Original Title: Yields Opportunities in a Risk-off Environment

Original Author: @ClBlockchain, crypto writer

Original Compilation: zhouzhou, BlockBeats

Editor's Note: This article introduces various opportunities to earn yields by providing liquidity in the current risk-off environment, covering on-chain strategies such as Sonic, Arbitrum, and Hyperliquid. This includes Shadow (Sonic's main DEX) earning high APR and Sonic Points through liquidity provision, Rings Protocol x Pendle earning stable yields through scUSD, Pear Protocol (Arbitrum) obtaining high funding rates through reverse trading, and Harmonix (Hyperliquid) engaging in low-risk arbitrage through the HYPE Delta-neutral vault.

The following is the original content (reorganized for readability):

Since the November 2024 elections, the crypto market has dropped about 25% from its peak of $3.7 trillion, with a total market cap of $2.76 trillion as of March 10, 2025. The market is clearly in a risk-averse mode. In this environment, stablecoins, delta-neutral products, and yield farming typically attract more attention and users.

Here are some innovative yield opportunities on different public chains; yes, we still love point rewards.

Yield Farming on Sonic

@ShadowOnSonic

Shadow is the core decentralized exchange on Sonic, utilizing a concentrated liquidity mechanism to provide users with high annualized returns. Its main strategy is to provide liquidity on S and staked S (with almost no impermanent loss) and hedge risks through shorting.

Expected Returns:

30-80% APR (liquidity provision yields)

Sonic Points Rewards

Pros and Cons:

High APR (considerable liquidity mining yields)

Requires active management of liquidity

Steps to Operate:

Buy S and convert part of it to stS via beets.fi (the ratio depends on the liquidity range).

Open a 1x short position on @HyperliquidX or @vertex_protocol to hedge against price volatility.

@RingsProtocolx@pendlefi

Rings offers scUSD, a yield-bearing stablecoin backed by USDC and ETH. The strategy is to mint scUSD and earn yields through its vault while passively earning Sonic Points by holding scUSD or providing liquidity on @pendle_fi for additional yields.

Pros and Cons:

No active management required

Pendle has performed well in the past

Must trust Rings' stablecoin and Veda vault

Steps to Operate:

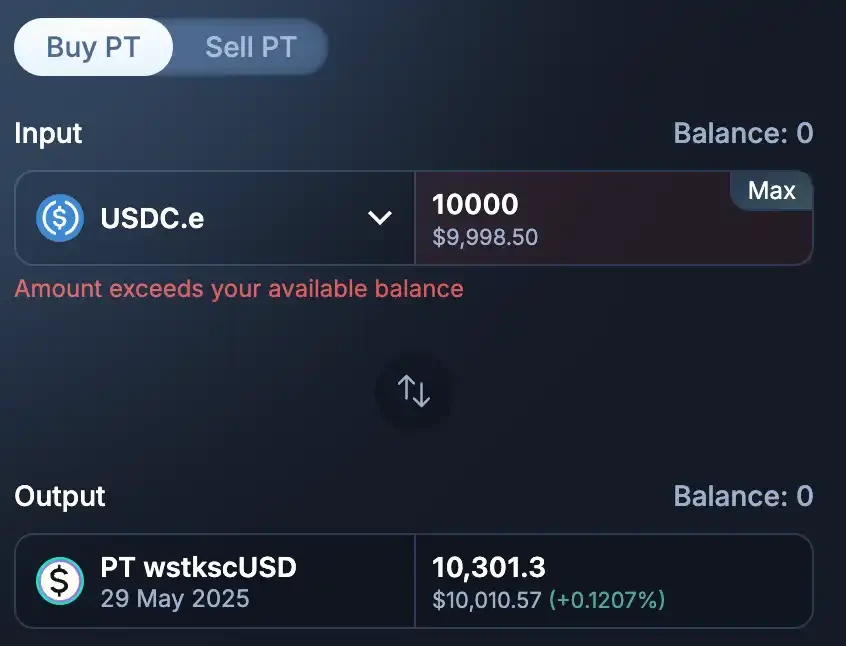

Mint scUSD by collateralizing stablecoins on Rings.

Stake scUSD to earn 5% yield + Sonic Points.

On Pendle:

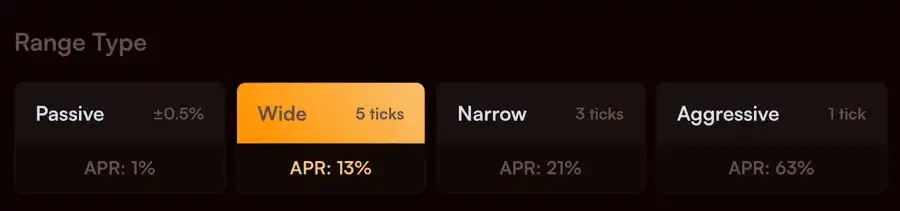

- Buy wstkscUSDPT, enjoy 13.75% APR, and hold until maturity (May 29, 2025).

Yield Farming on Arbitrum

@Pear_Protocol

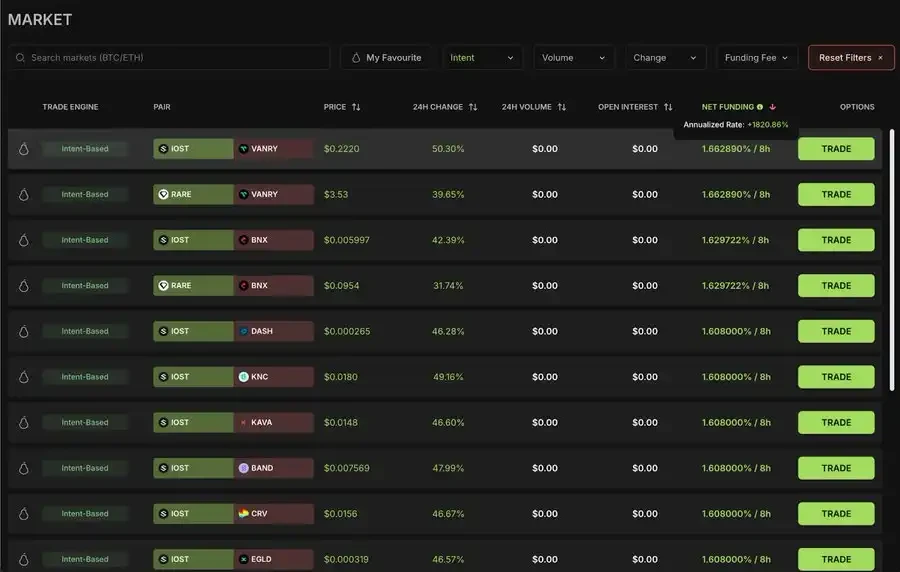

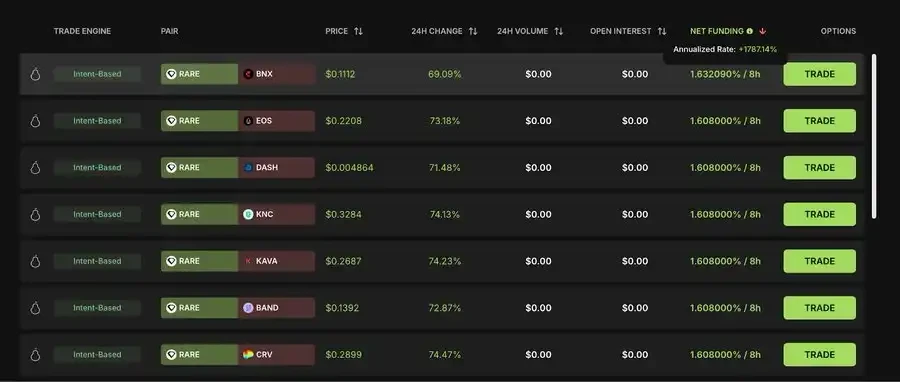

PearProtocol recently launched a new feature—Market Page, designed to discover trading opportunities and filter the most attractive funding rate opportunities from thousands of trading pairs.

Core Strategy: Reverse Trading to Earn Funding Rates

The core idea of this strategy is "reverse operation to earn market sentiment premiums." Opportunities arise from trading setups that are contrary to market sentiment:

Go long on assets that are heavily shorted in the market

Go short on assets that are heavily longed in the market

Considering that the market often accompanies open interest liquidations, this strategy is reasonable. However, it requires active management of positions, monitoring whether the net funding rate is favorable, and whether the 24-hour funding rate changes are positive.

Pros and Cons:

Can earn high funding rate rewards

Suitable for mean-reversion trading strategies

Requires active management of positions

Higher risk

Steps to Operate:

Enter the Market Page

Filter by net funding rate to find the best trading opportunities

With some research, you can discover quality trading opportunities.

Yield Farming on Hyperliquid

@harmonixfi

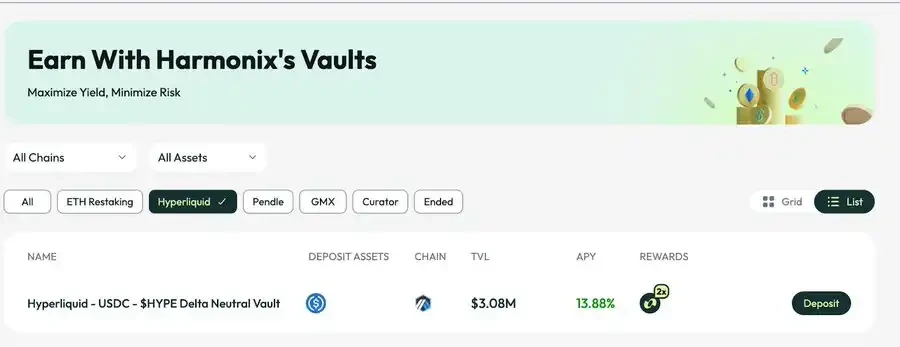

Harmonix has now launched the HYPE "DeltaNeutral" vault, where users can deposit USDC to earn yields while also earning Hyperliquid Points and Harmonix Points.

This vault generates returns through funding rate yields:

Half of the deposits are used to purchase Hyperliquid's native token HYPE

The other half simultaneously opens a short position in HYPE for hedging

This is a delta-neutral strategy that allows for risk-free exposure to the Hyperliquid ecosystem, but the HYPE funding rate may change at any time, so the overall risk is moderate.

Pros and Cons:

Higher yields while positioning in the HL ecosystem

Requires weekly monitoring of funding rate changes

Steps to Operate:

Enter the Harmonix platform: https://app.harmonix.fi

Select USDC/Hyperliquid vault

Deposit USDC to complete the operation

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。