Today's homework is relatively simpler. The reasons for the recent decline have been discussed quite a bit, but whether the rise is a rebound or a reversal still needs careful consideration. Tomorrow, I will post a tweet about this thought. Yes, it will be long and tedious again, but if I want to explain these matters clearly, I need to be a bit more detailed. I would like to summarize it in one sentence, but what would be the point of that? After all, I hope to establish the correct investment philosophy with my friends, rather than just imposing my personal investment conclusions.

The most significant news today is that Ukraine has agreed to a 30-day ceasefire, which lays the foundation for the end of the Russia-Ukraine war. The end of this war can balance the pressure on inflation from increased tariffs in the U.S., reduce the risk of a potential economic recession, and facilitate the development of rare earth minerals, thereby avoiding some of China's export restrictions.

U.S. stocks rose significantly due to this news, but suddenly dropped again an hour before the market closed, ending the day lower. It seems that the risk market is not easily convinced that an economic recession will not occur. Moreover, Trump's inflation strategy resembles a child's game; during dinner, he just announced an additional 25% tariff on aluminum and steel from Canada, which was then canceled after Canada eliminated a 25% electricity expense.

Can't these two just communicate like normal humans, make a phone call, or send a subordinate to confront each other before making a decision? Instead, they choose to send messages from the White House, creating a distance. Who bears the losses in the risk market? It's quite frustrating.

So, one really needs to be cautious with high leverage during Trump's administration.

Looking back at Bitcoin's data, the turnover rate in the last 24 hours has been quite high. It seems that the drop of $BTC below $77,000 has triggered panic among investors again. However, the data shows that it is still the investors who bought in the last few days that are panicking, while earlier investors have not made significant moves, even those who are at a loss.

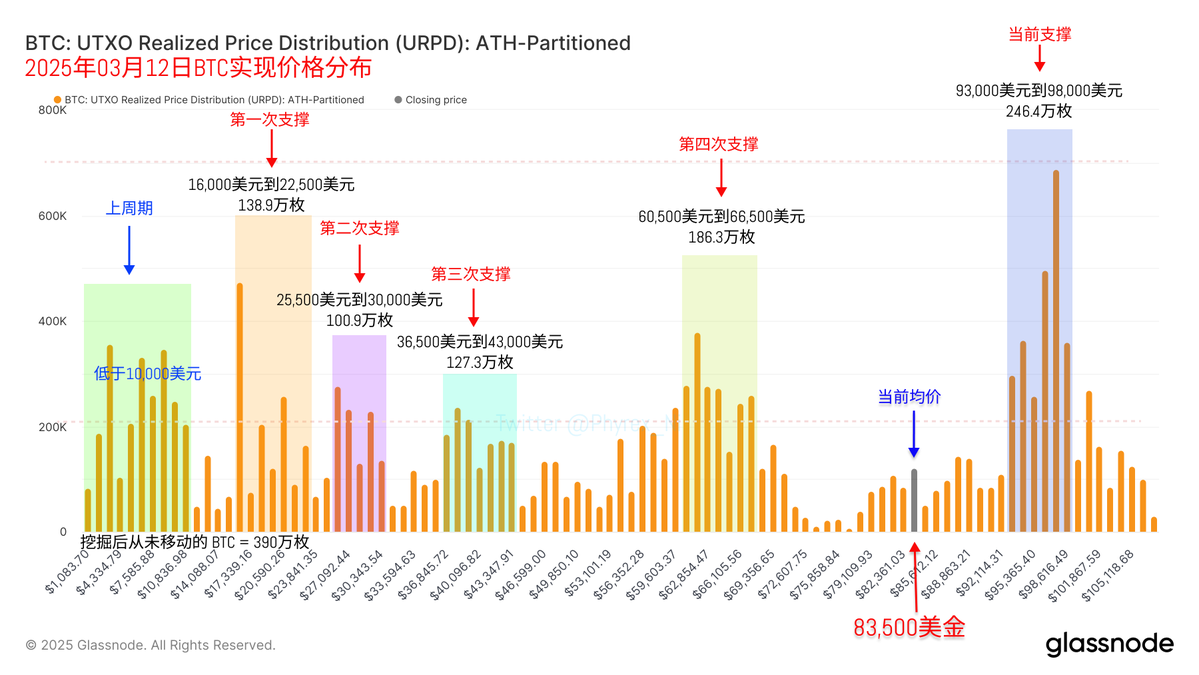

Therefore, after a period of volatility that clears out more short-term investors, the price may stabilize a bit more. Another piece of good news is that after dropping below $77,000, the gap at $76,500 in the URDP has also been filled. It was previously mentioned that gaps in URPD have historically never gone unfilled, so now that it has been filled, it is a relief.

Although the price difference is still quite large, there are still no signs of a breakdown in the concentrated area of chips between $93,000 and $98,000. A large number of investors in this range are not panicking, which is also a good support for the price. Currently, there are no signs of a new bottom being formed, so it seems there is still a chance to return to the price support range.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。