Although it is said that whether or not it is a bull market is not important, from the perspective of the economic cycle, it indeed does not belong to the traditional sense of a bull market. This has little to do with Bitcoin rising from $16,000 to $100,000. The main factors of a bull market are:

A monetary easing environment

Near-zero low interest rates

Quantitative easing and/or balance sheet expansion

The economy is developing positively

A decline in the dollar index

Government policy stimulation

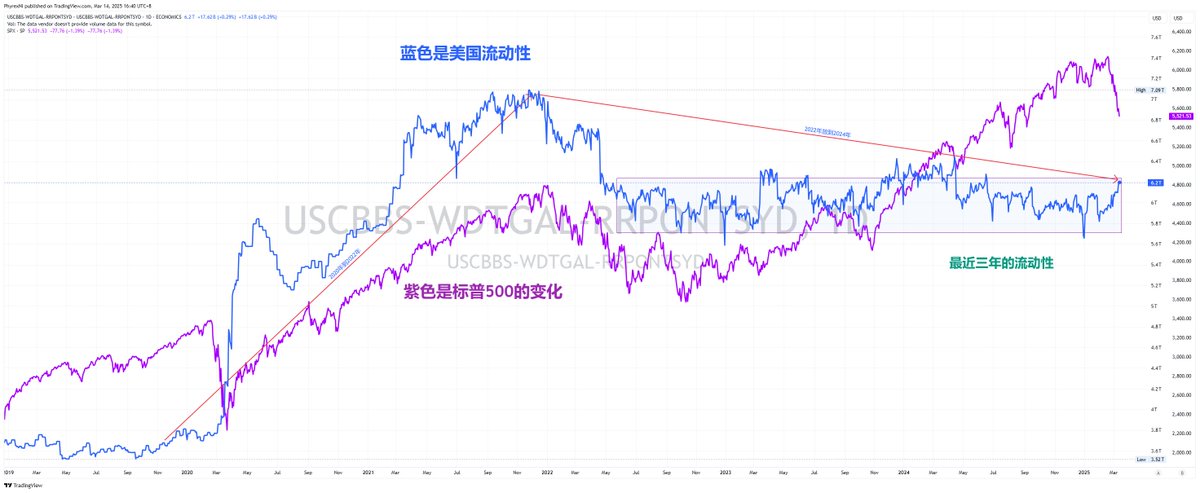

The essence of these six points is the stimulation of liquidity, meaning that the "water" in the market is abundant, rather than a reduction in market funds. At the same time, due to the decline in the dollar index, more investors will increase their risk appetite and be willing to invest in high-risk assets.

Zero interest rates are often accompanied by abundant liquidity and policy easing, such as balance sheet expansion. Therefore, during such times, the stimulation for risk markets is significant. For example, 2021 was such a case, marked by unprecedented monetary easing, which drove the overall rise of U.S. stocks and cryptocurrencies.

I know many friends disdain lengthy discussions, believing that anything without a bullish or bearish stance is nonsense, but in reality, this is economics. It may be obscure and may contradict some intuitive feelings, but the facts are indeed so.

As for whether it is a bull market, my opinion does not count; you can judge for yourself. If you think it is, then it is; if you think it is not, then it is not. It has nothing to do with me.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。