Source: BitMEX

Key Highlights

This week, the market experienced significant volatility, primarily influenced by escalating trade tensions—aggressive tariff measures and conflicting signals from the U.S. government have left traders and investors uneasy.

Follow-up on the White House cryptocurrency summit: The impact of the summit held on March 7, 2025, continues to unfold, with President Trump announcing the establishment of a Bitcoin strategic reserve. According to NBC News, this move initially failed to impress investors, leading to early market fluctuations this week.

Hyperliquid suffers a $4 million loss: On March 12, 2025, the decentralized exchange Hyperliquid lost $4 million in its HLP liquidity pool due to a trader cleverly manipulating the liquidation mechanism using high leverage.

TIA, IP, and PEPE performed well, with increases of 15.7%, 13.5%, and 1.5%, respectively; while GRASS, RAY, and AAVE underperformed, with declines ranging from -35.3% to -21.0%.

In the trading analysis section, we will delve into the once-star token $HYPE—Is now a good time to buy the dip?

Data Overview

Best Performers

$TIA (+15.7%): The significant rise of Celestia is attributed to short covering.

$IP (+13.5%): Story Protocol achieved substantial growth due to its innovative approach to intellectual property handling and increased community engagement.

$PEPE (+1.5%): The moderate rise of Pepe Coin may signal early signs of continued popularity for meme coins.

Worst Performers

$GRASS (-35.3%): Grass experienced a sharp decline due to ongoing challenges faced by the project and broader market adjustments.

$RAY (-26.4%): The drop in Raydium is primarily due to fierce competition within the Solana ecosystem and a decrease in meme coin trading volume.

$AAVE (-21.0%): AAVE had performed well in recent weeks, and this drop can be seen as a healthy correction.

News Briefs

Macroeconomic Environment

ETH ETF weekly net outflow: -$143 million (source)

BTC ETF weekly net outflow: -$862.2 million (source)

The first White House cryptocurrency summit disappointed some investors (source)

The Russian Ministry of Finance expresses a desire to control unregulated cryptocurrency activities through national infrastructure (source)

Cryptocurrency leaders attend Trump's summit, with strategic reserves in focus (source)

Argentina requests an Interpol red notice for LIBRA co-founder Hayden Davis (source)

Project Updates

Hyperliquid suffers a single liquidation loss of $4 million (source)

Ripple obtains DFSA license to provide cryptocurrency payment services in the UAE (source)

Solana's SIMD-228 proposal fails to meet the passing threshold, aimed at reducing SOL inflation rate by 80% (source)

Aave launches EURC stablecoin on Base, to be used as collateral for lending and borrowing (source)

PI rises 13% ahead of Pi Day; can the rally hold? (source)

Ledger states that Trezor Safe devices still have vulnerabilities to physical supply chain attacks (source)

The Lazarus group transfers 400 ETH to Tornado Cash, expanding malware attacks (source)

Trading Analysis

Note: The following content does not constitute investment advice. This is a compilation of market news, and we always recommend conducting independent research before executing any trades. The following content does not guarantee any returns, and BitMEX is not responsible for your trading performance.

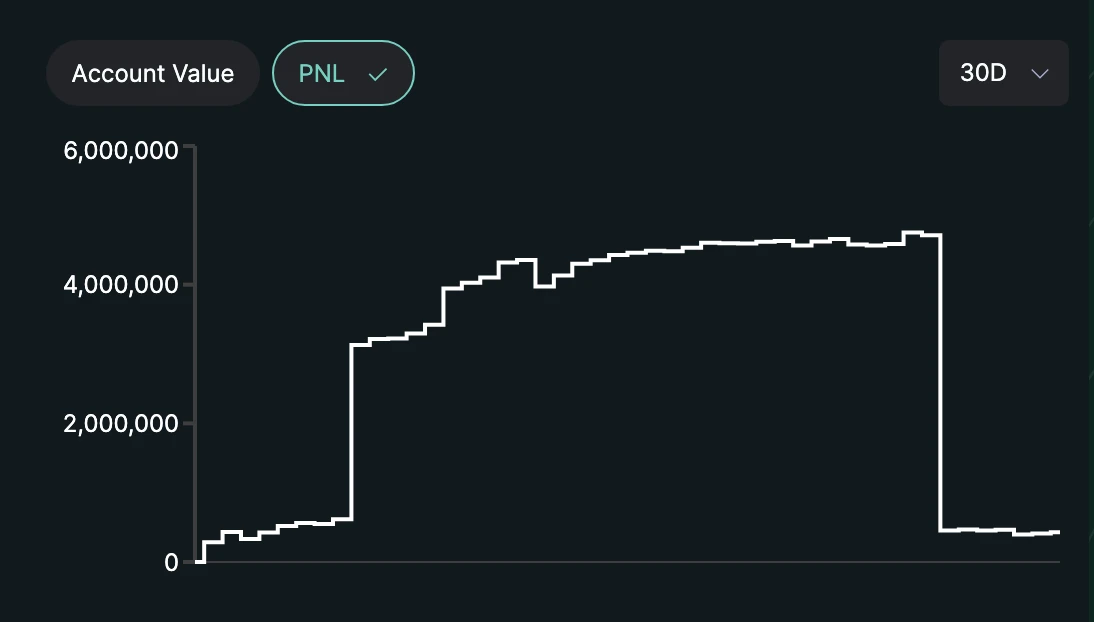

$HYPE Deep Correction: Analysis of Recent Plunge

The recent turmoil at Hyperliquid highlights the need for decentralized exchanges to maintain a delicate balance between innovation and risk management. The platform's pursuit of high leverage, low spreads, and rapid token listings has attracted a broad user base but also exposed significant vulnerabilities. The incident where a whale used a high-leverage Ethereum position led to a $4 million loss in the community-supported HLP liquidity pool underscores the potential risks of overly prioritizing rapid innovation while neglecting robust safety measures.

Event Recap

A trader with the wallet address 0xf3f4 opened a 175,000 ETH long position with 50x leverage, amounting to approximately $340 million. By strategically withdrawing collateral, the trader induced the liquidation of the remaining 160,000 ETH position, resulting in a $4 million loss for Hyperliquid's HLP liquidity pool, while profiting $1.8 million.

Market Reaction

As a result of this incident, Hyperliquid's native token HYPE fell by 8.5%, dropping from $14.04 to $12.84, before stabilizing at a low of $13.

Loss Mechanism Analysis

Execution Slippage

Limitations of the liquidation engine: The platform's liquidation mechanism struggled to handle the unwinding of such a large position, leading to severe execution slippage.

Insufficient market efficiency: This incident exposed the challenges decentralized systems face when processing large, rapid trades, particularly regarding liquidity constraints and execution speed.

Risk Management Limitations

Inadequate protective measures: The HLP liquidity pool lacked sufficient protection against large leveraged positions, allowing for manipulation through strategic profit extraction.

Community ownership risk: Due to the community ownership structure, depositors directly bear the losses, which may undermine trust and affect future liquidity supply.

Broader Impact on DeFi

Platform stability: The massive loss reduced the funds and liquidity in the pool, weakening the platform's ability to offer high-leverage trading and impacting overall market depth.

Regulatory and community scrutiny: This incident intensified discussions around risk management and potential market manipulation in decentralized protocols.

Long-term viability: Despite previously strong profitability, such incidents may force Hyperliquid to reassess its risk models and core strategies to ensure sustainable operations.

Hyperliquid's Response Measures

In response to this incident, Hyperliquid has implemented several changes:

Reduced maximum leverage: The platform has lowered the maximum leverage for Bitcoin to 40x and for Ethereum to 25x to mitigate risks associated with large positions.

Increased margin requirements: Higher margin is now required for large positions to prevent similar liquidation chain reactions.

Further risk control updates: Planned enhancements include dynamic risk limits and improved position monitoring to bolster overall platform security.

While these measures aim to strengthen risk management, their effectiveness depends on addressing the core vulnerabilities exposed by this incident.

Trading Perspective: Is HYPE Overvalued?

According to the latest data, HYPE is currently trading at approximately $13.30, with a circulating supply of 333,928,180 tokens and a market cap of about $4.44 billion. Considering a total supply of 1 billion tokens, the fully diluted valuation (FDV) is approximately $13.3 billion.

Given the recent events and the inherent risks of high-leverage trading platforms, the market is increasingly concerned that HYPE may be overvalued at the current FDV. Investors should exercise caution before making investment decisions, considering the platform's risk management capabilities and the overall market conditions.

Conclusion

Hyperliquid's recent challenges underscore the critical importance of maintaining a balance between innovative products and robust risk control in decentralized exchanges. While the platform's advanced features have driven growth, this incident highlights the potential consequences of insufficient safety measures. Investors and users must remain vigilant in assessing the opportunities and risks inherent in such rapidly evolving platforms.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。