In a significant development in the cryptocurrency investment landscape, the Bitwise Bitcoin Standard Corporations ETF commenced trading today under the ticker OWNB. This new exchange-traded fund (ETF) targets companies that have substantial holdings in bitcoin, specifically those holding over 1,000 BTC as a corporate treasury asset.

The launch of OWNB is a response to the growing trend among corporations to diversify their treasury assets into bitcoin amidst the backdrop of low-yielding cash options. According to the Federal Reserve, corporations are currently sitting on approximately $5 trillion in cash, prompting many to turn to bitcoin as a strategic reserve asset to potentially enhance returns.

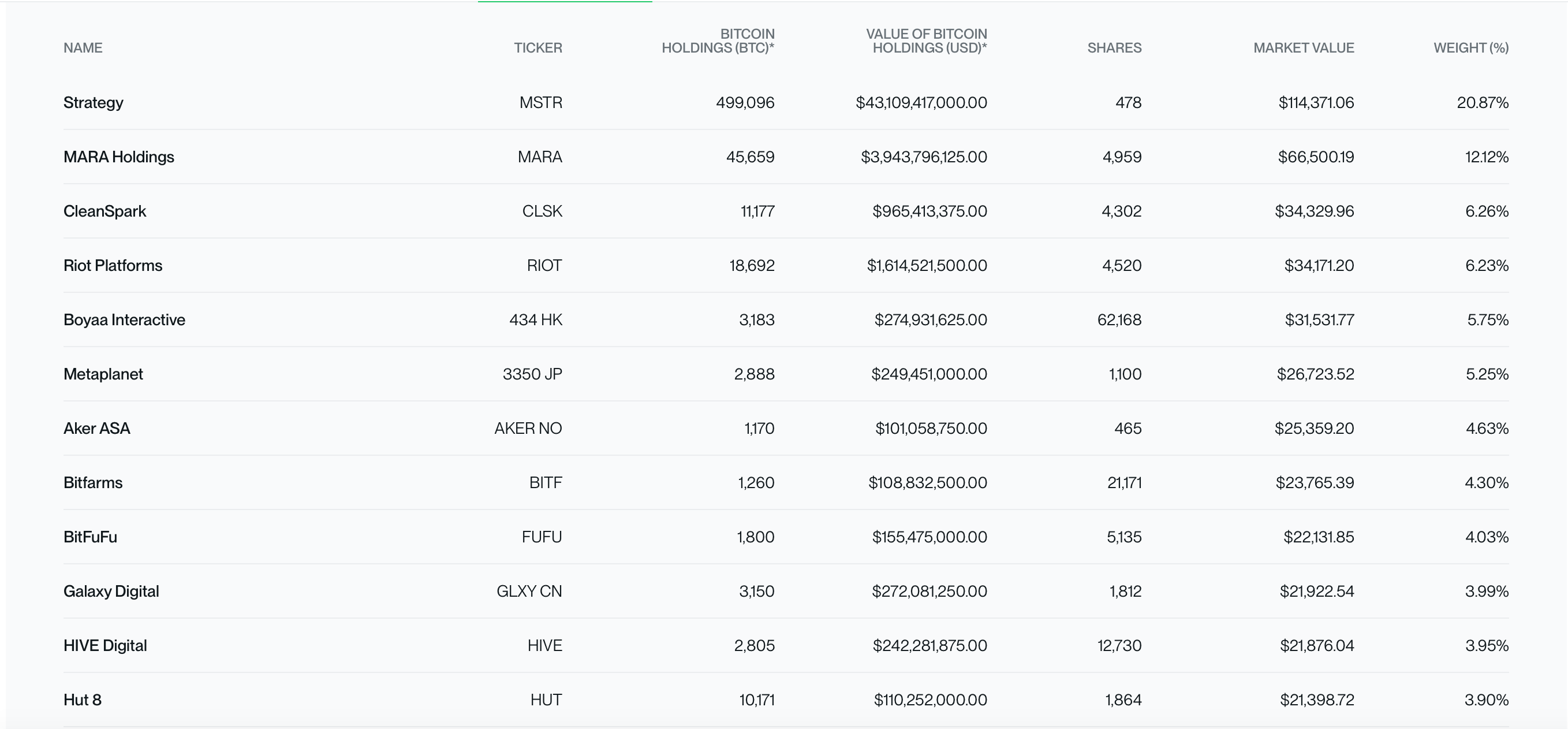

Bitwise’s OWNB holdings.

The ETF is based on the Bitwise Bitcoin Standard Corporations Index, which includes over 70 companies. These companies follow the model pioneered by MicroStrategy (MSTR), a leading player in corporate bitcoin investment. The index’s methodology ensures a diversified portfolio by capping the largest holding at 20% and rebalancing quarterly.

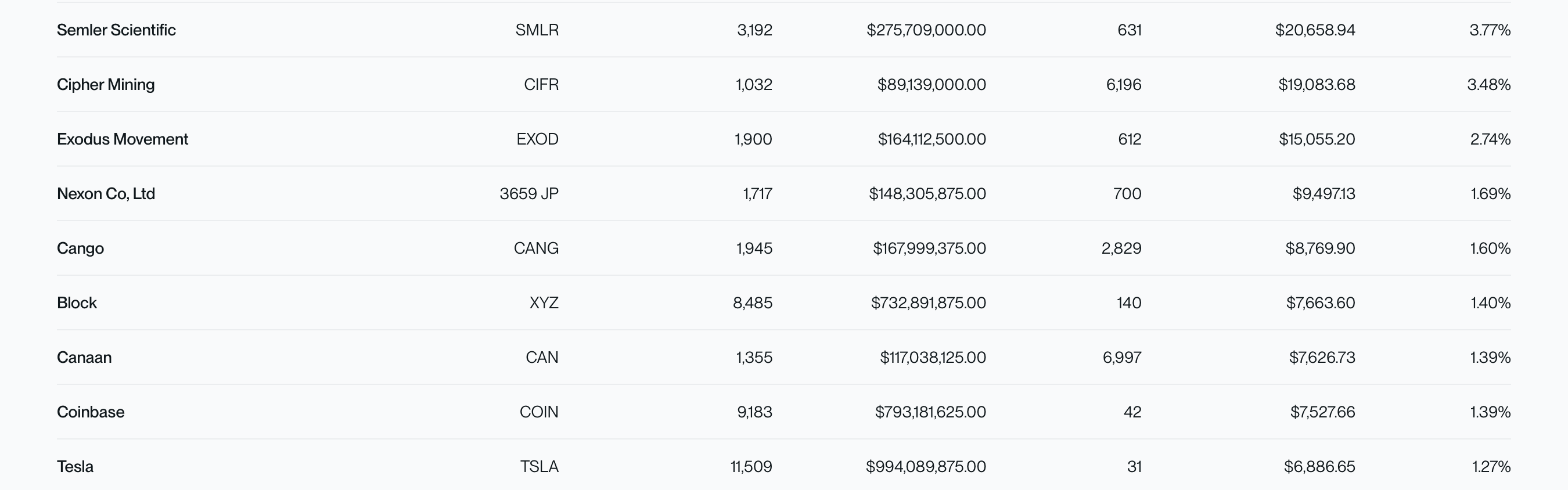

Bitwise’s OWNB holdings continued.

Key players in the Bitwise Bitcoin Standard Corporations Index include Strategy (MSTR), noted as the largest holder, followed by MARA Holdings, Cleanspark, Riot Platforms, and Boyaa Interactive. The list continues with Metaplanet, Aker ASA, Bitfarms, Bitfufu, and Galaxy Digital. These corporations are recognized for their substantial bitcoin holdings, each maintaining over 1,000 BTC, which qualifies them for inclusion in this unique index.

These companies are selected based on their bitcoin holdings, with a minimum threshold of 1,000 BTC. The index weights each company by the amount of bitcoin they hold, with a special weighting of 1.5% assigned to massive corporations whose BTC holdings constitute more than 1,000 BTC but less than a third of their total balance sheet.

Significantly, the OWNB ETF does not directly invest in bitcoin nor does it engage in derivative transactions based on bitcoin. Instead, it invests in the equity of companies deeply invested in bitcoin, offering investors a different avenue to gain exposure to the bitcoin market through traditional equity investment.

The introduction of the Bitwise Bitcoin Standard Corporations ETF provides a novel tool for investors looking to capitalize on the increasing trend of corporate bitcoin holdings, offering a bridge between traditional investment mechanisms and the burgeoning world of cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。