Let the past be handled by time, and leave the future to be proven by time. What we really need to do is to seize the present. What gives a sense of security today is nothing more than a fully charged phone and sufficient balance when going out. Time is passing, age is increasing, we understand more and see through things, yet happiness seems to have decreased. You and I both miss those years when I prompted and you executed, the simple trading times when we made profits without a care.

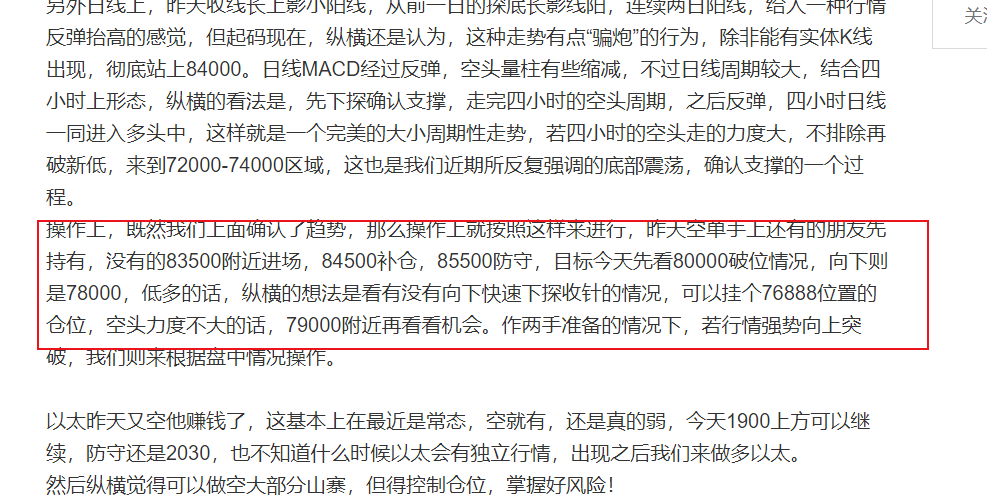

What can we say about yesterday's market? We still predicted the trend correctly, but the strength was somewhat lacking. Last night, the market peaked around 83,800, then began to decline. By early morning, it had just dipped below the 80,000 mark, but quickly recovered and started to oscillate and rebound, currently hovering around 82,000. In terms of operations, we can say yesterday was quite perfect; choosing to enter around 83,500 was basically the best position yesterday, with multiple entry opportunities provided. If you still say you didn't catch up, then there's nothing we can do. Ultimately, we successfully reached the first take-profit target near 80,000, making a profit of over 3,000 points. However, the bears did not manage to continue expanding afterward, and our theme yesterday was to short first and then go long, but we didn't catch the low long, missing some continuation of the bearish trend.

Returning to today, we are still looking at the four-hour chart. Yesterday, we particularly emphasized the four-hour structural pattern. Compared to today, if the market had broken below 80,000 in the early morning and continued downward, the four-hour chart indicators might have changed. However, the subsequent oscillation and recovery made the chart not much different from yesterday. Currently, it seems that there is still a bearish expectation in the four-hour chart because it didn't completely drop in the early morning, and the bearish volume has not been fully released. At the same time, the current rebound strength is indeed not strong. We mentioned yesterday that the issue of decline and exhaustion is present; the bulls are currently in this situation. If it had dropped yesterday, the bulls would have rebounded sooner. Moreover, the four-hour pattern is increasingly indicating a head and shoulders formation, and at a glance, the bears still dominate the current situation.

On other timeframes, the daily chart is still in a bearish adjustment cycle. Yesterday's candlestick formed a gravestone doji, and the closing was poor. Looking at smaller timeframes, the one-hour chart is currently in a rebound, but the MACD lines are weakening below the zero axis, showing insufficient strength during the rebound cycle, with no reversal signs. The RSI indicator is neutral to weak, without forming a divergence structure, and the moving average system shows a clear bearish arrangement.

In summary, in terms of operations, we should short, entering around 82,500. For more aggressive traders, entering above 82,000 is fine, with a supplementary position at 83,500, defending at 84,200, and targeting 78,000. If the bears are strong, then look for new lows in the 72,000-74,000 range!

As for Ethereum, I can only say I haven't incurred losses in Ethereum trading for a long time. I don't know whether to be relieved or what. However, it seems that the downward pressure on Ethereum yesterday was much less. According to past trends, with Bitcoin's drop yesterday, Ethereum would have dropped even more. Perhaps it won't be long before Ethereum starts to move independently? Today, Ethereum is more stable, shorting around 1,930, with a supplementary position at 2,030, defending at 2,060, and targeting new lows!

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

Scan to follow!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。