Yesterday, due to signs of easing in the Russia-Ukraine war, risk markets saw a good rebound, with Bitcoin and U.S. stocks both trending upwards. Although U.S. stocks did pull back before closing, $BTC is indeed performing well. I was wondering if this might help investor sentiment, but after seeing the spot ETF data from yesterday, it seems I was overthinking it.

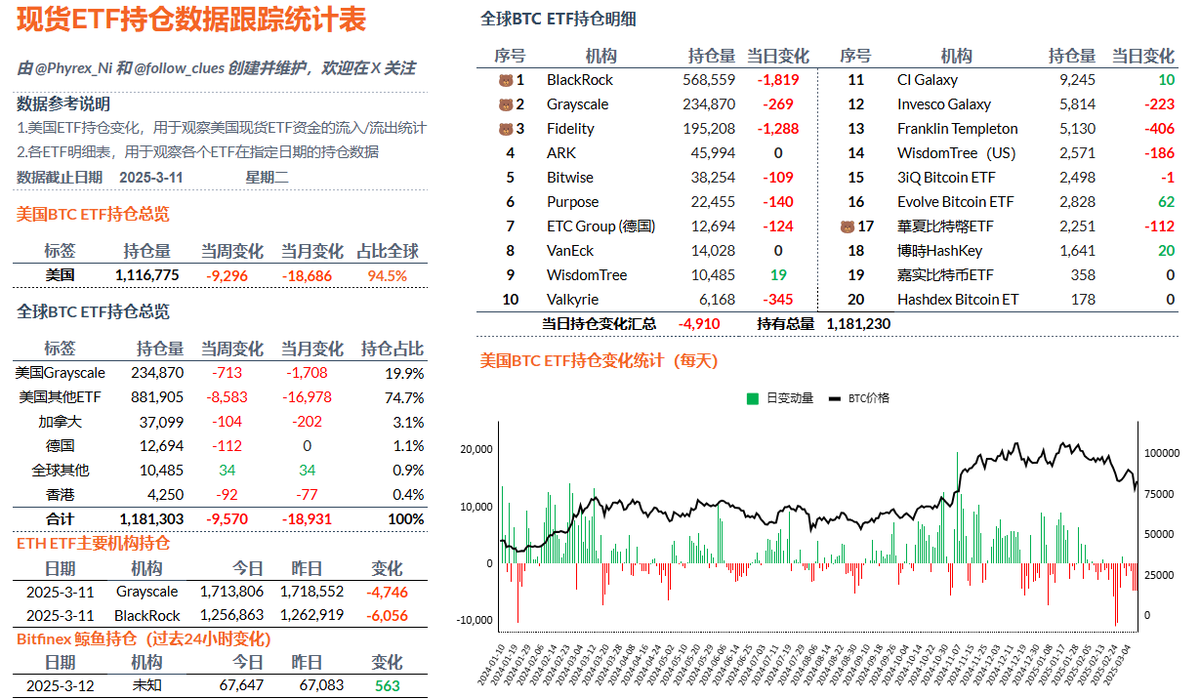

ETF investors did not stop selling due to the price rebound, let alone buying. BlackRock and Fidelity still maintained four-digit sell-offs, with 8 out of 12 spot ETF institutions experiencing net outflows, and the remaining 4 still at zero. Investor sentiment is still not good enough.

Today's CPI data is good, driving U.S. stocks and BTC to continue rising. There is also PPI data coming out tomorrow. If the PPI data is also good, at least market expectations will be positive, which allows us to basically conclude that the core PCE for the U.S. in March will be good, as this is the data the Federal Reserve is most concerned about.

Unfortunately, we still need to consider the issue of tariffs, as the inflation data from February does not represent the trend after the increase in tariffs.

The data has been updated, link: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。