-term market confidence, but the trade friction risks triggered by tariffs still pose uncertainty. The start of Daylight Saving Time changes trading times but has limited substantive impact; attention should be paid to changes in market liquidity during data release periods.

Other events such as the Bank of Canada's interest rate decision, OPEC report, and crude oil inventory data may influence inflation expectations through energy price fluctuations, which in turn could affect the pricing of crypto assets. Overall, short-term volatility in the crypto market will significantly increase, and investors need to closely monitor the deviation of CPI/PPI from market expectations, as well as the interaction between Federal Reserve policy signals and geopolitical events.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。