Author: Frank, PANews

"In all my days as a stock trader, the memory of this day is the most vivid. It was on this day that my profits first exceeded $1 million. It marked the first time I successfully closed a trade according to my pre-planned trading strategy. Everything I had foreseen has now become a past reality. However, surpassing all of this is: my fervent dream has become a reality.

On this day, I was the king of the market!"

—— "Reminiscences of a Stock Operator"

More than a century ago, legendary stock trader Livermore described his success with these words. A hundred years later, in the crypto market, a similar scene seems to be playing out again. Coincidentally, this time the king of the market is also a large-scale operator who succeeded and actively liquidated in a market with insufficient liquidity, performing an extreme operation that garnered the market's reverence. The difference is that this time the profits of the market king were paid by the exchange.

Century Cycle: The On-Chain Rebirth of Wall Street Ghosts

This whale invested $6 million with 50x leverage to go long on ETH and BTC just before Trump announced the inclusion of five crypto assets—BTC, ETH, SOL, ADA, and XRP—into the strategic reserve, earning $6.8 million in profit. Over the past month, this whale has repeatedly operated in the market, achieving substantial profits and once again executing a classic battle worthy of being recorded in Hyperliquid's history.

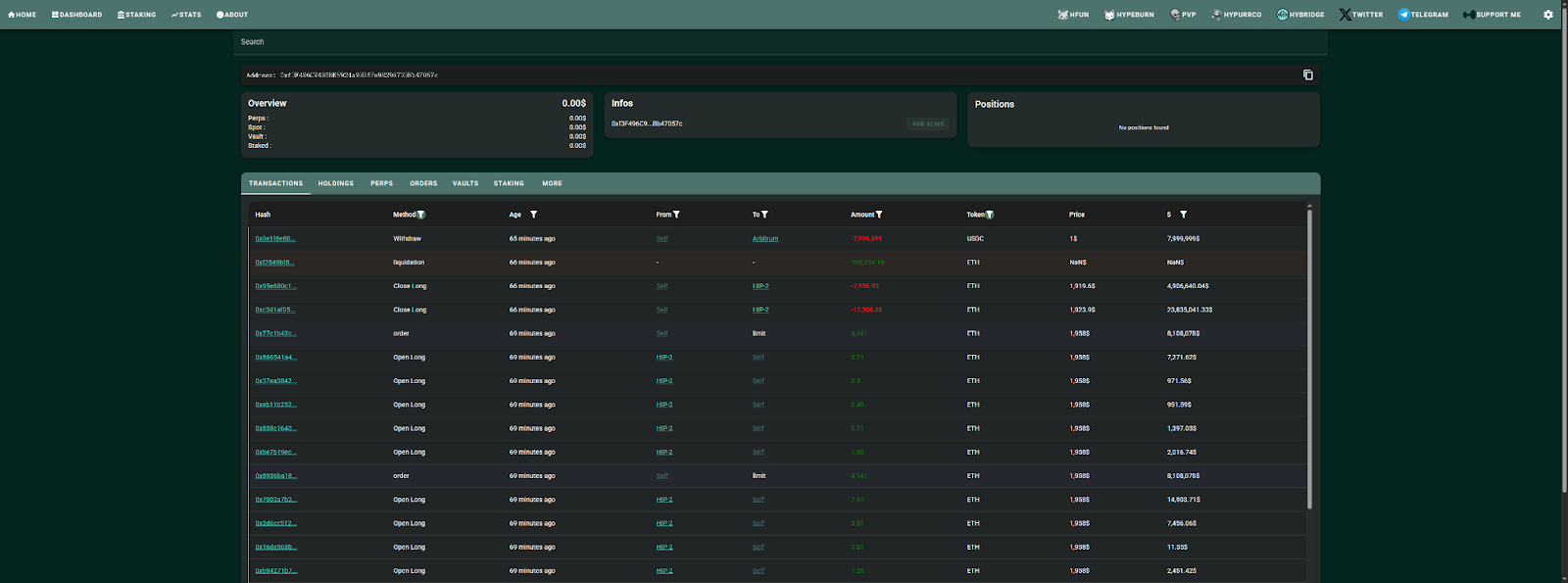

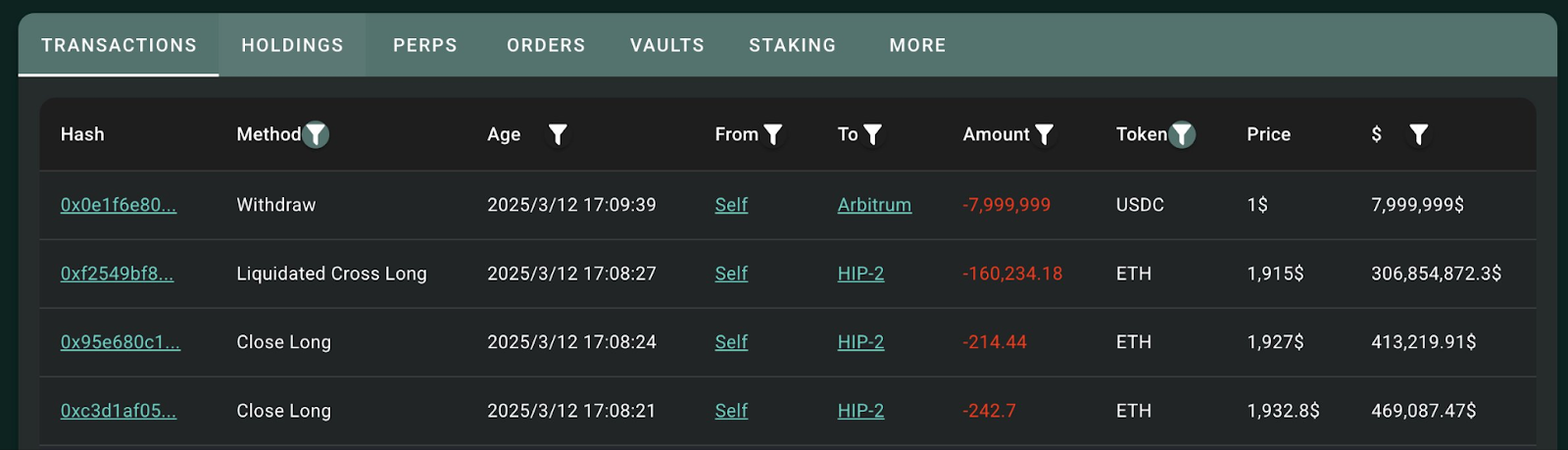

On March 12, this whale opened a long position of 160,000 ETH with 50x leverage, withdrew $8 million in funds, and then actively liquidated, ultimately making a profit of about $1.8 million, while Hyperliquid lost $4 million as a result.

This situation seems logically bizarre, but it essentially exploited a "loophole" in Hyperliquid's on-chain trading to achieve profit.

Let’s review the operation process of this whale:

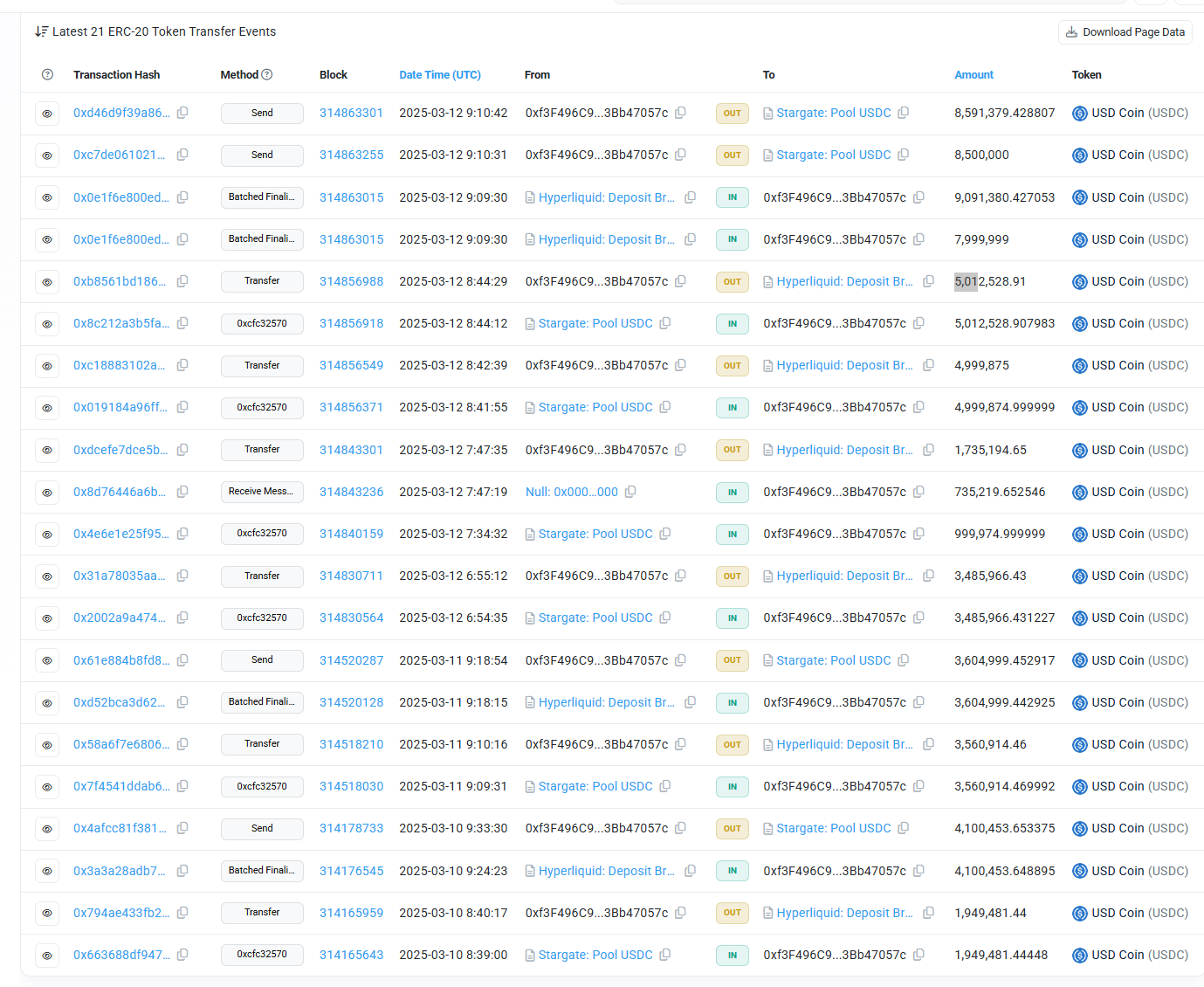

At 6:54 AM on March 12, this address deposited $3.48 million into Hyperliquid via a cross-chain bridge, opening a position of 17,000 ETH (worth $31.2 million).

Subsequently, this address increased its position to 21,790 ETH (worth $40.85 million) by adding margin and continuing to expand the position.

Following that, the address continued to add to its position, raising the total ETH position to 170,000 (holding value of $343 million). The paper profit was $8.59 million.

During this process, the address used a total margin of $15.21 million.

Ultimately, by closing positions and withdrawing margin, it recovered $17.08 million, realizing a profit of $1.87 million.

In the final operation, the user withdrew $8 million in funds, retaining about $6.13 million as margin, waiting for forced liquidation.

Hunting Moment: The Precise Calculation Behind the 170,000 ETH Position

Why did the whale operate this way instead of waiting to close for profit?

In this process, the whale had two options: one was to close the position directly, realizing a paper profit of $8.59 million. The benefit of this operation would be maximized. However, the on-chain counterpart might not be able to absorb such a large order all at once, and would have to wait for the price to continue to drop, reducing profits to execute the trade. If this $343 million order were to be actively closed, it might greatly impact market trends, causing a significant shrinkage of profits.

Therefore, the whale chose the second option, withdrawing margin and part of the profits (i.e., closing part of the position and then withdrawing the remaining excess margin), keeping the margin at the minimum standard for 50x leverage. This way, if the market continued to rise, he could gain greater profits and choose to continue closing positions in batches. If the market experienced a rapid decline, he would be liquidated at a 2% drop. However, since he had already withdrawn $17.08 million in funds, the overall profit had already been realized at $1.87 million. Thus, even if he were liquidated, it would not lead to an actual loss.

This seemingly reckless gambler's operation ultimately chose a conservative profit strategy.

In retrospect, according to data released by Hyperliquid, on that day Hyperliquid lost $4 million (which also included some profits from follow-up trades). Meanwhile, the whale achieved a profit of over $1.8 million.

In fact, calculating the profit-loss ratio, the whale's total cost was about $15.21 million, realizing a profit of $1.87 million, with a profit margin of about 12.2%. In terms of percentage and amount, this is not as favorable as the address's profits when Trump announced the inclusion of ADA and SOL in the strategic reserve.

Aftershocks and Insights: Driving the Evolution of On-Chain Exchanges

From the market's perspective, this operation ultimately resulting in the exchange footing the bill is an extremely rare occurrence. However, this situation seems to only be achievable on Hyperliquid.

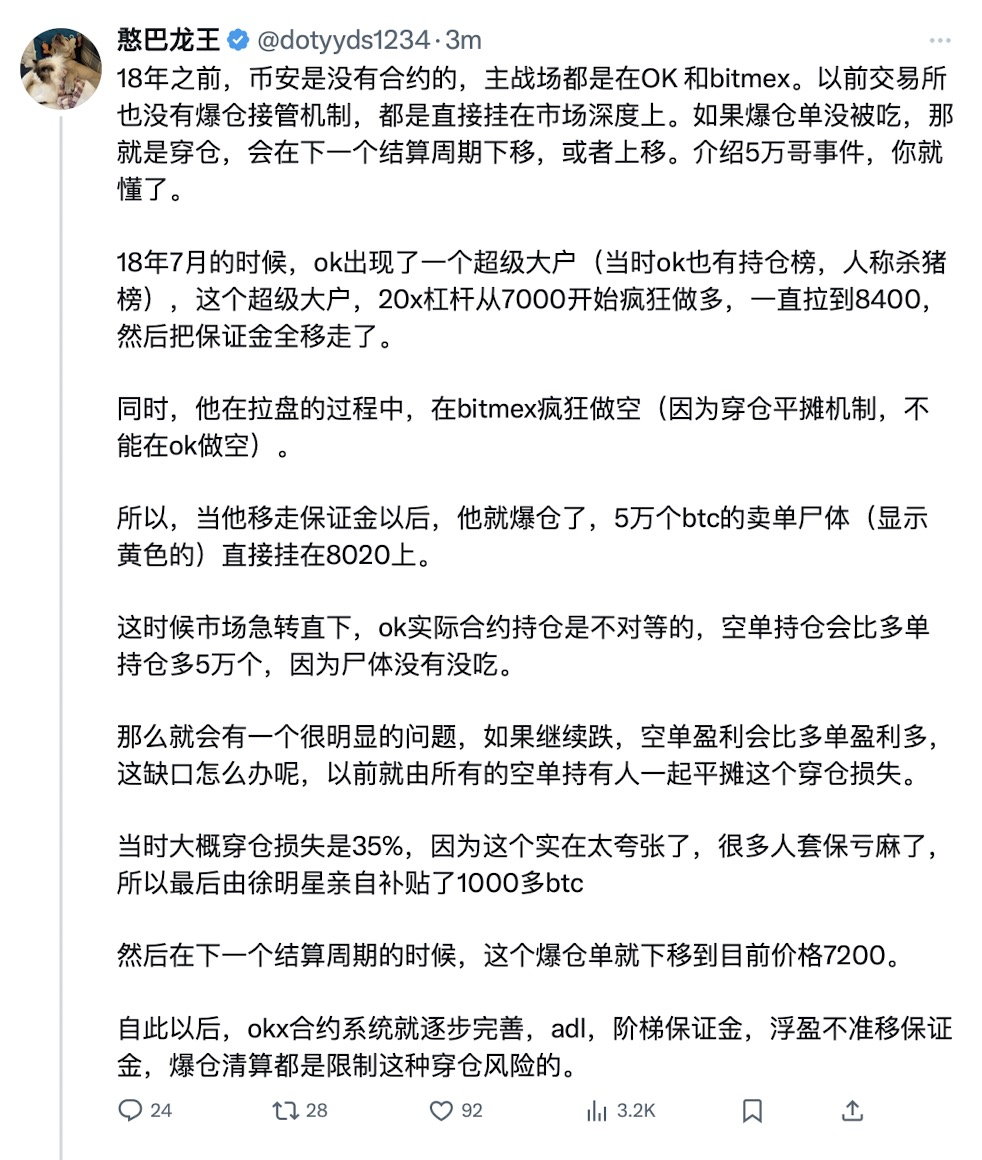

According to KOL Hanbalongwang's tweet, a similar incident occurred at OKEx in 2018. Using the same method, after making a profit, withdrawing margin caused the market to reach a liquidation price that no counterpart could absorb, resulting in the exchange footing the bill.

After the OK incident, various centralized exchanges increased their tiered margin systems to keep users' margins within a reasonable range. This recent event seems to have taught a lesson to the emerging on-chain exchange Hyperliquid. Due to the use of DEX trading throughout, there was no risk control on margin requirements.

This ultimately led to the whale's liquidation when the market lacked sufficient liquidity to absorb the forced liquidation orders, resulting in Hyperliquid having to cover the counterpart. HLP data shows that the $4 million loss was almost equivalent to Hyperliquid's entire monthly profit. As of March 10, Hyperliquid's HLP earnings had accumulated to $63.5 million, so even with this order's loss, there remained nearly $60 million in profit.

However, given that this incident sparked heated discussions on social media, there may be users who follow the whale's operations in the future. Hyperliquid also promptly stated that to avoid similar issues, it would adjust the leverage for BTC to 40x and for ETH to 25x.

Regarding speculation in the market about whether this method will fundamentally shake Hyperliquid, we can understand this possibility through calculations: currently, Hyperliquid's HLP pool still holds nearly $60 million in funds, and with BTC's maximum leverage of 40x, it can withstand a maximum liquidation risk of $2.4 billion. From this perspective, it seems that very few users have the strength to match that. And for general market orders, it only requires a market counterpart to offset.

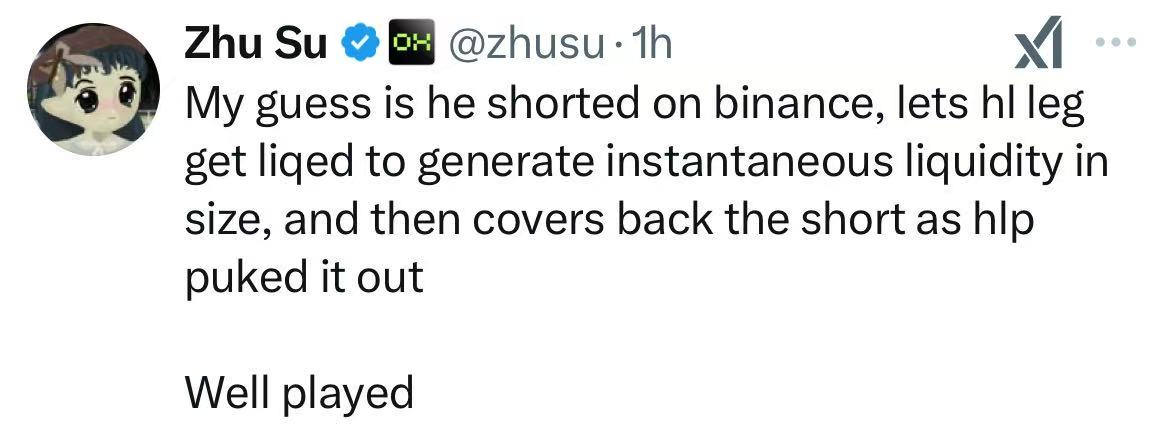

Looking back at the entire event, we can see that this whale may have conducted multiple tests before completing this operation. Zhu Su, co-founder of Three Arrows Capital, speculated that the reason this address could take such a large risk was that it was simultaneously shorting on Binance. This was equivalent to a hedged order status, and it was precisely because it discovered that Hyperliquid's mechanism during liquidation was different from that of centralized exchanges that it chose to proceed.

In reality, this operational method is not some miraculous innovation; as mentioned at the beginning, Livermore inadvertently achieved a similar effect over a hundred years ago. However, at that time, Livermore chose to go long and actively close positions for the survival of the market. In today's market, exchanges provide a safety net for such phenomena, allowing users to profit at the expense of the exchange. However, the space for such operational methods is likely to close once again, making it difficult for similar platforms to achieve comparable effects in the future.

For exchanges, this is yet another case of paying for lessons learned. For retail investors, such operations are merely fleeting moments, instances of discovering loopholes to gain profits, and do not possess replicable operational significance. They are just a topic of conversation in the midst of a dull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。