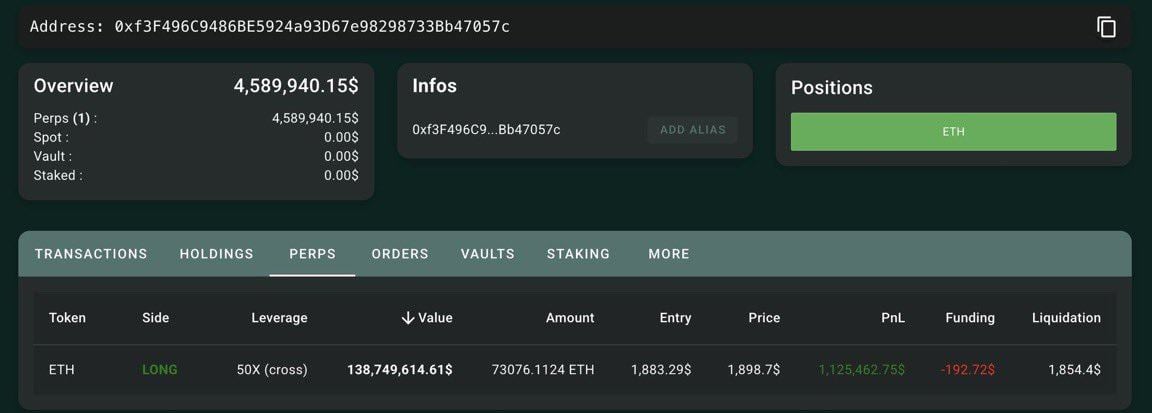

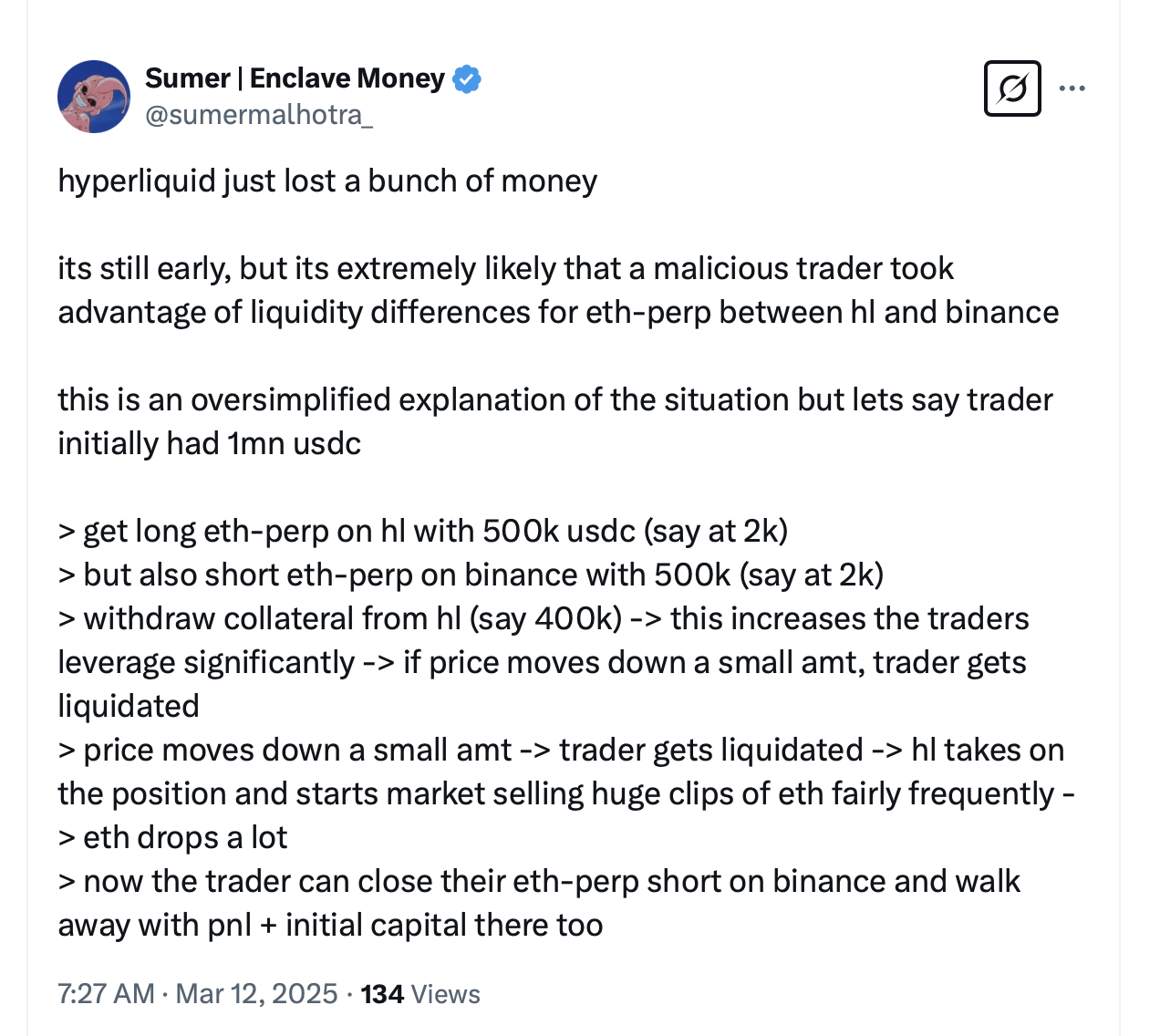

A Hyperliquid trader using wallet “0xf3f4” deposited $4.3 million in USDC to open a 50x leveraged long position on ethereum, amassing 113,000 ETH valued at over $200 million. After ethereum’s price rose, the trader withdrew funds, reducing their margin below required levels and triggering liquidation. Despite the forced closure, the trader still retained a $1.8 million profit—an atypical outcome for liquidations—while Hyperliquid’s liquidity pool (HLP) absorbed a $4 million loss.

The liquidation occurred when the trader’s equity fell below maintenance margins after withdrawals. Hyperliquid’s HLP, a community-owned vault, covered the deficit by purchasing the position at a favorable mark price but sold it at a lower market rate, resulting in the $4 million loss. The platform confirmed HLP’s all-time profit remains $60 million, underscoring its broader financial resilience.

Hyperliquid addressed speculation about protocol vulnerabilities in a March 12, 2025, statement: “There was no protocol exploit or hack. This user had unrealized PNL, withdrew, which lowered their margin, and was liquidated. They ended with ~$1.8M in PNL. HLP lost ~$4M over the past 24h.” The platform also announced reduced leverage limits, capping bitcoin at 40x and ethereum at 25x to bolster margin buffers for large positions.

Hyperliquid addressed speculation about protocol vulnerabilities in a March 12, 2025, statement: “There was no protocol exploit or hack. This user had unrealized PNL, withdrew, which lowered their margin, and was liquidated. They ended with ~$1.8M in PNL. HLP lost ~$4M over the past 24h.” The platform also announced reduced leverage limits, capping bitcoin at 40x and ethereum at 25x to bolster margin buffers for large positions.

The event ignited debate over risks in decentralized finance (DeFi), particularly high-leverage trading. Hyperliquid’s HYPE token briefly dipped from $14 to under $13 before recovering back above the $13 range, reflecting market unease. The platform’s reliance on community-backed liquidity pools to absorb losses contrasts with centralized exchanges, where such deficits typically impact internal reserves.

Hyperliquid’s leverage adjustments aim to prevent similar incidents, balancing user flexibility with systemic stability. The event highlights DeFi’s evolving challenges, where decentralized risk-sharing models face stress tests from high-stakes trades.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。