American users and the government have not benefited from airdrops.

It's 2025, have you ever made a significant profit from airdrops?

If you haven't, don't be too upset, because some people aren't even eligible to participate in airdrops—like our friends across the ocean in the United States.

A hard-to-believe fact is that the professional airdrop industry has flourished in the Chinese community, while in the U.S., due to regulatory restrictions, most crypto projects consider avoiding risks when formulating airdrop policies, excluding users from the U.S.

Now, with the U.S. government implementing various pro-crypto policies, the president taking various crypto-related actions, and more American companies accumulating Bitcoin, the U.S. has never had as much influence in the crypto market as it does today.

Changes in U.S. policy are also affecting the airdrop market landscape and providing references for innovation in other countries.

Against this backdrop, the well-known VC Dragonfly released the "Airdrop Status Report 2025", attempting to quantify the impact of U.S. policies on airdrops and the crypto economy through data and analysis.

Deep Tide TechFlow has distilled and interpreted the core viewpoints of this report, summarized as follows.

Key Conclusion: American users and the government have not benefited from airdrops

American users are limited by geographic restrictions:

Number of affected users: In 2024, approximately 920,000 to 5.2 million active American users (accounting for 5%-10% of U.S. cryptocurrency holders) were unable to participate in airdrops or use certain projects due to geographic restrictions.

Proportion of American users among global crypto addresses: In 2024, 22%-24% of global active crypto addresses belonged to American users.

Economic value of airdrops:

Total value of airdrops: Among 11 sample projects, the total value of airdrops was approximately $7.16 billion, with around 1.9 million global users participating, and the average median amount received per address was about $4,600.

Income loss for American users:

In 11 geographically restricted airdrop projects, the estimated income loss for American users was $1.84 billion to $2.64 billion (2020-2024).

According to an analysis of 21 geographically restricted airdrop projects by CoinGecko, the potential income loss for American users could reach $3.49 billion to $5.02 billion (2020-2024).

Tax revenue loss:

Personal tax revenue loss:

Federal tax revenue loss: approximately $418 million to $1.1 billion (2020-2024).

State tax revenue loss: approximately $107 million to $284 million.

Total tax revenue loss: approximately $525 million to $1.38 billion, not including capital gains tax revenue from token sales.

Corporate tax revenue loss:

- Due to the relocation of crypto companies, the U.S. has missed out on significant corporate tax revenue. For example, Tether (the issuer of USDT) had profits of $6.2 billion in 2024, which could have contributed approximately $1.3 billion in federal tax and $316 million in state tax if fully subject to U.S. tax regulations.

Impact of crypto companies relocating:

Cryptocurrency companies are choosing to register and operate overseas due to regulatory pressure, further exacerbating tax revenue losses in the U.S.

Tether is just one case illustrating the widespread negative impact of the industry's relocation on the U.S. economy.

Why are airdrops restricted in the U.S.?

The regulatory environment in the U.S. restricts the airdrop market due to regulatory uncertainty and high compliance costs. Here are the key reasons:

1. Ambiguous regulatory framework

U.S. regulatory agencies (such as the SEC and CFTC) tend to establish rules through enforcement actions rather than creating clear legal frameworks. This "enforcement-first" model makes it difficult for crypto projects to predict which actions are legal, especially for emerging models like airdrops.

2. Airdrops may be considered securities

Under U.S. securities law, the SEC determines whether an asset is a security through the Howey Test. The core of the Howey Test is:

Is there an investment of money?: Did the user invest money or other resources to obtain the asset?

Is there an expectation of profits?: Does the user expect to profit from the appreciation of the asset or the efforts of the project team?

Is there reliance on the efforts of others?: Are the profits primarily derived from the work of the issuer or a third party?

Is it a common enterprise?: Do investors share in the profits and risks?

Many airdrop tokens meet these criteria (e.g., users expect the tokens to appreciate), leading the SEC to classify them as securities. This means that project teams must comply with cumbersome registration requirements, or they may face hefty fines or even criminal liability. To avoid these risks, many projects choose to directly block U.S. users.

3. Complexity of tax policies

Current tax laws require users to pay income tax on the market value of tokens received during airdrops, even if the tokens have not been sold. This unreasonable tax burden, combined with subsequent capital gains taxes, further reduces American users' willingness to participate in airdrops.

4. Widespread geographic blocking

To avoid being deemed as offering unregistered securities to U.S. users, many projects choose to geographically block American users. This strategy not only protects the project teams but also reflects the stifling effect of the U.S. regulatory environment on innovation.

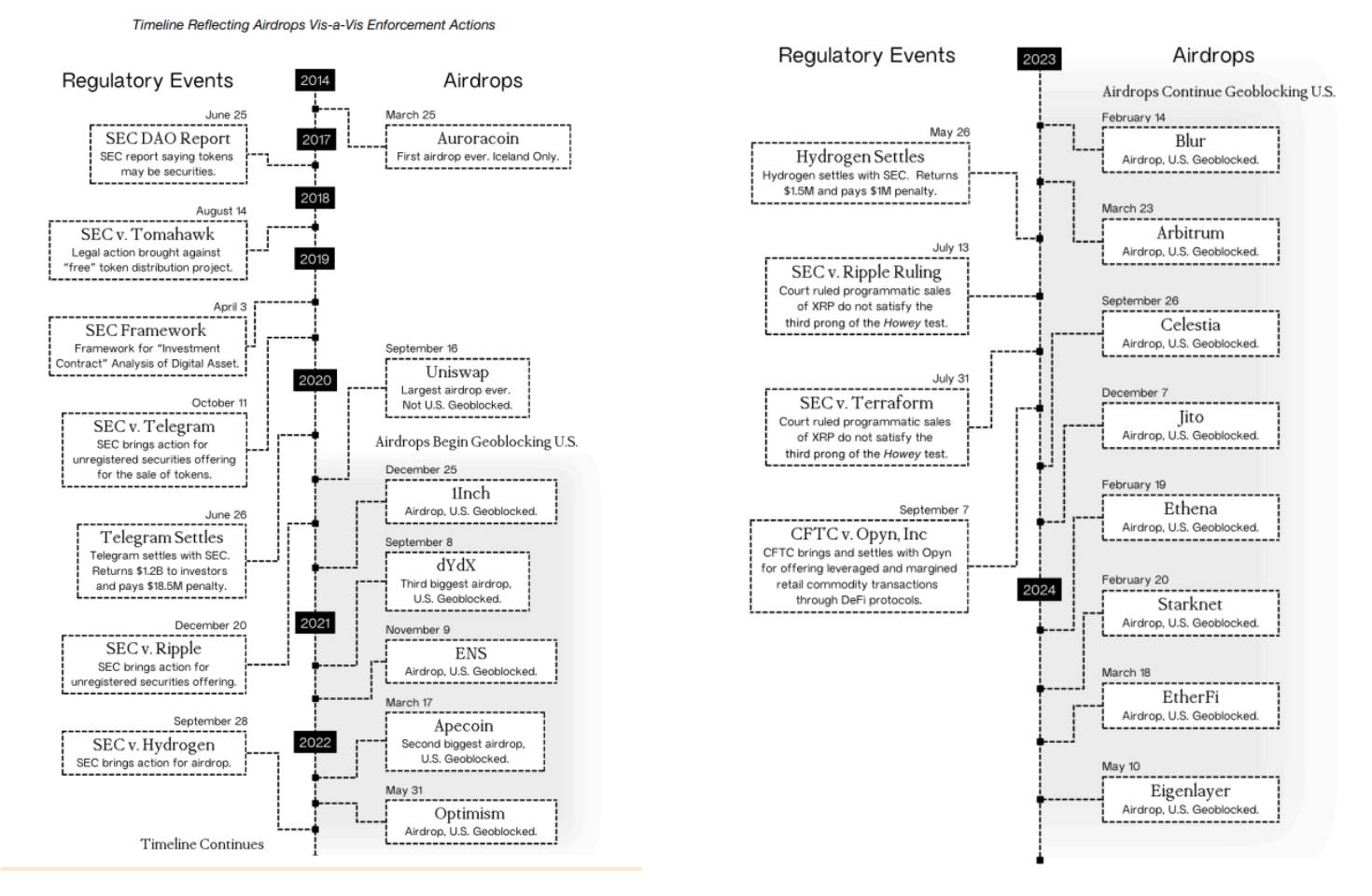

At the same time, the report also meticulously outlines the changes in U.S. crypto regulatory policies regarding airdrops over time and key events where significant projects were excluded from the U.S.

How do crypto projects block U.S. users?

These measures are aimed at protecting their compliance and avoiding penalties for unintentional violations. Here are common blocking methods:

1. Geoblocking

Geoblocking sets virtual boundaries to restrict users from specific regions from accessing services or content. Projects typically use users' IP addresses, DNS service countries, payment information locations, and even language settings during online shopping to determine users' locations. If a user is identified as being from the U.S., access will be blocked.

2. IP Address Blocking

IP blocking is one of the core technologies of geoblocking. Every internet device has a unique IP address, and when a user attempts to access a platform, the system will block IP addresses marked as American through a firewall.

3. VPN Blocking

Virtual Private Networks (VPNs) can hide users' real IP addresses to protect privacy, but project teams also monitor traffic from VPN servers. If a particular IP address shows unusually high access volume or diverse activities, the platform may block these IP addresses to prevent U.S. users from bypassing restrictions via VPN.

4. KYC (Know Your Customer) Verification

Many platforms require users to complete KYC processes, submitting identity information to confirm their non-American status. Some projects even require users to declare their non-American status through wallet signatures. This method is not only used to prevent illegal financing and money laundering but has also become an important means of blocking U.S. users.

5. Explicit legal statements

Some projects explicitly state in their airdrop or service terms that U.S. users are not allowed to participate. This "good faith effort" aims to show that the project team has taken measures to limit U.S. users, thereby reducing legal liability.

Although project teams strive to block U.S. users, U.S. regulatory agencies (such as the SEC and CFTC) have not provided clear compliance guidance, leading project teams to lack a clear understanding of what constitutes "sufficient blocking measures."

Blocking measures also increase operational costs and compliance risks. For example, relying on third-party geoblocking services (like Vercel) may lead to compliance risks due to data errors, with the responsibility ultimately resting with the project team.

What is the economic impact of the absence of U.S. users in crypto airdrops?

How significant is the economic loss caused by U.S. policy restrictions?

To quantify the impact of geographic blocking policies on U.S. residents' participation in cryptocurrency airdrops and assess the broader economic consequences of these policies, the report analyzes and estimates the number of U.S. cryptocurrency holders, evaluates their participation in airdrops, and defines the potential economic and tax losses due to geographic blocking.

Specifically, the report selected 11 geographically restricted airdrop projects and 1 non-geographically restricted airdrop as a comparison, conducting in-depth data analysis based on the number of participants and economic value.

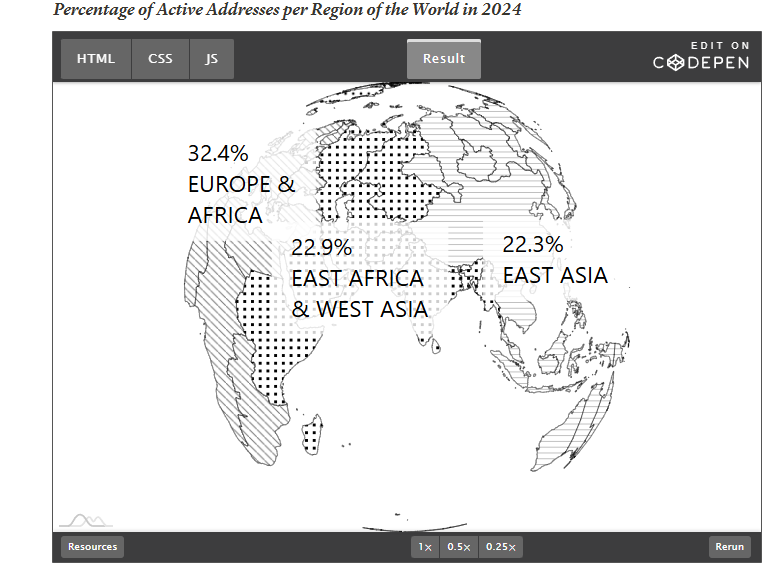

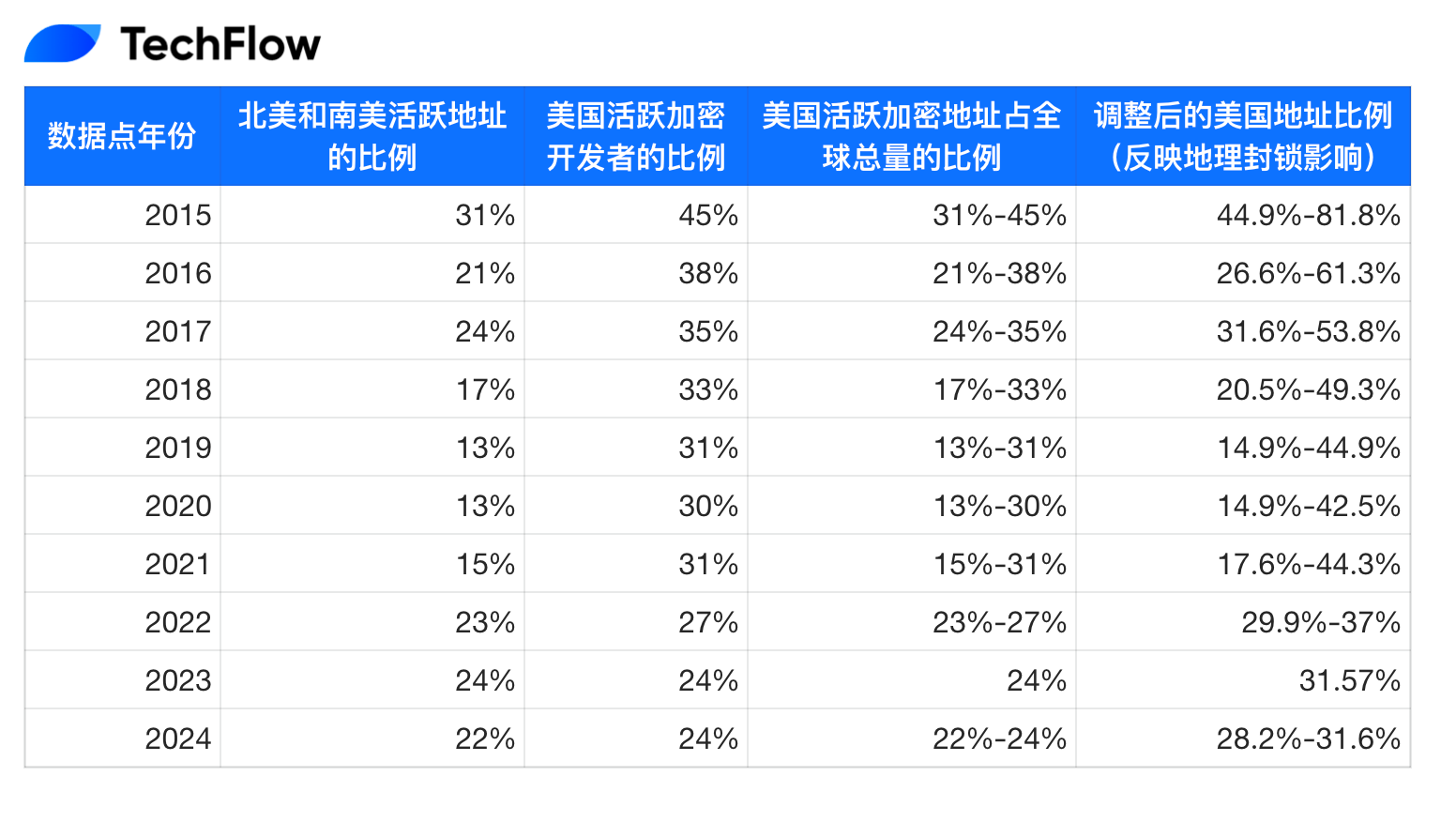

1. Participation rate of American users in crypto

In the U.S., among an estimated 18.4 million to 52.3 million cryptocurrency holders, there are approximately 920,000 to 5.2 million active American users each month in 2024, who are affected by geographic restriction policies, including limited participation in airdrops and project usage.

Data Points Year

Proportion of active addresses in North America and South America

Proportion of active crypto developers in the U.S.

Proportion of active crypto addresses in the U.S. compared to the global total

Adjusted proportion of U.S. addresses (reflecting the impact of geographic blocking)

2015

31%

45%

31%-45%

44.9%-81.8%

2016

21%

38%

21%-38%

26.6%-61.3%

2017

24%

35%

24%-35%

31.6%-53.8%

2018

17%

33%

17%-33%

20.5%-49.3%

2019

13%

31%

13%-31%

14.9%-44.9%

2020

13%

30%

13%-30%

14.9%-42.5%

2021

15%

31%

15%-31%

17.6%-44.3%

2022

23%

27%

23%-27%

29.9%-37%

2023

24%

24%

24%

31.57%

2024

22%

24%

22%-24%

28.2%-31.6%

(Original image from the report, compiled by Deep Tide TechFlow)

As of 2024, it is estimated that 22% to 24% of globally active crypto addresses belong to U.S. residents.

The total value generated from our sample of 11 projects is approximately $7.16 billion, with about 1.9 million participants globally in the airdrop, and the average median value received per eligible address is about $4,600.

The table below breaks down the amounts by project name.

Project Name

Geographic Blocking

Airdrop Date

Total Amount Received (USD)

Total Global Addresses Received

Median Amount Received per Eligible Address (USD)

Uniswap

No

2020/9/16

$670,104,171

221,288

$1,660

1inch

Yes

2020/12/25

$218,694,309

43,867

$1,654

Blur

Yes

2023/2/14

$265,174,361

124,631

$216

EigenLayer

Yes

2024/5/10

$645,390,084

232,366

$441

EtherFi

Yes

2024/3/18

$168,916,075

87,239

$637

Arbitrum

Yes

2023/3/23

$1,394,397,547

583,137

$1,787

Ethena

Yes

2024/2/19

$263,016,409

46,081

$72

Optimism

Yes

2022/5/31

$97,545,754

160,603

$388

ApeCoin

Yes

2022/3/17

$1,727,906,315

15,068

$38,760

DYDX

Yes

2021/9/8

$1,298,499,297

47,610

$2,576

ENS

Yes

2021/11/9

$838,394,931

102,821

$6,424

LayerZero

Yes

2024/6/20

$192,156,964

741,986

$130

Total

$7,156,572,098

1,857,901

$4,562 (Average Median)

(Original image from the report, compiled by Deep Tide TechFlow)

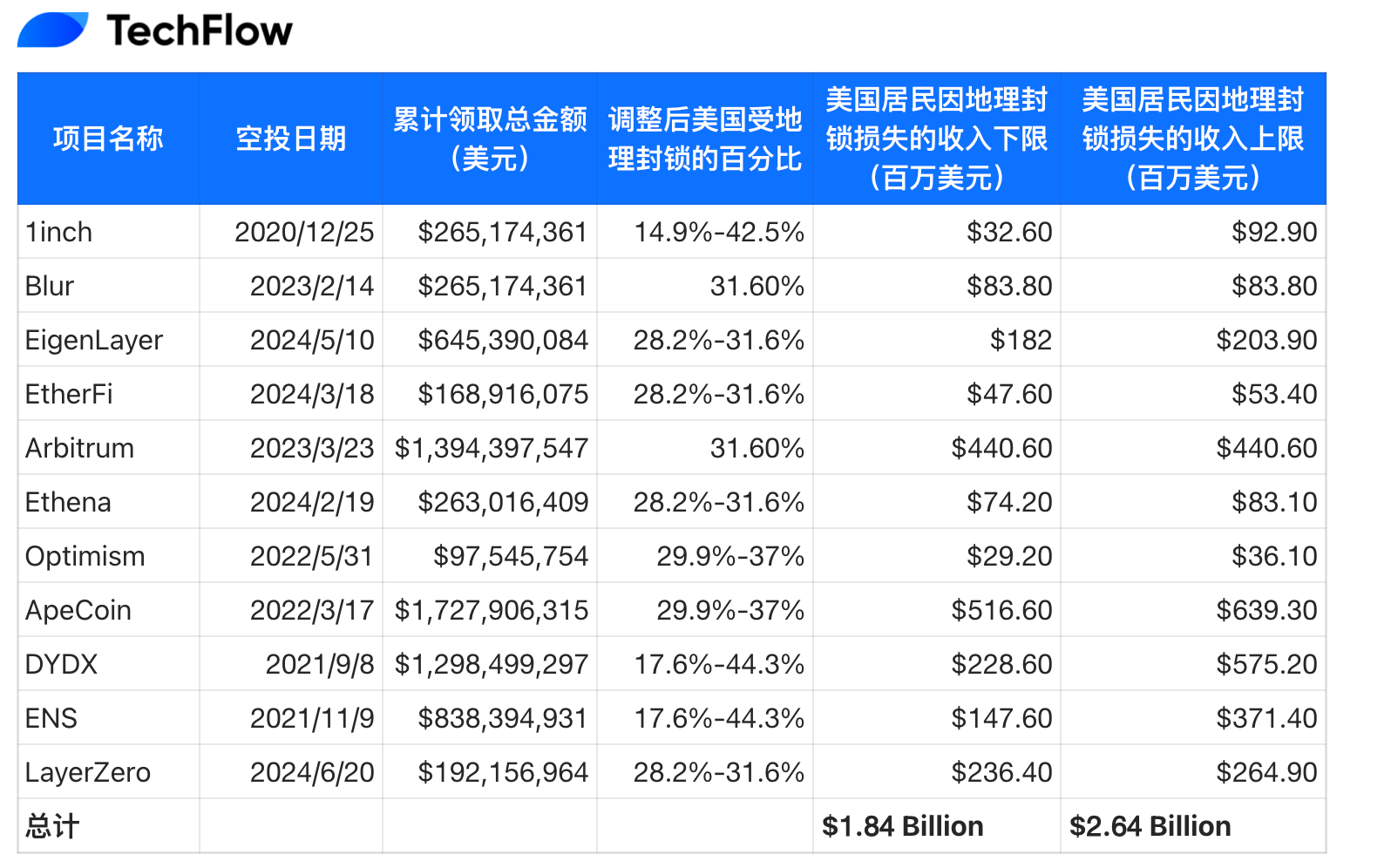

2. Losses for American Users Not Participating in Airdrops

Project Name

Airdrop Date

Total Amount Received (USD)

Adjusted Percentage of U.S. Residents Affected by Geographic Blocking

Lower Bound of Income Loss for U.S. Residents Due to Geographic Blocking (Million USD)

Upper Bound of Income Loss for U.S. Residents Due to Geographic Blocking (Million USD)

1inch

2020/12/25

$265,174,361

14.9%-42.5%

$32.60

$92.90

Blur

2023/2/14

$265,174,361

31.60%

$83.80

$83.80

EigenLayer

2024/5/10

$645,390,084

28.2%-31.6%

$182

$203.90

EtherFi

2024/3/18

$168,916,075

28.2%-31.6%

$47.60

$53.40

Arbitrum

2023/3/23

$1,394,397,547

31.60%

$440.60

$440.60

Ethena

2024/2/19

$263,016,409

28.2%-31.6%

$74.20

$83.10

Optimism

2022/5/31

$97,545,754

29.9%-37%

$29.20

$36.10

ApeCoin

2022/3/17

$1,727,906,315

29.9%-37%

$516.60

$639.30

DYDX

2021/9/8

$1,298,499,297

17.6%-44.3%

$228.60

$575.20

ENS

2021/11/9

$838,394,931

17.6%-44.3%

$147.60

$371.40

LayerZero

2024/6/20

$192,156,964

28.2%-31.6%

$236.40

$264.90

Total

$1.84 Billion

$2.64 Billion

(Original image from the report, compiled by Deep Tide TechFlow)

Based on the airdrop data in the table above, it is estimated that U.S. residents missed out on potential income of $1.84 billion to $2.64 billion from the sample group between 2020 and 2024.

- ### Tax Revenue Loss

Due to airdrop restrictions, the estimated tax revenue loss from 2020 to 2024 ranges from $1.9 billion (the lower limit estimated from the report sample) to $5.02 billion (the upper limit estimated from other CoinGecko studies).

The corresponding federal tax revenue loss calculated using individual tax rates is expected to be between $418 million and $1.1 billion, in addition to state tax revenue losses estimated to be around $107 million to $284 million. Overall, the total tax revenue loss in the U.S. over these years is estimated to be between $525 million and $1.38 billion.

Offshore Losses: In 2024, Tether reported profits of $6.2 billion, surpassing traditional financial giants like BlackRock. If Tether were headquartered in the U.S. and subject to full U.S. taxation, this profit would incur a 21% federal corporate tax, estimated at $1.3 billion in federal taxes. Additionally, considering the average state corporate tax rate of 5.1%, it is expected to generate $316 million in state taxes. In total, the potential tax loss due to Tether's offshore status could be around $1.6 billion annually.

- ### Crypto Companies Leaving the U.S.

Some companies have completely exited the U.S., such as:

Bittrex: It shut down its U.S. operations, citing "regulatory uncertainty" and an increase in enforcement actions, particularly from the SEC, which made it "impractical" to operate in the U.S.

Nexo: After 18 months of unproductive dialogue with U.S. regulators, it gradually phased out its products and services in the U.S.

Revolut: This UK-based fintech company suspended cryptocurrency services for U.S. customers due to changes in the regulatory environment and ongoing uncertainty in the U.S. crypto market.

Other companies are preparing for the worst-case scenario (i.e., lack of regulatory clarity and ongoing enforcement) and are beginning to establish operations overseas or shift focus to non-U.S. consumers. These companies include:

Coinbase: As the largest crypto exchange in the U.S., it has opened operations in Bermuda to take advantage of a more favorable regulatory environment.

Ripple Labs: After a lengthy legal battle with the SEC, as of September 2023, 85% of job openings are for overseas personnel, and by the end of 2023, the proportion of U.S. employees is expected to drop from 60% to 50%.

Beaxy: After the SEC sued the company and its founder Artak Hamazaspyan for operating an unregistered exchange and brokerage in March 2023, the exchange announced it would suspend operations due to the surrounding uncertain regulatory environment.

Some candid suggestions

Establish a "Safe Harbor" mechanism for cryptocurrency airdrops (Airdrops) for non-financing purposes:

Issuers must provide detailed information on token economics (such as supply, distribution methods), governance mechanisms, potential risks, and any usage restrictions.

Insiders must adhere to a lock-up period of at least three months to prevent insider trading or front-running profits.

Tokens can only be distributed through non-monetary contributions (such as services, participation in network activities, or prior holding qualifications); direct monetary transactions will disqualify their safe harbor status.

Expand the applicability of Rule 701 of the U.S. Securities Act to participants on technology platforms, particularly for cryptocurrency tokens distributed through airdrops or service compensation.

Align the tax treatment of cryptocurrency airdrops with the tax rules for credit card rewards or promotional gift cards to ensure fairness and reasonableness.

Airdropped tokens should not be considered taxable income upon receipt.

Taxes should be levied when the tokens are sold or exchanged for other assets, as this is when the tokens possess liquidity and have quantifiable market value.

Utilize the unique opportunity for regulatory innovation presented by the political transition period during election cycles.

The SEC should establish clear rules defining when digital assets are considered securities; abandon strategies of "regulatory enforcement" and "regulatory intimidation," and shift towards formal rule-making. Provide clear compliance guidance to help crypto startups innovate with peace of mind.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。