Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

In a bleak market, the large fluctuations of Liangxi and the "Hyperliquid 50x leverage trading whale" have become the focus of market attention. Many view it as a short-term market barometer, while the Hyperliquid whale, known for its previously extremely high leverage trading and precise opening prices, is considered "insider" capital, attracting countless followers.

Reference reading: [Reviewing the Hyperliquid contract "insider brother" operations, precise opening and closing positions].

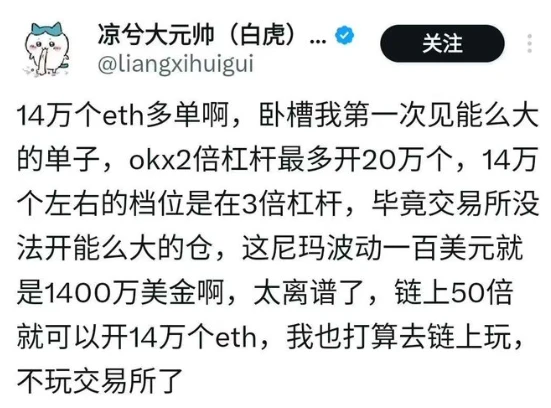

Today, the Hyperliquid 50x leverage trading whale began trading again, opening a long position in ETH worth approximately $300 million with 50x leverage, with a maximum floating profit of $8 million. However, shortly after, it chose to withdraw the vast majority of its principal and profits, actively raising the liquidation price, leading to its long position of 160,234.18 ETH being "liquidated," totaling $306 million.

The most classic question in the community is: "How can it open such a large position? Who is on the opposite side (who is losing money)?" Below, Odaily Planet Daily will provide a brief explanation of Hyperliquid and the HLP mechanism to answer this question.

Conventional Matching Mechanism

Readers are likely familiar with order book trading models like those of Binance and OKX, where the opposite side consists of long and short users.

On-chain, there are also two other models—AMM and GMX-style perp DEX.

AMM has become popular due to its permissionless nature and ease of use and calculation, but for mainstream, high-market-cap cryptocurrencies, it is not very intuitive for trading and also difficult to use leverage.

The GMX-represented perp DEX, uses GLP as the counterparty for traders, with the unique feature that the opening price is calculated using the marked price provided by oracles. Simply put, if a user is trading BTC, the oracle will obtain data sources from exchanges like Binance, OKX, Bybit, etc., calculate a marked price, and then open the contract at that marked price. For example, if the current BTC marked price is 82,000 USDT, then the user's opening price is that price, without having to sequentially eat through sell orders at 82,001 USDT, 82,002 USDT, and finally calculate the average price.

In the GMX model, GLP is a passive liquidity strategy, where the user's profit = GLP's loss, and vice versa, without accounting for various fees.

What about HLP?

Returning to Hyperliquid, HLP is also a strategy that pools funds and acts as a counterparty for traders, but unlike GLP, HLP is an active strategy, with Hyperliquid actively providing market making, earning profits through market making, collecting funding fees, and liquidation. All users can provide liquidity for HLP and share in the profits and losses.

Why can such a large position be opened?

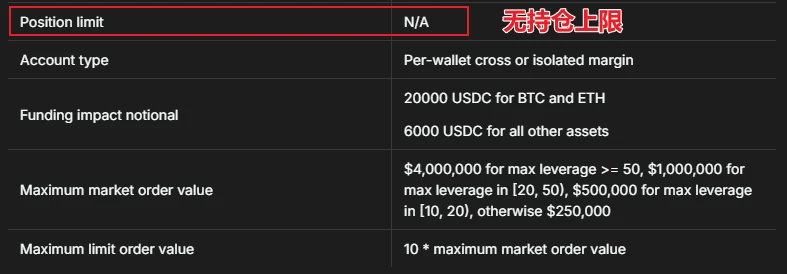

The most unique aspect of Hyperliquid is that, prior to this incident, it had no position limits, only imposing restrictions on the amount of market orders.

As a result, the whale executed hundreds of trades within two hours, opening ultra-high leverage long contracts worth $300 million, successfully attracting Liangxi as well.

What are the benefits of malicious liquidation?

Why did the whale choose to use margin transfer and raise the liquidation price to trigger liquidation for closing positions? There are two mainstream views:

The whale exploited a loophole in Hyperliquid's position limits, possibly having opened short positions on other platforms, using this method to create a sharp drop, providing a dual profit opportunity.

If the whale had chosen to manually and repeatedly close positions, given that it is now a "secondary head," closely monitored by the market, it could lead to a rapid decline in ETH, causing profits to quickly shrink during the closing process. Therefore, it opted for a one-time, rapid closing method.

How do other exchanges handle massive high-leverage contracts?

In fact, this scenario is not the first occurrence. To address the risk of liquidation, exchanges like Binance and OKX have also introduced mechanisms such as automatic deleveraging (ADL) and tiered margin to prevent risks.

Automatic Deleveraging: Taking OKX as an example, if the risk reserve cannot absorb further losses from liquidated positions, ADL will be triggered to limit further losses of that risk reserve. Essentially, losing positions are matched with opposite profitable or high-leverage positions ("deleveraged positions"), and the two positions offset each other and are closed. Due to ADL, profitable positions may be liquidated, thus limiting the future profit potential of that position.

Tiered Margin: As the position size increases, the corresponding margin ratio will also increase "tiered." Through the tiered margin mechanism, large position traders need to put in more margin, thereby reducing the risk of liquidation or breach due to market fluctuations. This means that users cannot open massive contracts that could significantly impact the market with low margin.

How does Hyperliquid respond?

Hyperliquid Vault data shows that after the whale actively triggered the liquidation mechanism, HLP lost a total of $3.45 million.

Hyperliquid's official response stated that this incident was not due to a protocol vulnerability or hacker attack, but rather because the user withdrew unrealized profits (PNL), leading to a decrease in margin and triggering liquidation. Hyperliquid stated that the user ultimately still made a profit of $1.8 million, while HLP lost about $4 million in the past 24 hours. Nevertheless, HLP's historical cumulative PNL remains at approximately $60 million.

In response, Hyperliquid announced it would adjust leverage limits to optimize liquidation management and enhance market buffering capacity during large-scale liquidations, with the maximum leverage for BTC adjusted to 40x and for ETH adjusted to 25x.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。