RWA track is one of the areas we have invested the most research in, second only to #AI. The essence of the #RWA track is to achieve the globalization of dollar assets (especially U.S. Treasury bonds, U.S. stocks, derivatives, etc.). In addition to political correctness, the scale and growth potential of this track are also the highest. Reports from #Messari and Boston Consulting predict that #RWA will reach a scale of $10 trillion by 2030, giving rise to many unicorn projects!

Today, @injective is promoting the on-chain integration of real-world assets (RWA) and has launched #iAssets, a new type of financial instrument that provides higher capital efficiency, instant liquidity, and programmability for assets such as stocks, bonds, and ETFs, breaking through the limitations of traditional tokenization models.

1️⃣ Key Features of #Injective iAssets

• No pre-funding or excessive collateral: Assets can be created and traded without locking in large amounts of capital in advance, improving capital utilization.

• Instant liquidity: iAssets are traded directly on #Injective's on-chain order book without relying on liquidity pools, enhancing market efficiency.

• Programmability: iAssets can be embedded in smart contracts for risk hedging, yield strategies, algorithmic trading, etc., increasing the flexibility of financial applications.

2️⃣ Institutional Capital Entering DeFi: Breakthroughs in RWA Tokenization

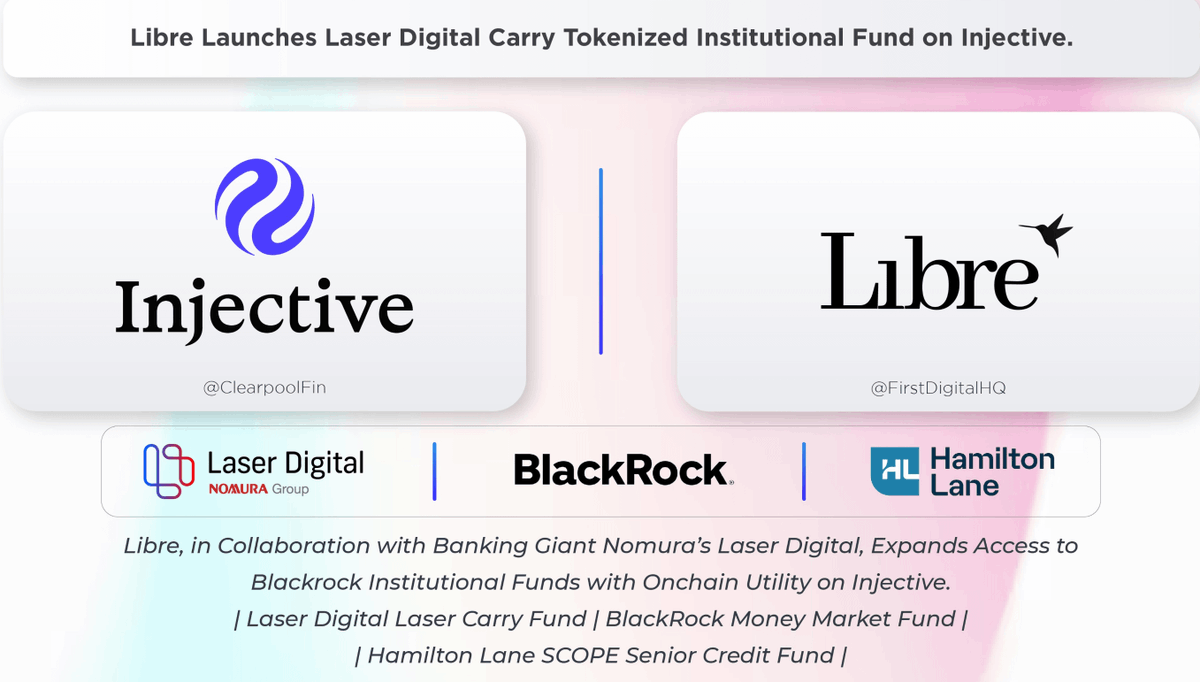

Libre collaborates with top asset management institutions such as Nomura, BlackRock, and Hamilton Lane to tokenize institutional-grade funds and bring them on-chain through Injective, including:

• BlackRock Money Market Fund: Provides stable returns through government bond-like products.

• Laser Carry Fund (Nomura): A market-neutral strategy fund that optimizes returns using funding rates and staking yields.

• Hamilton Lane Private Credit Fund: Offers high-quality institutional-grade credit investment opportunities.

3️⃣ Comparison of Injective iAssets and Traditional RWA Tokenization

Injective iAssets: No pre-funding or capital lock-up required; instant liquidity, on-chain trading; programmable and composable, suitable for DeFi.

Traditional RWA Tokenization: Requires locked funds or excessive collateral; asset liquidity is limited; static assets with no smart contract support.

Summary: #Injective iAssets further integrates traditional finance (TradFi) with decentralized finance (DeFi), making it easier for institutional capital to enter DeFi and enhancing asset transparency and liquidity. Although it still faces challenges in compliance and custody, its high capital efficiency and programmability will become important components of future financial infrastructure, warranting close attention and observation 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。