Original author: Marco Manoppo, Investor at Primitive Ventures

Translation by: Odaily Planet Daily (@OdailyChina)

Translator: CryptoLeo (@LeoAndCrypto)

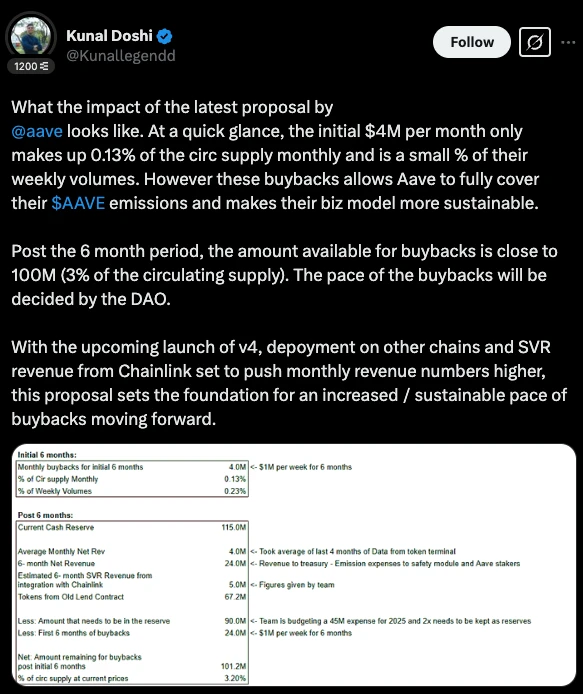

Editor’s note: Last week, Marc Zeller, founder of the Aave Chan Initiative (ACI), a contributing team of Aave DAO, proposed a new proposal, which is considered one of the most important proposals in Aave's history. In addition to optimizing the protocol's security mechanisms, the focus of attention is on the proposed Anti-GHO mechanism and the AAVE buyback plan, both of which can increase the value accumulation for token holders and lay the foundation for the long-term development of the protocol, token value accumulation, and attracting more users.

In the context of a relaxed regulatory environment, besides AAVE, several other mainstream DeFi protocols are also exploring ways to accelerate value accumulation for token holders, including Jupiter, Hyperliquid, and ethena. Marco Manoppo, an investor at Primitive Ventures, summarizes several mainstream DeFi protocols that are accelerating value accumulation for token holders, which Odaily has compiled as follows.

DeFi protocols are facing increasing pressure as they need to use part of their revenue to reward token holders. Major players like Aave, Ethena, and Hyperliquid are already exploring methods to trial value accumulation for their tokens.

The key driving factor behind this shift is the friendlier regulatory environment for DeFi brought about by Trump's election victory. Below is a breakdown of the latest token economics updates for Aave, Athena, Jupiter, and Hyperliquid, including their buyback plans and fee changes.

Aave

Aave has just launched a significant token economics update focusing on buybacks, fee distribution, and incentives for token holders. According to Marc Zeller, founder of the Aave Chan Initiative (ACI), this is one of the largest proposals in Aave's history. Refer to “Aave Economic Model Revolution: Anti-GHO Mechanism + Token Buyback”.

Buyback and Fee Conversion

Aave has initiated a six-month buyback plan, allocating $1 million weekly (approximately $4 million monthly) to control AAVE inflation and make the protocol more sustainable. After six months, the buyback pool could reach $100 million (about 3% of the circulating supply), with the deployment speed determined by the DAO. The goal is to control token inflation while strengthening Aave's treasury.

New Financial and Governance Initiatives

Aave is establishing the Aave Financial Committee (AFC) to handle financial funds and liquidity strategies. The plan has also completed the transition from LEND to reclaim 320,000 AAVE (approximately $65 million) for potential future use cases.

Umbrella: Aave's New Risk Management System

Aave spends $27 million annually on liquidity costs, so they launched Umbrella, a system designed to optimize capital efficiency and reduce risk, which will integrate multiple blockchains, including Ethereum, Avalanche, Arbitrum, Gnosis, and Base.

Anti-GHO Mechanism: New Rewards for Stablecoin Holders

A new reward mechanism, Anti-GHO, will replace the old discount model for GHO holders. These tokens can be burned at a 1:1 ratio to offset GHO debt or exchanged for StkGHO, thereby directly linking incentives to Aave's revenue.

It is still under development and may be part of the future "Aavenomics Part Two" update.

What’s Next?

With Aave v4, more chain deployments, and additional revenue sources from Chainlink's SVR, this update lays the groundwork for larger-scale and more sustainable buybacks in the future.

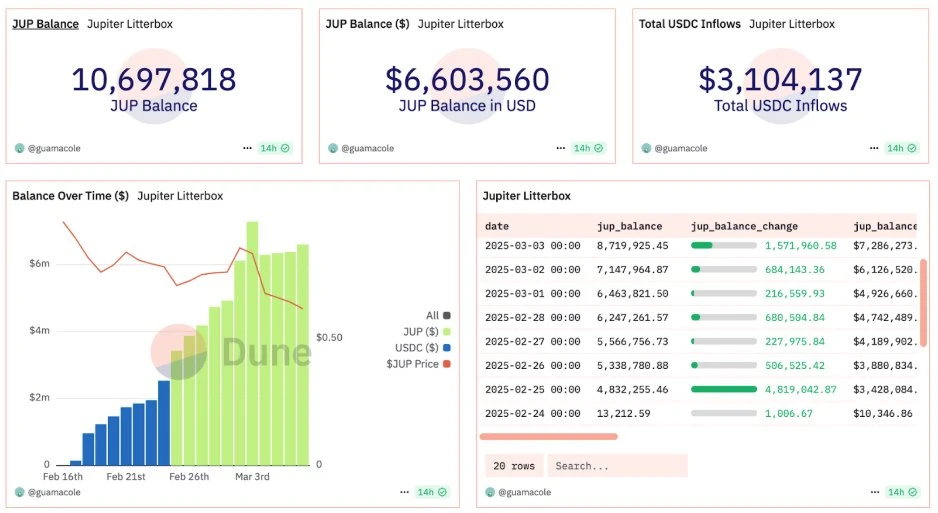

Jupiter

Jupiter has begun using 50% of its protocol fees to buy back JUP tokens, locking them for three years starting February 17, 2025. This plan aims to reduce circulating supply, enhance long-term stability, and increase participation in the Solana ecosystem.

In February, Jupiter conducted its first buyback, acquiring approximately 4.885 million JUP, worth about $3.33 million. Currently, Jupiter's Litterbox Trust buyback plan has exceeded 10 million JUP (approximately $6 million).

What’s Next?

On an annual basis, the $3.33 million buyback means over $35 million in buybacks each year. Data shows that Jupiter's 2024 revenue is projected to be $102 million, which means $50 million will be used for token buybacks.

Hyperliquid

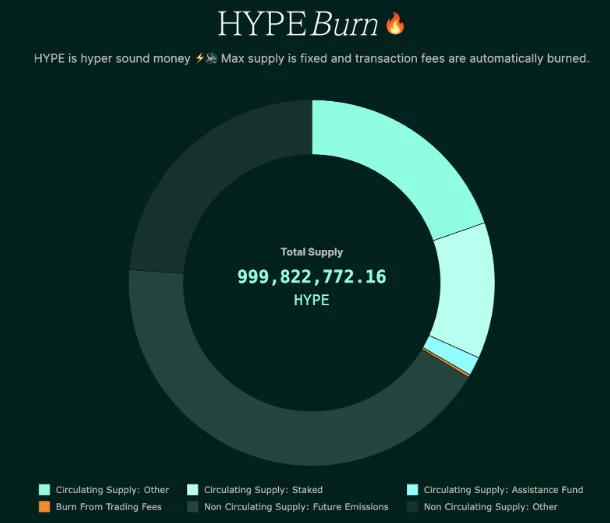

Hyperliquid's HYPE supply is 1 billion, with no allocation for investors. The specific allocation is as follows:

31.0%: Airdropped to early users (fully liquid);

38.888%: For future token emissions and community rewards;

23.8%: Team allocation, locked for 1 year, with most vesting between 2027-2028;

6.0%: Foundation;

0.3%: Community contributions;

0.012%: HIP-2.

The team-to-community ratio is 3:7, with the largest non-team holder being the Assistance Fund (AF), holding 1.16% of the total supply and 3.74% of the circulating supply.

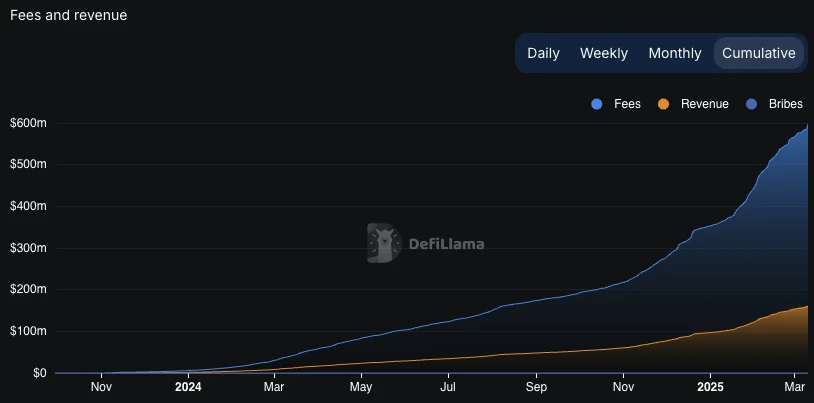

Revenue Model and Buyback

Hyperliquid's revenue primarily comes from trading fees (spot and derivatives) and HIP-1 auction fees. Since Hyperliquid L1 has not yet charged gas fees, revenue related to gas is not included.

Revenue Distribution:

46% of perpetual contract fees belong to HLP holders (supply-side rewards);

54% is used for HYPE buybacks through the Assistance Fund (AF).

Additional revenue sources include HIP-1 auction fees and spot trading fees (USDC trading fees), which are currently all allocated for HYPE buybacks.

In short, Hyperliquid has implemented a dual token deflationary strategy for HYPE:

Buyback—AF uses part of its revenue to buy back HYPE tokens from the market, which are held by AF and not destroyed;

Burn—All spot trading fees paid in HYPE (e.g., HYPE/USDC trading pair) will be burned, and all gas fees on HyperEVM (once fully launched on the mainnet) will be paid in HYPE and burned.

Buyback Impact and Staking

There are many publicly available data sources regarding Hyperliquid fees. Using data up to March 2025, AF drives approximately $2.5 million in HYPE (or about $35 million) in monthly buyback volume through 54% of perp trading volume.

HYPE staking will launch on December 30, 2024, providing approximately 2.5% annual yield based on PoS rewards, similar to Ethereum.

Currently, 30 million tokens held by users (excluding the 300 million tokens held by the team/foundation) have been staked.

What’s Next?

Hyperliquid could introduce a fee-sharing model where a portion of on-chain trading fees is directly distributed to HYPE holders, creating a more sustainable and rewarding ecosystem—though some may argue that the current model has created more revenue flywheels, both positively and negatively.

Hyperliquid earns fees through trading and HIP-1 auctions, with future revenue sources including HyperEVM trading. Instead of using all fees for buybacks or incentives, part of it could be used for:

Providing rewards to holders based on their HYPE holdings and staking amounts;

Rewarding long-term participants to encourage deeper engagement;

Storing in a community treasury, with governance deciding its use.

Possible Distribution Models:

Direct fee sharing—part of the trading fees converted to USDC (or retained as HYPE) and distributed regularly, like dividends;

Staking boost rewards—only users who stake HYPE receive rewards, incentivizing long-term holding;

Mixed Model—Combining fee redistribution and HYPE buybacks to balance price support and incentives.

Ethena

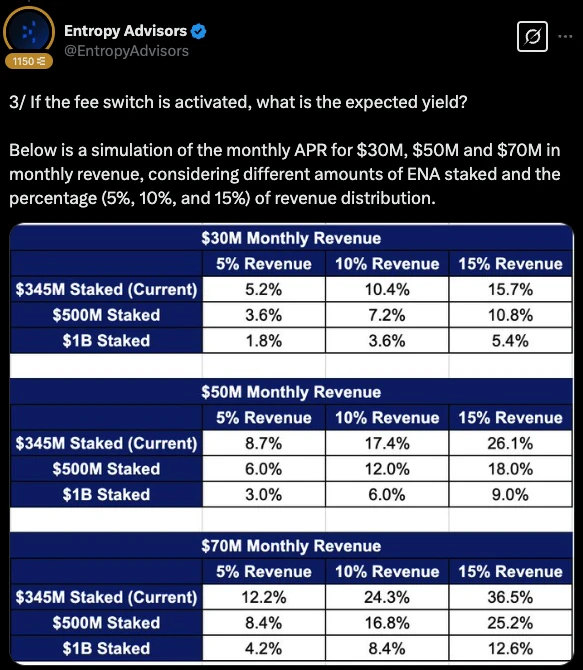

Ethena Labs is now one of the top 5 DeFi protocols by TVL, with revenues exceeding $300 million. As revenue grows, the proposal to enable ENA fee conversion put forward by Wintermute has been approved by the Ethena Risk Committee.

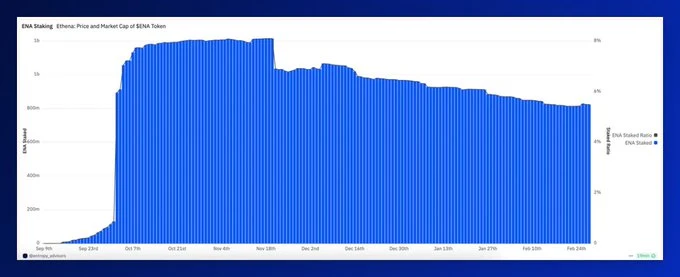

Currently, 824 million ENA (worth $324 million) has been staked, accounting for 5.5% of the total supply, but stakers can only earn points rewards and unclaimed ENA airdrops, without profiting from Ethena protocol revenues.

The proposal to enable fee conversion will allow stakers to directly access protocol revenues and strengthen DAO governance through aligned incentives with ENA holders.

Ethena primarily earns revenue by capturing contract market funding rates. Currently, 100% of the revenue belongs to USDe stakers and the reserve fund. Over the past three months, the average monthly revenue has been $50 million.

Preparations Before Fee Conversion

The Ethena Risk Committee has set five key benchmarks to ensure Ethena is in a solid position before sharing revenues.

Current progress on these metrics:

· Not Achieved

USDe supply target: 6 billion tokens, only 9% away from the target (current supply is about 5.4 billion tokens);

Exchange inheritance: Binance/OKX, no exact timeline yet, but Binance currently holds 4 million USDe;

sUSDe and sUSDS APY spread ≥ 5%, the spread has narrowed due to market downturns but may widen again.

· Achieved

Cumulative revenue: Over $250 million—this figure was surpassed in January and has now reached $330 million;

Reserve fund ratio ≥ 1% of USDe supply—With a reserve of $61 million, Ethena can now support $6.1 billion.

What’s Next?

Ethena is close to achieving its goals, but fee conversion will be temporarily shelved until all benchmarks are met. Meanwhile, the team is focused on increasing USDe supply, ensuring more exchange integrations, and monitoring market conditions. Once everything is ready, ENA stakers can begin to benefit from the revenue-sharing model.

Summary

Mainstream DeFi protocols are accelerating value accumulation for token holders. Aave, Ethena, Hyperliquid, and Jupiter are all rapidly implementing buyback plans, fee conversions, and new incentive structures to make their tokens more valuable, rather than merely speculative.

This trend reflects a broader movement in the industry towards sustainable token economics, where projects focus on actual revenue distribution rather than inflationary incentives.

Aave is leveraging its deep reserves to support buybacks and governance improvements, Ethena is working towards direct income sharing for stakers, Hyperliquid is optimizing its buyback and fee distribution models, and Jupiter is locking up tokens for buybacks to stabilize supply.

As regulatory conditions become more favorable and DeFi continues to mature, protocols that successfully align incentives with the community will thrive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。