Recently, Base—an Ethereum Layer 2 network incubated by Coinbase—has been rapidly attracting market attention. Funds and users continue to pour in, significantly enhancing ecosystem activity, with trading volume and total value locked (TVL) climbing steadily, hinting at an impending "big event." Industry insiders refer to this as "Base Season," and this wave of enthusiasm may become a highlight of the crypto market in 2025. This article will analyze the underlying logic of Base's growth through the latest data, explore why funds are flocking in, and recommend several investment directions worth paying attention to, providing investors with forward-looking insights.

Growth Picture Illustrated by Data

Base's recent performance can be described as "explosive growth," with multiple key indicators pointing to its potential for a "big event."

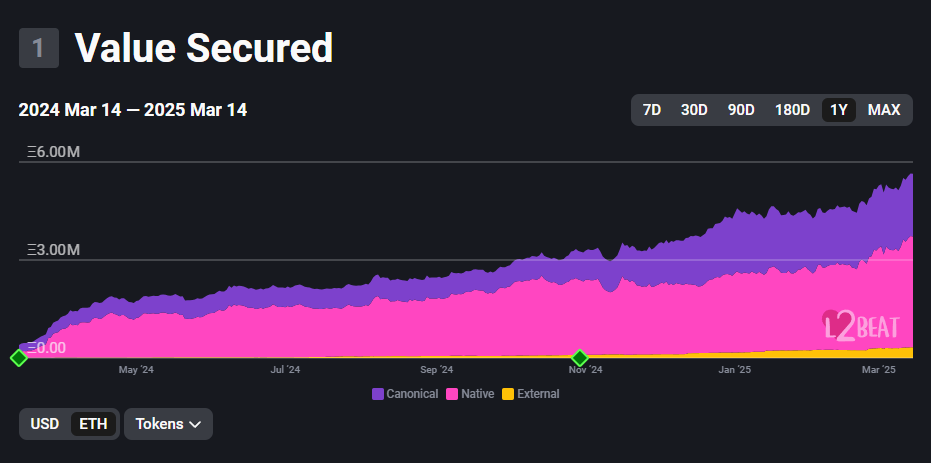

- Rapid growth of TVL: Base's total value locked (TVL) surged from $518 million at the beginning of 2024 to over $4 billion today, briefly surpassing Arbitrum and Optimism to become a leader in the Layer 2 space. This indicates that funds are accelerating into Base, significantly enhancing its ecosystem appeal.

- Active addresses: Base has consistently ranked first in daily active addresses among L2s, with the recent average daily active address count reaching 796,000, far exceeding Arbitrum One (243,500), Immutable (121,500), and other networks like Manta and Gravity Alpha Mainnet (approximately 10,000 each). The total number of active addresses has surpassed 1.5 million, showing a rapid increase in user participation, especially during several recent peak periods when the address count repeatedly broke 3.5 million, highlighting the vibrant vitality of the Base ecosystem.

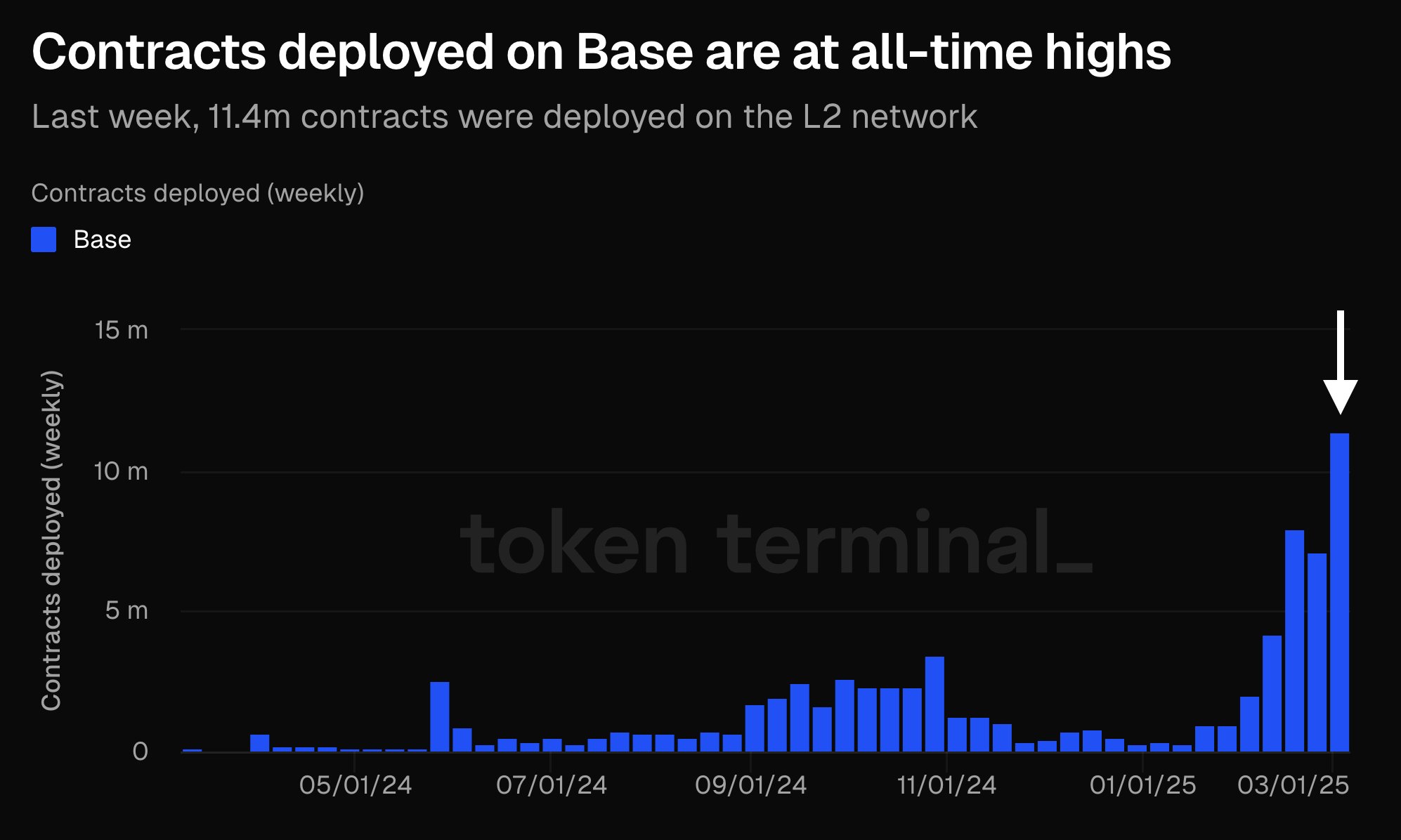

- Record contract deployments: On March 14, 2025, Token Terminal disclosed on X platform that Base deployed 11.4 million contracts last week, setting a historical high. This figure demonstrates developers' preference for the Base tech stack, with the ecosystem's diversity and innovation capabilities rapidly increasing.

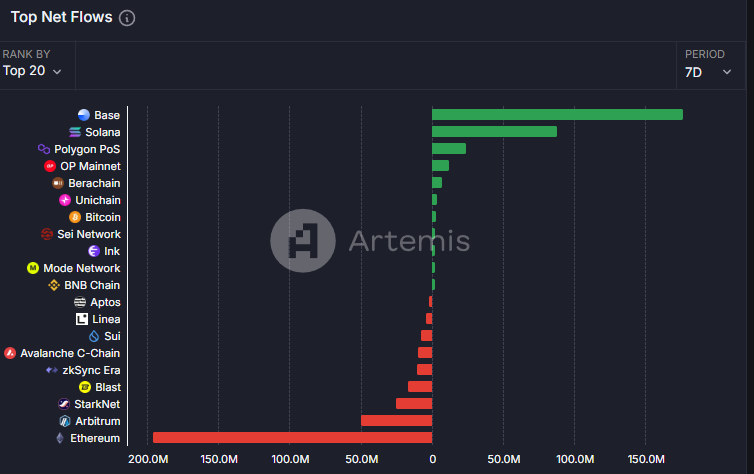

- Astonishing speed of fund inflows: According to the latest data from Artemis, Base topped the net fund inflow ranking over the past 7 days with over $20 billion in net inflows, far exceeding the second-place Solana (approximately $15 billion) and other networks like Polygon, OP Mainnet, and Berachain.

Behind these data points, the meme coin craze and the prosperity of the DeFi ecosystem on Base play a significant role. High activity not only attracts speculative capital but also provides fertile ground for developers. However, the rapid growth of TVL may contain speculative elements, and occasional network rollback issues under high trading volume remind us that Base's infrastructure still needs refinement. Nevertheless, these signals collectively outline a picture of Base potentially welcoming a significant turning point, perhaps officially kicking off Base Season in the second quarter of 2025.

Why Do Funds Favor Base?

Base's ability to attract such a large amount of funds is closely tied to Coinbase's strategic support. As the first publicly listed cryptocurrency exchange in the U.S., Coinbase provides Base with a strong brand effect and user base. Its partnership with Stripe to introduce USDC support makes Base an ideal choice for low-cost cross-border payments, allowing traditional funds to enter easily. There are also market rumors that Base may spin off from Coinbase and issue an independent token, further igniting early users' enthusiasm.

On the technical side, Base is built on Optimism's OP Stack, and the recently launched Flashblocks technology has reduced block time to 200 milliseconds, with transaction speeds even surpassing Solana. Transaction fees as low as under 1 cent compared to Solana's high costs and Ethereum's congestion have become key factors attracting funds. Additionally, the Base ecosystem encompasses popular areas such as DeFi, meme coins, and SocialFi, with the surge in trading volume driven by speculative capital. Some have joked on X that speculators might find Solana too costly and are turning their attention to Base's low-entry, high-return opportunities.

The macro environment also plays a supportive role. The early part of 2025 coincides with the beginning of Trump's new term, and the uncertainty of his policies may prompt funds to seek refuge in the crypto market, with Base, as a Coinbase-led Layer 2, becoming the preferred choice due to its compliance and stability.

Investment Opportunities Worth Noting

B3

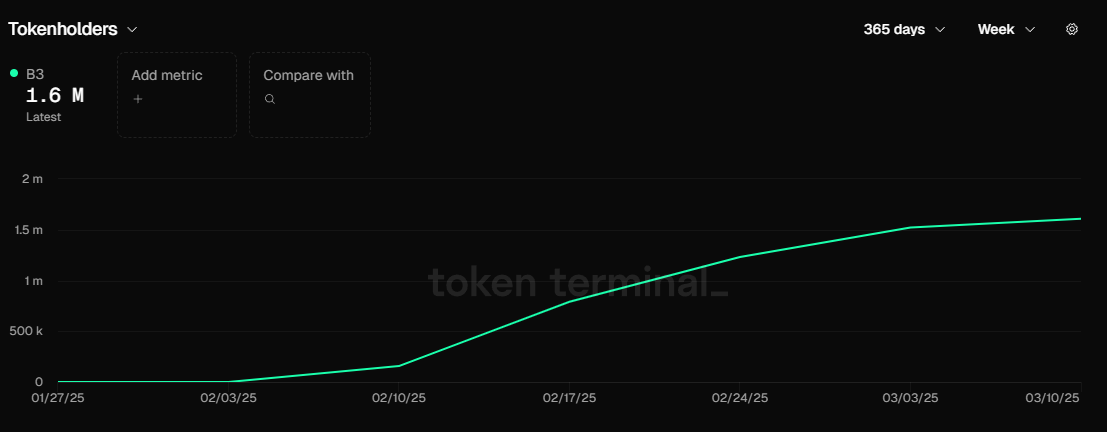

Amid the wave of the Base ecosystem, several projects have emerged that investors should pay attention to. First is $B3, a token representing Base's Layer 3 ambitions, primarily serving the gaming sector. After launching on Coinbase and Bybit in February 2025, the price of $B3 soared by 50%. Although the price later fell due to market influences, the number of holding addresses has continued to grow steadily, indicating market recognition of its prospects. The support of Flashblocks technology and the expansion of Layer 3 application chains may bring new growth opportunities for gaming projects, although its success still relies on user acquisition and ecosystem integration.

CLANKER

Another highlight is CLANKER. This token, launched by the AI-driven @Clanker tool, has deployed approximately 4,700 tokens, with a market cap reaching $113.8 million. Discussions on X suggest that CLANKER is undervalued, especially as it has outperformed other tokens during the rebound, possibly due to expectations of a Coinbase listing.

Additionally, the DeFi sector's Aerodrome should not be overlooked. As the largest decentralized exchange on Base, its TVL exceeds $1 billion, accounting for half of the ecosystem's locked value. Yield farming and liquidity incentive mechanisms have attracted attention from both institutions and retail investors, and despite fierce competition in the DeFi space, its growth remains promising.

Investment Recommendations and Conclusion

The arrival of Base Season stems from explosive growth in TVL and trading volume, Coinbase's strategic support, and the resonance of technological innovation with the meme coin craze. Funds are flowing from Solana and Bitcoin to Base, reflecting the market's recognition of its low costs and high potential. However, centralized risks, technical bottlenecks, and regulatory uncertainties remind investors to remain calm.

For investors, it may be wise to focus on $CLANKER and $B3 in the short term to capture speculative opportunities brought by meme coins and Layer 3. The key lies in controlling positions to avoid losses from high volatility while closely following Coinbase's official updates to grasp market rhythms. Base's growth is not without challenges; its future depends on technological upgrades and the continued prosperity of its ecosystem. In this potential wealth feast, data-driven insights and a balance of risk management may be the keys to success.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。