Original Title: First Principles - Compounders, L1s, IR, Buybacks

Original Author: 0xkyle__, Member of DeFiance Capital

Original Translation: ChatGPT

Editor's Note: The author believes that the biggest problem in the crypto space is not talent or capital, but rather a lack of first principles thinking, which leads the industry into a cycle of short-termism, extraction culture, and low integrity. The author analyzes the reasons why compounders are hard to emerge and suggests that high-level initiatives are needed to promote long-term thinking and focus on building revenue-generating products. Additionally, the inefficiency of general Layer 1 blockchains is criticized, recommending that they focus on specific areas and build ecosystems to give tokens value. Furthermore, it emphasizes that liquidity token projects should establish investor relations roles to enhance transparency, rather than relying solely on buybacks and burns, advocating for the use of funds to expand products and solidify long-term competitive advantages to break the current nihilistic predicament and achieve sustainable growth.

The following is the original content (reorganized for better readability):

The biggest problem in this field is neither talent nor capital. Simply put, it is a lack of first principles thinking. This is a culture that must change. The 1% need to start pushing this field forward.

If you have been following my Twitter recently, you will notice that I have been making a lot of noise about some extremely low-hanging fruit that seem to have high leverage and appear very easy to achieve, yet no one seems to "understand" or execute well. Here are some points I have made:

The real question is: why do more chains not use their funding programs to incubate their own dapps and build dapps that are clearly aligned with the chain? Instead of hoping these dapps won’t abandon the chain in two years.

The current price trends in this industry are largely due to everyone thinking, "You have to sell because one day it will go to zero." The reason is that no one has really built good products that people want to continuously invest in. Crypto needs compounders.

"Marketing" in the crypto space is often inconsistent with the product. If you are not a consumer-facing product—like a yield platform—why would you even market to retail users? The best marketing often comes from price increases. And the best at doing this are liquidity funds.

I will discuss each topic in this article, namely:

Compounders, culture, short-termism

General L1 is dead, must change

Liquidity tokens and investor relations

Buybacks and burns are the least bad, not the best

I named this article "First Principles" because all these points came to me while I was doing simple thought exercises on how to change today’s industry with common sense.

It’s not profound. Madness is doing the same thing over and over again while expecting different results.

We have gone through three cycles, doing the same thing over and over again—essentially creating a nihilistic, zero-value accumulation, maximizing the extraction of tokens and applications, because for some foolish reason, we decided to open the casino in this frenzied way every four years, attracting capital from around the world while gambling.

Guess what? After three cycles, ten years later, people finally realize that the house, the scammers, the manipulators, and the people selling you overpriced food and drinks in the casino are taking all your money. The only thing you can show for months of hard work is how you lost all your history on-chain. A field built on the foundation of "I will come in, make my money, and then leave" will not lead to the establishment of any long-term compounders.

This place used to be better; it was once a legitimate place for financial innovation and cool technology. We used to be excited about novel and interesting applications, new technologies, and "changing the future of finance."

But due to extreme short-termism, a culture of maximum extraction, and low integrity individuals, we have fallen into this self-consuming cycle of permanent financial nihilism, which collectively self-triggers when everyone thinks that continuously investing in random scam tokens is a good idea because "I will sell before he scams me." (Seriously, I’ve seen people say they know the "SBF token" is a scam but will sell before getting wrecked to "make a quick profit.")

You could say I lack building experience—that’s true. But this is a small field, and it hasn’t been around for long; working in this field for four years, while collaborating with some of the best and brightest funds, has given me deep insights into what works and what doesn’t.

Again, madness is doing the same thing over and over again while expecting different results. As a field, we have gone through the same thing year after year—feeling this nihilism after prices inevitably crash, believing that everything is worthless. I felt this when NFTs crashed (oh my god, this is all a scam), and now people feel this after the recent meme coin debacle, just as they did during the ICO era.

Changing the status quo is simple: we just need to start doing different things.

Compounders, Culture, Short-termism

A compounder is simply an asset that only goes up over a multi-year time frame—think Amazon, Coca-Cola, Google, etc. Compounders are companies with the potential for sustainable and long-term growth.

Why don’t we see compounders in the crypto space?

The answer is more nuanced, but fundamentally—extreme short-termism and misaligned incentives. Indeed, there are many issues with the structure of incentives, and Cobie’s private capture and phantom pricing articles cover this well. I won’t delve into this because the focus of this article is, as individuals, what can we do now?

For investors, the answer is obvious—Cobie points out here: you can choose to exit (and you probably should).

Indeed, people have chosen to exit: this cycle we have seen the decline of "CEX tokens" because retail participants chose not to buy these tokens; while individuals may not have the ability to change this systemic issue at the system level, the good news is that financial markets are quite efficient—people want to make money, and when existing mechanisms don’t make money, they don’t invest, making the whole process unprofitable, thus forcing mechanisms to change.

However, this is just the first step of the process— to truly establish compounders, companies need to start instilling long-term thinking in this field. It’s not just that "private market capture" is bad, but the entire chain of thought that has led us to this point—like a self-fulfilling prophecy, founders seem to collectively believe "I will make my money and then leave," and no one is really interested in playing the long game—this means the charts always look like McDonald's M shape.

The top must change: a company is only as good as its leaders. Most project failures are not due to a lack of developers but because the higher-ups decide to leave. This industry must start to view founders with high integrity, high initiative, and long-term thinking as role models, rather than idealizing founders who "pump and dump" in the short term.

The average quality of founders in this field is not high, and that’s no news. After all, this is a field that calls those who bind pumpfun tokens "developers"—the bar is really low. As long as you have a vision that extends beyond the first two months after the token launch, you are already ahead of others.

I also believe the market will begin to economically incentivize this long-termism, and we are already starting to see this. Despite the recent sell-off, Hyperliquid is still up 4x from its initial issuance price, which is something few projects can boast about in this cycle. When you know the founders are aligned with the long-term growth of the product, it is usually easier to make the case for "long-term holding."

This natural conclusion is that high integrity, high initiative founders will begin to capture a large share of the market because frankly, when everyone gets tired of scams, they just want to work for someone with a vision who won’t exit the scam—and there are too few people doing that.

In addition to having a good leader, the establishment of compounders also depends on the assumption of whether the product is good. In my view, this issue is easier to solve than finding a good founder. The reason there are so many nihilistic products in the crypto space is that the people creating these nihilistic products also have the mindset of "make money and then leave"—they thus choose not to take on new problems but simply fork popular things and try to make money from them.

However, the fact is that this industry does choose to reward this nihilistic thinking—like the AI agent craze in Q4 2024. In this case, after the dust settles, we will see the usual McDonald's M shape—therefore, companies must also start focusing on building products that can make money.

No revenue path = no long-term believers/holders = no buyers of assets because there is no future to bet on.

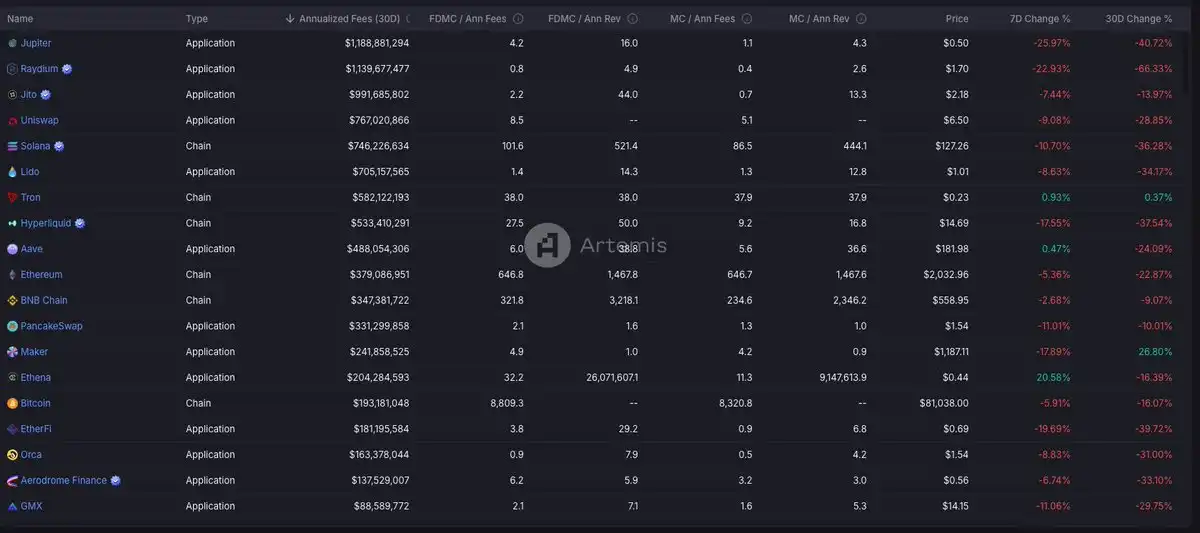

This is not an impossible task—businesses in the crypto space do indeed make money. Jito has an annual revenue of 900 million, Uniswap 700 million, Hyperliquid 500 million, Aave 488 million—during the bear market, they continue to make money (just not as much).

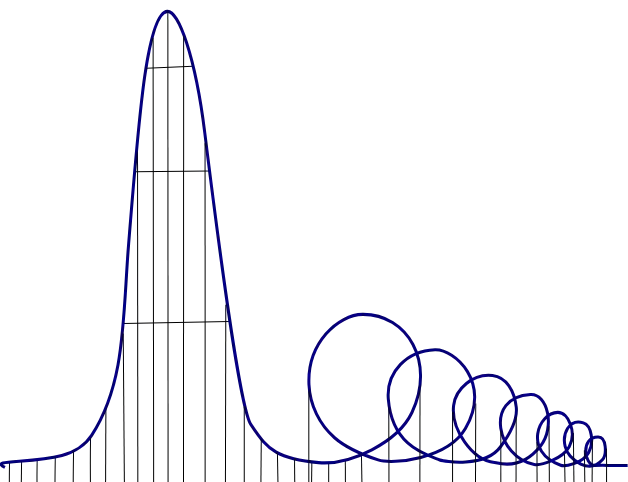

Looking ahead, I believe that fleeting, narrative-driven speculative bubbles will become smaller and smaller. We have already seen this—game and NFT pricing in 2021 was in the hundreds of billions, but this cycle, the peaks of meme and AI agents are only in the tens of billions. This is a macro-level euthanasia rollercoaster.

I believe everyone should be free to invest in whatever they want. But I also believe people want their investments to yield returns—when a game is so obviously signaled as "this is a hot potato, I must sell before it goes to zero," the rollercoaster will go faster and faster, and the market size will shrink as people choose to exit or lose all their money.

Revenue solves this problem—it makes you as an investor understand that people are willing to pay for the product, thus there is a certain prospect for long-term growth. When something has no revenue path, it is almost uninvestable on a long-term basis. On the other hand, a revenue path leads to a growth path, attracting buyers willing to bet on the sustained growth of the asset.

In summary, establishing compounders requires:

Top-level instillation of long-term thinking

Focus on building revenue-generating products

General L1 is dead, must change

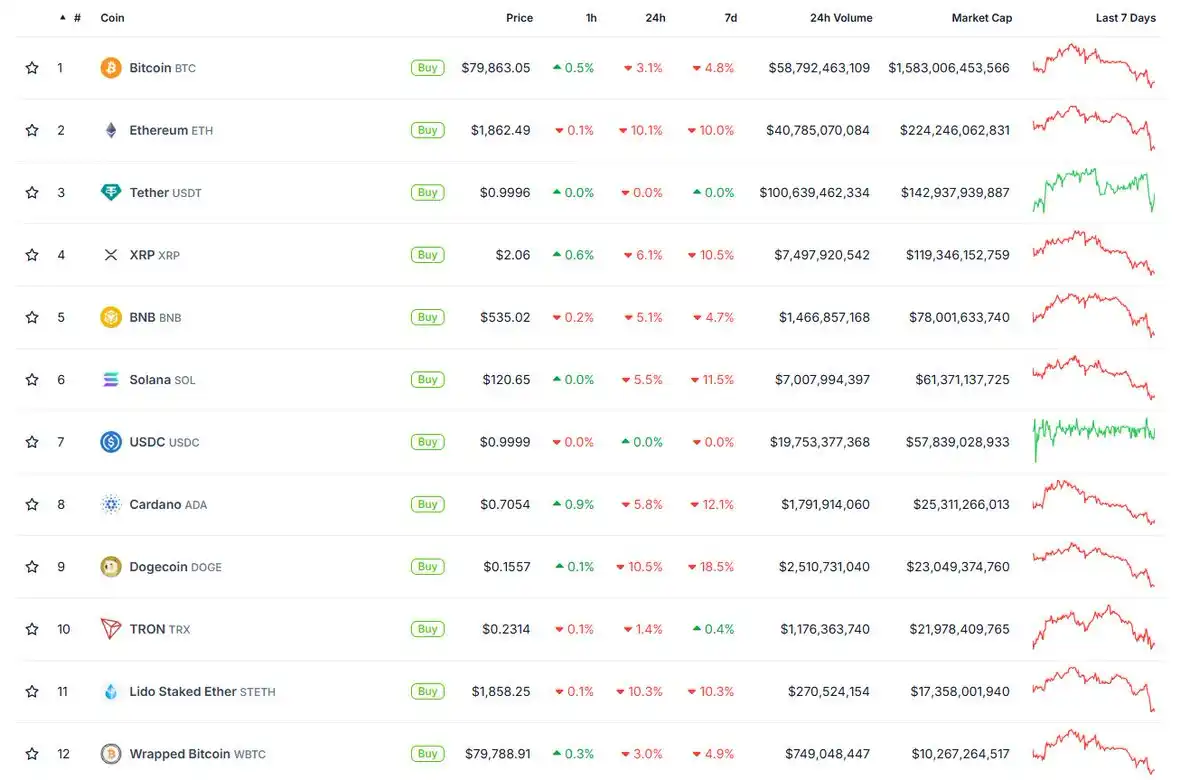

If you sort the Coingecko homepage by market cap, you will find that blockchains occupy more than half of it; aside from stablecoins, Layer 1 holds significant value in our industry.

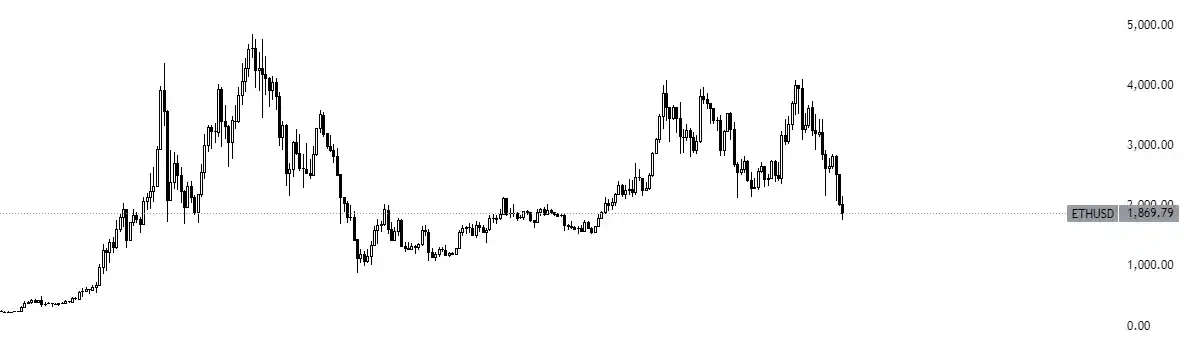

However, the chart of the second-largest digital asset after Bitcoin looks like this:

If you bought Bitcoin in July 2023, you would be up 163% at the current price.

If you bought Ethereum in July 2023, you would be up 0% at the current price.

That’s not the worst part. The 2021 bubble triggered a wave of "Ethereum killers"—new blockchains aimed at surpassing Ethereum in some technical way—whether it be speed, development language, block space, etc. But despite the hype and significant capital investment, the results did not meet expectations.

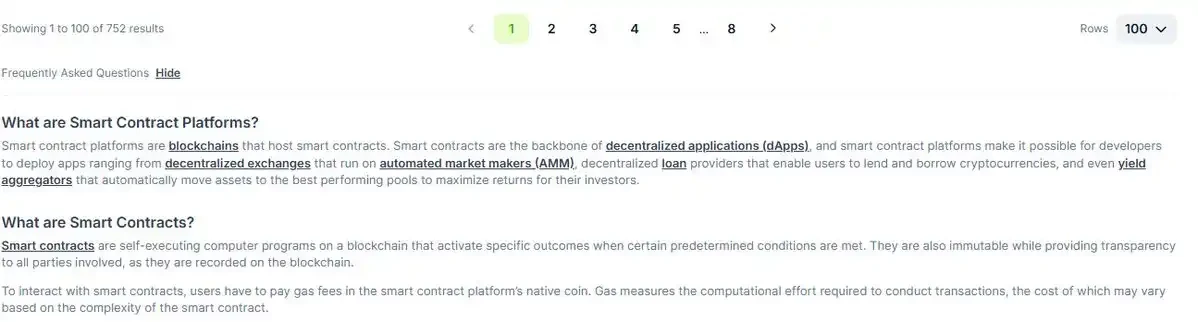

Today, four years after 2021, we are still facing the consequences of that wave—there are 752 smart contract platforms listed on Coingecko that have launched tokens, and likely more that have not.

It’s no surprise that most of their charts look like this—making Ethereum’s chart look relatively good:

Thus—despite four years of effort, billions of dollars in funding, and over 700 different blockchains, only a few L1s have decent activity—even those have not reached the "breakthrough user adoption levels" that everyone expected four years ago.

Why? Because most of these projects are built on the wrong premise. As Luca Netz pointed out in his article "What is Consumer Crypto," many of today’s blockchains follow a generalist approach, each dreaming that they will "carry the internet economy."

But this requires tremendous effort, ultimately leading to fragmentation rather than penetration, as a product trying to do everything often fails to do anything well. It’s an effort that costs too much money and time—frankly, many blockchains struggle to answer a simple question: "Why should we choose you over the 60th blockchain?"

The L1 space is another case where everyone follows the same script while expecting different results—they compete for the same limited developer resources, trying to outdo each other in funding, hackathons, and developer houses, and now we seem to be manufacturing phones (?)

Let’s assume an L1 succeeds. In each cycle, some L1s manage to break through. But can this success be sustained? The winner of this cycle is Solana. But here’s a viewpoint many of you may not like: what if Solana becomes the next Ethereum?

In the last cycle, a group of people was so confident in Ethereum’s success that they invested most of their net worth into it. Ethereum remains the chain with the highest TVL, and now even has ETFs—yet the price has stagnated. This cycle, the same type of people are saying the same things—Solana is the chain of the future, Solana ETF, etc.

If history is any indication, the real question is—can today’s victories guarantee tomorrow’s relevance?

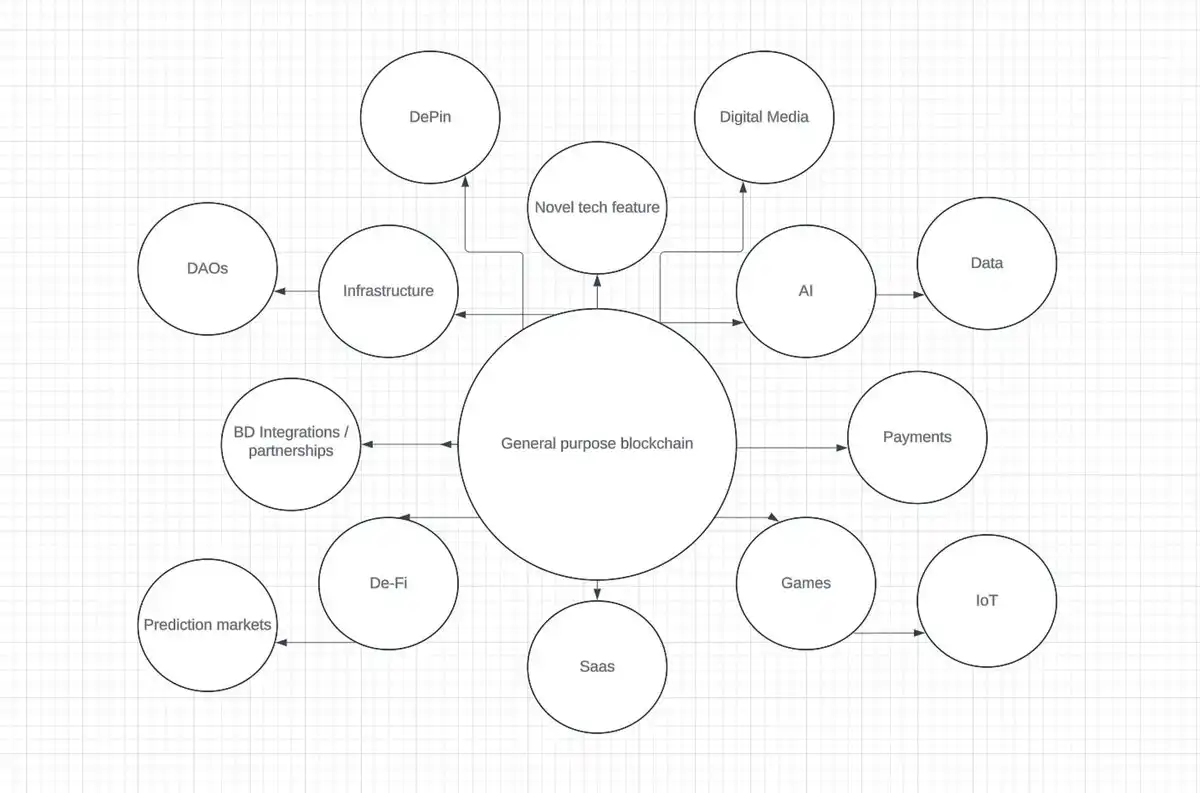

My point is simple: rather than building a general blockchain, it makes more sense for L1s to build around a core focus. Blockchains do not need to be all-encompassing for everyone. They just need to excel in a specific area. I believe the future is blockchain-agnostic—it just needs to perform well, and the technical details won’t matter as much.

Today, builders are showing signs of this—founders building D-apps are primarily focused not on the speed of the chain but on the distribution of the chain and end-user consumption—does your chain have users? Does it have the necessary distribution to gain traction for the product?

44% of web traffic runs on WordPress, yet its parent company Automattic is valued at only $7.5 billion. 4% of internet traffic runs on Shopify, yet its valuation is $120 billion—16 times that of Automattic! I believe L1s will also reach a similar end state, where value accumulates to applications built on the blockchain.

To this end, I believe L1s should take groundbreaking initiatives to build their own ecosystems. If we use cities as an analogy for blockchains (thanks to Haseeb’s 2022 article), we can see that cities began because specific advantages made them viable economic and social centers, then over time focused on a dominant industry or function:

Silicon Valley → Technology

New York → Finance

Las Vegas → Entertainment and Hospitality

Hong Kong and Singapore → Trade-centered Financial Hubs

Shenzhen → China’s Hardware Manufacturing and Tech Innovation Hub

Paris → Fashion, Art, and Luxury Goods

Seoul → K-pop, Entertainment, and Beauty Industry

L1s are no different—demand is driven by the appeal and activity they provide; therefore, teams must start focusing more on excelling in a specific vertical—curating the kind of appeal that attracts people into their ecosystem, rather than building various different exhibits hoping to attract users.

Once you have that kind of appeal that draws people into the ecosystem, you can build a city around that appeal. Again, Hyperliquid is an example of a team that has done well and iterated on first principles in this regard. They built a native perpetual DEX order book, spot DEX, staking, oracles, and multi-signature—all built in-house, then expanded to HyperEVM, a smart contract platform for people to build on.

Here’s a simple breakdown of why it works:

First focus on "building appeal": by first building perpetual trading products, Hyperliquid attracted traders and liquidity before scaling.

Control the stack: having key infrastructure (oracles, staking) reduces vulnerabilities and creates a moat.

Ecosystem synergies: HyperEVM now serves as a permissionless playground for developers, leveraging Hyperliquid’s existing user base and liquidity.

This "appeal first, city second" model reflects successful web2 platforms (for example, Amazon started with books and then expanded to everything else). Solve an exceptionally good problem, then let the ecosystem organically expand from that core value.

Therefore, I believe blockchains should start integrating their own products, building their own appeal, and owning the stack; as the captain, you are the visionary—this allows you to align your blockchain with your larger, long-term vision for L1; and ensures that projects do not immediately abandon ship when chain activity starts to decline, as everything is built in-house;

Most importantly, this process brings monetary value to your token—if the blockchain is a city, the token is the currency/goods people trade; by using it to drive value to the token—people need to buy your token to do interesting things on the chain. It gives your currency value and provides people with a reason to hold it.

Oh, but it’s important to remember—just because you specialize doesn’t mean there’s market demand for it. Another hard truth is that L1s must work in the right way at the right opportunities. Blockchains must develop products that people want—sometimes, people don’t really want "web3 games" or "more data availability."

Liquidity Tokens and Investor Relations

The next topic is about how I believe liquidity token projects should evolve in this space. Simply put—liquidity token projects need to start establishing investor relations (IR) roles and quarterly reports, allowing investors—whether retail or institutional—to clearly see what the company is doing. This role is not new or revolutionary—but it is severely lacking in this space.

Nonetheless, this space does very little in terms of IR. I’ve been told by business development leads from multiple projects that if you have some sort of "regular calls to pitch your liquidity token to funds," you are doing more in this space than 99% of other projects.

Business development is cool for attracting builders and ecosystem funds, but the IR role that tells the public what the token is doing is better—it’s really that simple. If you are a token looking to attract buyers, you need to market yourself—and the way to do that is not by renting the biggest booth at conferences or advertising at airports, but by pitching yourself to capitalized buyers.

By conducting quarterly growth updates, you start to show investors that the product is legitimate and can accumulate value—thereby enabling investors to speculate on the long-term prospects of the product performing well in the future.

As for how you should go about it—a good starting list is:

Report on quarterly expenses/revenue, protocol upgrades, numbers, but no MNPI—publish on a blog/website

Communicate monthly with liquidity fund managers to discuss your product/pitch yourself

Host more AMAs

Buybacks and Burns are Not the Best, but Not the Worst

The last thing I want to discuss is buybacks and burns in this space. My point is: if this money has no other use, I think buybacks and burns are a decent use. In my view, crypto has not yet reached a scale where companies can rest easy; there is still much work to be done in terms of growth.

The first and most important use of revenue should always be to expand products, upgrade technology, and enter new markets. This aligns with driving long-term growth and building competitive advantages; a good example in this regard is Jupiter’s acquisition spree, where they have been using cash to buy names to acquire products and key talent in the field.

While I know some people like buybacks and burns and will call for dividends, my point is that most crypto operations are similar to tech stocks because the investor base is of a similar type: investors seeking high returns want asymmetric payoffs.

To this end, it doesn’t make much sense for companies to return value directly to token holders through dividends—they can do so, but if they build a larger moat with cash reserves that serves them in 5 to 10 years, that would greatly benefit the product.

Crypto is now at the stage of beginning to enter the mainstream—therefore, it makes no sense to start slowing down momentum now; instead, cash should be invested to ensure the next winner stays ahead over a longer time frame, because despite all prices falling, the institutional setup in crypto has never been better—adoption of stablecoins, blockchain technology, tokenization, etc.

Thus, while buybacks and burns are much better than taking the money and leaving, they are still not the most effective use of capital, considering how much work remains to be done.

Conclusion

This bear market has begun to make people realize the necessity of building revenue-generating products as a path to profitability, as well as the inevitable demand for a legitimate investor relations role to showcase token performance.

There is still much work to be done in this space. I remain optimistic about the future of crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。