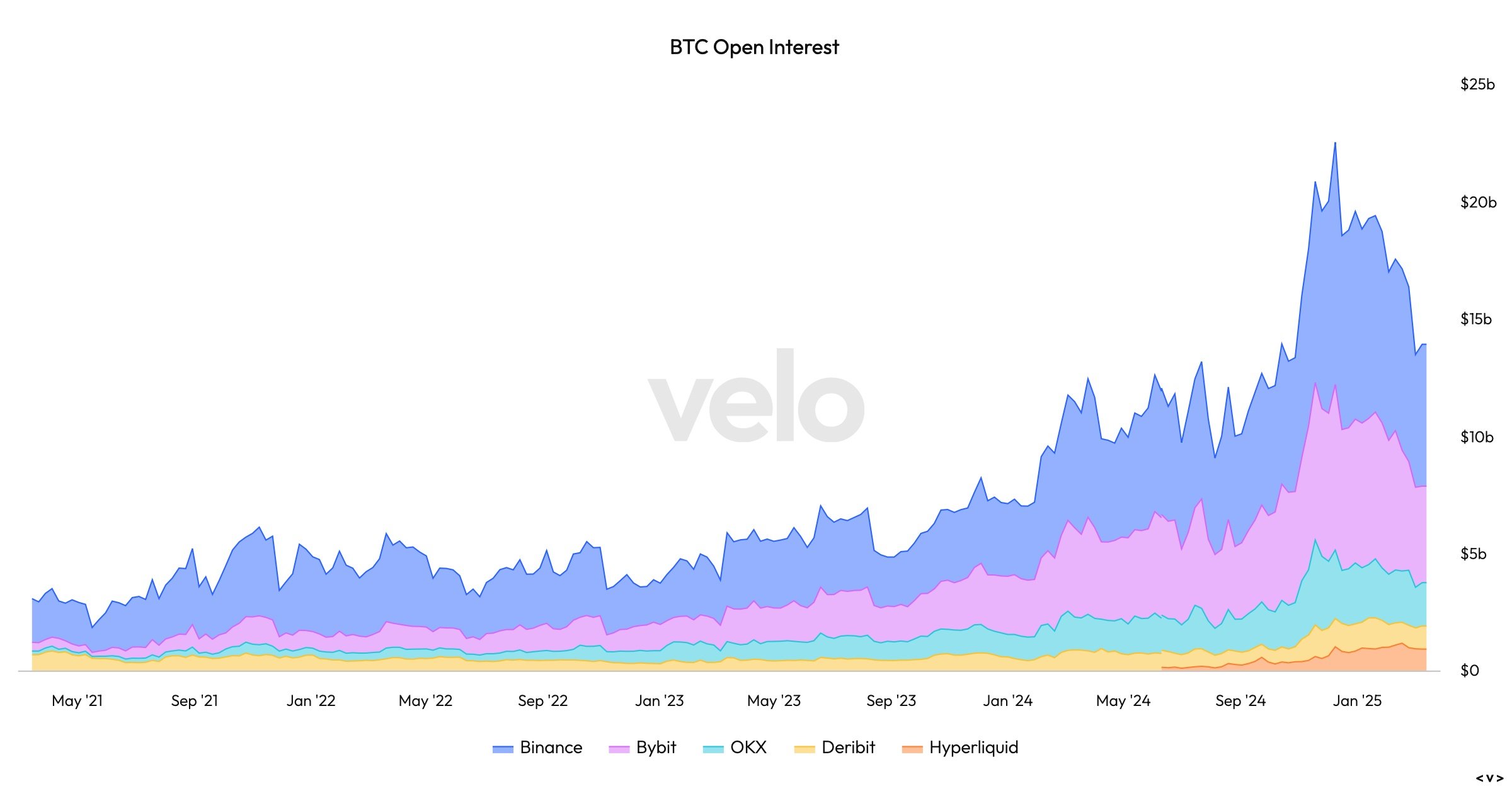

Bitcoin’s market activity shows signs of stabilization as key metrics return to levels seen before major 2024 events, according to recent data. Open interest—the total unsettled futures contracts—on centralized exchanges (CEXes) and the Chicago Mercantile Exchange (CME) has retraced this month, aligning with pre-November 2024 U.S. presidential election figures.

Bitcoin open interest (OI) on March 14, 2025, via velo.xyz.

Similarly, Bitcoin’s futures basis—the gap between futures and spot prices—has normalized to near zero, matching levels observed before the U.S. Securities and Exchange Commission (SEC) approved spot exchange-traded funds (ETFs) in January 2024.

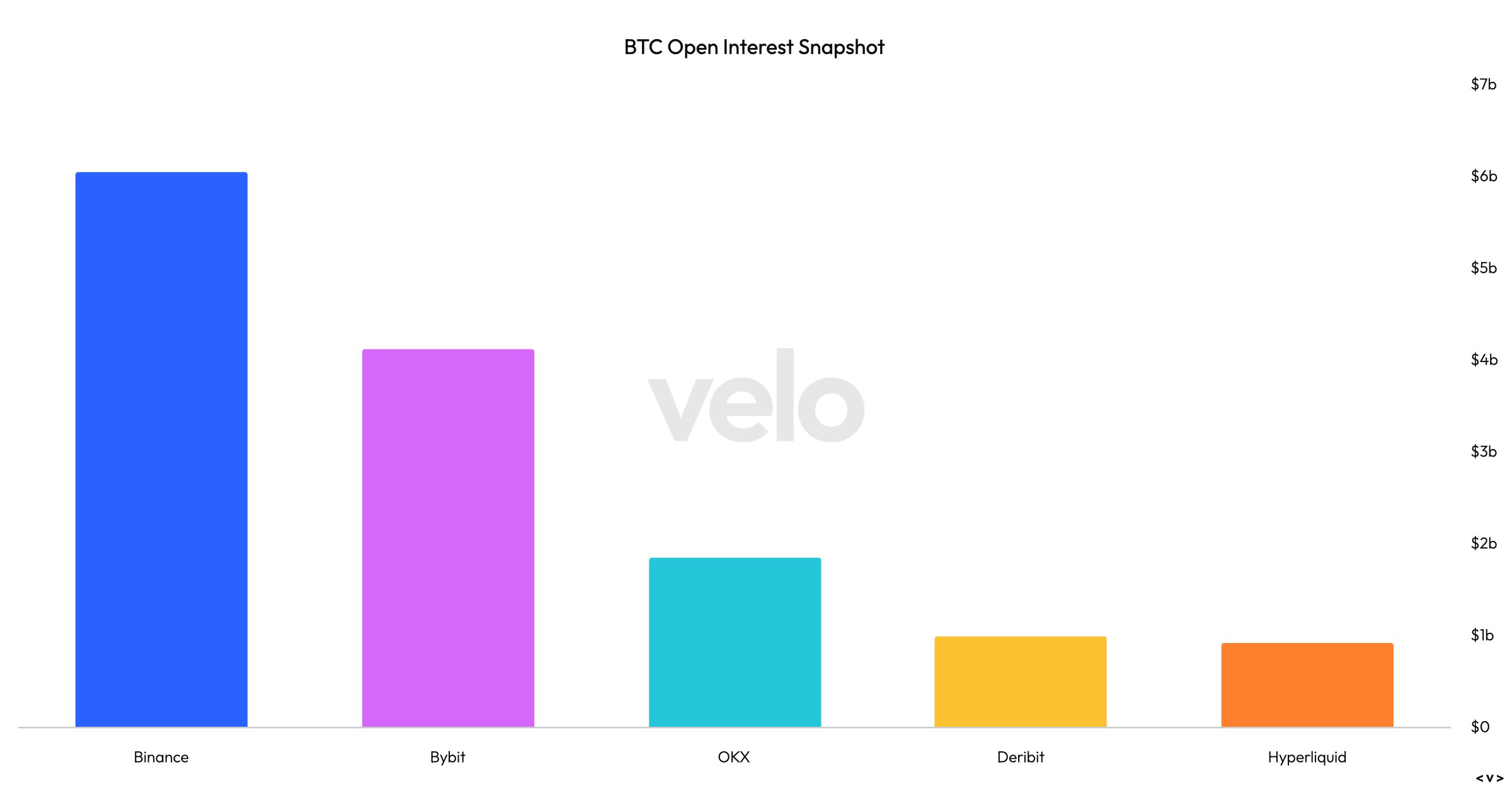

Bitcoin open interest (OI) snapshot on March 14, 2025, via velo.xyz.

Pre-ETF, the basis hovered around 0.556% but narrowed post-approval as institutional inflows boosted liquidity. The current basis reflects restored pricing efficiency between spot and derivatives markets.

BTC/USD spot price via Bitstamp on March 14, 2024, via bitcoinwisdom.io.

Bitcoin’s price recovery to $83,400 on March 14, 2025, contrasts with last week’s dip to $76,600, showcasing resilience despite recent volatility and Trump’s tariff threats. Notably, the spot price remains significantly higher than pre-ETF levels of $42,265 per bitcoin, suggesting broader macroeconomic or regulatory factors are influencing valuations.

Altcoin open interest dominance has also fallen from its peak, indicating reduced speculative activity in non-bitcoin assets. This could be attributed to traders prioritizing BTC and ETH amid stabilizing metrics. Market participants view the normalization of open interest and futures basis as positive indicators. The return to pre-event levels may reduce abrupt price swings, offering a more predictable environment for institutional and retail traders.

While the $83,400 BTC spot price defies expectations set by normalized metrics, experts cite ongoing macroeconomic trends, such as inflation cooling and regulatory advancements from the Trump administration, as potential drivers. For now, bitcoin’s ability to recalibrate after major events showcases its evolving maturity as an asset class. Predominantly, speculative forces have been expunged from the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。