The U.S. Bureau of Labor Statistics (BLS) is set to release the Consumer Price Index (CPI) for February 2025 tonight. Based on data collection from AICoin and historical trend analysis, the year-on-year CPI growth rate for February 2025 is expected to be 2.9%, slightly lower than January's 3.0%, but still above the Federal Reserve's long-term target of 2%. This data may maintain current economic stability, but if it deviates from expectations, it could trigger significant market volatility and even reverse the bullish trend in the cryptocurrency market.

The Crossroads of Benchmark Interest Rates: Seeking Change Amid Stability

Currently, the Federal Reserve's federal funds rate remains at 4.5%, and it was decided to keep it unchanged at the Federal Open Market Committee (FOMC) meeting in January 2025, with a statement emphasizing "no rush to adjust policy" (Federal Reserve, 2025). This stance reflects the Fed's concerns about the persistence of inflation, especially in the context of a still strong labor market and ongoing wage growth pressures.

If the February 2025 CPI meets the expected 2.9%, the Fed may continue to hold steady, waiting for more data to confirm whether inflation is genuinely cooling. Fed officials like Adriana Kugler recently stated in an interview with CNBC: "We need to pay attention to the persistence of inflation; if February's data does not show a significant decline, high-interest rate policies may continue until mid-year" (CNBC, 2025). The market generally expects a rate cut of only 0.5% in 2025 (U.S. Bank, 2025), indicating that policy adjustments will be extremely cautious, with any rate cuts depending on the combined performance of inflation data and economic growth.

However, if the CPI exceeds expectations (such as 3.0% or above), it may delay rate cut plans and even trigger a hawkish viewpoint, considering maintaining or slightly adjusting high rates to control inflation. The CME FedWatch tool shows that the current market probability of a rate cut before June 2025 is only 30%, reflecting investors' lack of confidence in a decline in inflation. Conversely, if the CPI is below 2.8%, it may open the door for rate cuts, stimulating further rises in the stock and cryptocurrency markets.

Cryptocurrency Market: Growth and Risks Coexist

The cryptocurrency market has recently performed strongly, with Bitcoin (BTC) prices surpassing $60,000 at the beginning of 2025. Analysts predict it could rise to between $75,000 and $170,000 in 2025 (Forbes, 2025; CoinPedia, 2025). This surge is attributed to increased institutional investment, the Bitcoin halving effect, and market optimism regarding Fed rate cuts. However, the release of CPI data could become a critical turning point.

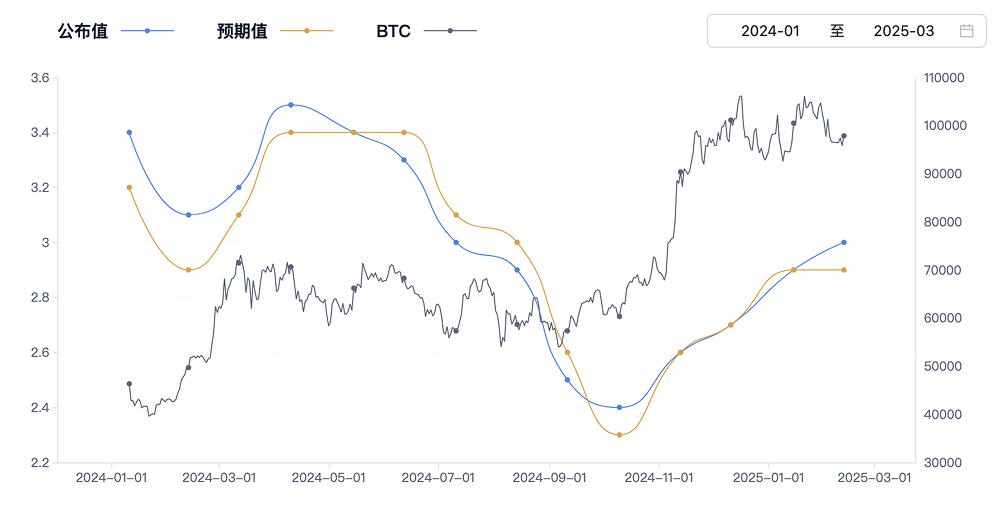

The immediate reaction of Bitcoin prices after the CPI release reveals the close connection between inflation data and the cryptocurrency market:

These data suggest that if the February CPI is 2.9%, it may support Bitcoin's bullish trend, with prices potentially testing the $70,000 mark further. However, if the CPI exceeds 3.0%, it could reverse the upward trend, leading to a price drop in the short term and even intensifying market sell-off pressure. In a high-inflation environment, investors may turn to safe-haven assets like gold. CoinPedia analysts warn: "The cryptocurrency market is highly sensitive to inflation data; a deviation of 0.1% can trigger severe volatility, and investors need to manage risks."

Economic and Market Outlook: Stability or Reversal?

The release of the February 2025 CPI data is not only a barometer of inflation but may also become a watershed moment for the direction of the economy and financial markets. Currently, the U.S. economy is showing moderate growth, with the unemployment rate remaining below 4% and consumer demand still strong. If the CPI is 2.9%, it may maintain this trend, supporting confidence in the stock and cryptocurrency markets while providing the Fed with space to continue observing. The S&P 500 index has recently surpassed 5,500 points (Yahoo Finance, 2025), indicating investor optimism about the economic outlook.

However, if the CPI exceeds expectations (such as 3.0% or above), it may trigger market adjustments. Inflation above expectations will delay rate cut expectations, increasing borrowing costs for businesses and consumers, thereby dragging down economic growth. The cryptocurrency market may be the first to feel the impact, with Bitcoin prices potentially retreating below $50,000, triggering a broader sell-off. Historical data shows that when the CPI peaked at 8.5% in 2022, Bitcoin's price fell from $69,000 to $16,000, highlighting the destructive impact of high inflation on risk assets.

Conversely, if the CPI is below 2.8%, it may pave the way for rate cuts, stimulating further rises in the stock and cryptocurrency markets. The Fed may cut rates by 25 basis points in mid-2025, boosting investor confidence and pushing Bitcoin to challenge the $80,000 mark. However, this optimistic scenario depends on the continued easing of energy prices and supply chain pressures, as current geopolitical risks (such as the escalation of the Russia-Ukraine conflict) may disrupt this expectation.

A noteworthy detail is that even minor changes in CPI data (such as 0.1%) are sufficient to affect market sentiment. Exclusive analysis from Grok 3 indicates that this phenomenon reflects the current economic environment's fragility, with investors' expectations regarding inflation and monetary policy being highly polarized. Global central banks, such as the European Central Bank and the Bank of Japan, have also recently indicated that they will pay attention to U.S. CPI data, demonstrating its influence on the global economy.

Industry and Expert Opinions

Economists and industry leaders hold differing views on the impact of the February CPI data. Joe Brusuelas from FactSet believes: "A CPI of 2.9% indicates that inflation pressures are not gone, but they are not out of control either. The Fed may continue to observe, while the cryptocurrency market will closely monitor whether the data supports the current bullish trend." Meanwhile, cryptocurrency analyst PlanB states: "If the CPI is below expectations, Bitcoin may break through $70,000, but if it exceeds expectations, the market may face a period of adjustment" (Twitter, 2025).

Fed officials like Lael Brainard emphasize: "We need to weigh inflation against employment goals; the February data will be an important reference, but decisions will not be based solely on a single indicator" (Federal Reserve, 2025). This viewpoint reflects the complexity of the Fed's search for balance between high inflation and economic growth.

Conclusion: Choices at a Critical Moment

The release of the February 2025 CPI data is not only a barometer of inflation but also a critical moment testing the Fed's policies, the resilience of the cryptocurrency market, and the outlook for the global economy. Grok 3 predicts that a CPI of 2.9% may maintain the current trend, supporting moderate growth and confidence in risk assets; however, if the data deviates from expectations, it may reverse market direction, triggering adjustments or declines. Investors should closely monitor the immediate reactions following the data release, along with subsequent statements from the Fed and global economic dynamics, to formulate appropriate strategies.

Disclaimer: The above content does not constitute investment advice.

AICoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。