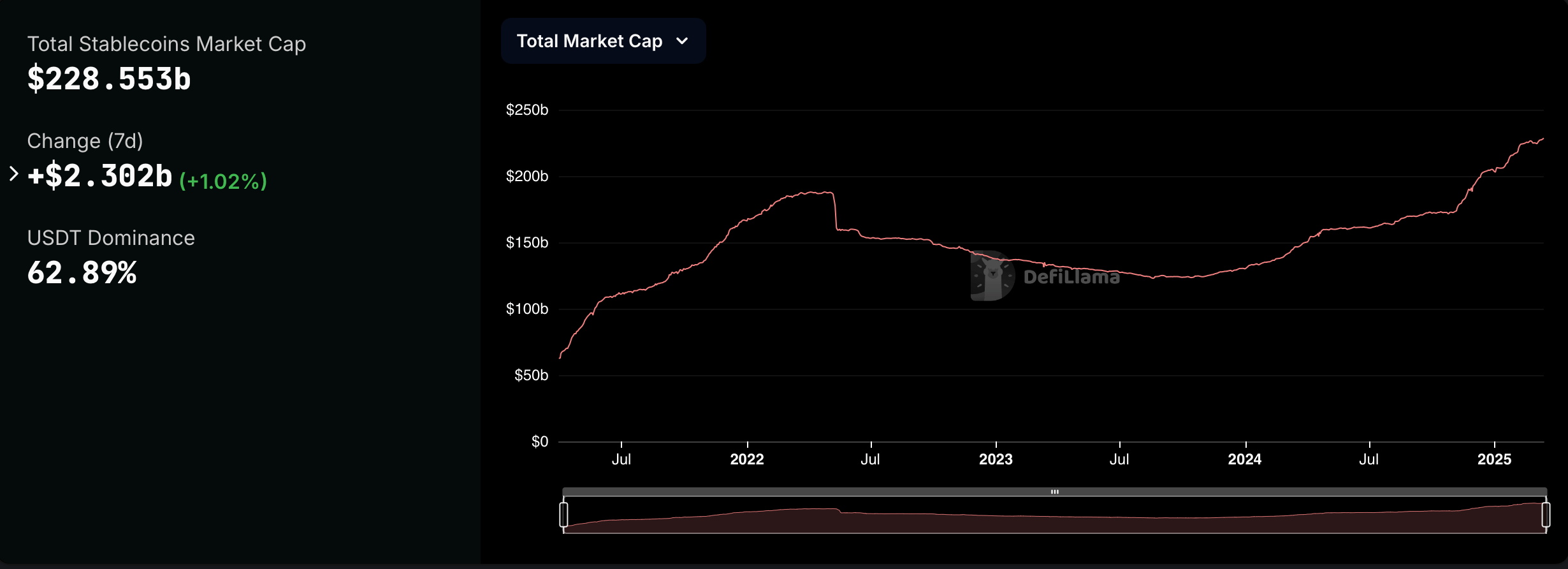

The stablecoin ecosystem—fiat-pegged digital tokens—now sits at $228.553 billion after a $4.23 billion boost in just 14 days. Leading the pack is tether (USDT), which commands a whopping $143.74 billion, or 62.89%, of the stablecoin pie.

Altogether, these steady-value coins account for roughly 8.34% of the $2.74 trillion crypto market, with USDT alone holding 5.25% of the entire digital asset space. Circle’s USDC holds strong with a $58.371 billion market cap, claiming 25.54% of the total stablecoin ecosystem’s value.

Stablecoin economy after the first two weeks of March 2025.

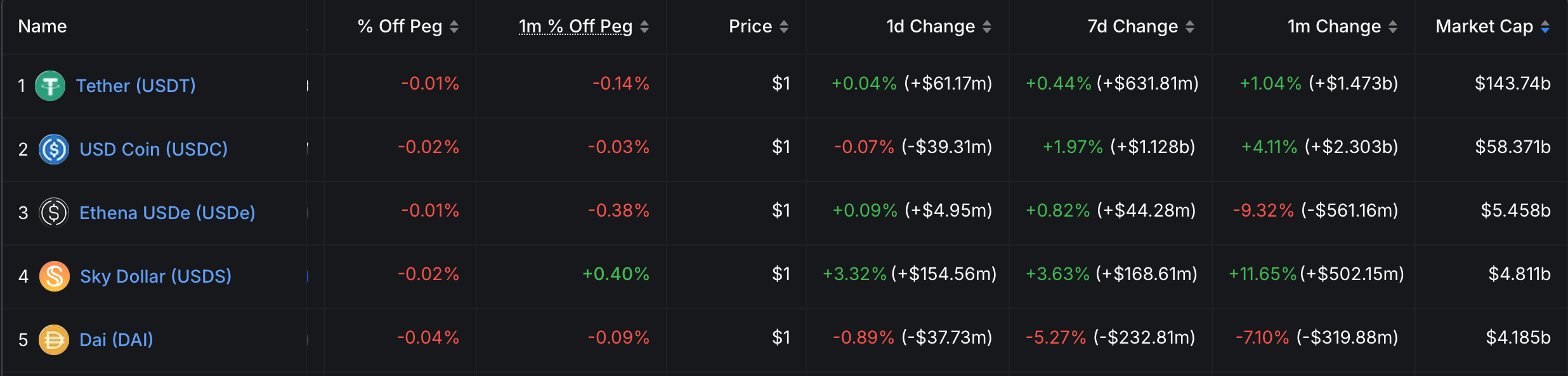

Over the past seven days, USDT’s supply inched up 0.44%, while USDC’s stash jumped 1.97%. Ethena’s USDe secures third place with $5.458 billion, fueled by a gentle 0.82% supply bump this week. Meanwhile, Sky’s USDS climbed 3.63% this week, hitting $4.811 billion.

Top five stablecoins by market cap in mid-march 2025.

But not everyone’s riding high: Sky’s DAI tumbled 5.27% to $4.185 billion. First Digital’s FDUSD slid 2.48% over seven days, dropping to $1.796 billion. Usual’s USD0 also dipped below the billion mark, falling 5.72% to $978.18 million.

Paypal’s PYUSD, however, edged up 0.33% this week—and over the past month, it skyrocketed 29.14%, adding $172.29 million to the supply. PYUSD’s market cap now sits pretty at $763.46 million in eighth place, according to defillama.com stablecoin metrics.

Rounding out the list, USDX Money’s USDX holds ninth place with $625 million, ticking down 0.05% this week but edging up 0.21% over 30 days. Ondo’s USDY wraps things up with $592.73 million, slipping 0.45% in a week yet smashing PYUSD’s monthly growth with a 55.55% leap.

Stablecoins are thriving amid crypto’s slump, showcasing a dynamic mix of competition and innovation. While established giants like USDT maintain dominance, newer entrants are still shaking things up with aggressive growth. The sector’s resilience highlights a balancing act—stability for users and gathering yield for holders—as digital dollars carve out an ever-larger slice of the crypto pie.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。