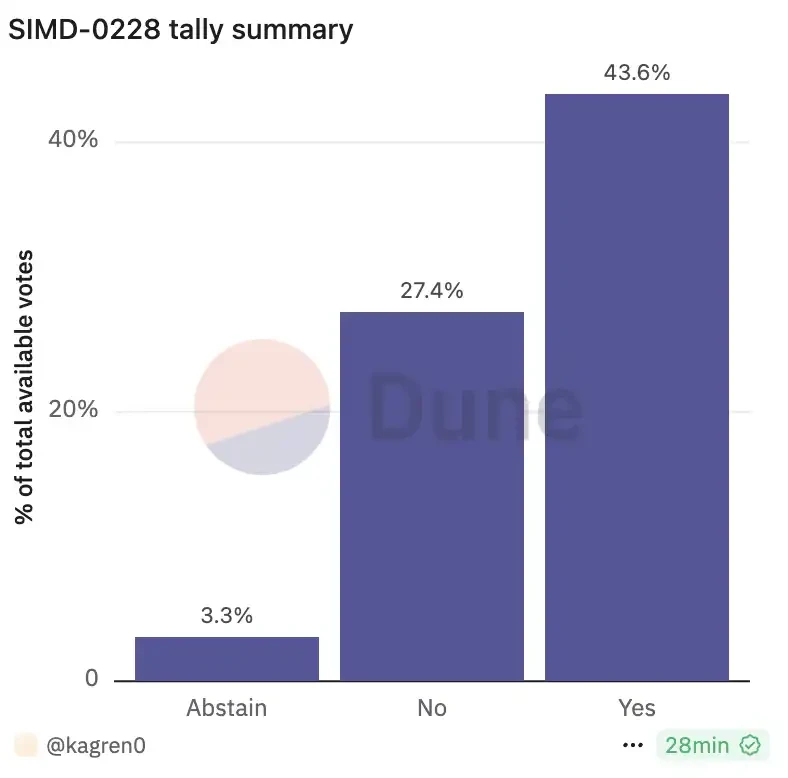

On the morning of March 13, the Solana community welcomed a highly anticipated voting result: the SIMD-0228 proposal failed to pass with 43.6% of the votes in favor, falling short of the required two-thirds majority. This proposal was introduced by Multicoin Capital in January of this year, aiming to adjust the inflation model of SOL from a fixed pattern to a dynamic one. The proposal set a target staking rate of 50% to enhance network security and decentralization. If the staking rate exceeds 50%, the issuance will decrease to curb further staking; if it falls below 50%, the issuance will increase to encourage staking. The inflation rate will fluctuate between 0% and the maximum value based on the current issuance curve. Currently, Solana's inflation mechanism is fixed, with a constant issuance rate of SOL rewards for staking. If the proposal had passed, the inflation rate would have been adjusted according to market dynamics. According to Coin Metrics, as of February, Solana's inflation rate was 4%, down from the initial 8%, but still far above the terminal target of 1.5%, currently declining at a rate of 15% per year.

In short, this proposal originally hoped to lower the inflation rate by adjusting the issuance method of SOL tokens, making the network economy healthier. After the results were announced, discussions on the X platform quickly heated up, with voices of both supporters and opponents rising.

What does the community think?

With the failure of the SIMD-0228 proposal, some users, such as @Airdrop_Guard, interpreted the result as "a repeated failure of retail uprising against capitalists." On the eve of the vote, supporters of the proposal were hopeful, believing that this reform could bring a turning point for Solana. He pointed out that the current annual inflation rate of the Solana network is 4.91%, with 28 million new SOL tokens added each year, which, at current market prices, translates to an increase of $3.46 billion in selling pressure. The introduction of the SIMD-0228 proposal was precisely to address this issue by dynamically adjusting the inflation rate, but unfortunately, this compromise failed to gain sufficient support and was ultimately not implemented.

Others who supported the SIMD-0228 proposal also believed that lowering inflation was an excellent opportunity to make SOL more valuable. Helius Labs founder @0xMert_ called for support for the proposal from a long-term perspective: "This is for the health and future of the network; we cannot miss this opportunity."

Supporters believe that if the proposal passes, SOL will not only attract more investors but also solidify Solana's position in the blockchain world. They see SIMD-0228 as an economic "booster" that would make Solana stronger. X user @Web3Precious stated: "Reducing inflation equals a scarcer SOL, which is more valuable for us stakers." In his view, the current fixed issuance is like constantly "printing money," while the new model could make the network more efficient and competitive.

Opponents of the proposal breathed a sigh of relief. Their main concern was that if the SIMD-0228 proposal passed, although it superficially lowered inflation, it might sacrifice Solana's core advantage—decentralization. @solblaze_org had repeatedly voiced warnings on X, stating: "This proposal could destroy Solana's decentralization; we must oppose it!" His reasoning was that reducing staking rewards would make it difficult for small validators to survive, ultimately leading to the concentration of network power in the hands of a few large players.

@David_Grid also expressed similar concerns: "What about small validators? They are the foundation of the network." Opponents of the proposal believe that SIMD-0228 could make Solana more like a "rich man's club," contradicting the original intention of equal participation in blockchain. Others questioned the timing and details of the proposal, arguing that implementing it now carries too much risk and could bring unpredictable shocks to the DeFi ecosystem.

Who is pushing, and who is resisting?

The core of the SIMD-0228 proposal is straightforward: to change the issuance rules of SOL tokens from a fixed schedule to a flexible, market-demand-based model. Specifically, it aims to adjust the issuance based on the staking participation rate, significantly reducing the annual inflation rate from the current 4.5% to 0.87% or even lower. Supporters believe this will make SOL scarcer, stabilize its price, and ultimately enhance the value of the entire network. In simple terms, it aims to transform SOL from a "money printing machine" into an asset more akin to "hard currency."

Related reading: "Can Solana's inflation model modification proposal boost SOL prices further?"

So the question arises: why is there such a significant divide over a proposal that seems so inclusive? Former Solana Foundation member @bennybitcoins pointed out that the main conflict lies in the interests of large validators versus small validators.

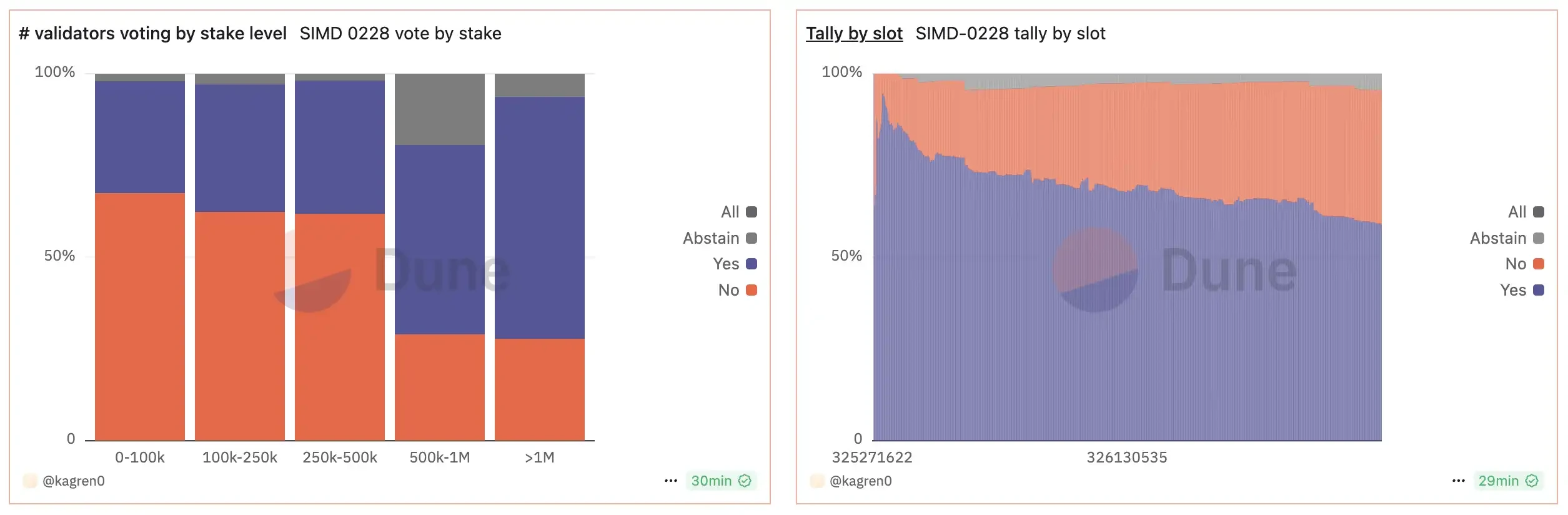

According to @wublockchain12's analysis, in this SIMD-0228 vote, over 60% of validators with a staking amount of less than 500k SOL voted against it; among validators with a staking amount between 500K and 1M, over 51% voted in favor, but nearly 20% abstained; among validators with a staking amount over 1M, nearly 66% voted in favor. Since the voting rules require that the proportion of votes in favor must reach two-thirds of the total votes (in favor + against), even if the large validator group tends to support it, it ultimately did not reach the threshold for passing.

From the voting results, those supporting the proposal often include investors and institutions holding large amounts of SOL, who hope to enhance token value by lowering inflation and gain greater returns. Some large staking pools and foundation members may see this as an opportunity to drive up SOL prices, attracting more external capital into the Solana ecosystem. Additionally, large validators have advantages in "transaction fees + MEV" income, so the reduction in staking rewards may not significantly impact their revenue.

The opposing camp is more composed of small validators and developers of DeFi projects. Small validators may have a relatively high proportion of staking rewards in their income structure of "staking rewards + transaction fees + MEV," and a reduction in staking rewards would significantly impact their income, potentially making it difficult to cover node operating costs, ultimately pushing them out of the network. The DeFi community is also concerned that inflation adjustments could affect liquidity and user participation, weakening the vitality of the ecosystem.

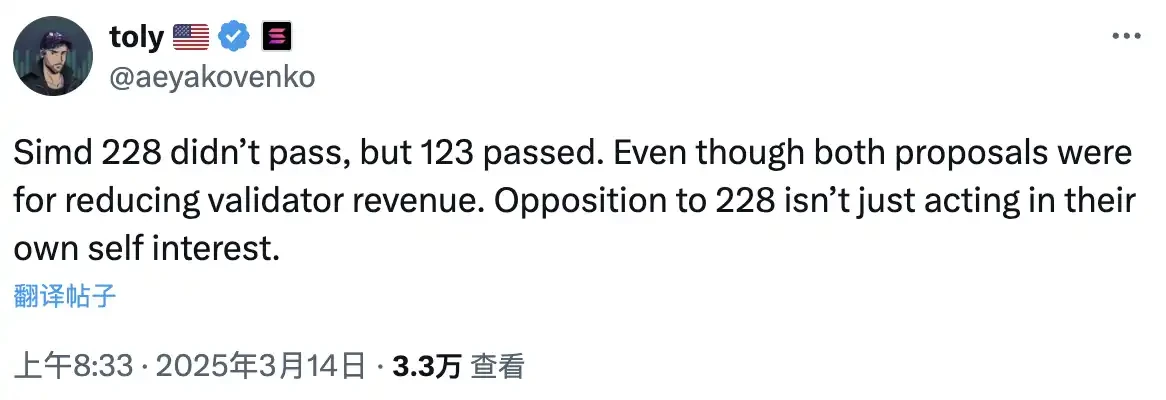

However, Solana co-founder toly stated that while SIMD-0228 did not pass, SIMD-0123 did pass, and since both proposals aim to reduce validator income, "opposing 228 is not just for the interests of their respective camps."

Moreover, the stance of the Solana Foundation has also drawn attention. Foundation chair Lily Liu had previously publicly stated that the proposal was not mature enough and could affect SOL's asset growth. She preferred to maintain a fixed yield to reduce market volatility. As of the time of writing, the Solana Foundation has not made a clear statement regarding the voting results.

Despite the sharply contrasting views, this vote showcased the vitality of the Solana community. A participation rate of up to 74% demonstrated the cohesion of the Solana community, with almost no one willing to stand on the sidelines, which itself indicates the importance everyone places on the future of the network. As @Mable_Jiang said, "The active participation and intense debate among community members over the past few days have been very touching and surprising—this is exactly what healthy governance of an open public blockchain should look like. For example, community leaders like @calilyliu and @aeyakovenko have different views on the proposal, but they can still express their opinions 100% faithfully without worrying too much about political factors. Believe it or not, this is by no means taken for granted; it requires slowly cultivating a culture within the community."

Perhaps the failed vote on SIMD-0228 is not the end but rather a new starting point. Supporters may continue to push for similar reforms, while opponents will more firmly defend the principles of decentralization. Every debate within the community is sketching a clearer outline for Solana's future, and this spirit of open dialogue and participation may be Solana's most valuable asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。