From Bitcoin to Altcoins, valuation is complex, and market sentiment and service value determine long-term potential.

Author: ggrow

Translated by: Baihua Blockchain

When discussing cryptocurrencies, people often focus more on the dramatic price fluctuations rather than the underlying technology. While I am reluctant to focus solely on price volatility, it is still necessary to explore this topic and analyze the reasons behind price fluctuations as a cautionary point. The following is the main text:

01 Valuation of Cryptocurrencies

The valuation process of cryptocurrencies like Bitcoin is very complex, similar to commodities like gold or silver. Factors such as scarcity, circulation, and supply-demand relationships are crucial. Additionally, unique factors such as adoption rates, regulatory policies, and user bases can also affect the value of Bitcoin and other cryptocurrencies.

1. Scarcity

The total supply of Bitcoin is capped at 21 million coins, making it similar to precious metals where scarcity is a key factor in valuation.

2. Circulation

As of the writing of this article, approximately 19 million of the 21 million Bitcoins have been mined. The remaining Bitcoins will be gradually released through mining, a process influenced by computing power and halving cycles. Halving occurs approximately every four years and reduces miners' rewards, increasing the cost and difficulty of generating new Bitcoins.

Halving and Costs

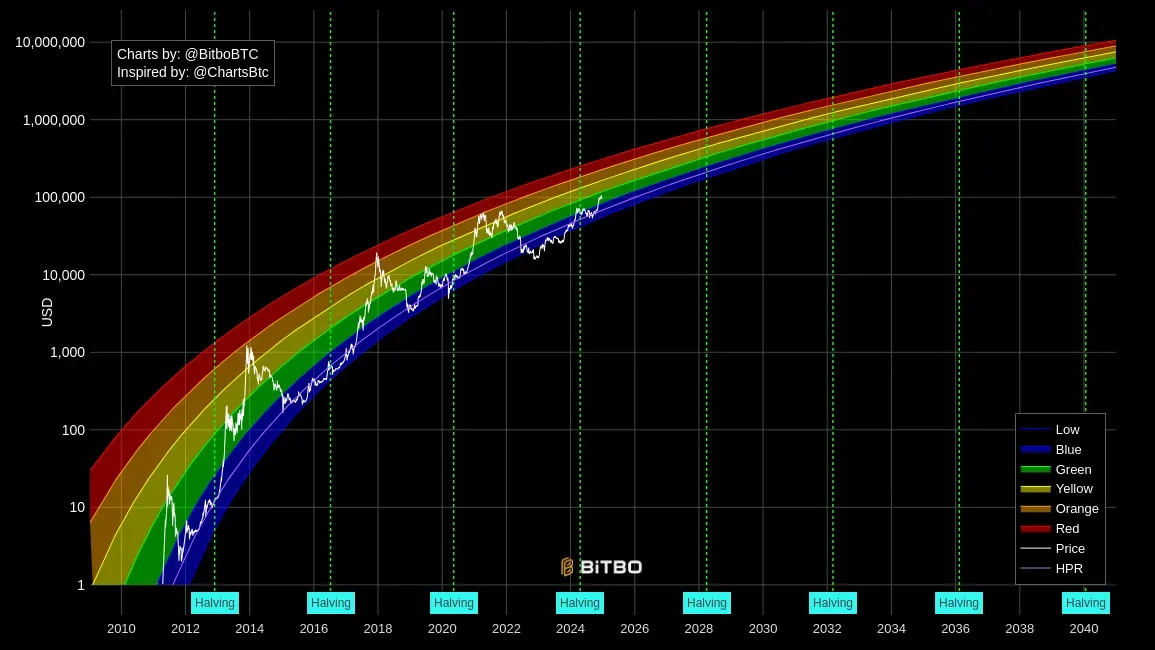

After halving, mining costs increase because more computational resources are required. Therefore, the price of Bitcoin is partially influenced by hardware and energy costs. Tools like the "Bitcoin Rainbow Chart" can help visualize historical price trends and provide insights into future price movements based on halving cycles.

The cost of mining one Bitcoin can be very high, with electricity costs varying by country, ranging from $1,324 to $321,112. Additionally, winning the "lottery" of Bitcoin mining requires significant investment in powerful hardware and at least 1% of the total mining power. Here, "lottery" refers to the randomness and competitiveness of successfully mining a block.

Bitcoin Rainbow Chart

Bitcoin Rainbow Chart

3. Supply-Demand Relationship

The supply of Bitcoin decreases over time, not only because its issuance is capped at 21 million but also because an estimated 3-4 million Bitcoins are permanently lost due to forgotten or inaccessible private keys. Purchasing cryptocurrency essentially means acquiring a valuable unit that can be exchanged for fiat currency, goods, or services.

The smallest unit of Bitcoin is called a "Satoshi," with 1 Satoshi equal to 0.00000001 BTC.

02 Altcoins

Altcoins include over 10,000 tokens, covering stablecoins, platform/network coins, utility tokens, and meme coins. Here, I will focus on platform/network coins and utility tokens.

Platform/Network Coins

For networks like Ethereum, their valuation depends on the following factors:

Number of Users

Daily Transaction Volume

Transaction Speed

Scalability

Applications (dApps) utilizing the network

Ethereum is just one of many networks. While competitors claim to be faster or more scalable, only time will tell which networks can survive in the long term. Buying Ethereum means acquiring a digital asset that allows you to participate in its blockchain, including using smart contracts—a self-executing protocol written directly into code.

Tokens

Blockchain startups often raise funds by issuing tokens on platforms like Ethereum. The value of these tokens can sometimes be easier to estimate because they may be similar to internet services. For example, Ripple (XRP) offers services similar to PayPal, facilitating fast, low-cost cross-border transactions.

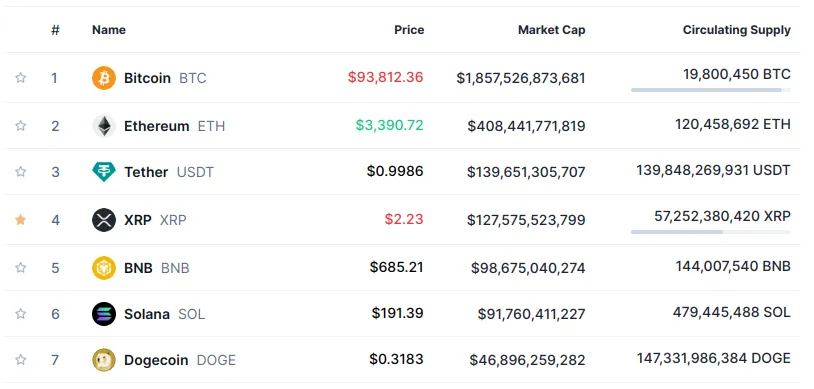

Market capitalization reflects the perceived value of a company or asset in the market. This allows us to compare non-cryptocurrency companies with blockchain companies providing similar services. For tokens, market capitalization refers to the total value of a specific cryptocurrency, calculated by multiplying the current price of a single token by the total circulating supply.

As of the end of 2024, Ripple (XRP) has a market capitalization of approximately $130 billion, while PayPal's market capitalization is around $90 billion.

Although a 1:1 comparison between non-crypto companies and blockchain companies may not be entirely accurate, it can roughly indicate whether the price aligns with the services provided.

On December 24, 2024, CoinMarketCap's market summary for XRP (Ripple)

**03

Sentiment and Market Indicators**

Extreme price volatility in cryptocurrencies is driven by market cycles, sentiment, and FOMO (Fear of Missing Out).

**FOMO and "Rug Pulls"**

FOMO often begins with hype around a certain cryptocurrency on social media. People buy in, driving up the price, and then sell when others follow suit (i.e., "rug pull"). This process is known as "pump-and-dump."

**Pump-and-Dump**

**Pump-and-dump is common in tokens with very low prices, which often have many zeros.** For example, if a token's price rises from 0.000001 to 0.000002, it may seem like a small increase, but it is actually a 100% gain. However, if you buy at 0.000002 and the price falls back to 0.000001, you will lose half your investment. This extreme price volatility can be misleading, especially in trading units of such small tokens.

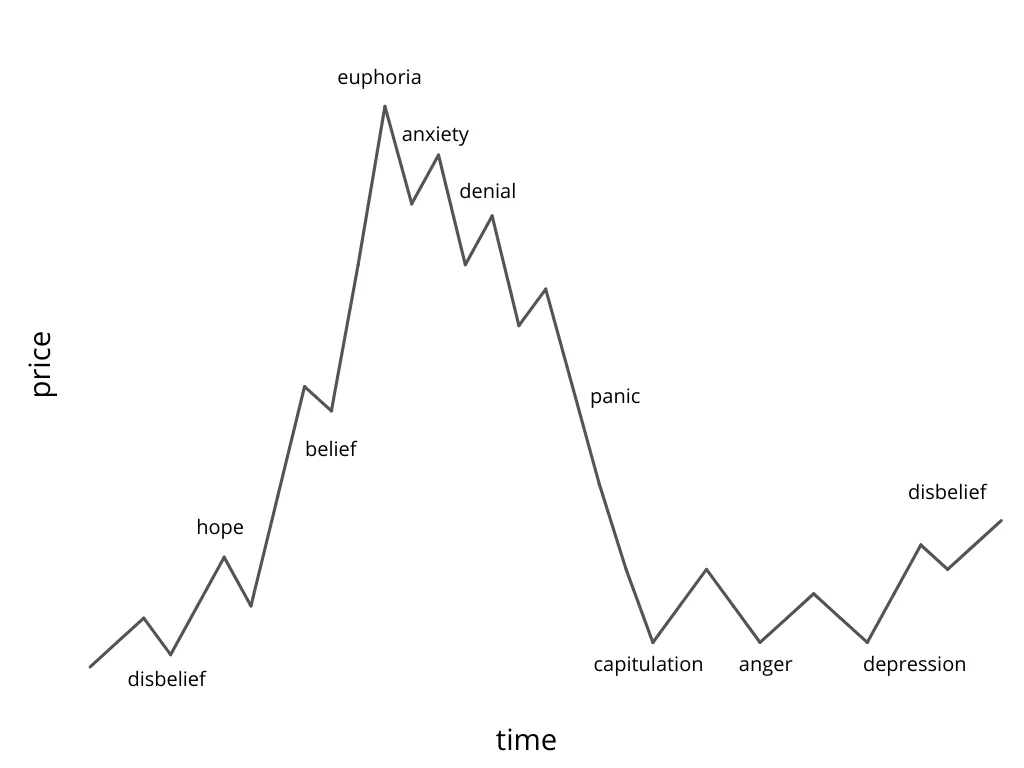

**Market Cycles**

**Like stocks, mortgages, cars, and luxury goods, cryptocurrencies also have cycles.** However, **due to their nature as emerging technologies, their cyclical fluctuations tend to be more extreme.** FOMO can significantly amplify price increases. It is difficult to determine which stage of the market cycle we are in, and even a repeat of an early cycle does not guarantee that the peak will be higher than the previous one.

For Bitcoin, it can be argued that halving (reducing new supply and increasing mining costs) plays a role in future price increases. However, for tokens with fixed circulation (pre-mined), the halving effect does not apply. In the long run, **valuing tokens based on the services they provide is more reasonable than relying solely on speculative price fluctuations.**

**Psychology of Market Cycles**

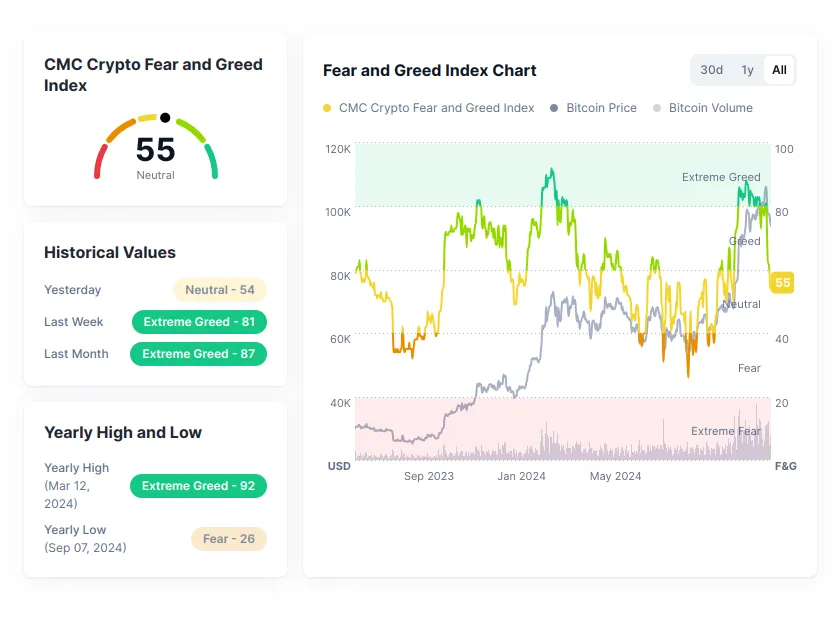

**Market Sentiment (Crypto Fear and Greed Index)**

This index measures market sentiment through data such as volatility, trading volume, and social media activity:

**Extreme Fear (0-24): Panic selling, possibly near price bottom**

Fear (25-49): Cautious market sentiment

Neutral (50-74): Balanced market

Greed (75-100): Strong bullish sentiment and FOMO

Crypto Fear and Greed Index

Altcoin Season

Altcoins typically follow Bitcoin's market cycles but with a certain delay. During "Altcoin Season," investor attention shifts from Bitcoin to altcoins, driving their prices up.

Crypto Winter

Crypto Winter refers to a prolonged period of low cryptocurrency prices, usually fluctuating within a narrow range. This does not mean there are no new developments or news; rather, it reflects a period of market stagnation, with prices low and investor sentiment generally cautious. Despite the calm in the market, innovation and progress continue behind the scenes, with new projects and advancements still occurring.

04 Conclusion

Cryptocurrencies are essentially software and user networks, similar to the internet or banks. Bitcoin alone has over 80 million users. Understanding the technological and market factors helps make informed decisions in this volatile market.

Article link: https://www.hellobtc.com/kp/du/03/5711.html

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。